mrPliskin/iStock via Getty Images

Fed Chairman Jay Powell is one busy guy.

According to the Fed website, the Federal Reserve has five main responsibilities:

- To conduct monetary policy to promote stable prices and maximum employment.

- To promote the stability of the financial system to contain systemic risk.

- To promote the safety and soundness of individual financial institutions.

- To foster the efficiency and soundness of the payment and settlement system.

- To promote consumer protection and community development.

At least four, and perhaps all of these areas are currently problematic and require constant focus.

Chairman Powell must feel like the circus act plate spinner trying to keep all of the plates spinning so they don’t crash and break.

Between his fight against inflation, attempt to prevent a bank run, support to rescue individual problem banks, and efforts to protect non-insured depositors, he certainly has his hands on all the poles to keep the plates spinning.

In addition, he has another responsibility not listed explicitly – to keep the Federal Reserve functioning properly.

Of all of his responsibilities, the last is perhaps the most important because without a strong, efficiently operating Fed, performing the other tasks is not possible. The strength of the Fed has come into question because:

For the first time in 107 years the Federal Reserve is losing money!

The recently released Federal Reserve System Audited Annual Financial Statements for 2022 show that in the fourth quarter the Fed lost money for the first time since 1915.

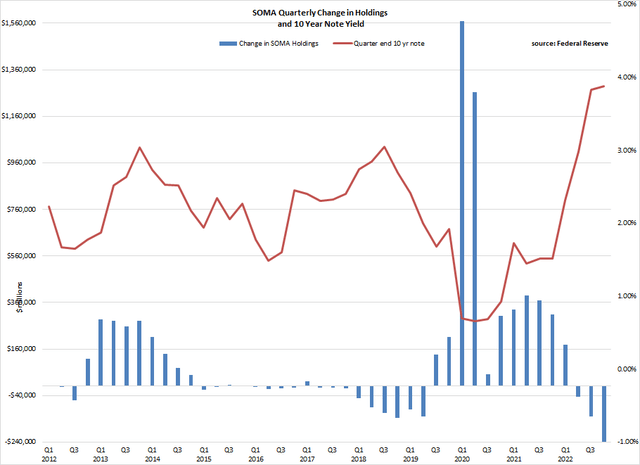

The immediate reason for the losses is because Fed has an asset/liability mismatch on their balance sheet. The Fed’s assets are primarily long-term fixed rate US Treasury Bonds and Mortgage-Backed Securities (MBS,) while their liabilities are short term and variable rate.

As the Fed has been tightening over the past year to combat inflation, the interest rate they earn on their fixed rate holdings in their System Open Market Account (SOMA) has remained constant, while the cost of their liabilities has increased with each Fed tightening move to raise the Fed Funds rate.

The result of the rise in short rates is that the Fed’s Net Interest Margin declined over the course of the year and eventually turned negative.

At year end the Fed had $8.4 trillion in fixed rate assets earning 1.85%. On the liability side the Fed had $5.6 trillion of reverse repurchase agreements and depository bank reserves, that they must pay interest on.

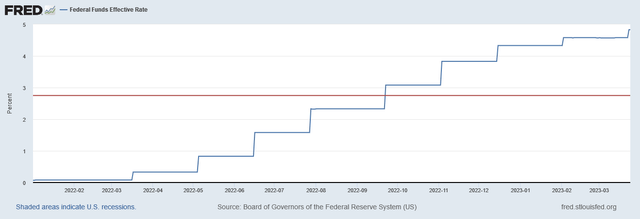

The break-even rate for the Fed was when they had to pay 2.75% on their liabilities. This threshold was crossed on September 21, 2022 when the FOMC raised the target Fed Funds benchmark by 75 basis points to the range of 3.00-3.25%. Since then, there have been 4 additional rate hikes totaling 175 basis points to the current range of 4.75-5.00%.

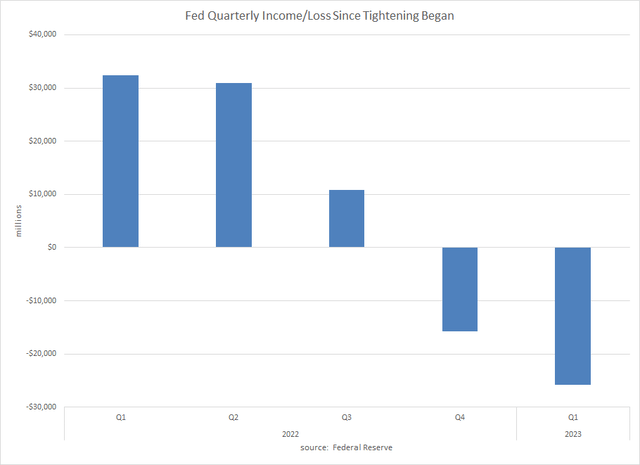

The quarterly declines in net income since the Fed began tightening can be seen on the following chart:

