kali9/E+ via Getty Images

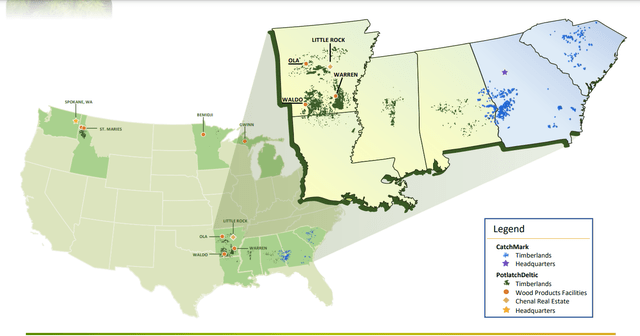

On 5/31/22 PotlatchDeltic (NASDAQ:PCH) announced a merger in which it will buy CatchMark Timber Trust (CTT) for 0.23 shares of PCH for each share of CTT. This equates to an enterprise value of $919 million for CTT and a converted value of CTT shares of $12.88 using the unaffected price of PCH shares.

Mergers are often a source of opportunity so let us dig in to see if there is a play here. I begin by analyzing the merits and demerits of the merger and follow with an analysis of the arbitrage between CTT and PCH shares while they are in this state of limbo.

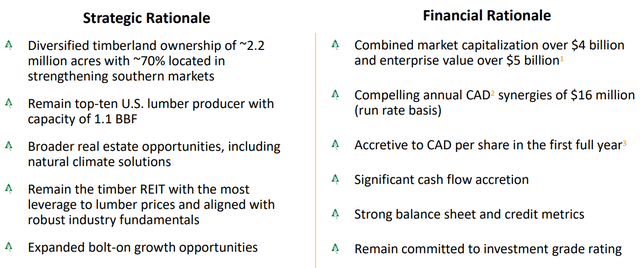

Potlatch's stated reasons for the merger

I commend PCH in their communication of the merger as they came out with a full presentation as well as a conference call in which analysts could ask questions. Following is their stated rationale for buying CTT:

My take on the merger - strategy and valuation

If one reads the above slide from PCH's presentation closely you may notice that most of the strategic rationale are entirely available to PCH as a stand-alone entity. The only real strategic benefit is that of extra scale.

Even though Potlatch's existing holdings are somewhat close to those of CTT, I don't think they will glean any significant advantage in terms of market share.

Since timber is such a hyper-local commodity due to transportation costs, it is somewhat hard to find revenue synergies.

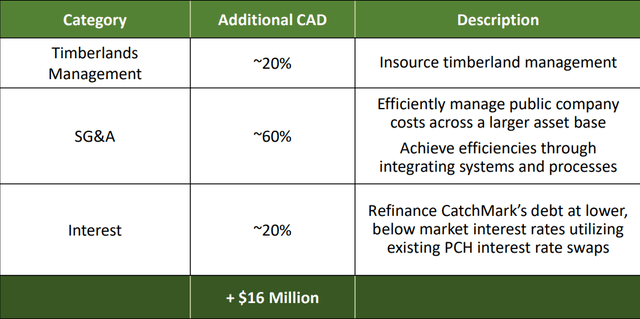

There are, however, some nice cost synergies. In taking over CTT much of the redundant overhead can be eliminated and some of the silvicultural work that was previously outsourced can be taken over in-house by PCH's experts. In total, PCH is guiding for $16 million of synergies annually

The 80% that comes from the combination of Timberlands management and SG&A are the cost savings I mentioned above and I think it will be quite easy for PCH to realize them.

The interest savings is real too, but I'm not sure that I would call it a synergy. Here is how it was discussed in the merger conference call.

"Mark Adam Weintraub Seaport Research Partners Okay. Great. And if I could sneak one last one in and then certainly hand over. But since you bought up on the refinance, could you kind of explain a little bit how you're going to use interest rate swaps and how that's going to be to the benefit of shareholders.

Jerald W. Richards VP & CFO You bet, Mark. So if you recall, back in March of 2020, when financial markets were dislocated. We did a large interest rate swap that essentially locked in a whole series of future refinances for us into January 2029, just extraordinarily attractive levels. And we've had those swaps outstanding. And the value recently of the whole trade is between $90 million and $100 million, if they're in the money. So we have an opportunity here to pull a portion of the remaining swaps forward and actually apply those to the refinance of CatchMark's debt. And what that does at the end of the day is where you have -- when I go get quotes from farm credit system, I think about it net of patronage, the -- to get a fixed rate loan is probably on a 10-year basis is probably around 4% or so, maybe a little higher. Using these swaps will allow us to refinance at like about 2.35% just to give you the latest quote. So not only reduce CatchMark's interest expense run rate, but also we're also going to be able to refinance it well below market rates currently"

Basically, what it comes down to is that PCH locked in a really favorable rate back when interest rates were significantly lower. Since then, they have been sitting on the option to borrow at phenomenal rates and they are finally putting that to work through refinancing CTT's debt.

