AndreyPopov

"History is largely a history of inflation, usually inflations engineered by governments for the gain of governments."

With all the big moves we have seen in Leading Indicators, crude oil, treasuries, and bank stocks, no one can seem to agree on what's going on with the economy these days, and why I mention that "uncertainty" is elevated to a level we have not seen in a very long time.

Financial markets have been shaken over the past week by banking sector concerns. At the heart of this volatility lies the question- "Can these issues be contained or is it indicative of widespread contagion to come?" To be sure, the news ratchets up risk in the short term, and there may be other players that come under pressure. But for now, I believe the problems discovered by Silicon Valley Bank, Signature Bank, and Credit Suisse are self-induced. The stock market by its positive price action recently is in agreement.

The entire economic fallout from the latest banking crisis has yet to be determined. At the moment, some investors have concluded that this crisis will dramatically shrink liquidity and trigger a recession within months. I was in that camp well before the SVB fiasco. If we don't see a broad-based decline in economic activity as a result of the frantic Fed rate hike campaign, equity bear market, and fallout from the recent banking events over the past two weeks, it will surely tell us "This time is Different."

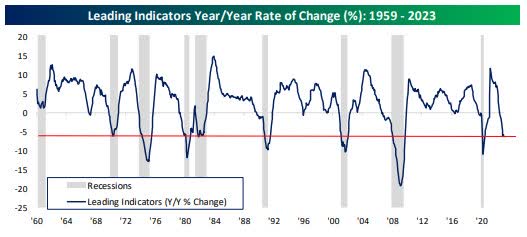

That's the same message that Conference Board data has been sending and the latest report reinforced that message. As shown in the chart below, streaks of declines in the leading index as long as the current year-long drop has always resulted in recession. The current cycle without an increase is already the fourth-longest in the data's history, topped only by periods from the '73-'74 recession, the '90 recession, and the global financial crisis.

LEI (www.bespokepremium.com)

Similarly, the year-over-year decline in the leading indicators data is at a level that has always meant a recession historically. Bottom line? Even before this banking event, the economic trajectory was looking pretty doubtful despite lots of analysts and economists calling for a soft landing. Now, even assuming the hit to the banking sector doesn't grind activity to a halt, it's easy to pencil in a recession…and if bank lending does take a hit (which remains to be seen) things aren't going to be improving rapidly.

Later on, we'll take a look at a post-mortem of the SVB event, a topic that has now been explained and discussed in countless articles. Suffice it to say the U.S. Treasury had offered to set a precedent to provide a backstop, even if it's inflationary, and risks running the debt levels up even more. After consideration, Secretary Yellen walked back her initial comments on a universal bailout. Finally, some common sense entered the scene, and perhaps the treasury realized they can't "promise" anything like that without congressional approval.

The Macro View

Either way, the government will potentially face its own different but slightly related crisis in the years to come if rates remain higher for longer. The federal debt load has ballooned over the past several years, thanks in large part to the overspending after the Covid crisis. While most of that was done when rates were low, the government also mainly used shorter-term debt to finance that spending. According to the Brookings Institute, the weighted average maturity of the U.S.'s debt currently is around 75 months or a little over six years. At the same time, though, the payments required to service the interest have gone parabolic over the last year or so and are expected to rise further.

And now as the lower-rate debt issued these last several years mature if the government wants to maintain the same level of spending, it will either have to issue new debt at higher interest rates or raise taxes, neither of which will likely be good for growth. The alternative is to reduce spending, which is never politically popular and also not good for growth. So, the U.S. in the years ahead will likely face some challenges that will need to be addressed - the rising cost to service its debt and having to choose between reducing its spending or funding it with more costly debt if rates don't plummet again (or by raising taxes). Combining that backdrop with a higher tax, anti-business platform in place, and REAL growth is going to be hard to come by.

Flight To Safety

Investors were spooked, stormed the doors of the Treasury, and piled into short-term treasuries. The yield on the 2-Year U.S. Treasury collapsed from 5.05% on March 8 to 4.10% on Friday. Gold and Silver were bought indiscriminately as investors were looking for a real store of value. I don't place them in that class but in today's backdrop, it sure looks like they were. The precious metals could continue to have tailwinds behind them in a changing MACRO scene as the fiat money system gets tested by a combination of higher debt levels and a lack of confidence.

I expect all of the recent consternation over the U.S. banking system to blow over at some point because I sense that this is not systemic. For those that wish to make bets on the Financials, they better have a long-term view of the markets OR have a great sense of timing to play a "trade" here and there. There could be more regulatory fallout from this and I suspect banks are going to be under scrutiny and they will be acting VERY conservatively for a while. That suggests loan growth slows down, and is yet another HIT to their earnings power and economic growth. In general, this adds to the higher-risk environment which we are currently navigating. However, the difference today is HUGE. In the past 18 months, investors have come to realize that the Fed can't come to the rescue now. Inflation is yet to be solved.

