Dog teaching investors how to make money online

iridi

This is a quick rundown of a few of the equity REITs I expect to perform well over the next several years.

Industrial

We're going to start with industrial REITs.

Which ones are on sale? Basically, all of them. However, the ones we've become most interested in (and purchased) are Rexford (REXR), Terreno (TRNO), and Prologis (PLD).

Prologis provided some slides from their NAREIT presentation.

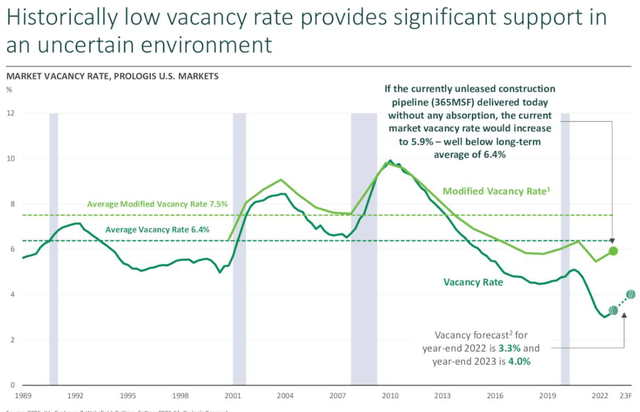

One of the things investors should know about the industrial REITs is the exceptionally low vacancy rate:

PLD

The actual vacancy rate is the darker line. The light green line shows where vacancy would be if all projects that are under construction were completed and vacant. That's an absurd challenge, but it's a great technique to look at the impact of additional supply.

It says that even if all projects were completed without a single renter, the vacancy rate would still be below average. Of course, PLD isn't building these properties to let them sit vacant. They have an excellent development program, and it has been quite profitable.

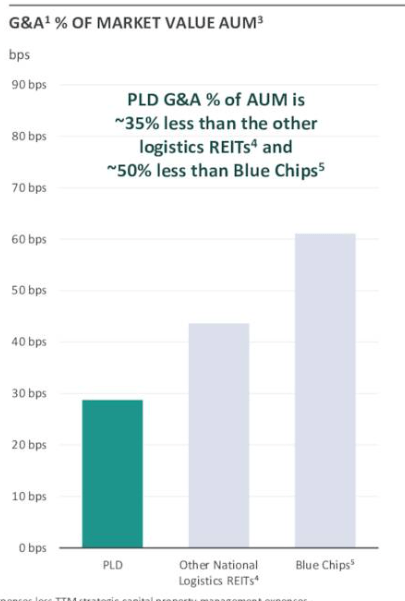

They also highlight the strength of the industrial REIT subsector when it comes to general and administrative expenses (that's overhead):

PLD

PLD is doing exceptionally well. Overhead costing less than 0.3% of assets is great, but the average for the other industrial REITs is still well below 0.5%. That's great. The vast majority of the money each of these REITs generates is used to reward shareholders.

Further, industrial REITs are reporting excellent leasing spreads. Those spreads are combined with strong escalators in their leases to generate substantial growth in AFFO per share year-over-year.

Manufactured Home Park REITs

Sun Communities (SUI) and Equity Lifestyle (ELS) are great REITs also. SUI also posted a new presentation in November.

SUI and ELS have been exceptional wealth builders over long periods. How did they do that? Pretty simple formula:

- Raise rents.

- Pass rents through to NOI (Net Operating Income) instead of increasing expenses.

- Be careful with leverage, so higher NOI drives higher AFFO per share.

- SUI has also been actively issuing shares when they trade at a healthy premium to net asset value. The acquisitions they made with the cash further accelerated growth in AFFO per share.

- Grow dividends because cash flow is growing.

