Cineberg/iStock Editorial via Getty Images

By Erik Norland

At A Glance

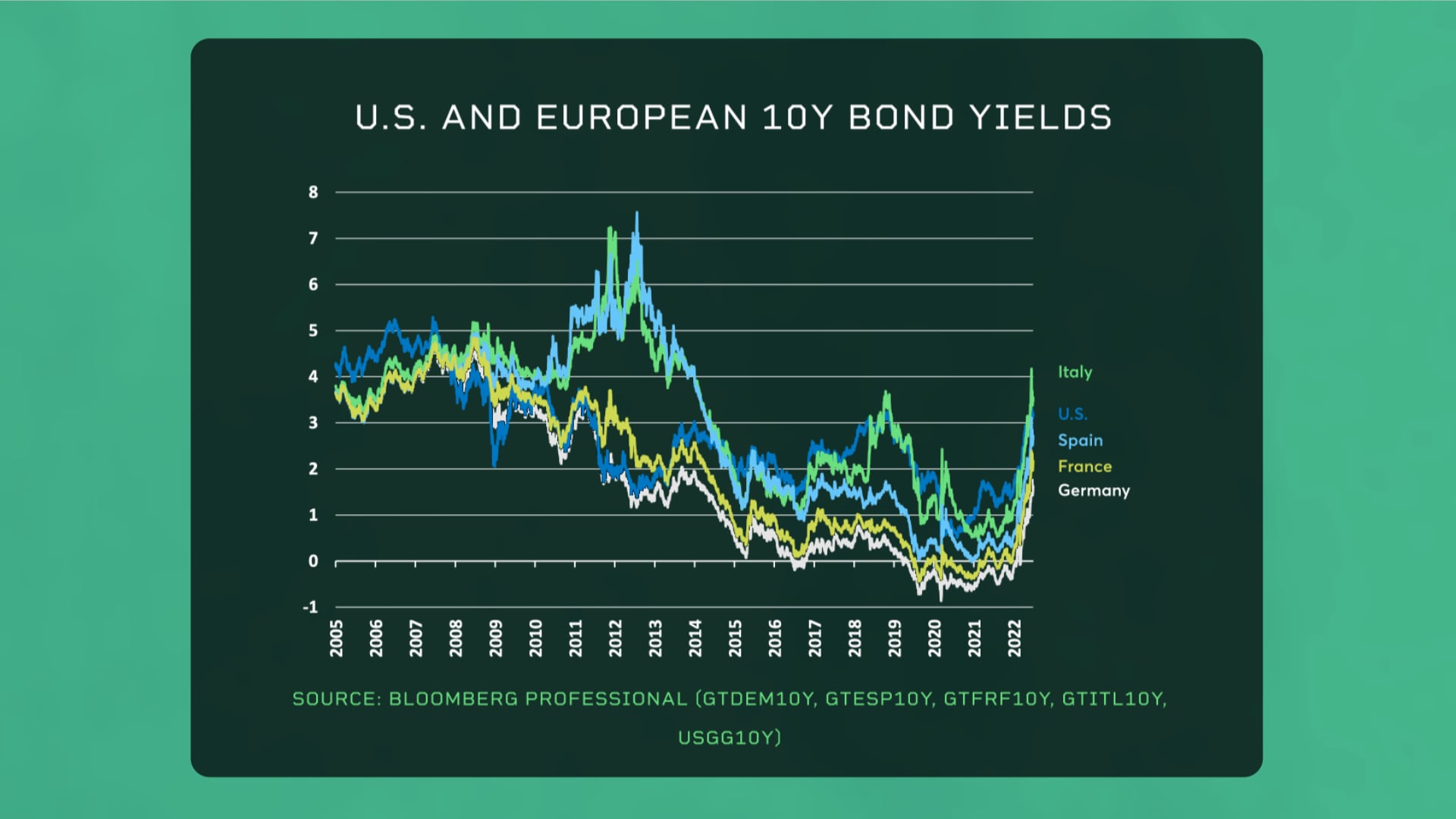

- Between 2009 and 2012, the euro area experienced a sovereign debt crisis

- The European Central Bank is ending its bond-buying program and prepping to raise rates

Is the eurozone headed for another debt crisis?

