FreezeFrames/iStock via Getty Images

Coterra Energy, Inc. (NYSE:CTRA) is an independent exploration and production company operating in a few different basins throughout the United States. Unlike many of its peers, Coterra Energy never weathered through the crude oil price collapse since it was formed via a 2021 merger between Cabot Oil & Gas and Cimarex Energy but that has certainly not stopped the company from rewarding its investors handsomely in direct defiance of the problems elsewhere in the market. Indeed, Coterra Energy’s stock is up an impressive 56.74% year-to-date and, when combined with its solid 7.83% annualized yield, it is very easy to see a potential appeal here. Despite the already impressive performance that we have seen, the stock certainly does not appear to be overvalued. In fact, by most metrics, Coterra Energy is quite substantially undervalued. Thus, it may make a great deal of sense to add the stock to your portfolio today.

About Coterra Energy

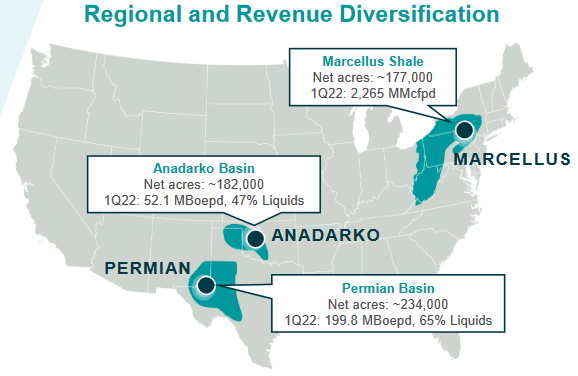

As stated in the introduction, Coterra Energy was formed via a late-2021 merger between Cabot Oil & Gas and Cimarex Energy. These two companies operated primarily in three shale basins throughout the United States and these operations were carried over to the combined company. Coterra Energy has operations in the Permian Basin, the Anadarko Basin, and the Marcellus Shale:

Coterra Energy

One of the things that we notice is that there are two primary types of basins here in terms of resources. Most notably, the Marcellus Shale is almost exclusively thought of as a natural gas and natural gas liquids play. Meanwhile, the Permian Basin is generally considered to be a crude oil-focused play, although it is also a major production center for both natural gas and natural gas liquids. This may lead one to believe that Coterra Energy’s production is a reasonably balanced mix between crude oil and natural gas. This is indeed the case, although the company’s production is somewhat heavily focused on natural gas. In fact, 76% of the company’s production and 54% of its first-quarter 2022 revenue came from natural gas. This is a good place to be since the fundamentals of natural gas are much stronger than the fundamentals for crude oil, which we will discuss later in this article. This is a marked difference from what we saw a decade ago when natural gas was frequently flared off as it was not worth bringing to the market. We do still see a decent amount of diversification here though, particularly when it comes to revenue proportions, which positions Coterra Energy well to take advantage of any market shift that favors one commodity over another.

It is not a surprise to anyone reading this that crude oil and natural gas prices have increased substantially over the past year, although they did ease slightly on this week’s crude oil inventory build. After all, we have all been paying much higher prices at the pump. As of the time of writing, West Texas Intermediate crude oil has increased by 59.89% and the price of natural gas at Henry Hub is up 129.01% over the past twelve months. This has enabled many exploration and production companies, including Coterra Energy, to generate free cash flow. This is a substantial improvement over a decade ago when pretty much the entire shale energy industry was struggling to generate positive free cash flows. In the first quarter of 2022, Coterra Energy reported a positive free cash flow of $954 million, which compares quite favorably to the $758 million that the firm reported in the fourth quarter of 2021. This is mostly because energy prices were higher during the most recent period as the company’s production was actually down quarter-over-quarter.

The generation of free cash flow is something that we very much like to see. This is because free cash flow is the money that is left over from the firm’s operations after it pays all of its bills and makes all necessary capital expenditures. This is, therefore, the money that is available to reward the shareholders by doing things like paying down debt, buying back stock, or paying a dividend. This last option is exactly what Coterra Energy has opted to do. The company has chosen to return 69% of its free cash flow to the shareholders through share buybacks and dividends, 50% of the free cash flow will be going to the dividend alone. In pursuit of this commitment, the company has instituted a base plus variable dividend policy, similar to the one being pursued by Pioneer Natural Resources (PXD) and a few other companies in the sector. The way that this works is that the company will pay out a fixed dividend of $0.15 per share quarterly plus an amount that depends on its free cash flow during the previous quarter. Coterra Energy wants the total dividend to be 50% of its free cash flow. Thus, the higher the company’s free cash flow, the higher the company’s dividend will be. In response to the company’s first-quarter 2022, it declared a dividend of $0.60 per share pursuant to this policy. This gives the stock an annualized yield of 7.83% at the current price, which is easily one of the highest yields in the market. As the company’s dividend directly increases with Coterra Energy’s free cash flow, this may even help alleviate some of the pain that you suffer when filling up your car.

