fullvalue

Investment thesis

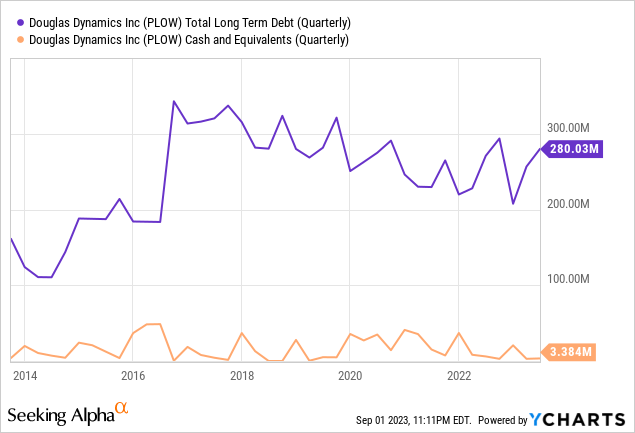

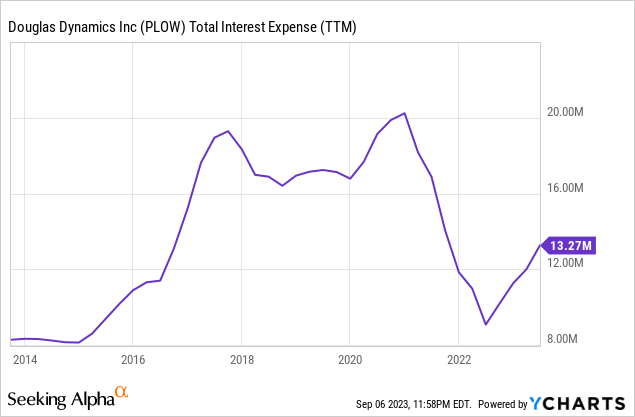

Following the company's enormous expansion that took place in the 2013-2016 period boosted by acquisitions, Douglas Dynamics (NYSE:PLOW) has been facing various headwinds since the outbreak of the coronavirus pandemic, including manufacturing disruptions and lower demand caused by mandatory lockdowns in 2020, and subsequent supply chain issues, labor shortages and inflationary pressures in 2021, 2022 and 2023. All this happened with a leveraged balance sheet whilst investors expected a more accelerated deleveraging after the end of the acquisition spree back in 2016. In addition, increasing interest rates are currently causing interest expenses to grow again, which is putting some pressure on the company's operations and the dividend.

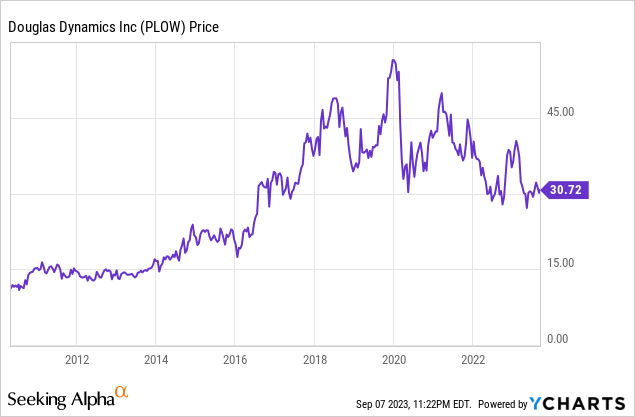

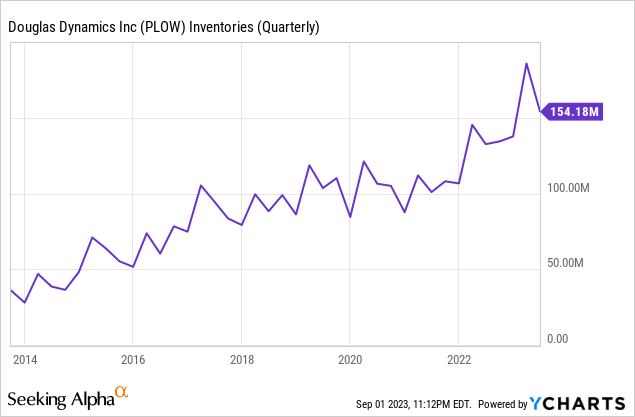

As a consequence, the share price declined by 46% from all-time highs as investors are currently on the sidelines. Also, there are growing concerns about a potential recession in the foreseeable future caused by rising interest rates, which would likely have a significant impact on volumes. However, the balance sheet is currently more robust than in 2016 despite recent headwinds as the company has managed to slightly reduce long-term debt while building strong inventories and accounts receivable, so cash from operations is expected to be strong in the coming quarters, which should ultimately allow for some further debt reduction in the medium term. In this regard, revenues have more than tripled since 2013 thanks to acquisitions, so paying down debt should eventually unlock significant value, which makes me believe that the recent share price decline represents a good opportunity for long-term dividend investors as the dividend yield on cost currently stands at 3.84%.

