KreangchaiRungfamai/iStock Editorial via Getty Images

Samsung Basics

Headquartered in Suwon-Shi, just south of South Korea's capital city Seoul, The Samsung Group is a diversified industrial conglomerate with subsidiaries in multiple industries. Its largest subsidiary, Samsung Electronics, has as of May 23, 2022 a market cap of 455.22 trillion Korean Won (KRW), which translates to around $380 billion.

Samsung launched in 1938 when Lee Byung-Chul set up a grocery trading store in Taegu, Korea where he exported noodles to China. By the late 1950s, Samsung had acquired commercial banks, an insurance company, and cement and fertilizer manufacturers. By the 1970s, Samsung was a behemoth in the textile, heavy equipment manufacturing, chemical, petrochemical, and shipbuilding industries.

It was during the 1970s that Samsung got into the electronics business, acquiring a 50% stake in Korea Semiconductor and exporting black-and-white televisions around the world. When Lee Byung-Chul died in 1987, the Samsung Group was split into five subsidiaries, with Samsung Electronics going to Lee's son Lee Kun-hee and the other four subsidiaries going to other of Lee's children.

Lee Kun-hee instituted vast cultural changes that made Samsung Electronics the largest of the subsidiaries, manufacturing mobile phones, semiconductors, LED and LCD screens, and appliances. Today, Samsung Electronics accounts for about 70% of the Samsung Group's total revenue; however, patent-infringement lawsuits and bribery scandals have dogged Lee Kun-hee and his son and successor, Lee Jae-yong.

During the 2000s, Samsung supplied microprocessors to Apple for its earliest iPhone models, and it created the Galaxy smartphone series of phones which are among the world's top-selling smartphones. Since 2006, Samsung has been the world's best-selling television manufacturer, and in 2010, it began creating the Galaxy Tab series of tablet computers. Source: statista.com

How Samsung Electronics Makes Money

In January 2022, Samsung announced its fiscal year 2021 figures and according to ZDNet, they showed a staggering year-over-year increase of 43.5% in operating profit which Samsung attributed to strong mobile and chip sales. The largest contributors to Samsung's operating profit were its chip business, which contributed over half, followed by the company's mobile business, which saw growth in sales of its premium smartphones, especially the Galaxy S series.

Coming in third was the company's mobile panels business which experienced high demand from manufacturers such as Apple. Fourth was Samsung's consumer electronics businesses which benefited from pent-up demand for TVs and home appliances following the COVID pandemic. The fifth contributor to Samsung's operating profit was its logic chip and foundry unit which recorded its highest-ever quarterly revenue.

- As of Q4 2021, Samsung Electronics' biggest generator of revenue was its semiconductor segment which accounted for approximately $21.8 billion; other key contributors were the company's mobile communications and display panel businesses. Source: Statista

- As of March 31, 2022, Samsung Electronics' gross profit margin was 39.48%. Source: YCharts

- Samsung is the number one Android smartphone manufacturer in the world, accounting for 36.4% of the market. Source: AppBrain

- Samsung Electronics is the world's second-largest electronics manufacturer by revenue behind only Apple Inc. Source: BizVibe.

- Samsung is the world's second-largest semiconductor manufacturer, behind only Intel. Source: Zippia.

- Samsung's 5G equipment was the first to be approved by the U.S. Federal Communications Commission (FCC). Source: Mobile World Live.

- Samsung is the largest company in South Korea, with its products accounting for 20% of that country's exports. Source: The Korea Herald.

- Samsung's revenues account for 17% of South Korea's GDP. Source: Reuters,

Buying Samsung Stock

Samsung, which is Korean for "three stars", is one of the most easily recognized names in technology. However, for U.S. investors wanting to buy Samsung's stock, it's not an easy process.

Samsung's shares trade on the Korea Exchange, KRX. They're not traded on any U.S. stock exchanges and can't be bought through discount brokers such as Schwab and Robinhood.

Samsung doesn't issue American Depository Receipts (ADRS) which trade on a U.S. exchange. It does issue Global Depository Receipts (GDRs) which are listed on the London Stock Exchange and the Luxembourg Stock Exchange; however, Rule 144A of 1934's U.S. Securities Exchange Act prohibits U.S. residents from trading GDRs.

Note: If you're not already familiar with them, a Global Depository Receipt (GDR) is a certificate issued by a bank in two or more countries, usually the U.S. and a European country, for shares in a foreign company. American Depository Receipts are the same as GDRs except that they represent shares of a foreign company only within U.S. markets. Most ADRs represent one share, are priced in U.S. dollars, and are traded on a U.S. exchange. GDRs are priced in the local currency of the country where the exchange is located.

4 Ways To Buy Samsung Stock

You can buy Samsung stock on the Korea Exchange (KRX), over-the-counter as a "pink sheet" stock, or as part of a Korea-focused exchange-traded fund. In some ETFs where Samsung is included, it accounts for over 20% of the fund's total value.