This is real savings that will generate real cash, but I do want to draw the distinction that it has nothing to do with the merger. PCH could realize the financial benefit of this lower rate at any point in time. The financial gain came when they locked in the great rate in 2020, so great job to PCH for doing that, but it is not a merger synergy.

Overall, I don't think it is a particularly strategic merger, but sometimes it is okay to just gain the benefits of scale and the cost efficiencies that come with that.

Valuation of merger - NAV

I find the buyout price to be a bit steep, both in terms of the absolute dollar value, and the currency with which it was bought. The $919 million price tag represents a price per CTT owned acre of $2625 which compares to the roughly $2000 per acre of recent south-eastern timberland transactions. Some of the premium can likely be explained by CTT's general high quality of land. It is well stocked with significant standing inventory and well located with higher-than-average stumpage price realization.

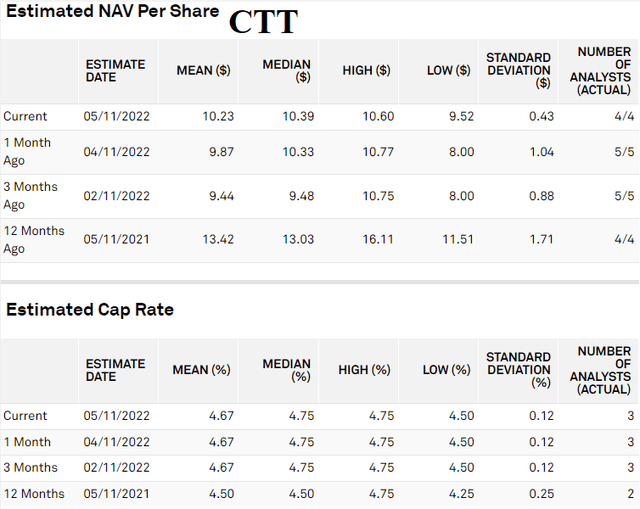

That said, at $12.88 per share, they bought CTT for substantially above NAV which consensus spots at $10.23

S&P Global Market Intelligence

The 4.67% cap rate used to calculate this NAV strikes me as about right, so I think NAV was somewhere between $10 and $11.

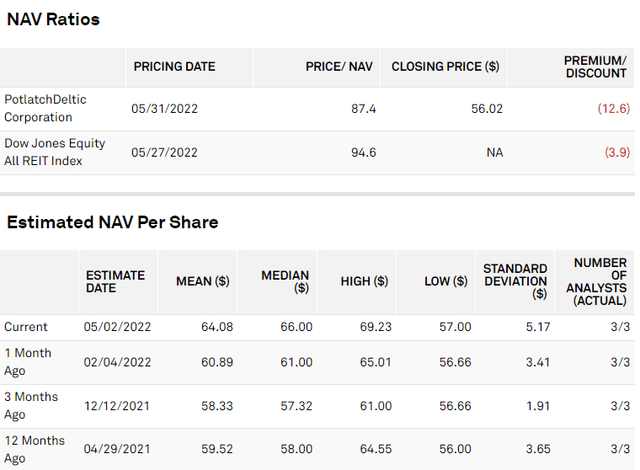

The premium is made even more substantial by Potlatch using discounted stock to buy it. As of Friday's close, which is the price used to calculate the exchange ratio, PCH was trading at 87.4% of NAV

S&P Global Market Intelligence

Generally speaking, it is rough buying companies at a premium to NAV using stock at a discount to NAV.

As such, I am quite confident the deal reduces PCH's NAV/share.

Cashflow valuation

In the same merger presentation, Potlatch claims the merger is accretive to CAD per share.

PCH

I disagree.

Mills in general are a high cashflow business relative to timber and particularly right now while lumber prices remain above historical norms.

Timber as a business is relatively low cashflow with much of its gains coming from non-cash appreciation of the land. As such, a milling focused REIT buying a timber focused REIT is likely going to be dilutive to CAD/share. The numbers seem to agree with me.

