kupicoo/E+ via Getty Images

This article was published at iREIT on Alpha on May 19, 2023 and coproduced with Williams Equity Research

The News

The Franchise Group's (FRG) business model is straightforward, cash flow heavy, and in some ways, has little competition. There really isn't anyone else buying and optimizing franchises like FRG is.

That's the type of formula we strive to find and invest in. And apparently, we are not alone.

Franchise Group agreed to a take private in a management buyout led by CEO Brian Kahn for $30 a share in cash. Franchise Group rose 2.2% in premarket trading.

The consortium purchasing Franchise Group includes B. Riley Financial (RILY) and Irradiant Partners, according to a statement. The consortium is buying the 64% of the company's issued and outstanding common stock that the Management Group does not presently own or control.

Did that raise an eyebrow?

It did for me.

As we've noted in the past, Brian Kahn, the CEO, is heavily invested in the company he runs. The latest data indicates he owns about 10% of the company. That's over 11 million shares.

MBO Controversy

We can't determine if the takeout is favorable for shareholders unless we understand the mechanics. It's also necessary if we want to know if the deal is fair or done with good intentions.

A management buyout ("MBO") occurs when a company's existing management team leads the takeover of the company. That's what happened with Franchise Group.

This can be confusing, so I'll explain with an example (note: this does not necessarily reflect the intentions and events surrounding the buyout of Franchise Group).

Imagine you are the CEO of publicly traded company Bobby's Chemicals. You own a minority 5% stake. Public shareholders own most of the shares. And even though you have a lot of influence and control as CEO, the Board of Directors ultimately calls the shots when it comes to major decisions.

You have a great idea to expand this business, but it comes with risk. The Board reviews the proposal, and declines. One of the other large investors in Bobby's Chemicals, ABC Investment Management, also likes the idea. In fact, they like it so much they are willing to help you take control of the company.

If you can get the existing public shareholders to sell, you can take the company private. Now, you implement your growth plan. And as a private company, you can move a lot faster with less decision makers involved.

All this sounds reasonable, right?

Here comes the tricky part.

You are the CEO, which means you have a fiduciary duty to the shareholders of Bobby's Chemicals. You must do what's in their best interest. But at the same time, you are leading another group of investors to buy Bobby's Chemicals.

As CEO, are you really going to get the best possible price for the public shareholders?

Let's think about it.

If you push for too high of a takeout price, then ABC Investment Management is going to walk away from the deal. They don't want to overpay. They have investors too. ABC Investment Management has a fiduciary duty to those investors.

But if the takeout price is too low, then you've failed your duty to the public shareholders. To be clear, Bobby's Chemicals Board makes that decision. But as CEO and likely the person setting the takeout price, you should be fighting for the highest possible number.

If you know the Board will take $40 per share but think you could help the company get $42, what number do you offer?

As part of the takeout team, you are conflicted.

What about your sizeable equity stake in Bobby's Chemical's?

Wouldn't that mean you are aligned with the public shareholders?

Not necessarily.

ABC Investment Management may be willing to increase your stake from 10% to 20% to be the CEO of the new company. That would easily makeup for getting $40 per share on your 5% stake compared to $42. There is a myriad of ways to incentivize you to shoot for the lowest takeout price possible.

Now that we have a strong grasp on how a MBO works, let's get back to Franchise Group.

Takeout Analysis

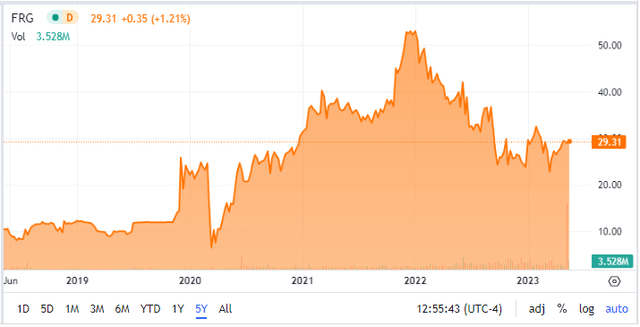

Let's take a look at where FRG has traded in the past using a 5-year stock chart.

