T_o_m_o/iStock Editorial via Getty Images

A couple of weeks back, we promised to "share extracts from our weekly reviews." This article, taken from an analysis originally published for Macro Trading Factory's subscribers on Nov. 28, is part of that effort.

Join our Market-Beating Service before year-end for only $499/Year

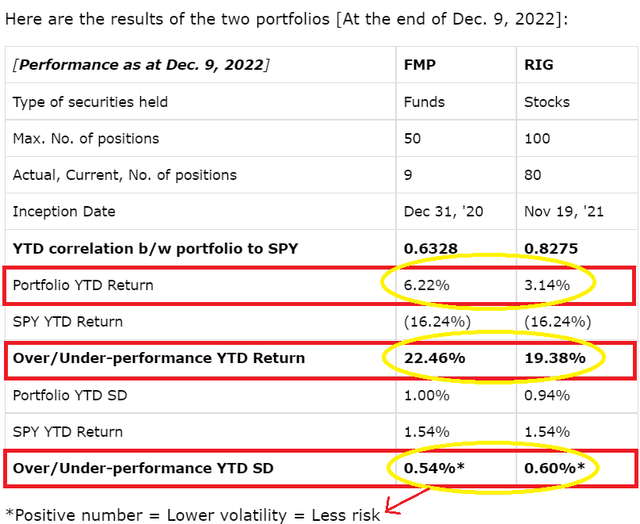

Macro Trading Factory offers two portfolios: “Funds Macro Portfolio” ("FMP") and “Rose's Income Garden” ("RIG"); both aiming to outperform SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to remain "involved"/invested in a simple, though more risk-oriented (less volatile) way.

Each of our portfolios, spanning across all sectors, offers you a hassle-free, easy to understand and execute, solution.