The Fed Disconnect

It has been my view that interest rates are high and they will remain that way for a while, but not everyone agrees with that now. We've seen a change in sentiment brewing. Some economists see a silver lining for the economy and believe the market is doing the tightening for the Fed right now- moving up the timeline for an end to the Fed's tightening cycle.

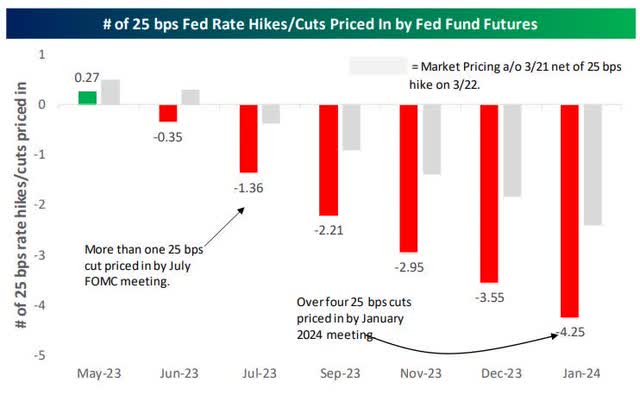

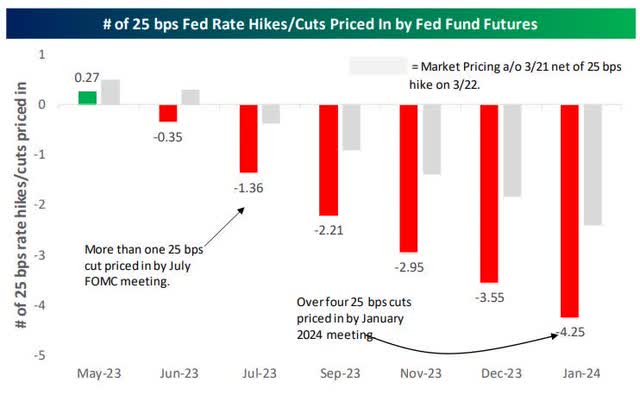

Even as Powell attempted to convince the market that rate cuts are not on the horizon, the Fed Fund Futures market has priced in more cuts. It's pricing in more than an entire 25 basis point cut by the July meeting, and by next January it has priced in double the amount of cuts from two to four. I can't remember a time when there was more of a disconnect between what the Fed is forecasting compared to what the market is expecting. Only time will tell which side proves correct, and history tells us its version.

Rate projections (www.bespokepremium.com)

During the last roughly thirty years, there have been five separate rate hiking cycles. While the most recent cycle has been the most aggressive in its speed to the upside, if it ends at current levels, it will be the second lowest terminal rate of the five. If this market pricing is correct and the Fed is forced to cut rates by the July meeting, it would be the shortest distance between the last hike and the first cut of the cycles shown.

I simply can't explain this disconnect, and I'll stop trying to figure it out. Forecasts are all over the map. What I do know is this will be another extreme in uncertainty that can be added to the list. Finally, it doesn't change the cautious outlook and the uncertainty levels because here is the problem with the rate cut scenario. In my view, the Fed will ONLY embark on a rate-cutting binge because of all the issues I just mentioned coming to fruition.

Economic data may start to fall off a cliff quickly sending the economy into extremely slow growth and then a recession. Somehow that doesn't suggest a rip-roaring equity market scenario, so I'm wondering what investors are celebrating by believing the Fed is going to Pivot this year. Furthermore, as mentioned in last week's MACRO article, history tells us the stock market typically sets a new low AFTER the first FED cut. Once again, is this time going to be different? That was another reason I lifted the uncertainty level to DEFCON 3 last week.

While I intend to keep an OPEN mind, I'll repeat what I have said for well over a year now. We are in a new environment than the one we were in over the past decade. Things that worked in that old environment, won't work with a cold capital market and rates hitting 4-5%+. I still feel when we add everything up, the odds favor us remaining in a difficult market environment for quite some time. That doesn't mean I see the equity markets go straight lower or that there won't be very strong rallies to play, but in general, I think most should focus primarily on preserving capital and not taking any needless risk.

The Fed reiterated its inflation stance. It was the same message that they have delivered for months now. The market ignored it. In my view, nothing has changed and that includes my near-term outlook for the markets.