The Fed earned $32.4 billion in 1Q22, their largest quarterly earnings on record. Net Income dipped slightly to $31 billion during 2Q22 reflecting the first 25 basis point tightening in March, followed by the next move of 50 basis points in May. The 3Q22 net income was impacted by 75 basis point hikes each in June, July and September, dropping to $10.9 billion. Finally, in 4Q22, with additional hikes in November and December totaling 125 basis points net income turned negative for the first time in 107 years as the Fed lost -$15.8 billion.

The net loss continued into 1Q23, growing to -$26 billion with additional hikes in January and March. The Fed losses will persist until short rates decline to below the 2.75% break even rate.

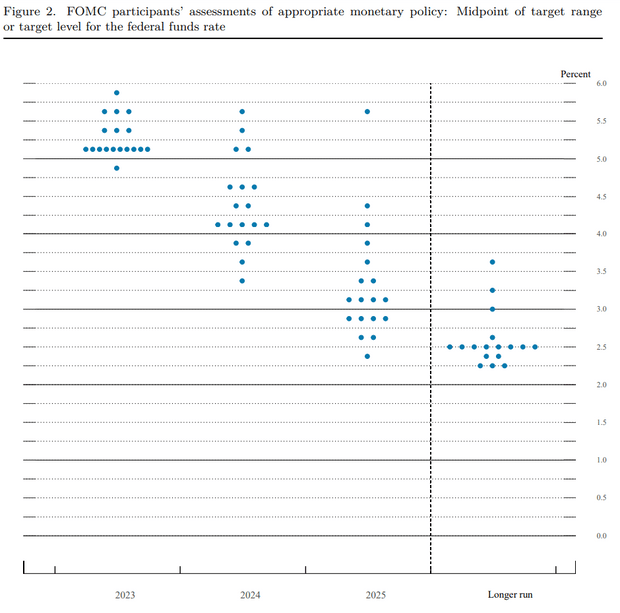

Based on the dot plot from the March 21, 2023 FOMC meeting, participants projections don’t see the Fed Funds rate dropping below 2.75% until 2026.

FOMC

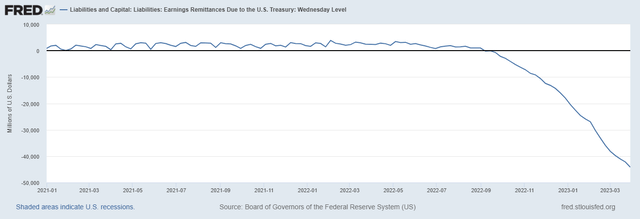

Deferred Asset

The cumulative losses through the end of 1Q23 exceed the Fed’s capital of $42 billion. In a commercial bank, this would create insolvency, but the Fed operates by a different set of rules. Under Fed accounting, the losses have no impact on its capital. Instead, the losses are carried in a newly created deferred asset account called “Earnings Remittances Due to the Treasury,” which is recorded as a negative liability on the balance sheet. Losses will continue to increase the deferred asset account until the Fed turns profitable again and those earnings will then be used to reduce the deferred asset. Such treatment causes the Fed to create new reserves to cover the losses.

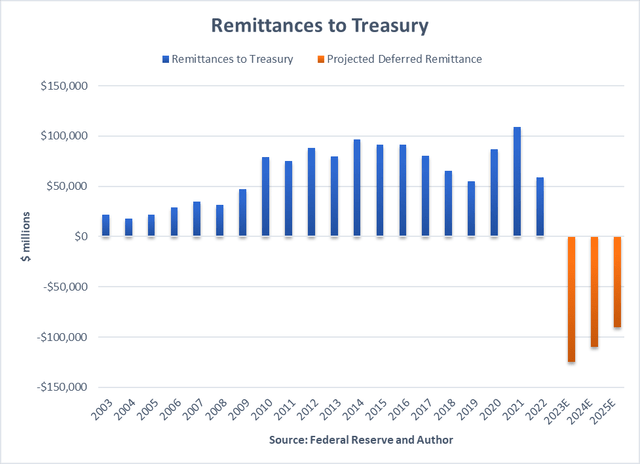

The Fed has a huge research staff of hundreds of PhD economists. They have studied the issue of the likelihood of recording deferred assets since the Fed began paying interest on reserves. In 2018 they published a simulation analysis that concluded there was a 30% chance of the Fed carrying a deferred asset, and they determined that it would be no larger than $20 billion. The study was updated in July 2022 when the Fed stated, with certainty, that a deferred asset would soon be booked. This analysis concluded that the deferred asset would peak at $180 billion.

