blackred

Note: Prices discussed are in Canadian Dollars or US Dollars and are indicated as such.

When we last covered Crescent Point Energy (NYSE:CPG) we had a decidedly bullish view.

Our price target ($10.00 USD and $13.00 CAD) is based almost exclusively on net cash generation (after capex and dividends) of about $2.1 billion CAD over the next two years and that comes to about $3.75 CAD per share or $2.85 USD per share. We are not taking into account valuation expansion from these levels, which could add substantially to returns.

Source: Living On The Hedge

The stock has fought back the strong US dollar, but the returns have been less than what we thought we would get.

Seeking Alpha

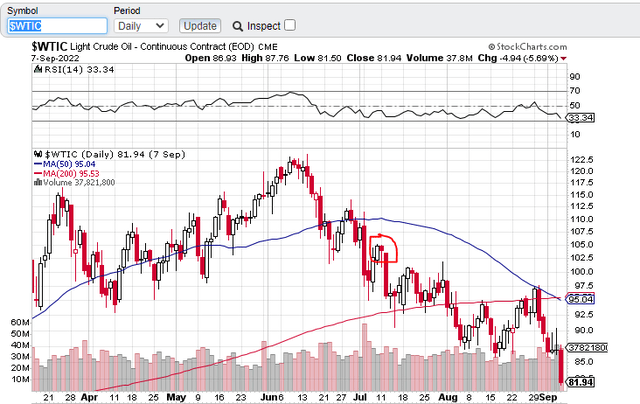

Of course, that has a lot to do with this.

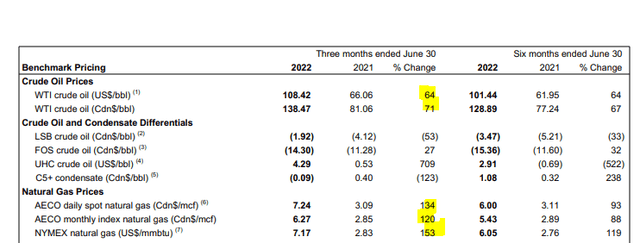

Crude oil prices have tumbled a rather brisk 22% in less than two months. We examine the thesis and cash flow projections in light of this and update our thesis.

Q2-2022

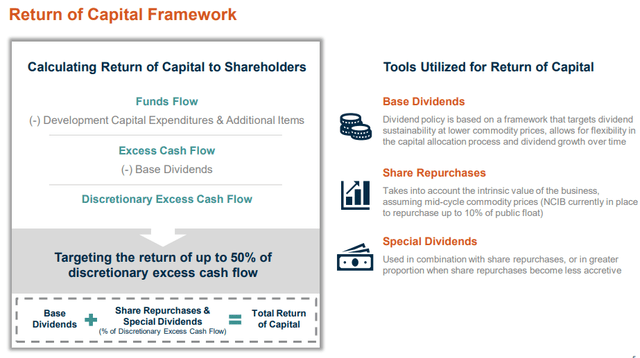

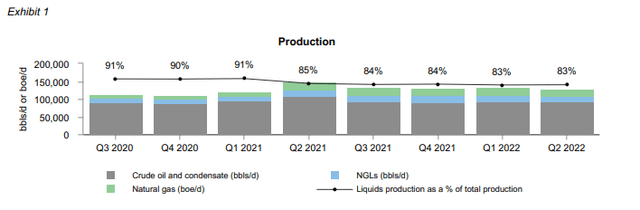

Before we get to the impact of the collapse, we want readers to get an idea about the superb quarter that just came to pass. CPG's Q2-2022 production of 129.2 mBOE/day was 2% ahead of where the street was at. 2% beats are rare on production as those are the most well-telegraphed numbers. Cash flow per share was also higher than expectations and came in at $1.03 CAD per share. Most notable for us was that the capex guidance was held at $875-$900 million CAD. With the rampant cost inflation and the tight labor markets, we felt this was likely to be a casualty very soon, but we were pleasantly surprised. Net debt was reduced by $300 million CAD during the quarter and CPG reached the $1.3 billion CAD net debt mark. This led to CPG management communicating its enhanced capital return program where in it was targeting 50% of free cash flow to be sent back to shareholders, either via dividends or share repurchases.

Keep in mind that even Q2-2022 saw repurchase of 7.1 million shares, about 1.3% of its outstanding shares.

Impact Of Oil Price Decline

The vast majority of estimates for 2023 had already assumed some sort of normalization of oil prices. Most estimates were centered around $80/barrel USD. So in that sense, there should be little movement in actual performance even if oil finds a floor here. Current estimates are for cash flow of around $4.00 CAD per share and that is not too far away from what is projected for 2022. Key reasons are as follows.

