Daniel Balakov

Investment thesis

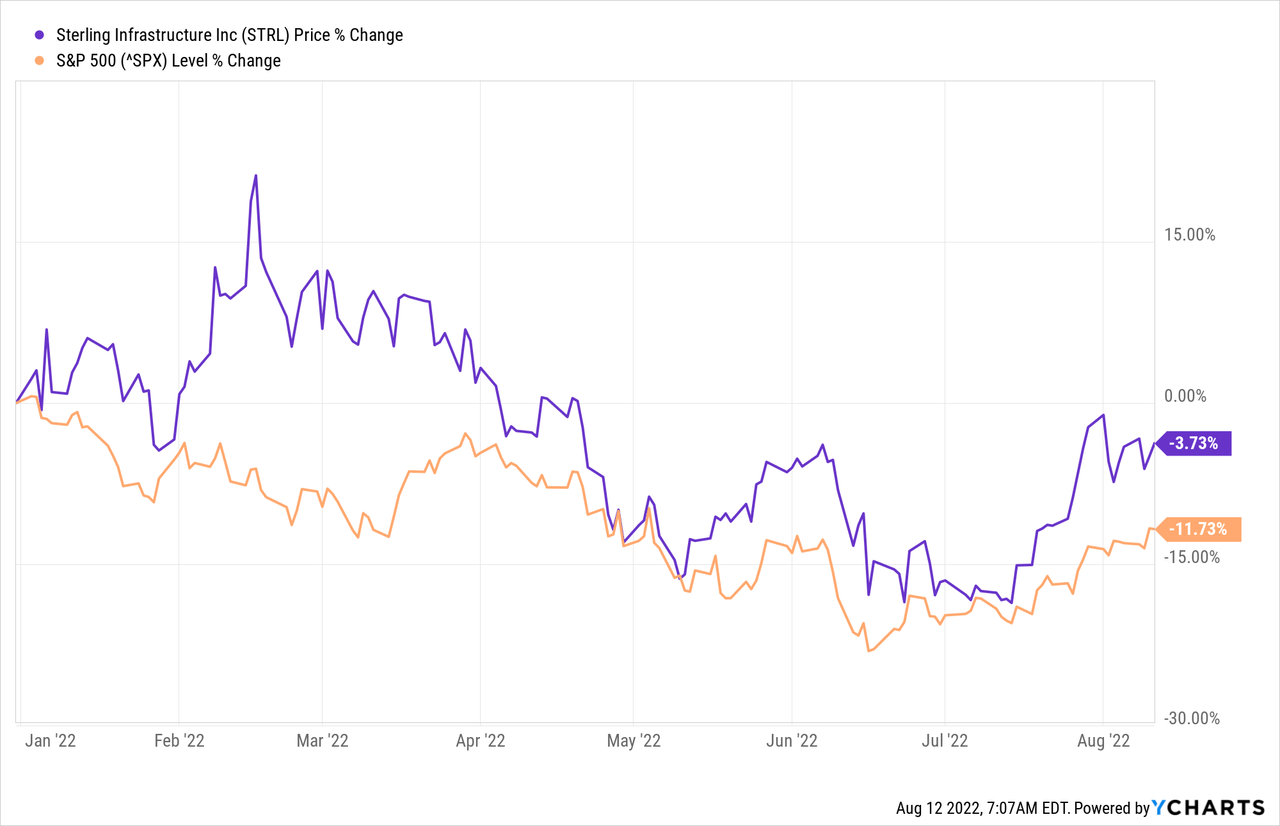

Sterling Infrastructure, Inc. (NASDAQ:STRL) has performed quite decently in the previous year and YTD, flowing along with the economy as a cyclical stock. The company experienced a growth of 37.34% in its share price during the previous year in line with the economic recovery but has lost about 22% since mid-February, underperforming the broader market, most likely because of its cyclical nature.

The market outlook and trends currently reflect favorable opportunities for long-term growth despite the challenging market pressures that include persistent supply chain issues and labor challenges left behind by the pandemic and the macroeconomic-imposed inflation and recessionary environment.

The management is focused on its strategic business elements and objectives to remain competitive in the current market environment, translating business opportunities into strong financial performance.

With the attractive valuation metrics and strong growth opportunities, I expect the stock to show prominent capital appreciation by 2023.