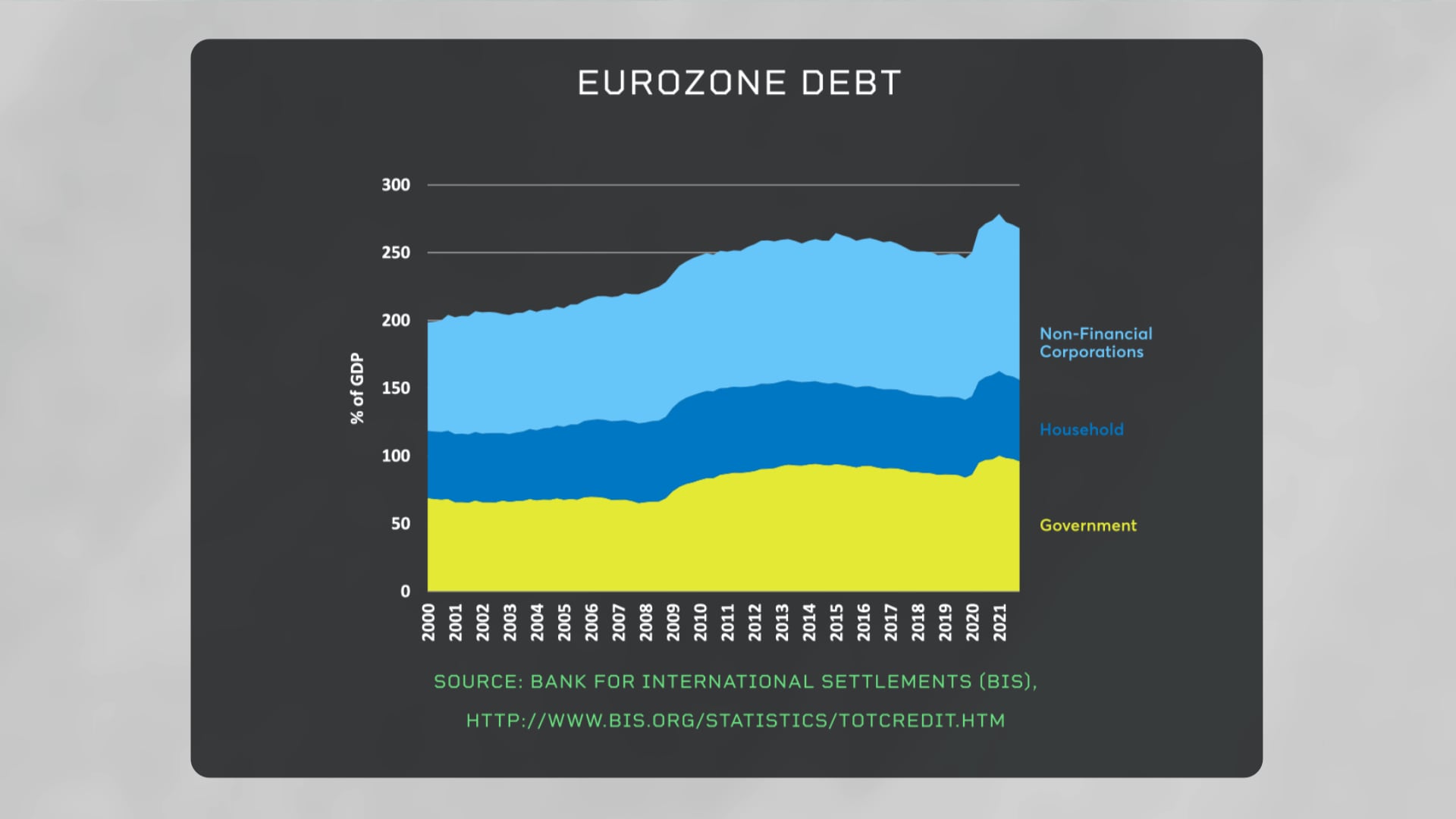

Judging from the overall level of debt in Europe, the answer seems to be “no.” European debt ratios have barely budged since 2012.

Bubbling beneath the apparently calm surface, there is a more complex reality.

Keeping Score

Some Eurozone countries, including Ireland, the Netherlands, Portugal, and Spain have spent the past decade deleveraging and their debt ratios have plunged. While countries like Germany and Austria still have far below-average debt ratios compared to Greece and Italy who have average or above-average debt ratios but ones that haven’t gotten worse. However, there is one group of countries that are more worrisome. Belgium, Finland, and especially France have seen their debt levels grow much faster than economic activity. This has left France as Europe’s most indebted nation.

A Precarious Situation

Part of the reason there has been no debt crisis in Europe over the past decade is that the European Central Bank (ECB) had interest rates near or even below zero. ECB president Christine Lagarde has signalled a 25-basis point rate hike for July and perhaps a 50-basis point rate hike for September. In a rising rate environment, the potential for debt crises grows, especially among Europe’s most indebted nations and European bond yields are beginning to reflect that risk.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.