Torsten Asmus

August 3rd proved to be a very interesting day for shareholders of Marathon Oil Corporation (NYSE:MRO). This is because, in addition to reporting some positive earnings results, the company also reiterated strong guidance for the 2022 fiscal year. Overall, the picture for the company is looking up even though energy prices have weakened lately. Some investors may fear a further decline in pricing as the risk of a recession is deemed high. But even in the event that prices plunge from here, shares do look attractively priced and should be considered by most investors to be low risk compared to other players in the oil and gas space. Because of this, I have decided to rate the business a ‘strong buy’, reflecting my belief that the company would likely continue to outperform the market materially moving forward.

An interesting quarter

After the market closed on August 3rd, the management team at Marathon Oil announced financial results for the second quarter of the company's 2022 fiscal year. In that release, data looked quite encouraging. For starters, we should touch on the headline news. Revenue came in at $2.31 billion. In addition to crushing the $1.14 billion generated the same time one year earlier, the sales figure also came in $190 million higher than what analysts anticipated. Interestingly, This rise was not driven by any material change in production. In fact, net sales volume for the company dropped by about 1%, falling from 348,000 boe (barrels of oil equivalent) per day down to 343,000. This change, management said, was really driven by just the natural decline of the company’s properties.

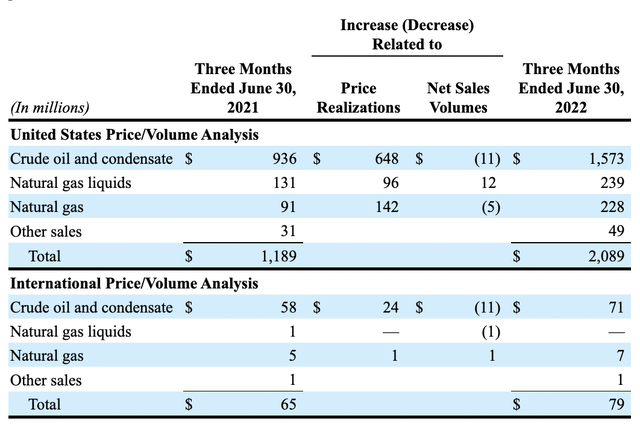

What the company did benefit from, instead, with a significant improvement in pricing. Crude oil, for instance, averaged $110.10 per barrel for the quarter. That's 70% higher than the $64.73 per barrel achieved one year earlier. Natural gas liquids pricing rose by 67%, while natural gas pricing jumped 162%. Management actually provides a lot of detail regarding the impact that different changes had to the company's top line. In all, higher realized prices added $886 million to the company's top line in the U.S. market, while adding a further $25 million to its international operations. Globally, net sales volume declines hit the company to the tune of $15 million.

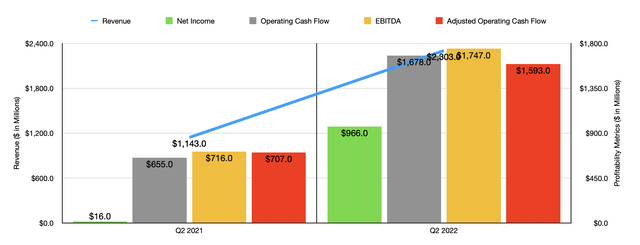

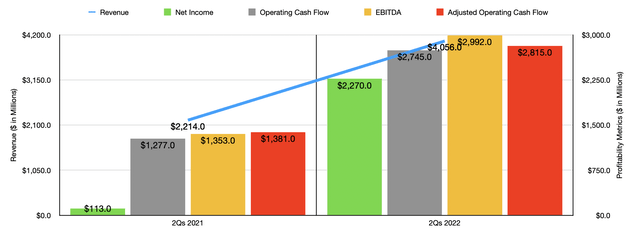

Thanks to this rapid improvement in revenue, profitability and cash flows for the latest quarter came in strong. Net income of $966 million dwarfed the $16 million generated in the second quarter of 2022. On a per-share basis, earnings came in at $1.37. The adjusted earnings per share were slightly lower at $1.32, beating analysts' expectations by $0.04 per share. Even more important would be cash flow. Operating cash flow came in at $1.68 billion. That compares favorably to the $655 million generated in the second quarter of 2021. If we adjust for changes in working capital, it would have risen from $707 million to $1.59 billion. Meanwhile, EBITDA for the company also improved, climbing from $716 million to $1.75 billion. And as the chart below illustrates, all of this on both the top and bottom lines had a positive impact for the full first half of the year as well.