The Company

The company has been operating for almost seven decades out of The Woodlands, Texas. It was formerly known as Sterling Construction Company, Inc. and changed its name to Sterling Infrastructure, Inc. in June 2022.

"The company primarily offers transportation, e-infrastructure, and building solutions, operating domestically in the Southern, Northeastern, Mid-Atlantic United States, the Rocky Mountain states, California, and Hawaii. STRL engages in rehabilitation and infrastructure projects for highways, roads, bridges, airports, ports, light rail, and water, wastewater, and storm drainage systems in various states for the transportation departments, regional transit authorities, airport authorities, port authorities, water authorities, and railroads."

"The company also provides site infrastructure improvement contracting services for blue-chip end users in the e-commerce, data center, distribution center, warehousing, and energy sectors. In addition, STRL undertakes concrete work for national home builders, regional and custom home builders, and developers and general contractors in commercial markets."

The company’s e-infrastructure segment accounts for 43% of the total revenue, followed by the transportation segment’s 38%, and building solution’s 19%. Each segment reported YoY growth of 82%, 0.5%, and 13.7% respectively.

E-Infrastructure solutions

Sterling’s E-Infrastructure Solutions business is primarily driven by developing data centers, e-commerce distribution centers, and warehouses. This segment is set to experience strong market demand and bookings in the upcoming quarters because of the growing e-commerce businesses and more retailers building their e-commerce strategies, leading the way to new warehouse projects.

The company is more likely to experience new opportunities despite the recent supply chain challenges. The strong warehousing availability concern coupled with the continued need for new data centers has put SRTL in a very favorable position throughout the decade.

Industry experts expect the demand to remain extremely strong for building warehouses and distribution centers with the growing e-commerce business. Despite 16.7 million square feet of new buildings on the East Coast in 2021, warehouse availability remains strained.

The US e-commerce sales are likely to increase by 26% by 2025, leading to 1.5 billion square feet of demand globally. To fulfill this expected e-commerce demand, the U.S. needs 330 million square feet of space committed to warehousing by 2025. The US hyperscale data center market witnessed 110 facilities expansion over the year, mostly in Arizona, Texas, Nevada, Virginia, Illinois, and California. This market is expected to grow at a CAGR of over 3% from 2022 to 2027, directly pouring demand into STRL's opportunities pool.

Because of their cyclical nature, construction companies like STRL will likely suffer from the current macroeconomic conditions and recessionary pressures. The company has noted indicators of end users pulling back due to equipment and land availability challenges, supply chain, especially material, delays, and fuel price increases.

Still, the long-term prognosis is positive because of the growing demand. It is important to note that the company has withstood multiple recessions during its seven decades of operations.

Growth Opportunities

STRL barely managed to increase its growth in the transportation solutions segment, demonstrating a YoY growth of only 0.5% during the first half of 2022. Government spending and infrastructure focus directly affect the company’s growth and profitability. The segment is primarily driven by civil state and municipal funding, with the transportation department providing 50% of the federal funds for highways and bridges project outlays.

President Biden's Bipartisan Infrastructure Law commits a hefty amount to rebuilding the country’s infrastructure, including up to $65 billion in broadband infrastructure deployment and $91 billion in guaranteed funding to support federal public transportation programs.

The regulation will reconstruct American bridges, rails, and roads, help provide clean drinking water expansion, and high-speed internet for the public, tackle the environmental emergency, and put resources into networks that have been repeatedly abandoned in the past. The US government aims to spend over $200 billion in 5 years for transportation infrastructure improvements, including $110 billion reserved for roads and bridges, $66 billion for rail, and $25 billion for airports.

This significant government increasing of funds will trickle down into the economy, especially benefiting companies like STRL, which is directly involved in these infrastructure initiatives. The company will likely expect a revenue hike in the upcoming quarters, benefiting from this trickle-down effect, resulting in stable revenue and earnings growth.