The Week On Wall Street

Monday's session kicked off the last week of the quarter. The S&P 500 (SP500) chopped around during the first two trading sessions before a "Risk-ON" mentality took over. The BEARS have had the headlines all going their way recently but have been unable to get any real momentum to the downside going. The BULLS seized on that "whiff" and pushed prices higher right to the end of the week, end of the month, and end of the quarter.

The Economy

The final read of Q4 GDP was revised lower by a tenth of a percent to 2.6% from 2.7%. One piece of interesting news was Core PCE which was revised up to 4.4% versus forecasts for a reading of 4.3%.

Inflation

Personal income increased by 0.3% in February and consumption rose by 0.2%. Those follow a 0.6% gain in January income and a 2.0% surge in spending. The savings rate edged up to 4.6% from 4.4%.

Inflation cooled slightly. The PCE deflator rose 0.3% from 0.6% and posted a 5.0% y/y clip from 5.3%. The core rate was up 0.3% too from 0.5% and the year-over-year rate was 4.6% y/y from 4.7% y/y. Real spending declined -0.1% from 1.5% previously. The report is pretty good news but it doesn't warrant the opening of Champagne bottles nor does it warrant a cause to declare gloom and doom. What we can say with some confidence is that inflation has peaked.

Other than that it simply states what has been stated for a while; Inflation will remain sticky and the road to lower inflation is going to be bumpy and longer than many want to realize. I doubt this report gets the FOMC to step off the brake in May as inflation is still elevated.

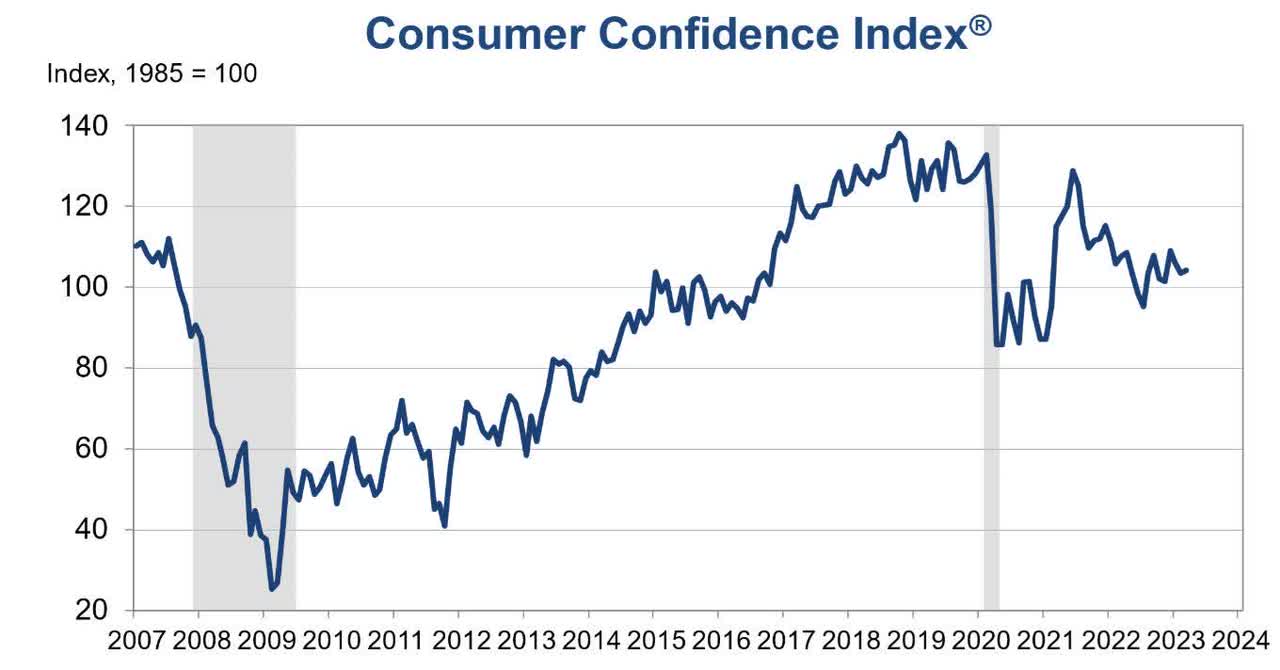

Consumer

Consumer confidence rose 0.8 ticks to 104.2 in March, better than expected, after slumping 2.6 points to 103.4 in February. The 101.4 from November remains the weakest since the 95.3 in July and compares to the 1-year high of 109.0 in December.

Consumer confidence (www.conference-board.org/topics/consumer-confidence)

Confidence levels remain WELL below pre-pandemic levels.