One would expect that energy companies would be trying to increase their production aggressively in order to take advantage of the high energy prices that we have today and maximize their profits. This is not the case though and in fact, Coterra Energy has guided for relatively flat production compared to last year. Over the course of 2021, Coterra Energy produced an average of 634,000 barrels of oil equivalents per day but it has only guided to produce an average of 600,000 to 635,000 barrels of oil equivalents per day over the course of 2022. This is in line with the 630,000 barrels of oil equivalents per day that the company produced on average in the first quarter. There is a reason for this lack of production growth. For quite some time now, investors have been upset that the energy industry has generally underperformed pretty much everything else in the market despite the tremendous production growth that the industry delivered over the period. Coterra Energy has adopted something of a new business model that is focused on maximizing free cash flow while simply maintaining production. This allows the company to avoid the enormous capital expenditures associated with aggressively growing production (which is one reason why the shale industry has been one of the largest issuers of junk debt over the past decade). It also allows the industry to avoid oversupplying the market and thus keeping energy prices high. Coterra Energy’s actions thus make a great deal of sense. This strategy also allows the company to generate a high level of free cash flow, which should allow it to continue rewarding its investors with that large dividend. Thus, Coterra Energy’s actions to avoid production growth are very investor-friendly.

Fundamentals Of Oil And Gas

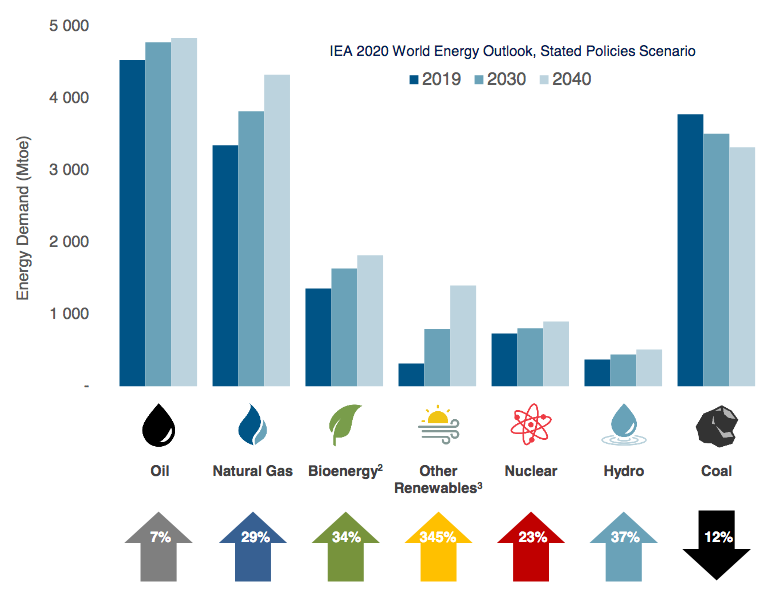

As Coterra Energy is a producer of crude oil and natural gas, it would make a great deal of sense to take a look at the fundamentals of these resources. Fortunately, these fundamentals are quite good. This will almost certainly be a surprise when we consider that the media, government figures, and various others have been talking about the end of the fossil fuel industry. However, the International Energy Agency projects that the global demand for natural gas will increase by 29% while the demand for crude oil will increase by 7% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

The demand growth for natural gas will be driven by global concerns about climate change. These concerns have incentivized governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. One of the most common of the strategies being employed to accomplish this is to encourage utilities to retire their old coal-fired power plants, which are replaced with renewables and natural gas-fired plants. The natural gas plants are necessary because renewables are not reliable enough with current technology to support a modern electric grid. Natural gas is reliable and it burns cleaner than any other fossil fuel so it makes an ideal fuel source to supplement renewables.