Financial Resilience

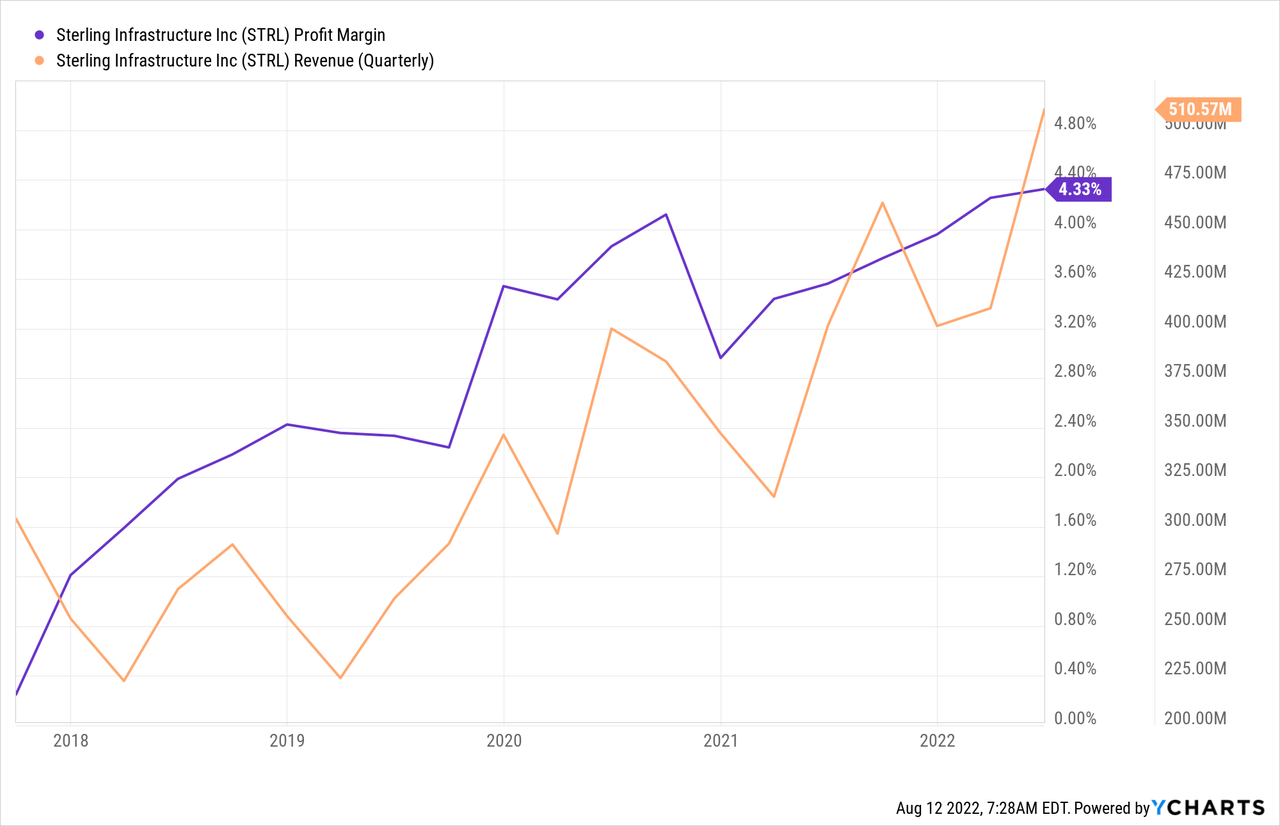

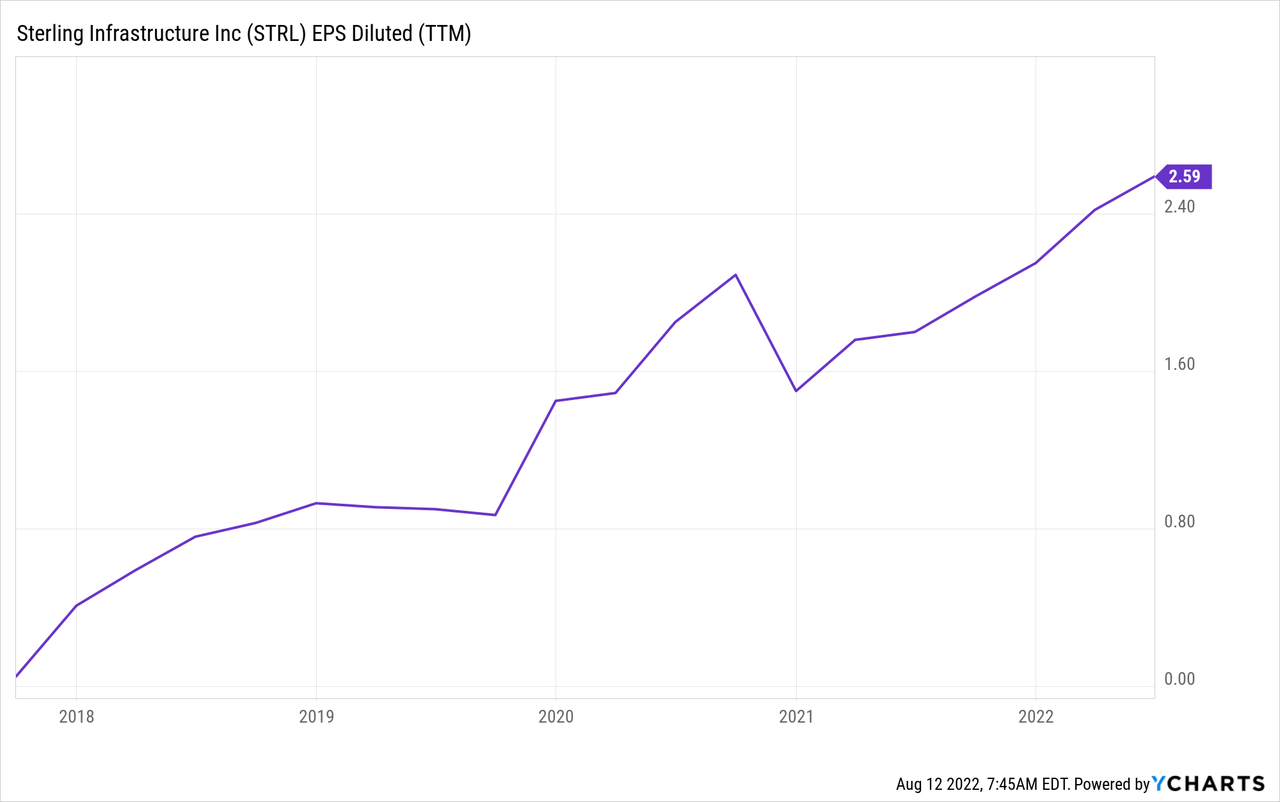

STRL has published resilient earnings reports over the past few years despite the pandemic. With a 5-year revenue CAGR of 18.2% and a 3-year EPS CAGR of 42.26%, STRL has shown strong growth metrics despite a hindered performance from Q3 2022 to Q2 2021.

In the TTM, the company has also beaten analyst estimates with YoY revenue growth of 23.35% and a DEPS growth of 44%. In contrast, the overall sector has shown YoY revenue growth of 16.59% and a diluted EPS growth of 27.29%. The company’s profit margins have also improved from 3.6% in 2021 to 4.3% in the MRQ.

