monsitj

Investment Thesis

Illinois Tool Works (NYSE:ITW) is well-positioned to deliver revenue growth and margin expansion. The company is seeing good demand for ~75% of its business portfolio which should offset slowdown in the remaining businesses. The company growth should also benefit as inventory destocking at its customers end by mid-2024. Management is executing well focusing on “customer-back” innovations and increasing penetration to drive above-market growth and I expect these initiatives to help the company drive good growth in the long term. The company’s margin should benefit from volume leverage, improving price/cost, and management’s efforts to improve operational efficiency.

The company’s valuation is also reasonable and the stock has a good dividend yield of ~2.34%. Given good growth prospects and a reasonable valuation, I believe the stock is a good buy at the current levels.

Revenue Analysis and Outlook

After seeing a Covid-19-related decline in revenues in FY20, ITW’s revenue quickly recovered and surpassed pre-pandemic levels in FY22. In addition to the market recovery, the company is also benefiting from initiatives to gain market share. In the second quarter of 2023, ITW reported 1.6% Y/Y increase in revenue to ~$4.07 billion. The organic sales growth was 3% Y/Y driven by resilient demand in most of the ITW's industrial end markets, partially offset by inventory reductions at the end customers and channel partners due to stabilizing supply chain conditions. Foreign currency headwinds and divestitures overall negatively impacted the sales by 1.4% YoY.

Looking forward, the company should continue to benefit from good demand in the majority of its portfolio. While some of the company’s interest- rate sensitive and consumer-oriented businesses like international construction, commercial welding, automotive aftermarket, and appliance components are seeing some softening due to broader macroeconomic environment, these businesses represent only ~25% of the company's sales and the demand in the rest ~75% of the portfolio remain strong.

One near-term event some investors are concerned about is the ongoing UAW strike at some plants of General Motors (GM), Ford (F), and Stellantis (STLA). I am not too worried about it though. This strike is much limited in scope compared to 2019 UAW strike at General Motors. The 2019 strike involved ~48,000 GM workers while the total workers involved in 2023 strike is ~13,000 for all three automakers. So, while 2019 strike impacted the company's Q3 2019 revenues by 1 percentage point and Q4 2019 revenues by 50 bps, the impact from the current strike is likely to be lower if we assume similar length of strike. Further, one should also note that the 2019 UAW strike was the longest on the record since 1970s. So, there is a reasonable possibility that 2023 strike may not stretch that long. With the company's organic growth rate around 3% for Q2 2023, I believe it can easily weather the impact of this strike and continue its near-term organic growth.

Further, the company is facing some headwinds from inventory destocking at customers who are now reducing their inventory levels as supply chain disruptions are easing. According to management, this inventory destocking adversely impacted the company's sales by 1 to 1.5 percentage points Y/Y last quarter. Despite this the company was able to grow its organic revenues by 3% Y/Y, indicating that underlying demand for the company's products was up in the 4% to 4.5% Y/Y range. While I expect inventory destocking to continue for the next couple of quarters, once it is over by mid-2024, the company’s organic sales growth can accelerate to 4% plus Y/Y range.

In the long-term, management is targeting 4% to 7% Y/Y organic growth driven by 1% to 2% end market growth, 1% to 2% increase in net market penetration, and a 2% to 3% annual contribution from "customer-back" innovations.

Under customer-back innovations, ITW focuses on identifying the pain points of its end customers and providing them with innovative solutions. This strategy has given good results across its business segments and is also helping the company drive market share gains.

A good example of this is the company’s warewash business which serves Quick Service Restaurant customers. One key problem these customers were facing was difficulty in drying plasticware properly when using traditional dishwashers. To address the customer need, the company introduced dishwashers with its patented drying technology that is guaranteeing perfectly dry plasticware. The rollout of these dishwashers with big QSR customers has delivered over $50 mn in revenue growth for the company with further revenue growth potential as this product continues to gain traction and help ITW increase market penetration.