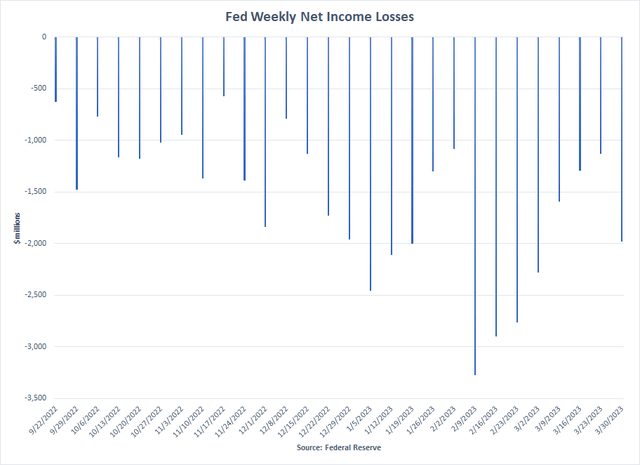

Eight months later the Fed has, on the books, a $44.2 billion deferred asset, and it now looks like it will grow beyond their top estimate by mid-2024. The Fed is currently losing more than $2 billion per week.

So much for the PhDs simulations.

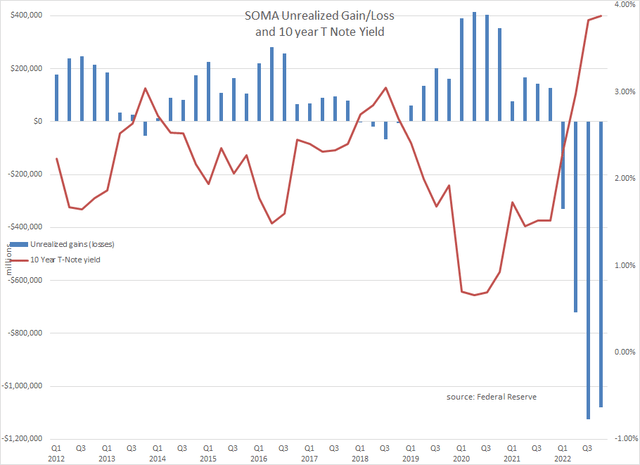

The Fed’s SOMA portfolio has an unrealized loss of $1.1 trillion

In addition to their operating losses, the Fed is carrying a $1.1 trillion unrealized loss on their SOMA portfolio.

This is due to the fact that when the Fed purchased the SOMA holdings during QE, interest rates were much lower.

As can be seen in the chart below, one third of the SOMA portfolio was purchased with yields below 1%, and another one quarter of the portfolio was purchased with yields between 1%- 2%. In fact, during the COVID pandemic, when Treasury yields were their lowest on record, the Fed was practically the only buyer of Treasury securities, as they purchased 57% of the increase in Treasury securities. Rates started rising when the Fed’s purchases slowed.

One hundred percent of the SOMA portfolio was purchased when yields were lower than they are today. As a result, the entire SOMA portfolio is underwater. That is, every single security in the SOMA portfolio was purchased at a higher price than its market price today.

Due to another convenient feature of the Federal Reserve Board of Governors accounting policies, these SOMA losses are unrealized, as the Fed carries its securities at amortized cost. Their market value only shows up in a footnote on their financial statements.

If the Fed were to sell securities from their SOMA portfolio, they would have to report the difference between their purchase price and the market price, thereby recognizing the loss. It is for this reason that the Fed is reducing their balance sheet through security roll-offs, so they don’t record any losses.

