Panasevich/iStock via Getty Images

Confrontation comes naturally to me and indeed I score as “disagreeable” on the Myers-Briggs personality test. I have enjoyed debating since I was a small child and once I was old enough to have a bit of self-awareness I realized I was not a good debater. So I set out to learn how to do it properly and shortly after finishing my undergrad, I began an autodidactic study of philosophical argumentation. While I am still far from a great debater, I did learn some key lessons which are relevant to the topic at hand – differentiating between a legitimate short thesis and a short and-distort-attack.

This article will discuss the various short-and-distort attacks on Medical Properties Trust (NYSE:MPW) and contrast them with the actual fundamental risks. We will conclude with our analysis of MPW as an investment going forward.

Eristic versus Socratic argumentation

I believe one can scout short and distort attacks by the style of argumentation they employ. A legitimate short thesis will usually come in the form of Socratic argumentation while a short and distort attack is more eristic in nature. These terms are not financial vernacular so we shall define them below:

- An eristic argument is one in which the goal is to “win” the argument.

- A Socratic argument is one in which the goal is to achieve truth or get closer to truth.

Winning can be defined in many ways but in the case of short and distort attacks, winning is convincing large swaths of readers to short the company or longs to sell their shares.

Legitimate arguments will of course attempt to be persuasive, but the tone is quite different. For a good example of a legitimate short thesis please check out Jim Chanos’ short of Digital Realty (DLR). Chanos discusses it here in a long form interview.

It is not perfectly Socratic as Chanos does use some hyperbolic language, but on balance I think it still serves as a great example of a legitimate short thesis. The basic idea is that Chanos provides reasoning as to why he thinks hyperscale data centers have poor forward ROIC relative to their cost of capital and that this makes DLR overvalued.

In contrast, an eristic argument is much less logical in form. It usually involves multiple logical fallacies which on the surface seem like convincing arguments but if you analyze thoroughly, they aren’t real arguments. Some of the most frequently employed fallacies are:

- Ad hominem

- Non sequitur

- Ad verecundiam

- Straw man

- Guilt by association

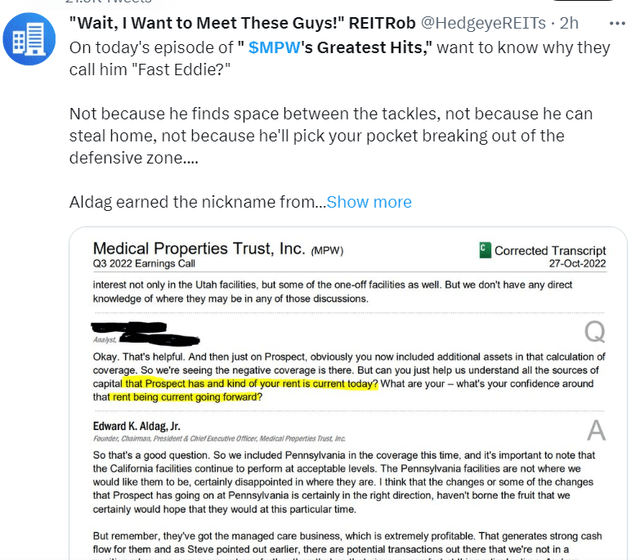

If you have been following the MPW short and distort attacks you will probably have seen each of these used. In just the last few days here are some examples. A Tweet from Hedgeye on 5/24/23:

A clear attack on MPW’s CEO which I’m not sure I really understand as from what I can tell he largely DID answer the analyst’s question. Even if Hedgeye is correct in their interpretation that Aldag sidestepped the question that is quite standard practice among CEOs. Part of a CEO’s job is to portray the company in a positive way so as to maximize access to capital markets.

Nearly every CEO spins and sidesteps. If spinning were evidence of bad management, the entire market would essentially be uninvestable.