As 75% of Coterra Energy’s production is natural gas, it should be easy to see how it should benefit from the rising demand for natural gas. However, the company will likely benefit in another way. That is that the fundamentals for crude oil and natural gas point to a likelihood of sustained high prices. This is due to the basic laws of economics. As we just saw, the demand for both substances is expected to grow going forward. However, fossil fuel production is unlikely to grow to the same degree. The energy industry has been chronically underinvesting in upstream production and midstream infrastructure capacity since the 2015 crude oil bear market. This is one reason why the offshore drilling industry never fully recovered from the collapse that happened in the middle of the decade. In fact, Moody's states that the industry must immediately invest $542 billion into upstream production capacity alone in order to avoid a supply shock. It is highly unlikely that a spending increase of this degree will actually happen. Most traditional energy companies, especially in the United States and Europe, are under tremendous pressure from politicians, environmental activists, and even some investors to improve the sustainability of their operations. In addition to these pressures, many investors want the industry to improve its returns. There is absolutely no reason for the energy industry to increase its capital expenditures in this sort of environment. Thus, we have a situation in which the demand growth will likely outstrip the supply growth, which economic law states will result in rising energy prices. This scenario should, of course, benefit Coterra Energy and ultimately its investors through the free cash flow-based dividend. Consumers may lament the high energy prices but investors certainly do not have to.

Financial Considerations

It is always important that we look at the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a business than equity is because debt must be repaid at maturity. As most companies do not have sufficient cash on hand to repay their debt as it matures, this is typically accomplished by issuing new debt and using the proceeds to repay the maturing debt. This can result in the company having to pay more in interest following the rollover depending on market conditions. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes the firm’s cash flow to decline can push it into insolvency if it has too much debt. This can be a very real concern with companies like Coterra Energy because of the volatility of commodity prices.

One metric that we can use to measure the financial structure of a company is the net debt-to-equity ratio. This ratio tells us the degree to which the company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of March 31, 2022, Coterra Energy had a net debt of $1.997 billion compared to $11.768 billion in equity. This gives the company a net debt-to-equity ratio of 0.17, which is very reasonable. Here is how that compares to some of its peers:

Company | Net Debt-to-Equity |

Coterra Energy | 0.17 |

Continental Resources (CLR) | 0.80 |

Pioneer Natural Resources (PXD) | 0.12 |

Diamondback Energy (FANG) | 0.41 |

Devon Energy (DVN) | 0.45 |

As we can clearly see, Coterra Energy’s financial structure appears to be very reasonable compared to its peers, with the company less reliant on debt to fund its operations than many of them. This is very nice to see as it is a clear sign that the company is not excessively leveraged. Overall, there should be no particular risks with respect to the firm’s debt.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a sure-fire way to generate a suboptimal return on that asset. In the case of an independent exploration and production company like Coterra Energy, one metric that we can use to value it is the price-to-earnings growth ratio. This ratio is a modified version of the familiar price-to-earnings ratio that takes the company’s earnings per share growth into account. Generally, a price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its earnings per share growth and vice versa.

According to Zacks Investment Research, Coterra Energy will grow its earnings per share at a 55.04% rate over the next three to five years. That gives the stock a price-to-earnings growth ratio of 0.13 at the current price. This is a sign that the stock is likely significantly undervalued at its current level. However, as I have pointed out before, almost everything in the energy industry is substantially undervalued today. Therefore, let us compare Coterra Energy to its peer group to see which company offers the most attractive relative valuation:

Company | PEG Ratio |

Coterra Energy | 0.13 |

Continental Resources | 0.17 |

Pioneer Natural Resources | 0.89 |

Diamondback Energy | 0.26 |

Devon Energy | NA |

(all data courtesy of Zacks Investment Research)

Clearly, the sector as a whole is undervalued. However, we can also see that Coterra Energy seems to be offering the most attractive valuation out of its peer group today. This furthers our thesis that this company could be a solid investment in today’s environment.

Conclusion

In conclusion, Coterra Energy appears to offer a lot to an investor. The company boasts a very attractive combination of a strong balance sheet and an incredibly low valuation but it also possesses some significant growth prospects. The company’s dividend policy alone could endear this company to some investors since if you have to pay more at the pump, at least you can feel like you are getting some of your money back when that high yield hits your account. Overall, this company should prove very attractive to any investor.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!