Seeking Alpha

Prior to the pandemic, FRG was a $10 stock.

We started covering the stock in Q3 2021 as acquisitions started making headlines. The stock jumped over 50% shortly after initiating our first buy recommendation.

Q3 2020's quarterly dividend of $0.25 quickly rose to $0.375 then to $0.625 in Q4 2021. That was huge dividend growth by any measure. FRG has maintained that $0.625 ever since, which was a sky-high 11% yield before the deal was announced.

Since that share price peak, the stock has been under pressure. Results have generally been good, but FRG's mergers and acquisitions ("M&A") heavy business wasn't helped by higher interest rates.

To decide what a reasonable takeout price is, we need a deep understanding of FRG's financials. Let's start with recently released earnings and go back in time.

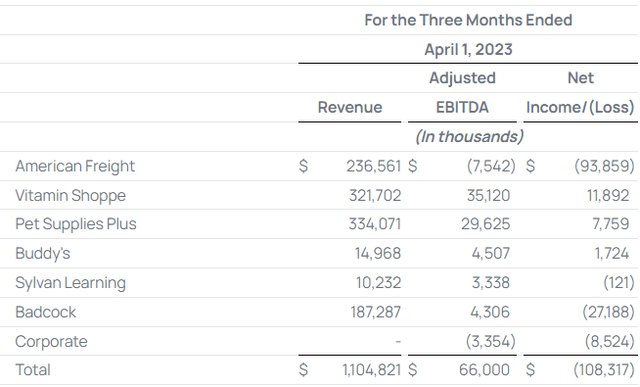

Source: FRG Q1-23 Earnings Release

FRG's Adjusted EBITDA was $66 million last quarter from revenue of $1.1 billion.

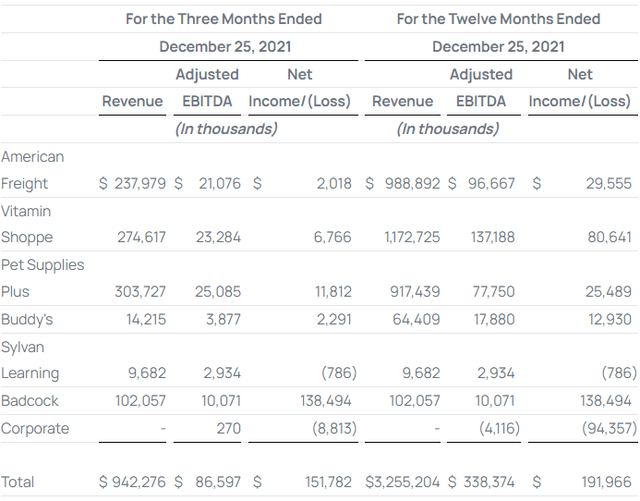

Source: Q4-23 Earnings Release

Q4 2021 had $942.3 million in revenue and $86.6 million in Adjusted EBITDA. Q1 2021 had $1.1 billion in revenue and $112.3 million in Adjusted EBITDA. Full year 2022 generated $3.3 billion in revenue and $338 million Adjusted EBITDA.

That's a lot of numbers, so let's digest.

Excluding nuances around M&A, FRG's recent results haven't been nearly as strong as when the stock was trading above $50. The fact FRG's stock price is lower today then back then makes sense.

Let's talk valuation over time.

That's what really determines the "right" takeout price.

At its peak around $55, FRG was worth $1.9 billion and generated $338.4 million in annual Adjusted EBITDA or a 5.56x multiple (the Net Income multiple is too volatile to be useful over time, so we use Adjusted EBITDA instead).

Today, based on annualizing the latest financial figures and the current market cap, FRG trades at a 3.8x Adjusted EBITDA multiple. Given the stock is at $29.50 versus the takeout price of $30, those numbers apply to the exit too.