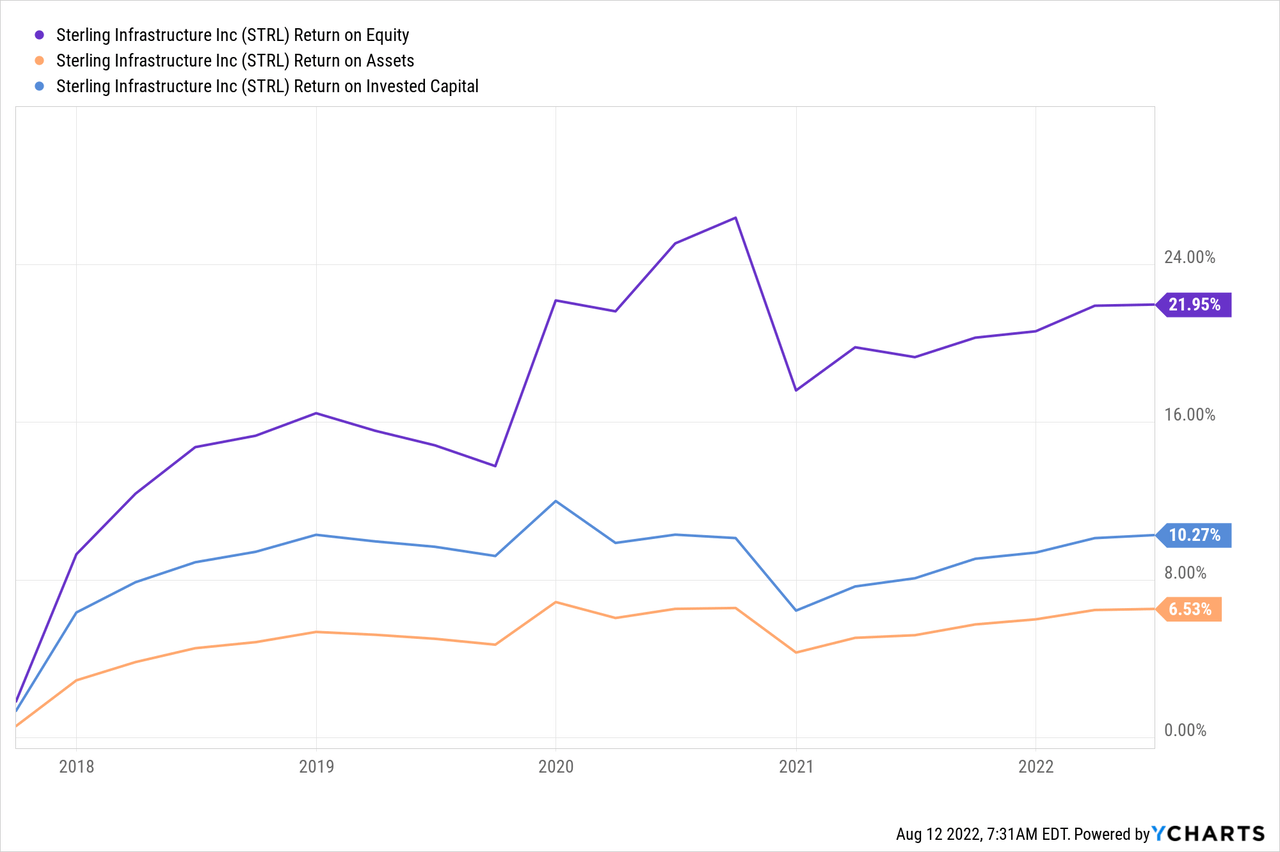

The company’s ROE and ROTC of almost 22% and over 10% are considerably higher than the sector medians of 14.4% and 6.7%, with the ROTA slightly beating the medians with almost 10%, indicating the effective use of resources by the management throughout the trailing twelve months. This is especially important to note as even during the relatively weaker performance period, through H2 2020 and H1 2021, the company has beaten analyst estimates 7 out of 8 times in the last 2 years.

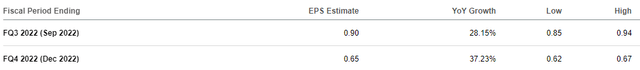

Analysts expect a YoY earnings growth of 28% and 37% during the next 2 quarters, which may seem excessive given the recessionary pressures, but they seem adequate in line with its historical performance. This shows the market’s confidence in the company’s growth and resilient financial performance even during the harsh macroeconomic uncertainties.

The company’s EPS was recorded at $1.5 at the end of 2020. Since then, the EPS has been consistently rising, showing sequential growth, and closing at $2.6 at the MRQ. Following the current trajectory, the EPS will likely exceed $3 by this year’s end.