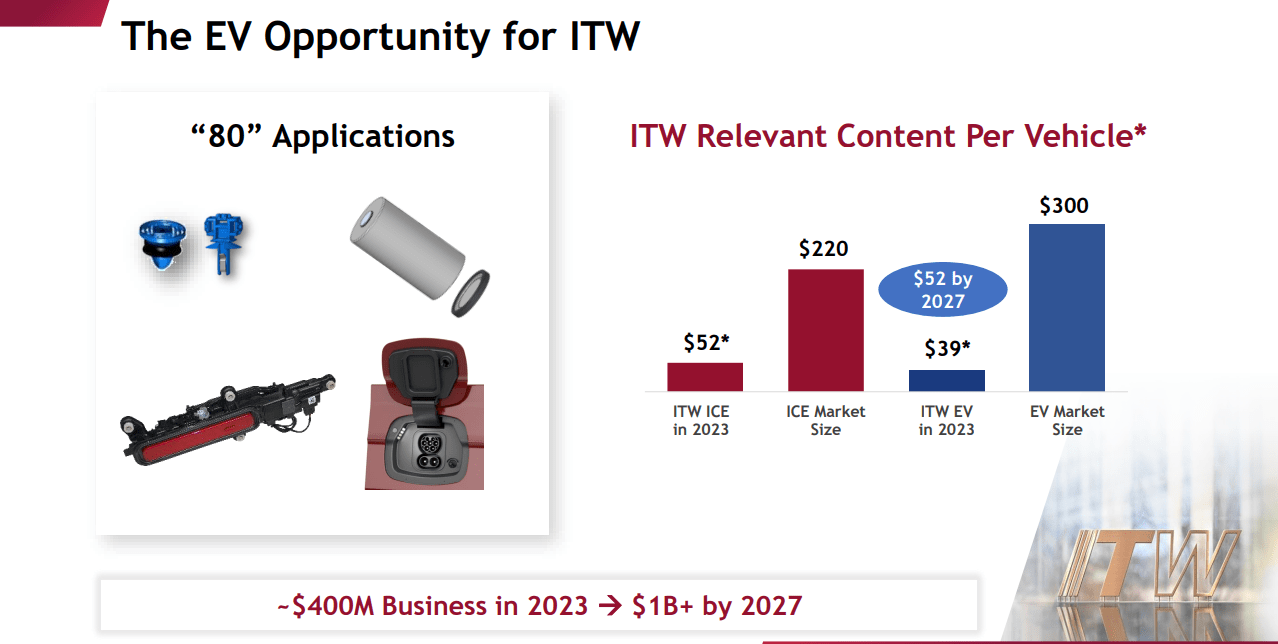

Another example is the company's EV business where the company continues to introduce new product lines. Currently, the company’s EV business has $39 in relevant content per vehicle which management plans to increase to $52 by 2027 through new product line introductions. In the long run, management sees an addressable EV market potential of $300 on a dollar-per-car basis.

ITW's EV Opportunity (Investor Day Presentation)

So, the company has good near as well as long-term organic growth outlook driven by strength in majority of its end-market, inventory destocking headwind easing by mid-2024, product innovation, and increasing market penetration. In addition, the company also has a healthy balance sheet with a net leverage ratio of ~1.8x at the end of 2Q 2023 which should enable it to do small bolt-on acquisitions to drive growth. So, I am optimistic about the company's revenue growth prospects.