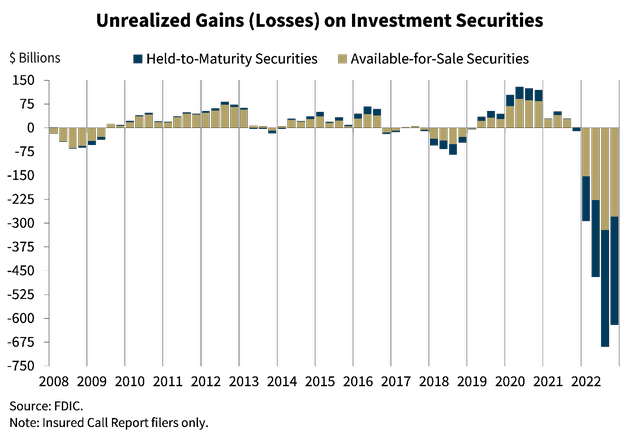

The irony of the Fed’s situation is that they have the same exact asset/liability mismatch on their balance sheet that is roiling the banking industry causing the current banking crisis. The Fed is trying to douse the flames of a burning banking industry while their own house is on fire.

Many have become intimately aware of the Available-For-Sale versus Held-To-Maturity accounting designations for bonds on commercial bank balance sheets.

FDIC Chairman Martin Gruenberg addressed this issue in testimony to the Senate Committee on Banking on March 27th. He said banks had “heightened exposure to interest rate risk, which lay dormant as unrealized losses for many banks as rates quickly rose over the past year.” The banking industry, as a whole, had $620 billion in unrealized losses on their bond holdings as of year-end.

To put the Fed’s unrealized loss position in perspective, their unrealized loss of $1.1 trillion at year end is nearly double that of the entire US banking system!

Seigniorage

One of the unique aspects of a central bank is their ability to make money by creating money. This is called seigniorage. Seigniorage refers to the interest a central bank earns on creating money less the cost of producing, distributing and replacing currency, or bank notes. These earnings are used to cover the operating costs of the central bank. It is a way for the central bank to earn a profit to be self-sustaining. This is a critical element for a central bank to be independent.

For much of the history of the Fed, their earnings, or seigniorage, was very stable and consistent. The Fed would create reserves and then they would invest in short term interest earning assets. There was virtually no cost to the reserves that they created.

The stable seigniorage allowed the Fed to absorb losses due to their monetary policies during periods of economic stress without impacting the financial position of the Fed. Excess earnings were, by statute, remitted to the Treasury.

This changed during the Great Financial Crisis in 2008 when the Fed began paying interest on reserves. It was done during a crisis period when the Fed reached the zero lower bound with their main tool of lowering interest rates. More needed to be done and the Fed turned to unconventional measures. They began Large Scale Asset Purchases, more commonly known as Quantitative Easing (QE). As a feature of rapidly expanding their balance sheet the Fed began to pay interest on reserves to maintain control of the Fed Funds rate.

With QE the Fed deviated from their long-term policy of only buying short term Treasury securities and began buying Treasury bonds and MBS. These long term assets were funded by the now variable rate interest they were paying on their short term liabilities. This is what created their asset/liability mismatch. They transferred the risk of owning Treasury and MBS securities from the banks to their own balance sheet.

The bonds purchased during QE were only intended as a temporary measure, but the Fed has had a difficult time normalizing this policy.

Things worked smoothly, and the Fed’s seigniorage grew steadily until interest rates started rising. Then the interest rate mismatch began to bite.

For the past 20 years the Fed has averaged earnings of $64 billion per year. This was returned to the Treasury and used to help offset the fiscal deficit. With losses projected for the next several years, these Treasury remittances will be eliminated for the first time ever, and the government will need to find new ways to replace this lost revenue.

Why It Matters

The Fed insists that their operating losses and unrealized SOMA losses will not affect their ability to conduct monetary policy.

While this may be true in the short run, longer term the Fed’s financial impairment may be problematic.

Much has been written about what is necessary for a central bank to be effective in achieving their mandates. A seminal article was published by Peter Stella, the former Head of Central Banking for the IMF in 1997. He postulated that central banks need financial strength to have the independence and credibility necessary to commit to a given policy objective.

Stella argued that “central banks can operate without capital in a technical sense. Eventually, however, their balance sheets may deteriorate to a point where they must abandon control over inflation , repress the financial system, become reliant on constant infusions from the Treasury, or, as a last alternative, be recapitalized.”

An independent central bank must be mindful of developments in its balance sheet and its profit and loss statements.

Some argue that the Fed doesn’t need capital because it can always meet its liabilities by printing money. While this is true, creating reserves to cover losses is inflationary and exacerbates the problem the Fed is trying to solve.

But this is not a binary issue. The question is not is the central bank solvent or not solvent. It is one of gradation.

The Fed staff published an article “Fiscal Implications of the Fed’s Balance Sheet” by Michele Cavallo et al in 2018 that presented a formula for determining solvency of a central bank. They weren’t solely looking at the Fed’s capital account.

The formula combines “Tangible Wealth” with “Intangible Wealth.”