A brief overview of the company

Douglas Dynamics is a North American manufacturer and upfitter of commercial work truck attachments and equipment that has operated since 1948, and its market cap currently stands at $709 million as it employs almost 2,000 workers.

Douglas Dynamics brands (Douglasdynamics.com/brands)

The company has significantly expanded through acquisitions in the past few years and operates under two business segments: Work Truck Attachments and Work Truck Solutions. Under the Work Truck Attachments segment, which provided 85% of the company's revenues in 2022, the company manufactures snow and ice control attachments, as well as other related products, under the Fisher, SnowEx, and Western brands, and under the Work Truck Solutions segment, which provided 15% of the company's revenues in 2022, the company manufactures municipal snow and ice control products and offers a complementary line of upfitting services and products under the Henderson and Dejana brands.

The share price currently stands at $30.72, which represents a 46% decline from all-time highs of $56.89 reached on February 25, 2020. This decline is significant and has been caused by coronavirus-related headwinds in 2020 and subsequent supply chain issues, labor shortages, and inflationary pressures in 2021 and 2022. More recently, the company reported lower volumes due to a very weak snowfall season during the first quarter of 2023, and despite a significant recovery during the second quarter, rising interest rates are causing a surge in interest expenses, which is drawing an increasingly complicated future while investors fear a potential recession as a consequence of the recent interest rate hikes carried out to moderate high inflation rates.

To break down what is currently happening in the company's operations and assess if this represents a good opportunity to take advantage of short-term pessimism, I will begin by explaining the recent evolution of revenues.

Revenues are recovering after a very weak first quarter

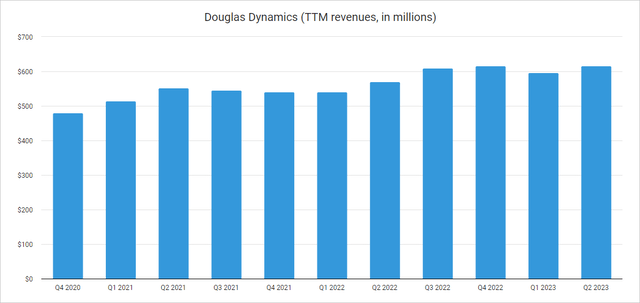

Boosted by acquisitions, the company's revenues increased by 192.24% to $571.7 million from 2013 to 2019, but the disruptions derived from the coronavirus pandemic caused a significant decline of 16.01% in 2020. As the North American economy reopened, revenues increased by 12.77% in 2021 and by a further 13.78% in 2022.

Douglas Dynamics (TTM revenues) (Seeking Alpha)

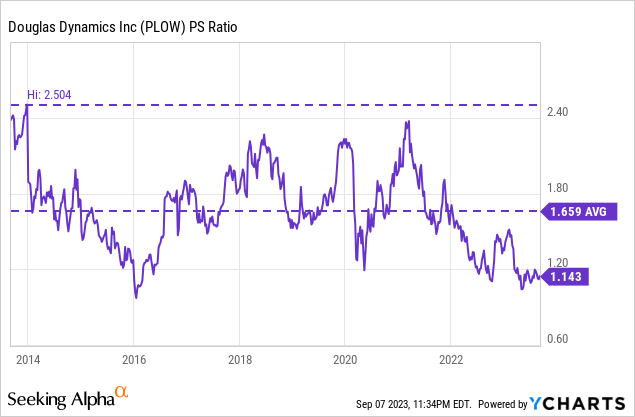

As for 2023, revenues declined by 19.55% year over year during the first quarter due to a very weak snowfall season as the East Coast saw its lowest snowfall season in decades, but revenues increased by 10.51% (also year over year) during the second quarter boosted by increased volumes, product price raises, and supply chain improvements, which raised the trailing twelve months' revenues to $615.7 million (7.70% higher compared to 2019), and the company reported near-record backlog as revenues are expected to increase by 2.66% in 2023 and by a further 6.89% in 2024. But despite record-high revenues and revenue growth expectations, the recent decline in the share price has caused a significant decline in the price-to-sales ratio to 1.143, which means the company currently generates annual revenues of $0.87 for each dollar held in shares by investors.

