urbazon/E+ via Getty Images

Investment Thesis

When I last covered Gilead Sciences (NASDAQ:GILD) - the $78bn market cap US pharmaceutical - for Seeking Alpha in May, I was critical of management - led by CEO Daniel O'Day - and wondered if, with the company having spent some $45bn on M&A over the past five years, which has yielded <$500m revenues per quarter (based on Q122 earnings), it was time for a change at the top?

That may be a little harsh on CEO O'Day, who was headhunted from Roche (OTCQX:OTCQX:RHHBY) in 2019, where he had spent three decades in various roles helping establish the Swiss pharma as an oncology superpower.

At Gilead, he has been asked to do something similar - to develop an oncology division that can help the pharma rebuild after its >$20bn per annum Hepatitis C franchise melted away in the middle of the last decade as patients were functionally cured.

It hasn't been a great start for the CEO, as I discussed in my previous note, Gilead had already spent ~$12bn on Kite Pharma and its cell therapy platform when O'Day arrived, which has led to two drug approvals - Yescarta and Tecartus - and $871m of revenues in FY21 - not a great return.

O'Day authorized a ~$5bn outlay on Forty Seven and its anti-CD47 therapy Magrolimab in 2021, and the $21bn buyout of Immunomedics in 2020 to gain access to its cancer drug Trodelvy. Since then, Magrolimab has had a clinical hold placed on its studies, while last quarter, Gilead accepted a $2.7bn impairment charge to reflect the likelihood of a delayed launch of Trodelvy in breast cancer.

Gilead stock is down 9% across the past year - the worst performer amongst the "Big 8" US pharmas, which are, in order of size, Johnson & Johnson (JNJ), Eli Lilly (LLY), Pfizer (PFE), AbbVie (ABBV), Merck (MRK), Bristol Myers Squibb (BMY), Amgen (AMGN), and Gilead. The average share price gain amongst these eight companies over the past three years is +62%, but Gilead stock has dropped in value by 5% over this period.

In my last note I suggested it may be time for O'Day to depart, but since that seems unlikely to happen - and Gilead has made some big promises in relation to its oncology division, promising that it will account for one third of all revenue by 2030 - in this post I will present a more optimistic view of the company, where it may find itself by 2030, in terms of approved products and revenues, and how that impacts its target share price today.

Gilead Portfolio Overview

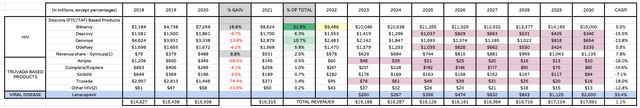

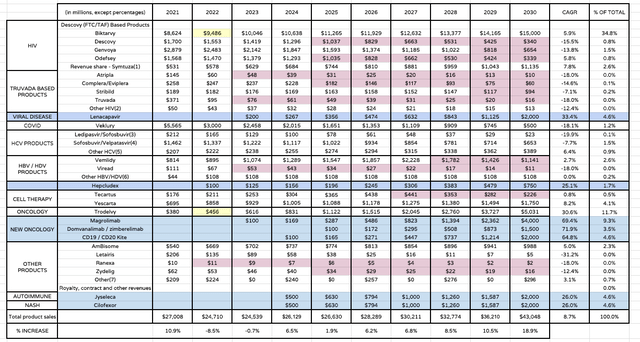

Gilead present portfolio and sales forecasts to 2030. (my table)

Source: my table using historical company data, my assumptions based on management's guidance.

The above table has a lot of moving parts so I will briefly break it down. In the first three columns of numbers, we can see product sales from 2018 - 2020 across all of Gilead's divisions - HIV, Truvada based products, COVID, HCV Products, HBC Products, Cell Therapy, Oncology, and Other Products.

The next column shows the percentage gain in sales between 2020 and 2021 - sales figures for 2021 in the next column. The next grayed-out column shows the % of total sales each product generated in 2021.

The first thing to note is how dependent Gilead is at the present time on sales of just two assets - Biktarvy, its mega-blockbuster in HIV, and Veklury, or Remdesivir, its COVID antiviral used to treat hospitalized patients. We also could add Genvoya to this list, since it accounted for 11% of all sales, although the fall in Genvoya revenues can be explained by patients being switched from this drug to Biktarvy.

Three assets accounting for nearly two thirds of all revenues is not normally a good position for a company to be in, and especially a pharmaceutical, since drugs have patent expiry cliffs, and when generic competitors are permitted to enter the market, their price point and sales volumes fall such that annual revenues begin to fall by at least 20% per annum.

Biktarvy is well protected from patent expiry, but will take a larger chunk of sales away from Genvoya each year, whilst the future of Veklury is uncertain, given that its anticipated fewer and fewer people will be hospitalized by COVID as the pandemic draws to a close.

As mentioned however, although Gilead has not made any bold predictions around its future growth, unlike e.g. Bristol Myers Squibb or AbbVie, for example, whose forecasts are quite detailed and meticulous, management has said that its oncology division will account for at least one third of total revenues by 2030, and there are several other exciting pipeline assets close to making it to market.