Tangible Wealth = Market Value of Interest Earning Assets – Interest Bearing Liabilities.

Intangible Wealth = Value of Future Seigniorage.

If the total is positive, the institution is solvent.

Looking at the Fed at two points under this formula is illustrative of the gradations.

At year end 2021, the value of the Fed in wealth was $3.2 trillion, but just one year later, the Fed’s value was cut in half to just $1.5 trillion. A 100 basis point rise in interest rates would bring it closer to zero.

Fed Wealth | ||||

billions as of 12/31 | ||||

2021 | 2022 | |||

Tangible Wealth | ||||

Interest Earning Assets: | ||||

MV SOMA Portfolio | $8,733 | $7,349 | ||

Interest Bearing Liabilities: | ||||

Reverse Repos | $2,183 | $2,890 | ||

Depository Reserves | $3,644 | $2,684 | ||

| Total Liabilities | $5,827 | $5,574 | ||

Assets - Liabilities | $2,906 | $1,775 | ||

Intangible Wealth | ||||

Value of projected seigniorage | $300 | -$300 | ||

Total of Tangible + Intangible Wealth | $3,206 | $1,475 | ||

This is similar to credit ratings on bonds. There is a big difference between a AAA credit and a junk credit. While both might be meeting their obligations, the AAA credit has a lot of room for things to go wrong. They have many strengths in terms of earnings, leverage, capitalization and debt coverage, so they can withstand some financial deterioration without it having much impact. A junk credit, on the other hand, doesn’t have the same strengths and needs everything to go just right. It is much riskier.

While the Fed might have been the equivalent of a AAA credit a year ago, their exposure to rising interest rates over the past year moves them closer to a junk credit now. They have a smaller margin for error. That we’re even raising the potential insolvency of the Fed is scary.

(For the purpose of this analysis seigniorage is only projected out to three years. Anything beyond that is deemed too speculative. This can be seen looking at how the projections changed so dramatically from year end 2021 to year end 2022. Recent results demonstrate that it no longer can be assumed that seigniorage is always positive.)

Independence and Credibility

Two key elements for a central bank to be effective in achieving their mandates are Independence and Credibility.

In order to be independent a central bank must be perceived as strong. Adequate capital supports independence and profitability gives the central bank the ability to be self-reliant. Both allow the central bank to conduct its operations without interference from politics. Monetary policy aimed at price stability and financial stability is deemed too important to be part of the trade-offs that concern the short-term financial interests of government.

Conversely, unexpected losses show weakness. As this weakness becomes more public it draws attention to the central bank and reduces the level of support.

An example of this is rearing its head currently as Senators Warren and Scott are calling for new oversight of the Fed based on their dissatisfaction of the Fed’s handling of the current banking crisis. When the Fed’s operating losses become more widely known there will be additional calls for limits on their power. This will hinder the Fed’s ability to conduct monetary policy.

Adequate capital also supports the credibility of a central bank. In order to carry out their responsibilities as a monetary authority the public must have confidence in the institution. The need for credibility is particularly heightened during periods of financial stress. A central bank that is independent of the government needs to be perceived as being able to deploy the necessary strength to address the problems.

Together, independence and credibility are critical elements for the central bank’s effectiveness.

Conclusion

To be effective the Fed needs to be strong, independent and credible. While the Fed has been perceived that way in the past, the errors they have made which have contributed to their financial deterioration over the past year as they’ve been battling economic and financial stress on several fronts, may come back to haunt them.

Despite the favorable accounting treatment, the Fed’s operating losses are significant and growing, and the unrealized losses on their balance sheet are large. As we’ve seen with the failures in the commercial banking industry, confidence can be lost quickly, and once gone it is difficult to rebuild.

The critics who argue that the Fed should not be concerned because they can always meet their obligations by creating new reserves, are not looking at the complete picture.

As Stella opined, weak central bank balance sheets invariably lead to chronic losses, abandonment of price stability as a primary policy goal, a decline in central bank operational independence and imposition of inefficient restrictions on the financial system.

The operating losses and unrealized SOMA losses have significantly weakened the Fed and threaten the Fed’s independence and credibility. The Fed has approached becoming a junk credit. A future financial crisis will test the Fed’s ability to achieve its mandate.

Stella stressed that the ultimate risk for a central bank is “policy insolvency,” which is not being able to meet its policy commitments. It is not the more common technical insolvency, or inability to meet its financial liabilities.

Chairman Powell has real problems to deal with. Time will tell how long he can keep his plates spinning.