Clearly, things are going quite well for Marathon Oil at this time. Unlike many other players in this space, Marathon Oil is very transparent about what they expect for the current fiscal year as a whole. If we assume that oil prices, as measured by WTI crude, will average $100 per barrel while natural gas prices will average $6 per Mcf, then the firm should generate operating cash flow of $5.80 billion. Capital expenditures should come in at $1.30 billion, resulting in free cash flow for the company of $4.50 billion. The pricing management provided as guidance is not all that far off from what prices have averaged in the first seven months of this year. Oil has been about $101.59 per barrel, while natural gas has been $6.24 per Mcf. This is all great, but we cannot ignore the tremendous volatility of the oil and gas space. As of this writing, for instance, WTI crude is around $89 per barrel, while natural gas prices are at $8.08 per Mcf.

The great thing for investors is that management has even gone so far as to provide something of a sensitivity analysis when it comes to both of these prices. Their current expectation is for each $1 change in WTI crude to impact the company’s operating cash flow for the year to the tune of $60 million. An identical change in natural gas prices would impact cash flow by $170 million. If we use current pricing, the drop in oil would hit the company in the amount of $660 million, while the increase in natural gas would help it to the tune of about $340 million. In all, current prices would translate to operating cash flow of $5.48 billion, while free cash flow would be $4.18 billion.

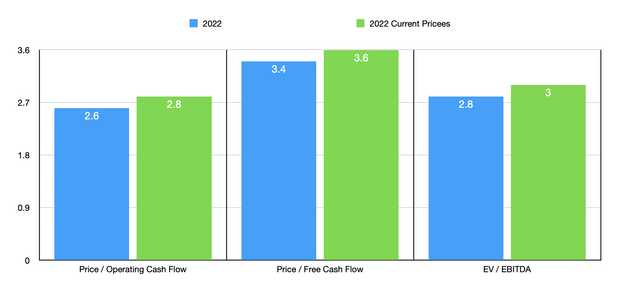

To value the company, I assumed that the current relationship between operating cash flow and EBITDA work stand through the rest of the year. From that point, I then calculated that the company is trading at a forward price to operating cash flow multiple of 2.6 and at an EV to EBITDA multiple of 2.8. The price to free cash flow multiple, meanwhile, should come in at 3.4. In this environment, the net leverage ratio for the firm is just 0.45. Any number that is 2 or lower is fine, with the current level best rated by Marathon Oil making it very safe relative to many other players in the market. My analysis also looks at a scenario using current energy prices. These multiples would be 2.8, 3, and 3.6, respectively, while the net leverage ratio for the firm would increase only modestly to 0.47.

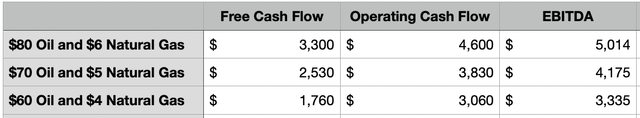

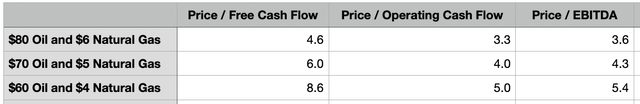

Why it's good to see that the company would still be robust in the current energy environment, those who have been involved in the oil patch for as long as I have know that prices can get far more volatile than what we are seeing today. So it's part of my analysis, I also decided to look at cash flow figures in the event that oil drops enough to average $80 per barrel this year while natural gas averages $6 per Mcf. My analysis also includes a scenario of $70 per barrel and $5 per Mcf, as well as $60 per barrel and $4 per Mcf. As you can see in the table below, pricing still looks very attractive for investors, likely meaning that the overall future for the company is looking up.

Takeaway

Based on all the data provided, I will say that I am currently impressed by what I see with Marathon Oil. The company is doing a remarkable job creating value for its investors and the firm looks like a much safer prospect in this market than many others that are out there. Although it's true that the future can be uncertain when it comes to energy prices and investors should always be okay with that risk, shares are cheap enough now and the risk is low enough for investors that I believe a ‘strong buy’ rating on the company is appropriate.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!