David Ramos

Thesis

Microsoft Corporation (NASDAQ:MSFT) stock has recovered remarkably since its robust FQ4 earnings release in late July. We highlighted in a pre-earnings piece that Azure's growth cadence should continue to help underpin its performance, even though the consumer-end market could perform poorly.

Notably, Microsoft telegraphed guidance on Azure growth that was better than we expected, despite the deceleration in usage-based spending. Therefore, it demonstrates that Azure has a solid base revenue that is secular and pretty resilient to macroeconomic headwinds, lending credence to its revenue visibility.

However, we also observed MSFT's recovery from its June bottom had been too fast for our preference and that a retracement looks overdue as it has moved past our fair value estimates.

Therefore, we revise our rating on MSFT from Buy to Hold and urge investors to bide their time before adding more exposure.

Investors Can Look Forward To A Better FY23

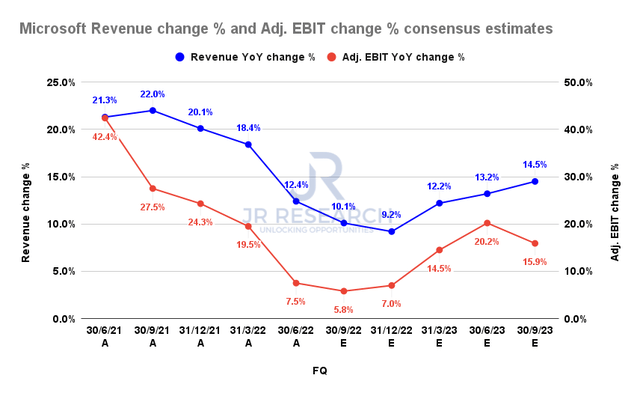

Microsoft revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

As seen above, the consensus estimates (very bullish) suggest that Microsoft's revenue and adjusted EBIT growth could reach its nadir in FQ1'23 before recovering markedly through FY23. Therefore, the market wasn't disappointed even though the company's FY23 guidance came in below the previous consensus estimates.

We believe the market has already astutely anticipated the deceleration for H1'22 through FY23, given the battering in MSFT since November 2021. Coupled with our confidence in the market's bottom in June/July, it has also lifted buying sentiments markedly for MSFT.

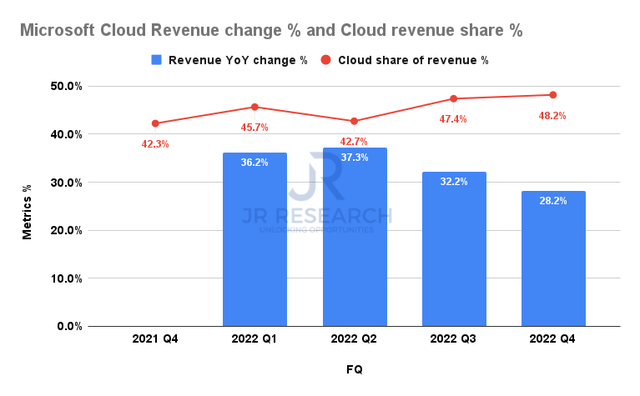

Microsoft cloud revenue change % (Company filings)

Notwithstanding, investors should continue to assess the growth trajectory of the company's leading source of growth: Microsoft Cloud. As seen above, its revenue growth has continued to moderate, even as it accounted for a higher share of total revenue.

Microsoft Cloud posted revenue growth of 28.2% in FQ4, down from FQ3's 32.2%. Notably, its revenue share increased to 48.2%, up from FQ3's 47.4%.

Still, we are pleased that Azure's growth cadence remains robust, as Microsoft highlighted 43% YoY growth (in constant currency), just slightly below Q4's 46% growth. Hence, it demonstrates the resilience of growth cadence, which could underpin the company's ability to sustain its Cloud revenue momentum.

Furthermore, Azure has been making more aggressive moves to gain share against AWS (AMZN) lately. WSJ reported:

[Microsoft] has issued talking points to other cloud companies aimed at jointly lobbying Washington to require major government projects to use more than one cloud service - WSJ

Therefore, it appears that CEO Satya Nadella & team is looking to add further pressure in the government vertical against Amazon's dominance in the IaaS space to spur further growth.

In addition, Microsoft ramped up its multi/hybrid cloud approach as it deepened its partnership with Oracle (ORCL) to facilitate greater interoperability between their platforms, improving access for their mutual customers. Hence, we are confident that Microsoft Cloud has a formidable moat that is seemingly growing its clout as it stretches the distance from Google (GOOGL) (GOOG), which is still chasing profitability and closing the gap on AWS.

MSFT's Price Action Corroborates A Long-Term Bottom

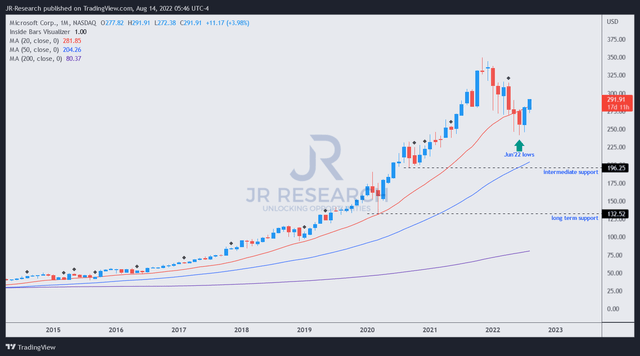

MSFT price chart (monthly) (TradingView)

As seen above, we are confident that MSFT has formed its long-term bottom in June on its long-term chart. Over the past eight years, investors should note that MSFT's long-term uptrend has been consistently supported above its 20-month moving average (red line).

Buying momentum from July and August has seen MSFT retook its 20-month moving average, seeking to sustain further buying upside. Therefore, the price action is highly constructive, and we don't expect further downside to its intermediate support ($200).

Is MSFT A Buy, Sell, Or Hold?

We revise our rating on MSFT from Buy to Hold.

MSFT's buying momentum could continue to help drive its short-term rally further. However, we believe the risk/reward profile seems more balanced at the current levels, given a slower growth profile moving forward.

Our internal fair value estimates suggest that investors should wait patiently for a retracement before adding exposure.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

24/7 access to our model portfolios

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

Access to all our top stocks and earnings ideas

Access to all our charts with specific entry points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!