gorodenkoff/iStock via Getty Images

[Please note that this article was first published on May 31st for subscribers of Macro Trading Factory ("MTF"), as part of our weekly macro/market review.

As such, whenever there's a reference to time, the pivot date is May 31st, although upon checking the

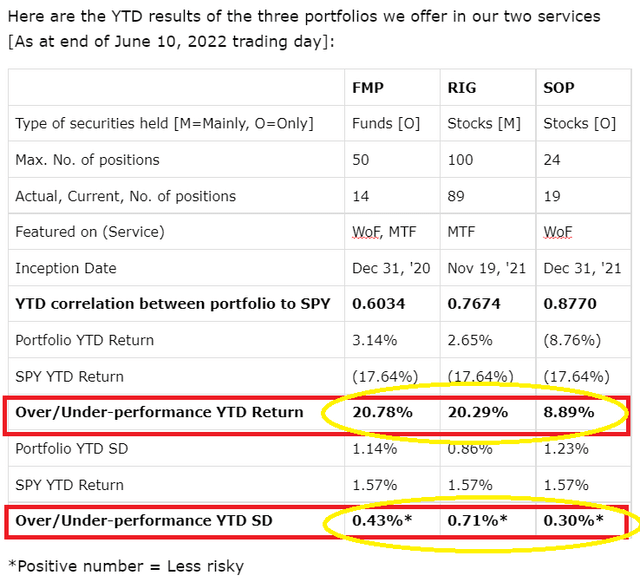

Macro Trading Factory is a macro-driven service, led by The Macro Teller and RoseNose.

The service offers two portfolios: “Funds Macro Portfolio” and “Rose's Income Garden”; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (less volatile), way.

Each of our portfolios, spanning across all sectors, offers you a hassle-free, easy to understand and execute, solution.