A fresh short attack from The American Prospect was published on May 23. It features lines such as:

“It seemed obvious to anyone paying attention that Halsen had fleeced the hospital. But why had MPT, which owned some 20 California hospitals and 444 medical properties across 30 other states and nine countries, signed up to be fleeced? The short answer is that it was all a massive Ponzi scheme. Of course it was: In the age of zero interest rates and private equity rollups, some entire industries devolved into pyramid schemes, and health care companies, with their high barriers to entry and Medicare billing privileges, were particularly vulnerable”

I suppose I admire the efficiency here as the writer managed to pack guilt by association, assumption of malintent, and non sequitur into a single paragraph. The non sequitur in this passage is perhaps less obvious than the other fallacies here, but it is the idea that Halsen fleecing the hospital operators entails MPW getting fleeced by Halsen which of course it does not.

Beyond fallacies, short and distort attacks have a habit of misinterpreting data (perhaps intentionally) in such a way as to fit the narrative of the short attack.

- Book value to suggest overpaying

- Assessed value to suggest overpaying

These fallacies were prevalent in the original misguided piece unfortunately published in the otherwise reputable Wall Street Journal back in 2021 which seemed to kick off the whole chain of short and distort attacks. For example, the article stated:

“It {MPW) provided $200 million to buy Steward assets valued at $27 million.”

The article used this information to insinuate that MPW was overpaying for assets or perhaps even intentionally overpaying for assets in some form of scheme.

The $27 million value to which they are pointing is either a GAAP book value or a tax assessment value neither of which is an appropriate way to value real estate.

If you have ever bought a house you probably noticed a substantial gap between the price and the tax assessed value. Anecdotally, the Zillow estimate on my house is presently about 40% above the assessed value.

GAAP book value is also wrong on real estate as properties get depreciated down to zero linearly through their assigned depreciation schedule (usually 30 years).

The latest example of eristic argumentation from a short and distort seller is Hedgeye’s tweet in response to a May 24, 2023 press release from MPW about the sale of Australian Hospitals.

I don’t know if this guy is just confused or what, but he seems to be laughing at MPW for the very low cap rate on sale being so close to the interest rate on “risk free” instruments like treasuries or CDs.

Maybe he just doesn’t know real estate, but when selling a property low cap rate is a good thing.

MPW in its press release is correctly pointing out that if the buyer was willing to pay $1.2B Australian dollars at a 5.7% cap rate (which is quite low in today’s environment) these are clearly strong assets.

It is also known that the EBITDARM coverage of these Australian hospitals was below the average EBITDARM coverage of MPW’s portfolio. Therefore, it is reasonable to suggest the transaction is reflective of the rest of MPW’s portfolio which implies the value is substantially greater than where MPW is priced.

Assessment of short and distort attacks

Given the weak nature of their argumentation I find the short and distort attacks to be completely ignorable at this point. They are not proper logical arguments and should not be factored into one’s assessment of fundamental value of MPW.

It is worth noting that they are also losing their ability to impact market price. Short interest is declining modestly and those who still own MPW have already been through countless attempts to be shaken out.

With that in mind, I do want to give proper attention to the actual legitimate bear arguments on MPW. With so much focus on the short and distort attacks it is easy to lose sight of the real problems.

Result does not dictate the merits of an argument

It is possible MPW will turn out to be a bad investment. That in no way validates the short attacks nor does it mean MPW or its affiliates or its operators had malintent. The world is always changing and nobody can see the future. Sometimes things just fail through natural causes or unforeseeable forces outside of one’s control. There has been no shortage of weird black swan type headwinds.