The final Michigan sentiment report revealed a downwardly-revised headline drop to a 3-month low of 62.0 in March from a 13-month high of 67.0 in February. The Michigan sentiment drop accompanied a March consumer confidence rise to 104.2 from 103.4. Analysts saw an IBD/TIPP index climb to a 15-month high of 46.9 from a prior high of 45.1, versus an 11-year low of 38.1 last August that was previously seen in June.

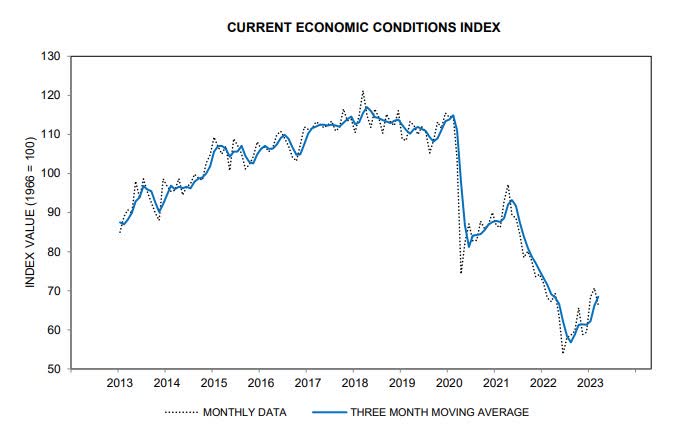

Michigan Sentiment (www.sca.isr.umich.edu/files/chiccr.pdf)

Aside from today's March drop, analysts have more generally seen a modest confidence updraft since mid-2022, though all of the measures have deteriorated sharply from mid-2021 peaks. ALL reports are WELL below pre-pandemic levels and near historic lows.

Manufacturing

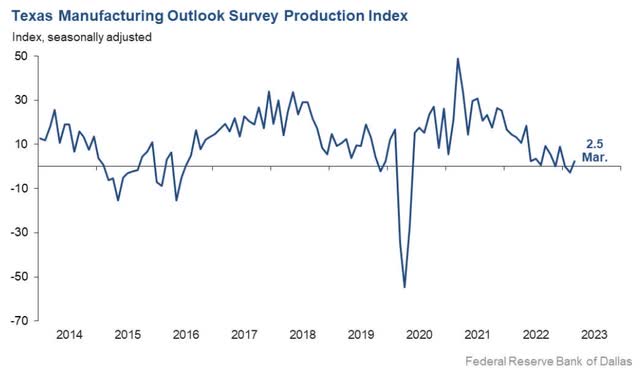

The Dallas Fed Manufacturing Index moved up from -2.8 to 2.5, a reading suggestive of a modest increase in output. Other measures of manufacturing activity showed mixed signals this month.

Dallas Manufacturing (www.dallasfed.org)

The new orders index was negative for the 10th month in a row and came in at -14.3, little changed from February. The growth rate of "orders" index was also negative and largely unchanged, at -15.2.

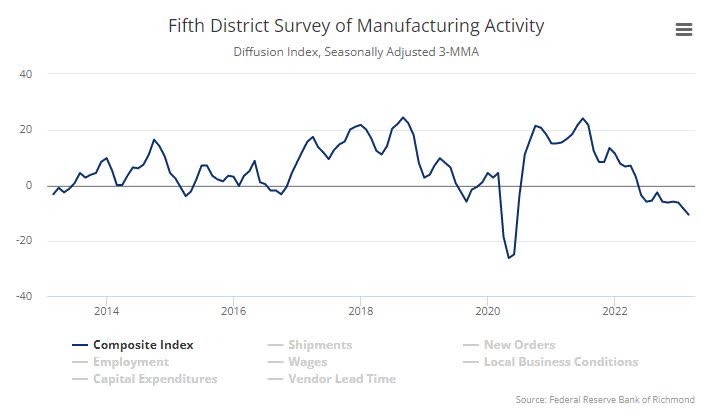

Richmond Fed manufacturing index rose 11 points to -5 in March, beating expectations, after falling 5 points to -16 in February, which is a 3-year low.

Richmond Fed (www.richmondfed.org/research/regional_economy/surveys_of_business_conditions/manufacturing)

This is a third straight month in contraction, and the 1 print from December leaves it the only month in expansion since April 2022. The components were a little more mixed with a couple now in positive territory after nearly all were negative in February.