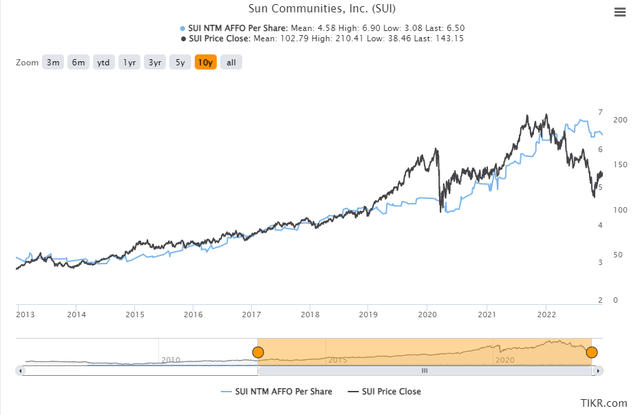

You can see the combination of growth in AFFO per share and share price easily over the last 10 years:

TIKR.com

The lines don't move in perfect correlation, but you can clearly see the trend higher in each value. Prices were getting a bit high before the pandemic, but they briefly plunged. While AFFO per share growth has continued to trend higher, we've seen prices fall significantly since late 2021.

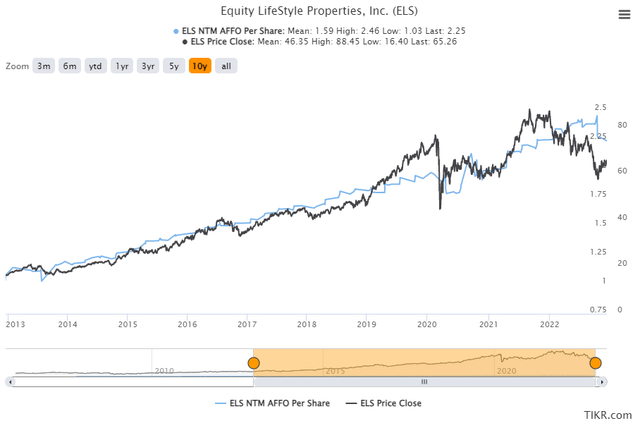

You can see a very similar trend with ELS:

TIKR.com

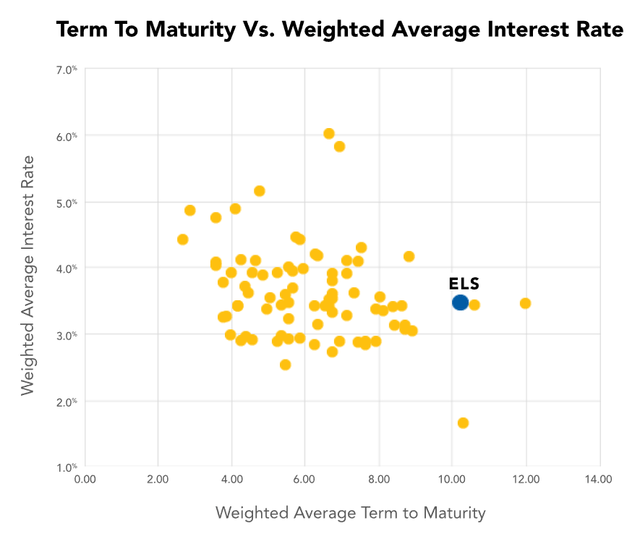

ELS has been less aggressive with issuing shares and more defensive with really pushing out the maturities on their debt. Consequently, ELS has a strong balance sheet with an extremely long weighted-average maturity on their debts. The REIT emphasizes this point by charting their weighted average interest rate and maturity against most of the other publicly traded equity REITs in the United States:

ELS

That's a long weighted-average time to maturity and an attractive interest rate. ELS is borrowing below current Treasury rates. Thanks to the long maturity and relatively low total amount of debt outstanding (compared to asset values), the impact to their interest expense from higher rates should be minimal for a long time.