This ratio is 31.10% lower than the average of the past 10 years and represents a 54.35% decline from decade-highs of 2.504 reached in 2014, which reflects growing pessimism among investors as they are placing significant less value on the company's revenues as the macroeconomic context is currently very uncertain, and growing concerns of a potential recession caused by recent interest rate hikes are keeping investors cautious. Also, recent headwinds have put a pause on the debt decline, which has tested the patience of investors in recent years, and rising interest rates now represents an added risk. Still, the company's profit margins have shown strong signs of improvement during the second quarter of 2023, which means the company may be soon able to continue deleveraging its balance sheet.

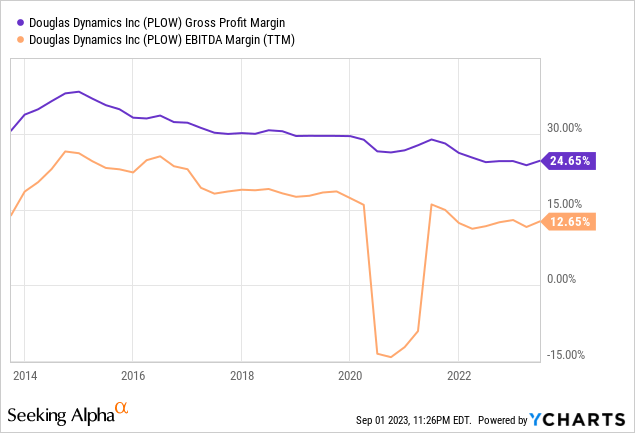

Margins are dramatically improving as pricing actions are taking effect while headwinds are easing

Following the disruptions related to the coronavirus pandemic in 2020 (and the decline in volumes caused by coronavirus-related restrictions), the company has faced a series of headwinds that have negatively impacted its profit margins in 2021, 2022, and 2023, including supply chain issues, inflationary pressures, and labor shortages, and the company failed to recover pre-pandemic margins as supply chain issues and inflationary pressures continue to impact operations as the trailing twelve months' gross profit margin currently stands at 24.65% and the EBITDA margin at 12.65%. Historically, the company reported gross profit margins of around 30% and EBITDA margins of over 15% (which means the company is actually very profitable in normal years despite current weakness). Nevertheless, both gross profit and EBITDA margins showed strong signs of recovery during the second quarter of 2023.

In this regard, the gross profit margin dramatically improved to 29.61% during the second quarter of 2023 (vs. 20.53% during the same quarter of 2022), and the EBITDA margin to 19.26% (vs. 2.32% during the same quarter of 2022) boosted by supply chain improvements, lower inflation rates, increased volumes, and product price raises. Furthermore, the management expects supply chain headwinds to ease even more during the second half of 2023 and in 2024, which means profit margins should reach levels similar to pre-pandemic years in the short-to-medium term. Labor shortages are also easing, and the management expects profit margins to continue improving through the second half of 2023 as the company's operations are marked by strong seasonality.

This improvement in profit margins should allow the company to continue strengthening its balance sheet in the coming quarters, which should unlock significant shareholder value in the long term as the company is currently still highly leveraged, and paying down some debt should free up cash that would instead be spent in covering interest expenses.

The deleveraging process should continue very soon

After the three major acquisitions carried out in 2013-2016, which included TrynEX in 2013, Henderson Products in 2014, and Dejana Truck & Utility Equipment Company in 2016, the company has been slowly reducing its debt levels from the peak of $342 million in 2016 to $280 million, which has resulted in a strengthened balance sheet and reduced long-term risks. Nevertheless, this debt load is still too high for dividend investors as interest expenses are more than half the amount of dividends paid, which means they are limiting dividend growth. Furthermore, cash and equivalents are very low at $3.38 million.

But despite very low cash and equivalents and high long-term debt, the company holds very high inventories of $154 million as it has raised inventories year after year, and expects to keep deleveraging the balance sheet in the coming quarters as it plans to convert part of these inventories into actual cash. In this regard, high inventories greatly reduce medium and long-term risks.

In this regard, the planned deleverage will be critical for improving the company's metrics as rising interest rates are causing a surge in interest expenses as they stood at $3.7 million during the second quarter of 2023, which means the company is expected to pay around $15 million in annual interest expenses (compared to the current trailing twelve months' interest expenses of $13.27 million).

