Cepton: Not Worth The 25% Dilution Risk

Summary

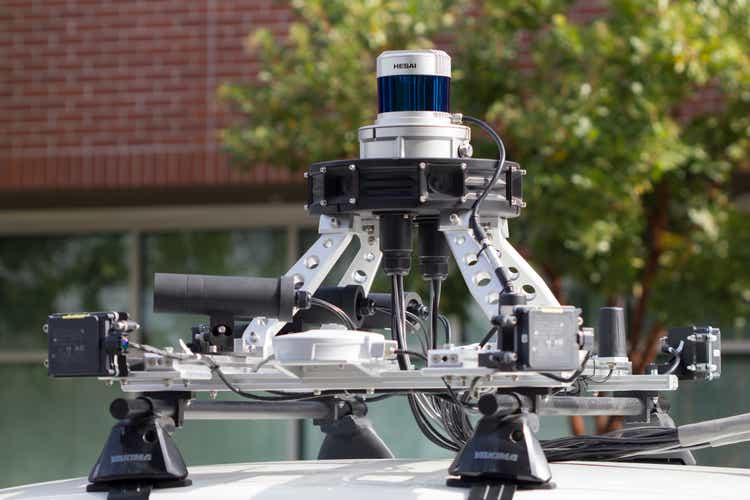

- Cepton's deal with GM to supply lidar for the OEM's Ultra Cruise ADAS is a major customer win, but supply volumes will be very low to start.

- Cepton is spending about $8 million to generate $1 million in revenue, an unsustainable rate as lidar product revenues will take at least four quarters to scale.

- A $100 million convertible preferred share investment from Koito provides much-needed cash, but also opens the door for nearly 25% dilution.

- Given the risks to commercialization and rising competition, dwindling cash, and dilution, Cepton does not look to be worth the risk.

Analyst’s Disclosure:I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.