American Tower

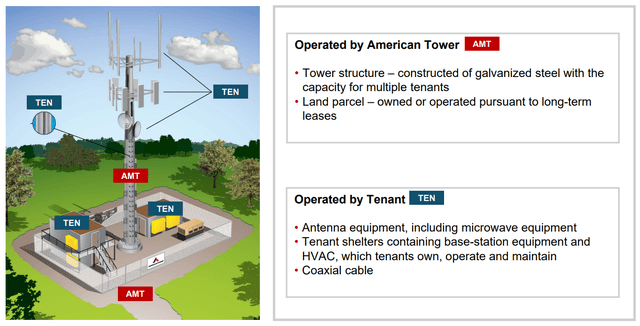

Don't like manufactured home parks or industrial REITs? That's strange because they're great investments, but we'll try another choice. American Tower is my largest position. The REIT owns cell phone towers and leases space to multiple tenants:

AMT

The tenants get to install stuff on the property. AMT gets to own the part with minimal maintenance.

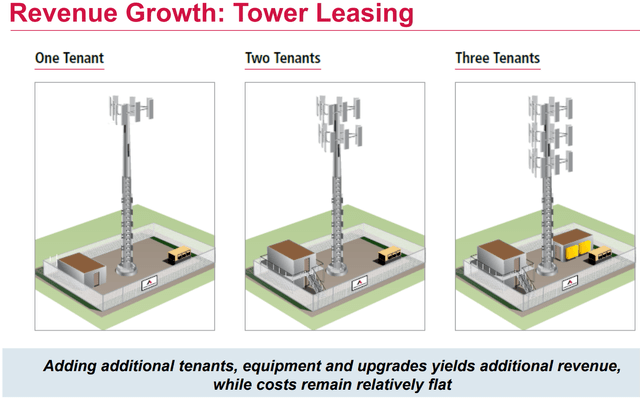

Rental rate increases are pretty low, but the REITs still generate strong growth in Net Operating Income. They do that by adding more tenants:

AMT

That's a good strategy. There are minor cost increases for tenants, but the real draw is tenants needing more locations. As wireless technology improves, speeds get faster. Since most people want their phone to have fast access, wireless companies need to remain competitive on speed.

However, faster speeds travel shorter distances. To maintain coverage of an area at higher speeds, the carriers need more locations. That's the appeal here. Consequently, tenants (the carriers) keep upgrading equipment and leasing additional locations so they can provide a strong enough network to attract customers.

Since there are minimal increases in costs for adding additional tenants, the yield improves dramatically when a second or third tenant is added to the same location.

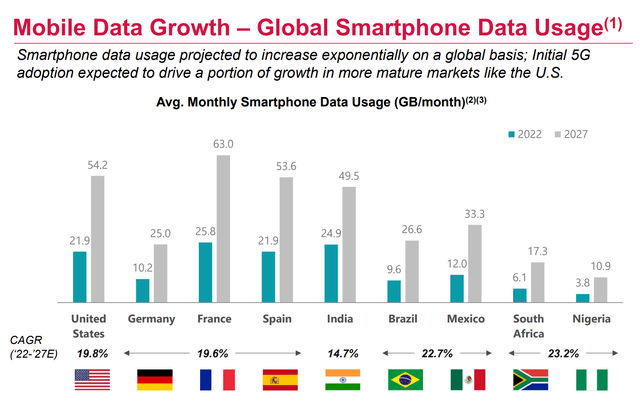

One time an analyst told me thought mobile data demand would slow down. I just laughed. My data use sure isn't going down. It's only increasing. The CAGR (compound annual growth rate) could slow down, but that's only because it starts at such high levels. The expected CAGR over the next few years is still very strong:

AMT

Conclusion

Six great REITs for investors. Each of these REITs cover dividends easily and present a solid history of generating strong growth in AFFO per share. Further, each REIT is in our portfolio and remain very attractive at current share prices.

There are several other great REITs that we don't have room to fit into this article, but six seems like a solid start.

Ratings: Bullish on AMT, ELS, SUI, REXR, TRNO, and PLD

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

You should try our service. Unlike most services, our service is backed by a real portfolio. Not a "model" portfolio. Not hypothetical positions. Not 7 different portfolios we made up in Google Sheets so we can brag about the good one. None of that crap.

You get real-time alerts on every trade. See current and past positions. I'm sick of analysts who have to retroactively pick a "portfolio" or get creative about defining "returns". Beat the index or get out.

Ask your analyst to share their portfolio value each month so you can verify their returns. When they object, try us.