Margin Analysis and Outlook

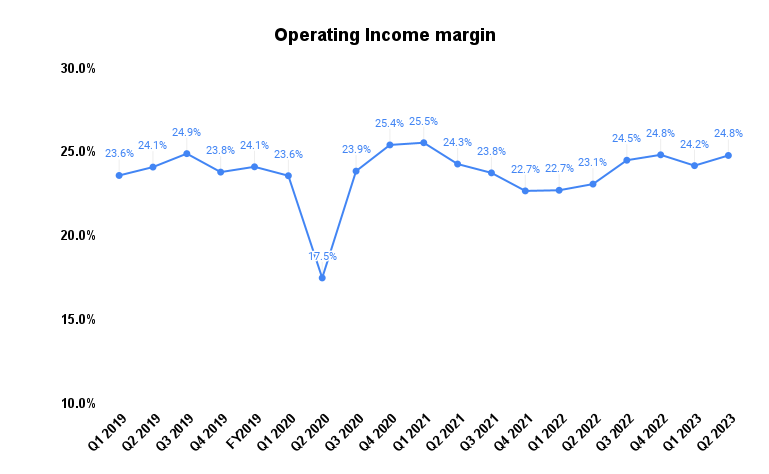

The company saw a sharp decline in operating margin during initial phases of Covid-19 lockdown but it quickly recovered as the volumes came back. Thereafter, the company faced inflationary costs and supply chain headwinds in late FY21 and FY22 which negatively impacted margins. However, the company’s pricing actions, moderating inflation, and easing supply chain constraints have helped it post margin improvement in the last few quarters.

In the second quarter of 2023, the company’s operating margin increased 170 bps YoY to 24.8%. This growth in operating margin can be attributed to the positive price/cost impact and cost-saving initiatives, partially offset by the higher wages and benefits.

ITW’s Historical Operating margin (Company Data, GS Analytics Research)

Looking forward, the company has good margin growth prospects.

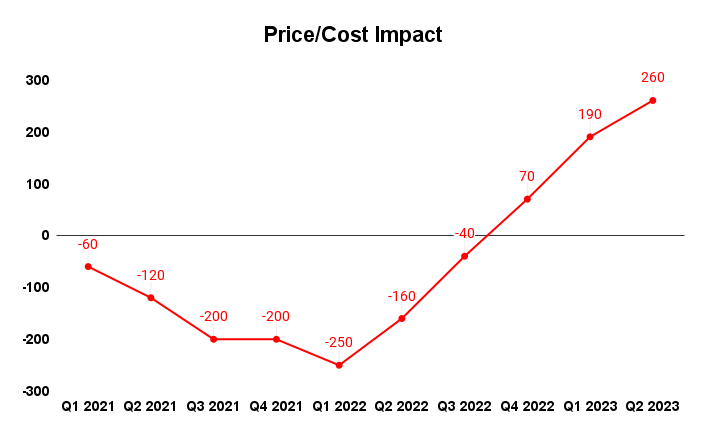

After being negative for the last couple of years, the company's price/ cost has turned positive since 4Q22 and is helping the company's margins. Given easing supply chain constraints and declining cost inflation as some raw material costs are beginning to deflate, I expect the price/ cost should continue to remain positive and help the company's margins.

ITW Price/Cost Impact (Company Data, GS Analytics Research)

Further, the company should also benefit from leverage from sales growth as revenue outlook is positive. In addition, the company is taking enterprise initiatives and an 80/20 approach to improve operational efficiency, increase productivity, and reduce costs. Also, as discussed in the revenue section, the company is also focusing on customer-back innovations. These products help ITW charge higher price to its customers and carry better margins. Management has given a long-term operating margin target of 30% by 2030, which indicates a significant improvement from the current levels.

Valuation and Conclusion

The company is currently trading at 22.86x FY24 consensus EPS estimate of $10.43 which is a discount compared to its 5-year historical average forward P/E of 24.47x. The company has a good forward dividend yield of 2.35% and a good track record of increasing dividends regularly.

Management has been executing well and the company is expected to continue posting good growth in near as well as long term thanks to management initiatives and good demand in most of its end markets. ITW also has a good margin expansion potential as price/cost continues to be positive and the company benefits from management’s efforts to improve efficiency and reduce cost. I believe the company is a good buy given reasonable valuations, attractive dividend yield, and good growth prospects.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.