EcoPic/iStock via Getty Images

South African equities have recently been under severe criticism from investors, with factors such as a recent greylisting, the ongoing Eskom crisis, and state corruption all adding to an unfavorable country risk premium.

Although the broader outlook on South African equities is unfavorable, good opportunities still exist within the regional market. Thus, we reassessed the iShares MSCI South Africa ETF (NYSEARCA:EZA) to see whether the fund provides access to such opportunities; however, we discovered that it hosts poor asset allocation, which is conveyed by both qualitative and quantitative metrics.

Here are a few factors for investors to consider for market participants with regional interests.

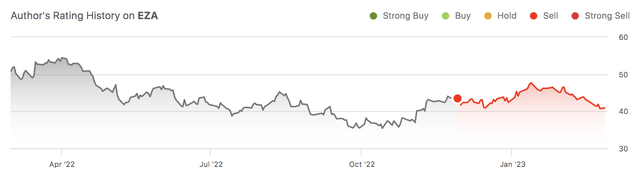

Pearl Gray's Ratings History of EZA (Seeking Alpha)

South Africa's Structural Issues

Issues

Matters have gone from bad to worse in South Africa. For months, the center of conversation among investors was the Eskom crisis, which dampened the outlook of many energy-intensive natural resources stocks. Before the Eskom debacle, factors such as the mass looting incident, state capture, ground-level theft, and failed infrastructure were all front and center.

However, a new talking point has emerged!

South Africa has officially been placed on a greylist by a French-based financial task force, FATF. As a South African citizen, I can tell you that this is no surprise, nor were the aforementioned issues. Keep in mind that faultlines only reach the global press long after they have occurred. In fact, although at a multiyear high, the Eskom crisis, civil unrest, decaying infrastructure, and state corruption have been long embedded into the nation's ecosystem.

What does South Africa's greylisting mean?

Without trying to sound too clever, I would instead communicate what the tabloids have stated: South Africa has been found guilty of funding terrorism and illicit trade. Therefore, foreign transactions require enhanced due diligence.

In our opinion, it is trivial that FDI and financial market transactions will slow down as a consequence.

Positives

You might find this mind-boggling, but South Africa's recent structural concerns have their positives. Firstly, suppose you are a non-South African resident or have limited knowledge of the jurisdiction. In that case, it is critical to take note of the disparity between leading South African enterprises and the South African government. Although governments have historically intervened in South Africa's private markets, the government's status is uncorrelated to the health of many of the leading South African businesses. The nation hosts some of the most outstanding emerging market companies that have coped with numerous challenges in the past.

For example, look at Truworths International (TRUWY), which now actively shields 80% of its revenue through alternative energy sources, which could end up more cost-effective than Eskom-generated power.

In essence, I believe South Africa's private markets will coalesce to fight the various systemic risks vested in the nation's core. However, it will take time, and the financial markets could emphasize an unfavorable country risk premium for the time being.

EZA's Portfolio Breakdown

The Good

Let us start by assessing some of the ETF's securities, which we believe are in good territory. Delving into extended analysis is beyond the scope of this article; thus, consider doing additional research before investing in any of the securities individually.

As many of our loyal readers know by now, we love Impala Platinum (OTCQX:IMPUY) (our latest Implats article). Sure, the company is faced with Eskom issues. However, as mentioned before, we believe slower production will result in higher PGM prices, offsetting operational risks.

Furthermore, EZA possesses some quality defensive plays like MTN and Bid Corp (OTCPK:BPPPF), who respectively participate in the telecommunications and consumer staples industries. South African telecoms and consumer staples are very concentrated industries with high-barriers-to-entry, which has allowed these firms to form moats. In addition, the Johannesburg Stock Exchange is currently low-beta-seeking, placing both these securities in an excellent position.

The Not So Good

The first "not so good" to highlight here is Naspers (OTCPK:NPSNY). I am not saying that Naspers is not a good investment. I am just saying that its stock price is purely defined by the geopolitical climate in China. It is a coin toss, and I know that iShares is trying to track a market-cap-weighted index here; however, maybe show some managerial prowess?

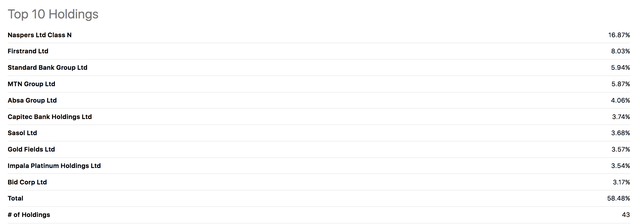

Furthermore, we consider the ETF's allocation in cyclical assets such as financials and energy a critical risk. Regarding the latter, we have previously discussed our dissatisfaction with energy stocks (see our Thungela (OTCPK:TNGRF) article here). And concerning financials, the word on the street is that transaction costs and borrowings will be disadvantageous for some of the nation's banks (due to the greylisting), which could leave EZA in a tizzy as it is heavily weighted toward banks.

The ETF Lacks Managerial Prowess

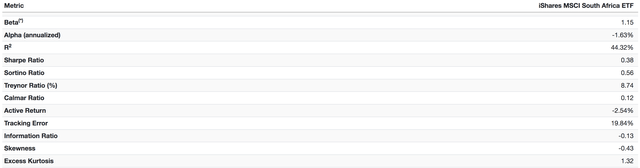

As stated before, EZA is a constrained ETF; more specifically, BlackRock's (BLK) iShares tracks the MSCI South Africa 25/50 Index. Nevertheless, the fund's 19.84% tracking error implies that its managers possess latitude to make independent bets.

In our opinion, EZA presents solid returns from a volatility-based viewpoint as it hosts positive Sharpe and Sortino ratios. However, the fund has a negative active return, meaning its managers are underperforming the tracking index. On top of that, the tracking error reveals independent risk attribution, and combining the tracking error with the underwhelming active returns conveys little managerial value additivity.

Click on Image to Enlarge (Author in Portfolio Visualizer)

Final Word

South Africa's structural issues will likely get the better of the iShares MSCI South Africa ETF for the time being. The ETF is overweight on financial stocks, which could suffer from the nation's recent greylisting, and its heavy bet on Naspers seems like a coin toss.

Furthermore, the ETF's historical performance illustrates that investors are paying iShares' managers a premium for below-par returns as the ETF's risk/return attribution is unfavorable.

- We reiterate our strong sell rating on the ETF with an indefinite horizon.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>