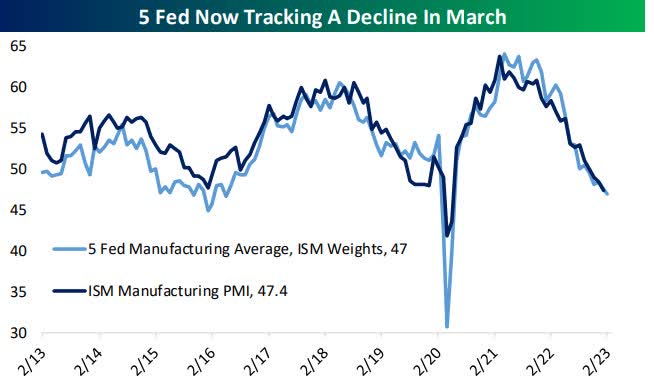

With all five regional manufacturing indices published by Federal Reserve districts now released, the Five Fed Manufacturing index is pointing to a fresh low for ISM in the month.

Regional Fed Surveys (www.bespokepremium.com)

Housing

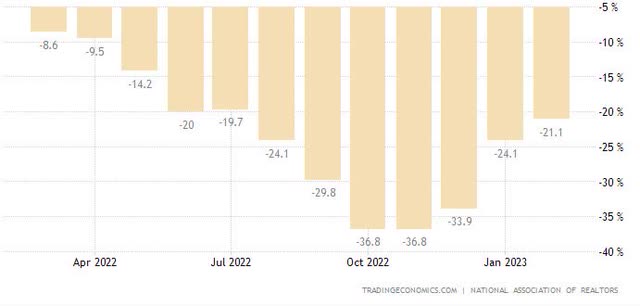

Pending Home Sales for February came in better than expected, rising by 0.8% compared to forecasts for a 3% decline. Today's report also marked the first string of back to back to back positive and better-than-expected readings since the second half of 2020.

Pend. Home Sales (www.tradingeconomics.com)

While the increases are welcomed, I would note that on a y/y basis, Pending Home Sales remain depressed. Relative to a year ago, February Pending Home sales declined 21.1% which is an improvement from late last year when they were down over 30% for three straight months.

The Fed

Even as Powell attempted to convince the market that rate cuts are not on the horizon, the Fed Fund Futures market has priced in more cuts. It's pricing in more than a full 25 basis point cut by the July meeting, and by next January it has priced in double the amount of cuts from two to four. I can't remember a time when there was more of a disconnect between what the Fed is forecasting compared to what the market is expecting.

Fed Futures (www.bespokepremium.com)

Bespoke Investment Group (emphasis added):

"During the last roughly thirty years, there have been five separate rate hiking cycles. While the most recent cycle has been the most aggressive in its speed to the upside, if it ends at current levels, it will be the second lowest terminal rate of the five. If this market pricing is correct and the Fed is forced to cut rates by the July meeting, it would be the shortest distance between the last hike and the first cut of the cycles shown."

I simply can't explain this disconnect. Perhaps it's because we have never seen this set of circumstances come together like we have today. Forecasts are all over the map. What I do know is this is another extreme in uncertainty that can be added to the list.

Silicon Valley Bank - A Post Mortem

We will hear every "excuse" and everybody pointing fingers at the "other" guy. The facts are crystal clear and this is an explanation that I doubt you will hear anywhere else. This event has already impacted the markets and is an important issue that comes at a time when investors are already drowning in issues.

This was much more than a "typical" bank failure, and investors need to pay attention because ALL of the effects are yet to be seen. I'm not talking about a systemic issue that will be a repeat of the Great Financial Crisis. However, what has occurred highlights the inherent problems that this economy and the stock market will be asked to face and cope with in the future. This goes way beyond banking.

SVB and Silvergate Bank have failed. Two other banks in California are scrambling to raise money. The problems at midsize banks appear entrenched in the San Francisco Fed district. Either that is one phenomenal coincidence or perhaps other issues surfaced at the San Francisco Federal Reserve Bank that distracted them from their number one priority. When we look at the actions and words from San Francisco Fed President Mary Daly the record on their priorities is VERY clear and VERY questionable. Ms. Daly makes no secret that her focus is on more progressive objectives of climate change and equity. In June 2021, she touted the regional Fed's work cataloging climate risks, including as she stated;

"Formal surveys, listening sessions, and targeted meetings with CEOs to better understand how climate risk affects decision making and resiliency planning."

"Consistent with our history, we have assembled a team to study how these issues are likely to impact the Federal Reserve's mandates in the future."

The San Francisco Federal Reserve Bank website states;

"Climate change may "challenge the resiliency" of banks and "low-and moderate-income communities and communities of color."

One might say that we can surely make exceptions to these "priorities" which are now part of the public image that they want to portray. The problem is it is a clear violation of Fed policy.

Chair Powell has said it repeatedly. Climate change is not a main consideration for monetary policy. He has made it abundantly clear that the institution's role in the matter is limited to oversight of banks and the rest of the financial system. Mr. Powell reiterated that stance this year:

"Without explicit congressional legislation, it would be inappropriate for us to use our monetary policy or supervisory tools to promote a greener economy or to achieve other climate-based goals."