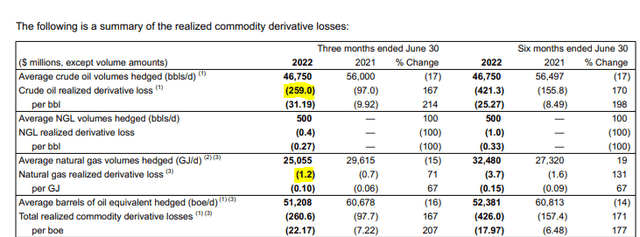

1) The extremely bad hedges of 2022 roll-off.

2) Canadian dollar is weaker and that helps.

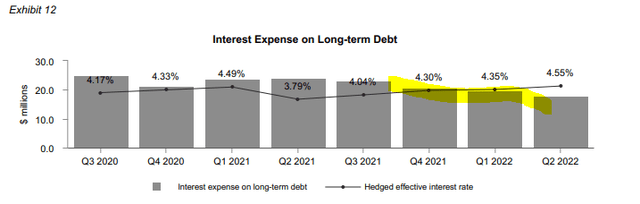

3) Debt reduction helps with lower interest expense.

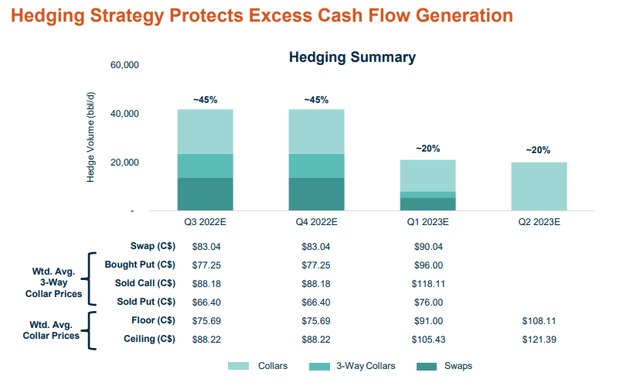

Of course, that revenue number is hardly locked in as CPG has very weak hedging based on the last update.

That was from about 45 days back, so we have no doubt that more hedges have been layered in. Nonetheless, oil price exposure is high.

On the other hand, little to no credit is being given to the company's unhedged natural gas exposure.

Natural Gas

Oil has quietly dropped down from the low "90s" over the last few quarters.

Funnily, it appears even CPG has forgotten about that as it does not even mention natural gas in its hedging slide. Let's look at how that is playing out. Natural gas prices increased even more than oil on a percentage basis over 2021.

All of this flowed to CPG as it had almost no hedges here. See the derivative losses for oil vs natural gas.

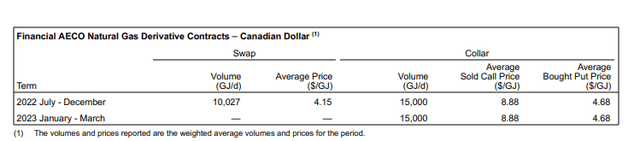

Going forward, hedges are just as low and the majority of that is a wide collar that should allow heavy capture of upside.

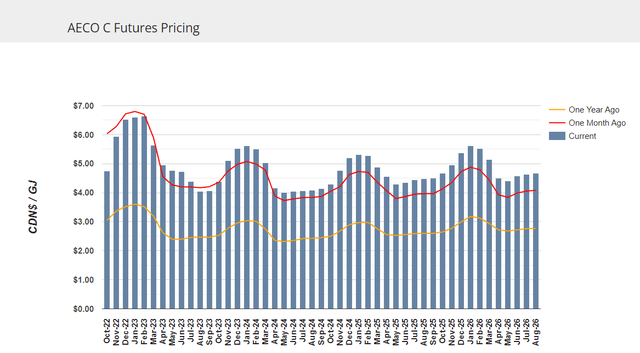

Now here is the kicker. Modeling pretty much across the board from banks is for Henry Hub and AECO gas prices to average under $4.00 USD and $3.60 CAD respectively. This makes little sense as even AECO strip is far ahead of that.

Henry Hub is even further away from their modeling.

We think there is a good chance that extremely high LNG shipments continue into 2023 and force Henry Hub and AECO prices to realign far higher. CPG's unhedged (and forgotten) natural gas exposure could really power cash flow higher. At our expected prices ($8.00 Henry Hub), holding oil at $80, we could see 80 cents CAD of incremental cash flow per share. That would push free cash flow up by almost 40% and render CPG debt free by end of 2023.

Verdict

CPG is extremely cheap whichever way you slice it. Unlike the altar of growth stocks where you have to use 2030 estimates to start making sense of even decimated stock prices, the returns are here. The free cash flow yield after base dividend works out to 25% at our expected oil and natural gas prices. The dividend is sustainable down to $45/barrel. Yes, volatility is high and can be unnerving. But the stock is cheap, even if longer-term prices average closer to $65/barrel oil and $4.00/mcf for Natural gas. We reiterate our Strong Buy rating.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our recently introduced and growing Fixed Income Listing.

Explore our method & why options may be right for your retirement goals.