Deal or No Deal

FRG was trading between $22 and $23 per share before the takeout deal was formally announced. $30 per share was a ~32% premium to the previous day's close. We are going to evaluate the transaction based on four key metrics.

Premium: A 32% premium is right in the middle of the 20% to 40% premium that is historically needed to get a deal done. Markets are currently tilted towards bearish, and interest rates and the financing market for deals like this aren't ideal. Given all that, we'll give this component a B+ grade.

Valuation: As a reminder, this normalizes for changes in financial results over time. This is strictly about valuation. Shareholders are receiving an Adjusted EBITDA multiple that's 32% lower than it was a year and a half ago. That coincides with maximum bullishness on the stock, so let's look at another time period. In Q1 2022, FRG generated $112 million in Adjusted EBITDA.

That was an annualized 3.2x multiple based on the market cap at the time. The market was in a very different place in late 2021 when FRG was trading at its peak. To assume shareholders can obtain that same multiple today is not realistic.

Compared to when the stock was in the mid-$40s a year ago, the $30 buyout price results in a valuation that is 19% more favorable. FRG's financials are not forcing a deal, and that should be taken into account. This results in a B- grade.

Share Price: The $30 share price compares to a 52-week high of $44.25 and 52-week low of $22.45. While a reasonable premium to a 52-week low, that should always be the case and is nothing special.

Compared to the 52-week high, which is usually reached when a company is taken private, the exit price is poor. It's even worse judged against the early 2022/late 2021 peak share price of $55. This category receives a D grade.

Management Effort & Intentions: A Filing 13D shows Kahn is rolling his equity stake into the new company. Based on available information, that means he's personally indifferent whether the company sells for $30 per share or $40.

He's not cashing out either way.

This creates the potential for the CEO to try to get the lowest share price possible for his new collective of investors. Based on my significant experience in this area, it's also likely that his compensation with the new entity is heavily tied to the growth in its value.

If that is the case, then the incentive is to takeout FRG at the lowest price possible.

As a reminder, Kahn is a Board member. But he isn't the Board. And it's the Board, not Kahn, who ultimately makes the decision for shareholders.

It's easy to channel frustration to Kahn, but no matter your opinion, he isn't responsible for FRG accepting the deal.

It's the whole Board. And the Board never indicated they were seriously soliciting other offers. Even if one doesn't appear, companies will often make a public pitch to at least make a solid effort to find one. Based on available information, we rate this aspect a D grade.

What Would We Do?

To start, we do not have the same information the Board or Kahn has. If we did, it might significantly change our perspective.

That said, it's the Board's job to communicate important information to shareholders so they understand what's going on and that the Board is acting in their best interest.

Recognizing all the financial data and market sentiment today, I would not have considered a takeout offer for less than ~$33 per share. That's the midpoint between pre-deal Adjusted EBITDA multiple and the cyclical peak's.

It comes out to a ~$1.1 billion market cap. Other methods of determining the rock bottom I'd consider all land between $31 and $35 per share.

In terms of what I'd not only consider but approve, it would need to be at least $35 per share.

That's a 55% premium to the pre-deal share price, and as a Board member, premiums of that level must be seriously evaluated. That level is also appealing based on other factors like the trailing 12-month valuation.

Even if I personally think FRG has the potential to be a $40-$50 stock again, that could take years of a recession hit in the near term.

It would be hard as a Board member to decline a $35 offer if the upside case is $40-$50 in two to three years. If investors allocate their cash for two years in a high yield savings account, the $35 to $39 with no risk.

As for me (Brad Thomas), I'm holding onto my shares (basis of around $28.50)... for now... still frustrated because I believe the company has potential to outperform as it builds trust with analysts and the investor community.

Also, WER has a beneficial long position in the shares of FRG either through stock ownership, options, or other derivatives.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.