That message is NOT ambiguous nor is it open for interpretation. The evidence suggests that Silicon Valley Bank was a rogue enterprise acting more like a hedge fund than a traditional community bank that also may have had its priorities compromised. The autopsy on this deceased bank reveals a high probability that we saw a rogue Federal Reserve Bank in San Francisco as well. They decided to make a clear decision to wander well off the policy trail that was plainly stated by the Fed chair on numerous occasions. Let me repeat, there is no ambiguity, no area of "interpretation" when it comes to the Federal Reserve and Climate. It is NOT part of their responsibilities.

The San Francisco Fed's PRIMARY job and unequivocal focus are to ensure that banks model economic and financial scenarios that are going to have a meaningful impact on their balance sheet. We do know that SVB was fulfilling the SF Fed's social and climate agenda, and perhaps everyone lost sight of their PRIMARY focus at this bank as well. SVB noted in its 2022 annual investor report that it received its first "outstanding" rating from examiners on its Community Reinvestment Act plan, which included billions of dollars for low-income housing and initiatives to promote "a green economy" and green communities that build wealth in communities of color.

No one is going to argue that those initiatives aren't worthy and that they caused the bank's failure, they did NOT. But it brings into question why examiners were so "understanding" and didn't address the balance-sheet risks. Unfortunately, there is a precedent for this type of malfeasance and the unintended consequences that come with it. All we have to do is go back to 2008 and revisit how the regulators before the 2008 housing crisis overlooked the underwriting schemes at subprime lenders and Fannie Mae because they promoted affordable housing. They wanted everyone to own a home, even those that couldn't afford it. In essence, they endorsed the issue that caused the Financial crisis. The same has occurred here, and it is now very clear why this situation got out of hand, required immediate attention, and the subsequent bailout occurred.

I don't envy the job of the regulators, they have a difficult task monitoring financial risks. When they muddle their mandate by adding political agendas, the risk of mistakes rises, and that is why Fed Chair Powell was adamant in his view on the Fed's responsibilities. If failed bankers deserve to lose their jobs (and they most definitely should), failed bank regulators also deserve to lose theirs.

After the initial knee-jerk reaction, the stock market is now coming to grips with what happened here. While the overall ramifications will NOT be as severe as what we experienced in the Financial crisis, the rippling effects will surely bring consequences for the economy. The overreaction that will cause lending to slow is just one negative that I've highlighted. Despite what will be the new "war cry" for more oversight and more regulations, you can't regulate for incompetency and misguided logic.

Ironically the "green agenda" is also going to be negatively impacted as "start-up" funding will be left out of the equation for the immediate future. What is even more ironic, when priorities are misplaced, is the group (the real victim), that was supposed to get "help" from the banking system - Middle-income and communities of color that require assistance getting lost in the debris. Meanwhile, the ten largest deposit accounts in SVB held 13 billion in assets, and they were bailed out. Regulatory agencies shouldn't get to pick and choose what THEY deem important while leaving their actual job description as an afterthought. In this case, both the Banks and the regulatory agencies did just that.

Unfortunately, those decisions will affect the economy and the stock market at a time when both can least afford another mistake.

The Daily chart of the S&P 500 (SP500)

It was Risk-On this week and the S&P was a big player in the broad stock market rally this week. The index was able to vault over resistance levels and even eclipsed the March 6th highs.

S&P 500 (www.FreeStockCharts.com )

That leaves the next target for the Bulls at the February highs in the 4190 range. If the BEARS are going to mount a defense they better get their act together soon. A move above the February highs and the BULLS will be talking about new all-time highs. Something that would have been thought to be off the table for a long time. The market marches to its tune.

Investment Backdrop

There is plenty of angst over the banking event in California and the confusing commentary coming from the treasury secretary. Still, there are no signs that there is a systemic issue other than a lack of responsibility. The situation in the EU with Credit Suisse and Deutsche Bank was another issue driving the fear bus. Ladies and gentlemen both of those foreign banks have been ongoing Train wrecks for YEARS. Here is another episode where they have gone off the rails again.

Regardless of our opinion on what might happen with the banks, these events have taken center stage and they add to the uncertainty that exists in the markets today. We've said it before, this market is all about equal opportunity. It doesn't like the BULLS or the BEARS. The S&P 500 has been locked in a trading range (3800-4100) since last October. Recently we have seen moves that opened the door for a run to 4100 which was immediately followed by a move that opens the door for S&P 3800. So far they have all been false starts. As of the close on Friday, the S&P sits above 4100 and one has to wonder if this is yet another false start.