Let us therefore break down the divisions one and one and try to map up a realistic forward sales scenario.

HIV Forward Forecast

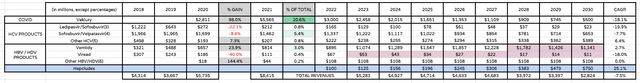

Forecast HIV product sales to 2030. (my table)

In the above table I have included historical HIV product sales, but I also have added some ballpark sales projections to 2030.

Biktarvy is a daily, fixed-dose combination of the integrase inhibitor bictegravir (BIC) plus two nucleoside reverse transcriptase inhibitors (NRTIs), emtricitabine ("FTC") and tenofovir alafenamide fumarate ("TAF"). The product has been a success from the word go, and is the world's best-selling HIV drug.

As we can see I have made a very bold prediction that Biktarvy can generate $15bn of sales by 2030 - it does not face a patent cliff this decade - at a CAGR of 5.9%. Descovy may face a patent expiry in 2023 (according to data I found in Gilead's 2021 10K submission) so I have reduced sales by 20% from then and shaded these cells pink.

Using the patent expiry table sourced from Gilead's 10K, I have applied the same logic to other products that are listed as going off patent, and used 2020/2021 sales growth percentages to forecast growth or losses of other products.

Finally, I have introduced a new pipeline product, Lenacapavir, which I'm predicting will launch in 2023, generating $200m of sales, and eventually peak at $2bn of sales in 2030.

Lenacapvir is a long-acting HIV therapy - injected once-every six months - that Gilead expects to compete with GlaxoSmithKline's (GSK) recently approved Cabenuva, which is a broadly similar product. The FDA declined to approve Lenacapavir in March, on Chemistry, Manufacturing and Control ("CMC") grounds - to do with deficiencies in the storage vials - which ought to be an issue Gilead can overcome.

Gilead hopes to market Lenacapavir as both a monotherapy and in combo with Merck's Islatravir, and I'm forecasting a $2bn peak revenue opportunity, since the therapy will need to be used in combo with other HIV treatments, but ought to be attractive to patients given its infrequent dosing. There are other HIV assets in Gilead's pipeline, but for the sake of brevity I'm using Lenacapavir as a cover-all.

In the end, the HIV division, according to my forecasts, does not stand to grow significantly - my CAGR is 1.1% to 2030. It's already a huge division, however, generating >$16bn of revenue in FY21, so I believe Gilead's goal here will be protecting what it has, rather than attempting to reinvent the wheel.

COVID, HCV and HDV

Forecast Veklury and HCV / HDV product sales to 2030. (my table)

Beginning with Veklury, this underrated drug has held its own throughout the pandemic as a COVID therapy, and was approved for treatment of non-hospitalized patients in January this year, after studies showed it reduced the risk of hospitalization by 87% versus placebo.

COVID is by no means going away - infection rates have risen in recent weeks - and Veklury generated ~$1.5bn of revenue for Gilead in Q122 alone, but nevertheless I'm forecasting for only $3bn of revenues in 2022, and have sales declining at a CAGR of ~18% to 2030, to just $500m. Veklury may find new label opportunities treating other forms of acute respiratory distress syndrome away from COVID, but I have it losing blockbuster (>$1bn sales per annum) status in 2027.

I'm also allocating a high peak sales figure for Vemlidy - a Hep B therapy of $2.2bn before a patent expiration in 2028. The drug can be used in combo with others, and although a generic version of the drug was recently tentatively approved by the FDA, I'm expecting Gilead's experience in this market to win through. I'm also forecasting new HDV therapy Hepcludex - already approved in Europe, to achieve peak sales of $750m by 2030.

Overall, then, across these two divisions, I'm expecting Veklury revenues to decline significantly, while the HBV / HDV division holds steady, making an incremental increase in sales as some products sales declines or patent expiries are offset by growth in newer products, and the launch of Hepcludex.

Cell Therapy

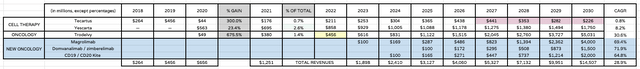

Forecast Cell Therapy sales to 2030. (my table)

Although Gilead has been criticized for failing to extract much value from its $12bn acquisition of Kite Pharma, in fairness to the company, cell therapy is an exciting growth field in medicine and to have had 2 therapies approved can be considered a success. Only Bristol Myers Squibb (Abecma and Breyanzi) can match that.

While I have Yescarta down a blockbuster, with approvals in follicular lymphoma, and several types of Diffuse large B cell lymphoma (DLBCL) imminent, I'm less confident in Tecartus' growth potential and note it's listed as having a patent expiry in 2028.

Trodelvy is a potential multi-billion seller for Gilead, but its development has been far from straightforward, despite approvals in metastatic urothelial cancer and triple negative breast cancer.