Valuation

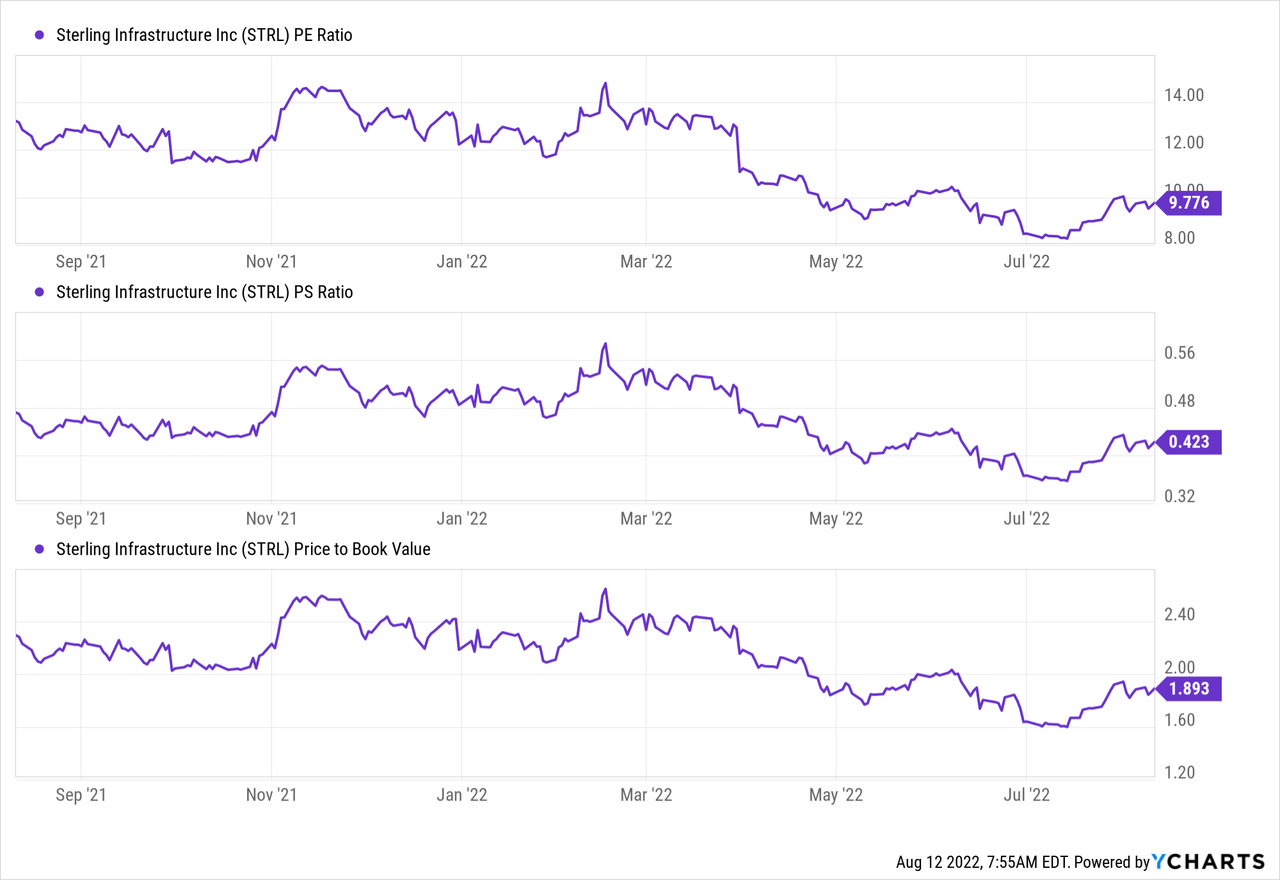

The stock's valuation is one of its strong suits because of the decline in share price since February. Based on relative valuation metrics, it trades at about a 50% discount to the sector median. Its TTM-based P/E, P/S, and P/B ratios are 9.75x, 0.42x, and 1.89x, compared to the industry's 19.50x, 1.39x, and 2.64x, a discount of 50%, 70%, and 28.4%. Similarly, its P/CF is 51% lower than the sector median of 16.5x.

The company's cash recently took a dive because of the $175 million cash payment as part of the $196.8 million Petillo Inc. acquisition. However, Petillo’s operations have already generated over $123 million in revenue as part of the company's e-infrastructure solutions segment. I expect the FCF per share growth to rebound by the start of next year as the company posts its first full-year report following the Petillo transaction, closing the gap between its share price and fair value.

Conclusion

Despite being a cyclical stock, STRL has produced positive results during the past years, with strong 5 and 3-year growth CAGR. The company's recent acquisition and the increased government infrastructure spending are likely to pitch into its future performance and result in even stronger financial performance.

The management has successfully deployed resources to maximize returns with above-average resource utilization and margin expansion. This ability to maximize returns will be crucial to translating the upcoming opportunities into financial performance.

The current macroeconomic environment has investors looking for resilient stocks, generally non-cyclical. STRL exhibits the best of both worlds with resiliency and cyclicality, with the ability to withstand the recessionary pressures and realize the potential of a post-recession economic recovery.