This has been a very difficult market over the past few months, more difficult, in fact, than what we saw last year when prices were consistently declining. Give an investor a trend that they can follow, and investors can produce profits. When they are submerged in a wishy-washy, start-stop backdrop, they tend to drown. Many are still holding out for a more dovish Fed, even though we just heard them tell everyone not to expect any rate cuts this year. I can't prove it BUT IF the market is positioned for rate cuts this year, then there is a lot of room for disappointment ahead.

Uncertainty continues to rule.

Sectors

Consumer Discretionary

This sector (XLY) has rallied ~15% in Q1. That is a nice rebound from the shellacking the Discretionary group took last year when it fell 36%. Unfortunately, the longer-term trends are still BEARISH, and other than a "special situation," I'm not adding exposure here.

Energy

Crude Oil has arguably been my favorite investment area over the past couple of years and it has treated us very well, both via the commodity itself and Oil stocks. However, I admit to being lost when it comes to explaining why it has dropped so much and my contacts who are also bullish on Oil in the long term are just as confused. Given a world that is still going to need Oil for the foreseeable future while world governments make it harder and harder to produce it, it seems the fundamentals should support, at the very least stability, and higher prices in the years ahead.

Something like a bad global recession that crushes demand can spoil that, but if that was the sole reason weighing on Oil right now, I think we'd see risk assets across the board suffering similar fates. Instead, Oil has sort of just done its own thing.

Energy stocks (XLE) have come off the mat posting a solid 7% rally this week. The longer-term trend lines were tested and if prices stabilize here or higher I label this as a normal pullback after an incredible run that preceded it. We shouldn't lose sight of the fact that USO, the United States Oil Fund LP, experienced a 440% rise from its bottom in 2020 to its top in 2022. So, while I have certainly been disappointed in Oil's performance lately, I remain bullish on it over the long run and think in the years ahead prices are going higher.

Financials

Not much has changed since last week. Both the Financial ETF (XLF) and the Regional Bank ETF (KRE) have been decimated. However, the XLF which has the large center money banks in it rallied this week and may have marked a near-term bottom. I wouldn't try to catch the falling knife unless you have a plan that includes averaging in to build a longer-term position.

The Regional Bank ETF (KRE) remains in no man's land and what we can call a good support level is down around the levels seen in 2020. The group is incredibly oversold and it will be important for the ETF to stabilize right here. Investors need to understand it will take a long time for this kind of damage to be repaired.

This recent selling event has solidified the long-term BEAR market trend in the sector and tells me this group will not be able to support the general market for a while.

Healthcare

A glimmer of hope for the Healthcare group (XLV) as prices stabilized recently and the ETF has now recorded three successive weeks of gains. Perhaps it is back to being considered a safer haven and the money moved out of Financials has also found its way into this sector.

The next step is to try and recapture the trend lines and get back into an uptrend. I'm still a believer in the group, especially in a weaker economy.

Biotech

The BEAR to BULL reversal pattern for the biotech index (XBI) was severely damaged and about to be declared DEAD. The Hot Trade now is to BUY companies that have little need to seek the capital markets to raise money, while SELLING those that will need to do so. Biotechs are always in need of capital and with this new mindset, the group was sold.

While the sub-sector is oversold, only those that can let this "phase" pass should entertain adding positions. I would look to do so in stocks that are still in BULL trends. A recent addition, Mirum Pharma (MIRM) fits that description and has held up well in the biotech selloff.

Gold

Gold (GLD) is in a BULL market trend and since I missed the liftoff, I have patiently waited for any pullback. I got my wish this past week and initiated a position in the Global Gold ETF (GLD).

Silver

Silver (SLV) is mimicking the action in Gold and the DAILY chart shows the possibility of another shot at taking out the $22.50 level. A level that has capped other rallies. The latest trade is now up ~15% since added on March 2nd.

Uranium

Last week I noted the Uranium ETF (URA) was going in the opposite direction, and was nearing a good support zone. I added to my long-term position early this week and the ETF responded with a nice four-day rally before pulling back on Friday. That leads me to believe we have seen a successful test of support.

The sector still displays a decent risk/reward situation.

Technology

Money managers went into a "window-dressing" mode, as they wanted their portfolios to show a decent amount of exposure to technology. The Technology ETF (XLK) has now rallied for three consecutive weeks adding 11% in that time frame. For the year the ETF is up 21%, clawing baking most of the last year's 28% loss.

Semiconductors Sub-Sector

We've talked about this "divergence" we've seen since the start of the year. Year to date, the Philadelphia Semiconductor Index (SOX) is up 27%, and through Friday's close has now eclipsed the February 2nd high.

