This guy is teaching complex math. It takes more education and pays less. We can make money with elementary math. Daniel de la Hoz/iStock via Getty Images

Who feels like some simple math? I do. Why? Because I can get paid to demonstrate simple math.

We often talk to our readers about pricing failures in the market. We're doing that again.

We're comparing AGNC Investment's (AGNC) preferred shares, AGNCM (NASDAQ:AGNCM) and AGNCP (NASDAQ:AGNCP).

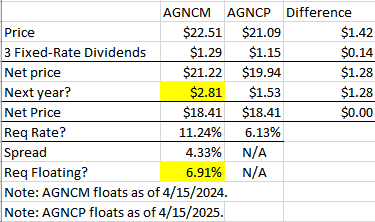

We can start with an image:

The REIT Forum

We start with the current prices. AGNCM costs more than AGNCP.

There are 3 fixed-rate dividends remaining before AGNCM floats.

Those 3 dividends will return $1.29 to AGNCM shareholders and $1.15 to AGNCP shareholders. We can deduct that to reach the "Net Price" of $1.28.

Is that really the right term? No, but that's what I'm calling it for the image. There isn't a math term for "price minus 3 dividends".

In hindsight, I should've labeled it as "Price Minus 3 Dividends". Let's move past that.

For total cash inflows and outflows to be equal one year after AGNCM begins floating, AGNCM would need to pay out $2.81 during the first year it floats.

We know that because AGNCP will pay $1.53 and the remaining "Net Price" was $1.28. What is $1.53 plus $1.28? It is $2.81. That's how we solve the equation. I told you, this is an article where the author gets paid for simple math.

A dividend rate of $2.81 for one year represents 11.24% on the face value of $25.00.

Since AGNCM's floating spread is 4.33%, we can subtract 4.33% to find the required floating rate of 6.91%.

Will short-term rates actually average 6.91% during that year from 4/15/2024 to 4/15/2025? Probably not, but we can't be certain.

First Conclusion

Since short-term rates will probably average less than 6.91% (from 4/15/2024 to 4/15/2025), an investor AGNCM will probably not recover the entire premium they paid before 4/15/2025.

However, it actually gets quite a bit worse.

Make It Worse

Reason 1: AGNCP investors get to keep their cash upfront. Since they get the cash earlier, they could earn a bit of interest on it. That's pretty nice.

Reason 2: Starting on 4/15/2025, both AGNCM and AGNCP are floating at different spreads.

AGNCP has the bigger spread. While AGNCM pays short-term rates plus 4.332%, AGNCM pays short-term rates plus 4.697%. Since the two shares will have the same short-term rate, the only difference is the spread. What is 4.697% minus 4.332%?

It is 0.365%.

What does that mean? It means AGNCP pays out a bigger dividend by 0.365% of $25.00. That comes to $.09125 per share per year.

So long as both shares are outstanding, AGNCP has to pay an extra $.09125 per share more than AGNCM each year. Therefore, you would probably prefer to have AGNCP at that point. Right? Not a trick question. You just get more income.

Easy Math

Prior to 4/15/2025, AGNCM probably won't recover the full $1.42 price difference.

After 4/15/2025, AGNCP always pays bigger dividends.

Therefore, AGNCM cannot possibly catch up after 4/15/2025. The only chance to catch up is before then.

Hypotheticals

What if shares get called?

Great, we have an ending date at $25.00 per share. Which share had a smaller net price (price minus dividends)? Probably AGNCP.

What if AGNCM gets called and AGNCP doesn't? It sounds stupid when AGNCP has a higher floating spread. Technically AGNCM can be called sooner, but that's really grasping at straws.

What if AGNCP gets called and AGNCM does not? Okay, if AGNCP gets called, will you suggest this was a bad call? Every so often, I hear someone arguing that they want a lower coupon rate because it reduces the risk of being called. In that case, just loan your money to the bank at 0.1%. They won't force you to take it back at face value.

Conclusion

Sometimes AGNCM is the best deal among AGNC preferred shares.

Sometimes AGNCM costs $1.42 more than AGNCP.

Those two events don't happen at the same time.

Today, AGNCM costs $1.42 more than AGNCP. Therefore, AGNCM is an inferior deal today.

How could an investor play this? They could sell AGNCM and use the cash to buy AGNCP. They would be getting a better value for their money. Yeah, it's that simple. Of course, this depends on the investor achieving execution near that price spread.

Preempting Bad Arguments

I understand AGNCM is going to float first. Hopefully, no one can read this article and miss that fact. However, saving $1.42 per share today is better than getting back a fraction of that amount in dividends over the next 7 quarters.

Someone will argue that math doesn't matter and AGNCM floats sooner. Someone always makes that argument. I do not understand how someone reads my work and still believes math doesn't matter, but some people do.

Why do I track these spreads so much? Because we trade back and forth between these shares as the spreads change. That can lead to having more shares of the original position. More shares is better. As you could reasonably guess, I own shares of AGNCP. When the price disparity says AGNCP is not as good as the others, I will want to swap out of AGNCP and into a different share.

I use the term "swap" because we're not focusing on the aspect of buying and selling. We're focused on picking between the shares. We execute our purchases and sales to readjust the portfolio based on which shares are more attractive. Consequently, we may sell something that is a good deal so we can replace it with something that is a great deal.

Why? Because I like more profits better than less profits.

Thank you for reading.