The drug directs chemotherapies to tumors expressing the protein TROP2, but its use to date has primarily been in later lines of therapy, and there are question marks over whether it can target more lucrative, early stage markets. With approval short in lucrative markets such as non-small cell lung cancer ("NSCLC") however, I'm giving O'Day the benefit of the doubt and forecasting $5bn in peak sales.

I'm also being generous with Magrolimab - which has now had its clinical trial holds lifted. It may work in a range of hematological cancers. There are nine clinical studies underway (according to a Gilead deep dive presentation on its oncology division) and it could make the grade in solid tumors, with its unique mechanism of action, helping macrophages identify and "eat" hidden cancer cells.

I'm also backing Kite to deliver another successful cell therapy - possibly targeting solid tumors - a hugely exciting prospect for a cell therapy - and Kite is a leader in CD19 directed therapies, with several pipeline assets that Gilead wants to put front and centre of its oncology growth strategy.

All told, then, I forecast Gilead to reach $15bn in oncology revenue by 2030, which would represent around one third of total revenues, just as management predicts it will.

Other Products + Jyseleca in Anti-Inflammatory and Cilofexor in NASH

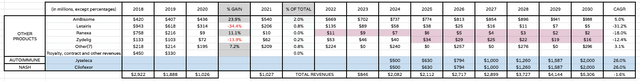

Forecast Other Product sales + Jyseleca and Cilofexor (my table)

Finally, I'm not expecting much growth from Gilead's "Other Products" division, other than from Ambisome, the antifungal. This is not a product I'm overly familiar with, however it offsets losses in other areas.

I'm more interested in two more product launches that have - once again - caused Gilead many problems throughout their approval process, but which I believe will make it to market and rack up some impressive sales.

Jyseleca is a JAK inhibitor - a type of drug that has proven to be effective but has been dogged by safety issues. AbbVie's (ABBV) JAK inhibitor Rinvoq has already racked up blockbuster sales, as have Pfizer’s Xeljanz (tofacitinib), and Eli Lilly (LLY) and Incyte’s (INCY) Olumiant (baricitinib).

Jyseleca has been approved in Europe and is targeting a US approval in Crohn's Disease, while Cilofexor is being developed to tackle fibrotic diseases, and has an approval shot in non-alcoholic steatohepatitis ("NASH"), in combo with Novo Nordisk's weight loss wonder drug Semaglutide. Cilofexor may be a speculative case for approval, but I have given each drug a $2bn peak sales position by 2030.

Total Revenues Forecast and Fair Value Target Price

Gilead product sales forecast to 2030. (my table)

Finally, then, I can present a table detailing how I see Gilead growing revenues at a CAGR of ~9%, between today and 2030, from $27bn, to $43bn, and in the process, placing itself once again amongst the heavyweights in the US pharma industry.

Of course, this is a highly speculative set of projections, and any reader could legitimately question any estimate, likelihood of approval, or even patent expiry (although many hours of online research and modelling have been invested in its creation).

With that said, however, when evaluating an investment into a pharmaceutical company, it's important to have your own idea of where the growth is coming from, what the pipeline looks like, and what the peak sales projections are.

Once you have your table, you can adjust accordingly, but if you have nothing mapped or projected, you can only blame yourself for missing out on a share price spike, not investing ahead of a strong year of revenue growth, or failing to spot when a company is in trouble.

In this article I have focused exclusively on the product portfolio, and paid little attention to debt, which currently stands at ~$25bn, or the dividend, which currently yields an impressive 4.72%.

Finally, to calculate a fair value share price target, I use a weighted average cost of capital of 9.4% (risk free rate of 1.7%, expected market return of 12%, and beta of 0.91), and use discounted cash flow analysis to calculate a target share price of $110. Using EBITDA multiple analysis, I calculate a price target of $144, for an average target of $127.

Conclusion: Can Gilead Double In Value and Revenue by 2030? It's Doubtful, But Theoretically Possible

The object of this article was not to persuade readers that my forecasts are clairvoyant and Gilead will double its revenues in eight years, but rather to illustrate the growth that may be possible at the company, based on its current portfolio and opportunities, and management's stated ambitions.

I hope it has proven to be useful, and acknowledge that every pharma is working with earlier stage assets that could prove more beneficial to it than anything in the late-stage portfolio, but that is far harder to model.

As a shareholder in Gilead, it's in my interests to develop the most accurate model possible, and fill in the blanks or make the necessary changes as I go. I share it in this post so readers can learn more about Gilead's portfolio and pipeline, and compare with their own data.

Do I think Gilead's share price can reach $120 in the coming years? That would be higher than its all-time peak, in 2015, when the HCV portfolio was generating $20bn per annum. CEO O'Day wants to develop something similar with the oncology portfolio, and although he may have made a bad start, the opportunities are certainly out there.

I'm happy to hold Gilead stock while accepting a generous dividend and keeping a close eye on developments at the company, and I don't think a return to the highs of 2015 can be ruled out.

Gilead drove a net profit margin of 23% in FY21, now the company needs to stop botching approval shots, stay away from M&A, and maximize the value of its pipeline.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.