Much of the strength in the semis has been attributed to Nvidia (NVDA) which has been on fire this year rallying more than 80% on the explosion of AI-related interest. Outside of NVDA, though, nine other stocks are up over 25%, and just over half (16) of the index's 30 components have rallied over 20%. Overall, just two stocks in the SOX are down YTD and they're also the only two underperforming the S&P 500 so far this year. However, let's also note that the semis as a whole lost 36% last year; NVDA was cut in half.

The group's relative strength has easily eclipsed the S&P this year, and in the past, we have used that as a sign of overall market strength. We'll know soon enough if this is a false breakout OR a sign the entire market, especially technology, is about to get a lift.

International Markets

China

Between 2012 and 2021, Chinese stocks performed broadly in line with global equities, with the MSCI China index trading sideways versus the MSCI World. While the rest of the world embarked on re-opening their economies, CHne went the other way. More lockdowns and Chines equities sold off. Unfortunately, the same mindset rolled over into 2022.

It looked pretty bleak before China's officials surprised markets by ditching its Covid controls and reopening its economy. This triggered animal spirits with the thought of a strong rebound in Chinese GDP growth. In essence, the Chinese have been locked down for ~3 years. If there ever was an argument o be made for pent-up demand it is here.

The next point to make is that China is one of the few major markets where economic growth and profits are likely to surprise the upside in 2023. I don't believe any other developed market can claim that. The Chinese business world is unlikely to face higher tax rates (as the Administration is proposing in the U.S.), nor is there a need for their government to enact any fiscal discipline policies. Unlike the rest of the globe, China is not in a war with the boogeyman known as inflation. It is very unlikely, the People's Bank of China will become a headwind. Their policy backdrop seems to be somewhere between neutral and supportive. This genuinely sets China apart from most other major markets.

Meanwhile, valuations on Chinese equities are "attractive." Upside growth surprises in China seem reasonably probable. The unfolding troubles in the U.S. banking system will likely cap (or at least slow) the recent rally in the U.S. dollar, which would help to boost emerging markets (including China), as well as precious and industrial metals.

We've seen the Chinese equity rally stall recently and that is an opportunity. After testing support Chinese equities rallied this week. I believe we can expect higher prices down the road given their current oversold and undervalued position. China is not without investment risks so it's not for the faint of heart, but the iShares China Large Cap ETF (FXI), the CSI300 (ASHR), and the KraneShares China Internet ETF (KWEB) all look interesting at these levels. In short, I like these risk-reward setups that are being presented to investors today.

Final Thoughts

If the Fed's message this week wasn't enough, here is something else to ponder.

Can the Fed Really Cut Interest Rates?

It's no secret. Investors have been made aware that Fed Funds Futures are predicting Fed policy to not only stop the hiking cycle but to cut rates by the end of this year. Perhaps that is what has ignited this rally and has investors moving some money back into stocks. I'll admit with all of the negative and uncertain headlines in the last week or so the indices have been quite resilient. The BEARS had a "fat pitch" served up to them and they whiffed.

However, after giving this some thought, I am hard-pressed to believe that a bank event caused by mismanagement is going to deter the Fed policy that has been established. That was confirmed AGAIN in the latest FOMC Meeting. Their mission is to quell inflation and bring it down to the 2% range.

History shows that the;

- Fed Doesn't Often Cut With Inflation This High...

- With a Job Market This Strong...

- And a Fed Funds Rate That Is Still Less Than the CPI.

The last bullet point is the most important.

So who has it right? The bullet points I just laid out OR the Fed Funds Futures? I sense a lot of frustration in this market from both the Bulls and Bears. I get it. The whipsaw nature of the moves has seen trap after trap develop on both the upside and the downside. As I have said several times recently, this has been an extremely difficult market to try to call with any sort of conviction. However, when facing the uncertainty that brings on indecision, it is always best to follow the primary trend in place - and that is still BEARISH.

There is still "UNCERTAINTY in a DIFFICULT BACKDROP." We have now witnessed a change in the air and investors should remain flexible and follow prices. I expect conditions to remain difficult, which pertains to both upside rallies and downside pullbacks. We might find ourselves in this backdrop for a while.

THANKS to all of the readers that contribute to this forum to make these articles a better experience for everyone.

Best of Luck to Everyone!

While many keep producing "wishy-washy" forecasts have been wrong, washy) wrong, the message here has been "crystal" clear and "correct". My market analysis has been firm since I called this BEAR market in February '22. The current setup could introduce the next chapter in this BEAR market.

The Savvy Investor strategy works in ANY type of market because it leaves emotion out of the equation. If you want to rise above the crowd you can't afford to miss out on what I'm saying today. The only way to participate is by joining The Savvy Investor Marketplace service at a reduced rate.