1. Buying on KRX

- You must first register with the Financial Supervisory Service and obtain an investor registration certificate.

- Open a stock trading account with a Korean securities firm, which will require you to execute a standing proxy agreement, fill out an investment ID application, register your signature, provide proof of your resident status, and provide a copy of your passport.

- Transfer funds into the account.

- You can now trade Samsung shares in real-time.

2. Buying Through a Local Securities Firm or Bank

- Open an account with a broker such as Merrill Lynch International, Inc., minimum amounts are surprisingly high, with $700,000 required for residents of the UK, and $3 million required for residents of Singapore.

- Deposit funds into the account.

- Place trade orders.

While this sounds relatively easy, downsides include:

- Fees that will be charged.

- Investors will have to change dollars into Korean Won and Won back into dollars, which comes with currency risk.

- There are minimum order sizes.

- Trading will have to occur during local trading hours, and currently, Seoul is 11 hours ahead of U.S. Eastern Daylight Time.

- Shares can't be traded on margin.

Financial institutions that are eligible to trade Korean stocks include:

- UK: HSBC, Morgan Stanley, UBS, Smith & Williamson

- Hong Kong: HSBC, BNP Paribas, Credit Suisse

- Singapore: HSBC, Phillip Securities, Kim Eng Securities

- Japan: Okasan, Aizawa, SBI

3. Pink Sheets/Grey Market

The National Quotation Bureau, or NQB, used to publish stock and bond prices on pink and yellow paper, respectively, which led to the name "pink sheets". Today, NQB is called the OTC Market Group and it trades in the stock of companies that are not listed on major exchanges. Also note that the OTC Market Group no longer refers to these securities as "pink sheets". These are usually microcap stocks, those having a market cap of less than $300 million, and nanocap stocks, or those with a market cap of less than $50 million.

The downsides to trading these securities are that they have low volume, which equates to limited liquidity. These stocks have high bid-ask spreads which makes it difficult to sell shares quickly. Because of this, investors who want to trade Samsung OTC should not use market orders but rather use limit orders.

4. ETFs

Perhaps, the easiest way to invest in Samsung is by buying an exchange-traded fund that includes Samsung Electronics. Two funds in which Samsung Electronics is a big component are:

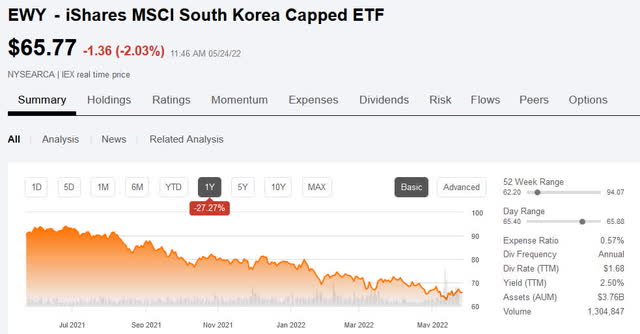

- iShares MSCI South Korea Capped ETF (EWY): has over 20% of its holdings in Samsung.

iShares MSCI South Korea Capped ETF 1-year price chart (Seeking Alpha)

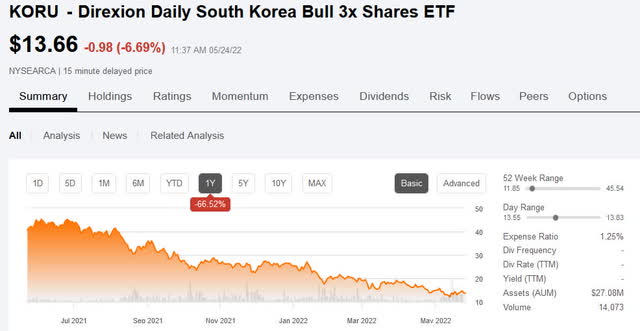

- The Direxion Daily South Korea Bull 3x Shares ETF (KORU): has 22.34% of its holdings in Samsung.

The Direxion Daily MSCI South Korea Bull 3X Shares fund 1-year price chart (Seeking Alpha)

ETF holdings are managed which creates a management fee known as an expense ratio. To minimize expenses, it's a good idea to look for ETFs that have expense ratios of 0.50% or less.

Samsung Ticker & Price of Samsung Stock

As of March 24, 2022, Samsung Electronics was trading at 66,500 KWR, or $52.72.

Samsung Electronics 1-year price chart (Seeking Alpha/Wendorf)

Bottom Line

Jumping through all the hoops described above to buy shares in Samsung Electronics might be worth it because when Lee Kun-hee died in October 2020, his relatives inherited a significant number of Samsung Electronics shares. This wasn't all good news, however, since Korea imposes stiff inheritance taxes, and Lee's relatives were on the hook for almost $8.6 billion.

Ever since Lee Kun-hee's death, the relatives have been selling shares to cover their enormous tax bill, and this has pushed Samsung Electronics' share price down despite the company's fundamental strength.