- Pandemic

- Rapid and extreme rise in interest rates

- Supply bottle necks

- Labor shortages

- Increased regulatory burden in healthcare

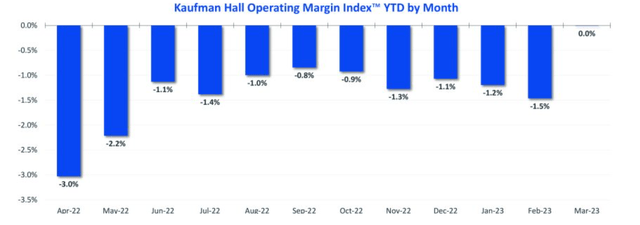

It has been the perfect storm of challenges. Here is the EBITDA profitability in the hospital sector.

Kaufman Hall

All of 2022 had negative operating margins for hospitals. It was the worst year in decades for the industry but there are signs of improvement. 2023 is stronger year over year with March coming in at 0 margin. Industry consensus seems to be that profitability will continue to improve and should turn into positive margins later this year.

It has been really hard and there is a long way to go to full stability.

MPW, as compared to other healthcare REITs, has atypically strong EBITDARM coverage ratios. Part of this is its international exposure as overseas hospitals are faring a bit better, but it is also a reflection of a generally strong tenant base.

Some tenants are faring better than others and there has already been ample coverage of MPW’s struggling tenants from myself and other sources.

Hospitals remain a tough sector so there are of course risks to investing in MPW. However, I believe those risks are more than priced in making MPW a favorable reward relative to the risk going forward.

My base case on MPW

Note that this is predicated on a slow but steady recovery to the hospital industry. While the pace of hospital operator recovery is not predictable, I do think there is a degree of inevitability to operators finding better profitability. Frankly, hospitals are needed so reimbursement rates or some other factor will be adjusted to make sure the majority of operators survive. Weak operators will go out of business. Many already have, but the meat of the bellcurve of operators will very likely recover.

As the majority of MPW’s tenants had > 1X EBITDARM coverage even through the darkest parts of 2022 I think the majority will continue paying rent. A few have struggled which knocked FFO/share down from about $1.80 if the hospital environment were great to about $1.50-$1.60 in the weak hospital environment.

MPW has not been immune to the challenging environment, but I do think the market price reduction was a bit overblown.

- Market price from $22 to $8

- Anticipated FFO/share from $1.80 to $1.55

That is quite the ratio of damage to market price as compared to damage to earnings. More than the 25 cent reduction to FFO is being priced in. At $8 the market is anticipating substantially more hits to come.

I simply don’t see that as likely. 2022 looks like it was the trough for hospitals and MPW specific transactions back that up. There has already been significant progress in dealing with most of the troubled tenants and EBITDARM coverage ratios are on the rise.

I think FFO/share will stabilize around current levels as deleveraging efforts slightly pull FFO down but favorable leasing and escalators pull FFO back up.

If I am correct about the future trajectory, $8 per share is far too cheap of a price for $1.50 as trough FFO/share.

Other REITs victims of short and distort attacks

Similar analysis of argumentation can be used to exonerate other companies being affected by the wave of misinformation.

- Arbor Realty (ABR) attacked by Ningi

- Welltower (WELL) attacked by Hindenburg.

- Hannon Armstrong (HASI) attacked by Muddy Waters

One could just about make a short and distort victim ETF. When the reports come out wait a few weeks for them to do their damage to the market price and then buy for the recovery as these turn out to be completely bogus arguments.

These might look like wins for the short sellers now but eventually market prices tend to return to fundamental value. It just takes a longer time horizon. For short attacks that went full cycle check out Iron Mountain (IRM) which used to be one of the most heavily shorted REITs or Farmland Partners (FPI) which has nearly tripled from its short and distort trough.

So far, Portfolio Income Solutions subscribers consist largely of investment professionals, whether current or retired. That’s great, I love having an educated readership as they ask questions that challenge me to dig deeper. At the same time, I believe financial information should be available to all and that financial education is foundational to success in life. As such, I have launched REIT University, a new branch within Portfolio Income Solutions and am offering a large discount to those who want to learn. It contains a crash course in fundamental investment and goes deep into REIT specific analysis.

Grab a free trial and start learning today!