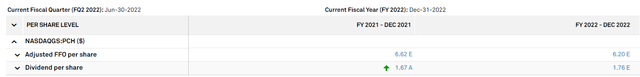

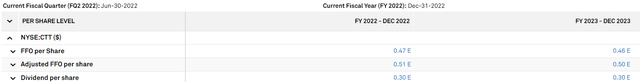

PCH was expected to get $6.20 of AFFO in 2022 putting it at a sub 10X multiple. AFFO is of course not quite the same as CAD, but it is a similar metric.

S&P Global Market Intelligence

That makes the dilutive cost of equity capital just north of 10%.

In contrast, CTT was bought out at about 25X forward AFFO making it a roughly 4% cap rate purchase.

S&P Global Market Intelligence

That is rather simple math. Acquiring at 4% with a 10% cost of equity capital is not going to be accretive.

So how is it that PCH can say the merger is CAD accretive on a per share basis?

Well, it turns out they are using a really funky calculation methodology which was illuminated on the conference call.

"Eric J. Cremers President, CEO & Director: Yes. So Mark, as we look at the pro forma going forward after synergies, CAD is around $42 million per year on average. And if I think about the incremental shares that we're going to be issuing in the merger, 11.5 million shares, I think about our current run rate and our dividend [ $1.76 ], that's about $20 million per year and increased dividend payments to the shares will be issuing to CatchMark's stockholders. So if our average is $42 million going forward and our extra dividend is $20 million, so there's a net $22 million that's accretive across all 81 million shares."

As stated by the CEO, he is using the dividend yield of PCH as the equity cost of capital in their calculation.

That just isn't right. If PCH stopped paying a dividend is their stock a 0% cost of capital?

The dilutive cost of equity is related to the earnings power of the company, not how much of those earnings the company arbitrarily decides to pay out as a dividend.

Overall take on merger

CTT has some great land and it will be a strong asset for PCH. However, Potlatch overpaid and I think it will be dilutive to both NAV and earnings on a per share basis whether you measure that by EPS, AFFO, EBITDA, or CAD.

This does not necessarily mean that PCH is a bad stock though. The merger is reasonably small relative to the size of the company. After the merger completes, CTT shareholders will only hold about 14% of the combined company.

PCH has already been punished rather hard with a 6.3% decline the day of the announcement.

In my opinion a 6.3% punishment is a bit harsh given how small the deal is. Even if the deal is as dilutive as my calculations suggest, it does not hurt PCH's overall cashflow per share by 6.3%.

As such, PCH is actually a better value now pro-forma for the merger than it was as a standalone.

Further, one has the opportunity to get into PCH at an additional discount through the merger arbitrage.

Small merger arbitrage

On Portfolio Income Solutions we maintain a

spreadsheet

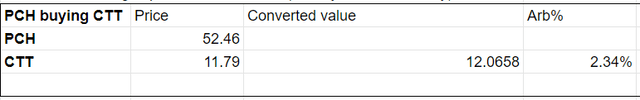

that tracks outstanding merger arbitrages with automatically updating price information. As of the time of this writing CTT can be bought for $11.79 and converts into a value of $12.06This provides a 2.3% arbitrage spread with CTT being the cheaper leg.

Like any other trade of this sort this is not riskless as the deal could fall through. I think this merger is very likely to consummate, but things can happen.

If one was already looking to buy PCH, this may be a good way to get in for a bit cheaper. We already took full advantage of using MGM Growth Properties (MGP) to get into VICI at a discount and are in the process of using Healthcare Trust of America (HTA) to get into Healthcare Realty (HR) at a discount.

I prefer Weyerhaeuser (WY) within the timber/lumber REIT space. It has proven to be the best operator and its valuation is quite attractive. As such, I am not buying CTT/PCH at this time.

Prices tend to bounce around rather inefficiently during the phase between announcement of a merger and finalization. As such, the arbitrage spread will fluctuate. I will be watching diligently though the Portfolio Income Solutions Arbitrage Tracker for a more enticing spread.

Opportunistic Market Sale: 20% off for a limited time!

Right now there are abnormally great investment opportunities. With the market crash, some fundamentally strong stocks have gotten outrageously cheap and I want to show you how to take advantage and slingshot out of the dip.

To encourage readers to get in at this time of enhanced opportunity we are offering a limited time 20% discount to Portfolio Income Solutions. Our portfolio is freshly updated and chock full of babies that were thrown out with the market bathwater.

Grab your free trial today while these stocks are still cheap!