Nevertheless, CFO Sarah Lauber stated, during the earnings call conference of the second quarter of 2023, that the management is monitoring new potential acquisitions, and therefore, an increase in debt as a result of new acquisitions is a risk for which investors must be prepared. In this regard, for the management to continue using debt with relative safety, it must first begin to reduce its inventories in order to convert them into actual cash, which should be achieved through a reduction in manufacturing capacity or a continuation of the recent surge in demand. If this is achieved, the management should report cash from operations strong enough to avoid taking on too much debt to keep expanding the company through acquisitions.

The dividend is safe, but investors shouldn't expect significant growth in the foreseeable future

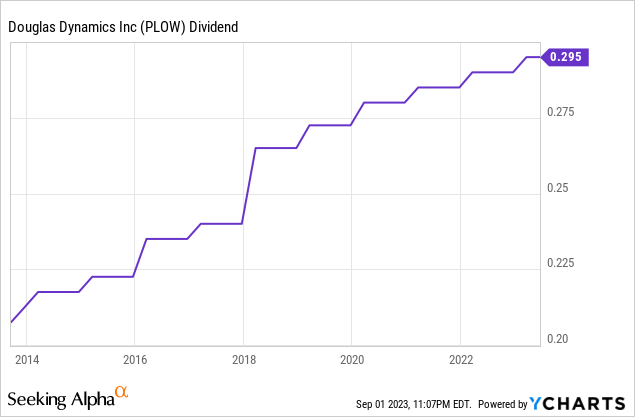

The company has managed to increase its quarterly dividend by 42.5% in the last 10 years from $0.207 to $0.295. The latest dividend increase was announced in February 2023 when it raised the quarterly dividend by 1.7% to the current quarterly payout of $0.295 per share.

This recent raise is a much less rapid increase compared to what investors were used to before the coronavirus pandemic, as can be seen in the chart above, and investors should be prepared for dividend growth rates below inflation rates in the short and medium term as interest expenses are currently limiting dividend growth. In the following table, I have calculated the sustainability of the dividend for the last quarters (using trailing twelve months' data) by calculating what percentage of the cash from operations has been allocated for the payment of dividends and the coverage of interest expenses in order assess the company's capacity to cover both expenses through actual operations.

| Period | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 |

| Cash from operations (TTM by quarter, in millions) | $72.5 | $61.0 | $60.5 | $10.4 | -$10.8 | $5.5 | $40.0 | $9.1 | $32.0 |

| Dividends paid (TTM by quarter, in millions) | $26.3 | $26.4 | $26.5 | $26.5 | $26.8 | $26.9 | $27.0 | $27.2 | $27.3 |

| Interest expense (TTM by quarter, in millions) | $16.9 | $14.0 | $11.8 | $11.0 | $9.1 | $10.2 | $11.3 | $12.0 | $13.3 |

| Cash payout ratio (TTM) | 60% | 66% | 63% | 361% | - | 675% | 96% | 431% | 127% |

As one can see in the table, the cash payout ratio has skyrocketed in recent quarters as cash from operations is currently weak, and interest expenses are increasing at a rapid pace, which is putting some pressure on the dividend. Regarding interest expenses, they are expected to reach $15 million per year using the second quarter of 2023 as a reference, but this will really depend on the evolution of interest rates and the company's ability to reduce current debt levels (which will depend on the company to convert inventories into actual cash).

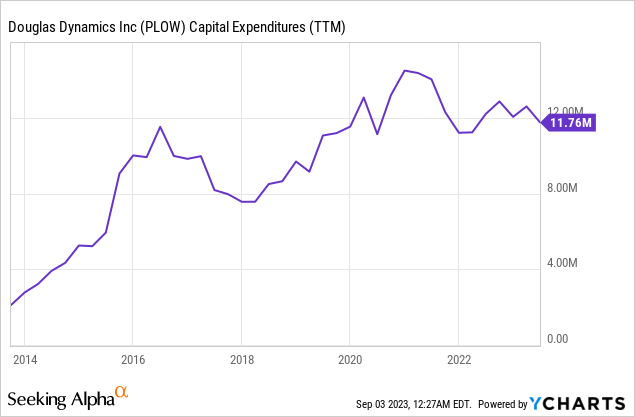

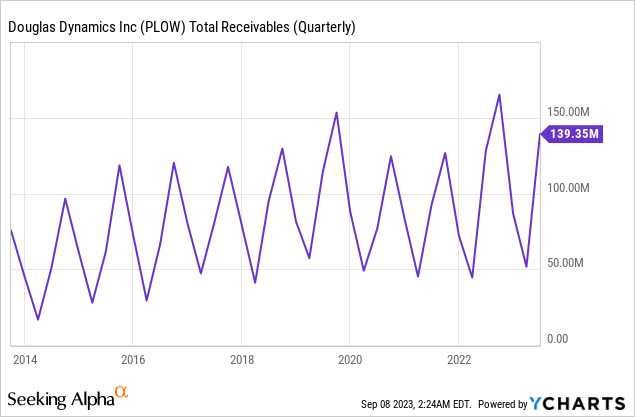

During the second quarter of 2023, the company reported negative cash from operations of -$9.3 million, and while inventories decreased by $31.6 million, accounts receivable increased by $91.2 million (boosted by growing demand) and accounts payable declined by $0.7 million, and the company reported a positive net income of $24 million (vs. $ 17.7 million during the same quarter of 2022). Trailing twelve months' net income also improved during the quarter compared to the same quarter of 2022 when it stood at $29.7 million. Still, we must keep in mind that the company must cover annual capital expenditures of around $12 million, which makes debt reduction necessary in order to relax the cash payout ratio and allow for its coverage.

Nevertheless, capital expenditures for the second quarter of 2023 were $2.5 million, which represents a significant decline from the $3.4 million reported during the same month of 2022 as the management is delaying investments in order to preserve as much cash as possible after a weak first quarter. Luckily, the company currently holds $139 million in total receivables, which explains the negative cash from operations of the second quarter of 2023.

As the company is highly seasonal due to the nature of its products, I will finish by saying that the trailing twelve months' cash from operations improved from $9.1 million during the first quarter of 2023 to $32.0 million during the second quarter, which despite not being enough to cover dividends paid and capital expenditures, should keep improving in the coming quarters as the company has been relentlessly building inventories year after year and now plans to start converting them into actual cash. Furthermore, slightly higher inflation rates compared to dividend growth rates should slowly help in relaxing the company's cash payout ratio, which represents the short and medium-term pain that investors should endure in exchange for a higher dividend yield on cost in the long-term and a healthier balance sheet.

Risks worth mentioning

In the long term, I consider Douglas Dynamics to be a company with a relatively low-risk profile as its products are essential in areas where it snows and its profit margins are high while its high inventories should allow for cash from operations high enough to significantly reduce current debt levels. In addition, it has been operating for 75 years, so it has proven its viability over the years. Despite this, there are certain risks that I would like to highlight, especially in the short and medium term as the macroeconomic landscape is currently very volatile and uncertain.

- Recent interest rate hikes carried out to moderate high inflation rates could trigger a recession, which would have a significant impact on volumes as customers would likely postpone the replacement of the products the company manufactures.

- A new weak winter season could cause another drop in demand for the company's products, which would have a new impact on sales and profit margins.

- If inflation rates rise again, profit margins could again suffer significant contractions.

- The company needs to slowly (and temporarily) reduce its production capacity and maintain a strong demand for its products to convert part of its inventories into actual cash. In this sense, a drop in demand as a result of a potential recession or another weak snow season could create difficulties in carrying out this partial emptying.

- If profit margins suffer another contraction or the company has difficulty converting inventories into current cash due to weak demand, it may need to take on more debt, which could significantly increase risks in the medium and long term. Another potential acquisition would also cause an increase in debt.

- In my opinion, the dividend is likely to keep showing very low growth rates in the short and medium term as taking advantage of inflation rates higher than dividend growth rates would likely result in a more relaxed cash payout ratio, which should ultimately allow for accelerated debt reduction. In exchange, patient investors will get a higher dividend yield on cost.

Conclusion

Although it is true that Douglas Dynamics has suffered many ups and downs since 2020, the balance sheet is stronger than in 2016 thanks to a partial reduction in debt and higher inventories, and revenues have already reached a higher level compared to 2019. In this regard, pricing actions to offset (still high) inflationary pressures should eventually dilute the company's debt position significantly. Not yet, because profit margins continue to be contracted compared to pre-pandemic years, but they improved significantly in the second quarter of 2023 as the company achieved good profitability figures (if we include in the equation the significant increase in accounts receivable compared to not-so-high negative cash from operations and the reduction in inventories) as the company keeps reporting positive (and improving) net income.

In this regard, I consider that the recent 46% decline in the share price and the current 3.84% dividend yield represent a good opportunity for long-term dividend growth investors with enough patience to wait for current headwinds to ease even more and for the company to continue strengthening its balance sheet thanks to low dividend growth rates in the medium term. In the foreseeable future, the company should be able to continue reducing its debt levels as high inventories should eventually allow for higher cash from operations, which should ultimately help in unlocking significant shareholder value and reducing long-term risks while leaving more room for future dividend raises.