SweetBunFactory

Dear readers/followers,

The semi-space is a risky place to invest and be in. The companies here often trade at expansive multiples and carry significant risk potential. Also, their yield is typically zero or very close to zero - only very few have significant dividend yield to reward shareholders. Most of the upside is likely to come from capital appreciation.

This is the case for Nordic Semiconductor (OTCPK:NDCVF) as well. The company has quality - we'll look at this during this initial article. I can also understand and quite clearly see why many investors are in fact positive on the prospects of the business. However, at the same time, we cannot underestimate the risk.

Nordic Semiconductor has traded below "par" for a long time - over 2 years at this point, and when it was undervalued, it was so for a very short period of time. The picture this company gives us is one of either being overvalued or very undervalued, rarely sticking to any kind of "fair value" I can sign off on.

This makes for a problematic thesis - but let's see what we can do here because we're talking about a Norwegian business with excellent fundamentals.

How good?

Nordic Semiconductor - The Fundamentals and A to Z

Nordic Semiconductor is a very interesting business. I say this because if you look at the company's fundamentals, which is where I always begin, we find sector-beating KPIs.

I'm talking better cash/debt than the average, I'm talking less than 0.06x debt to equity (source: GuruFocus), and I'm talking an interest coverage of 339x. I', talking about a substantial ROIC over its cost of capital, going to over 54% gross margins and double-digit net margins for a company in the semiconductor sector. This is nothing to sneeze at.

Nordic Semiconductor simplifies and is a market-leading player in ultra-low-power wireless communication solutions. What does this mean?

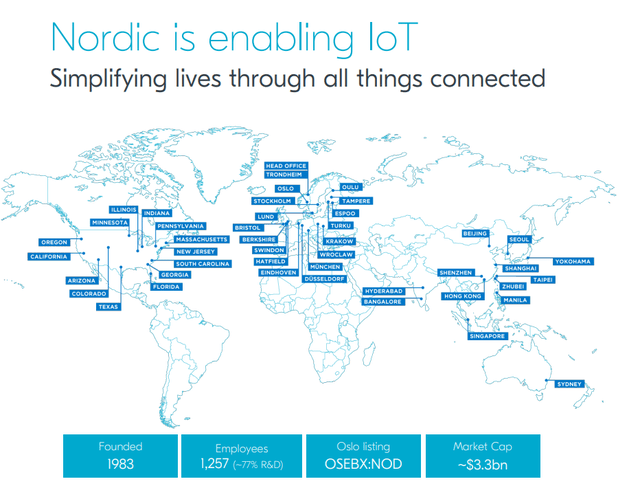

It means that this company, founded all the way back in 1983 with 1,257 employees with a native Oslo market cap of $3.3B, is a market leader in Integrated circuits, Embedded software, and cloud development tools for its sectors, focusing on short to long-range technologies.

Nordic Semiconductor IR (Nordic Semiconductor IR)

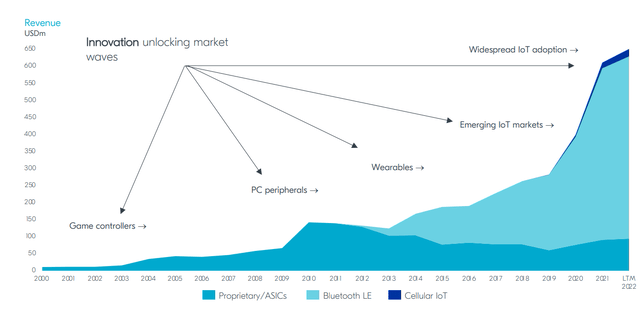

The company has a very strong and storied growth history, starting with things like game controllers, going into peripherals, wearables, and finally the IOT markets.

Nordic Semiconductor IR (Nordic Semiconductor IR)

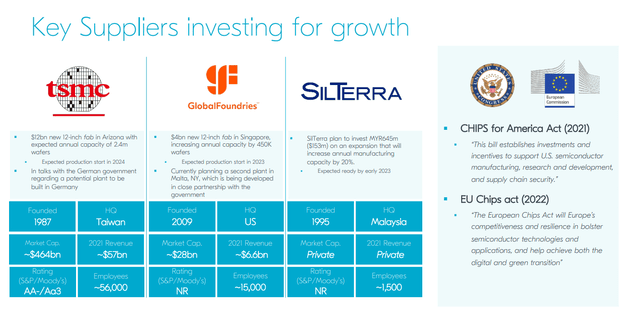

But basically, the company researches, develops, and sees to the manufacturing of Low-power ICs with embedded software and development tools for short, medium, and Long-range IOT solutions. The following companies are key suppliers for growth here.

Nordic Semiconductor ASA IR (Nordic Semiconductor ASA IR)

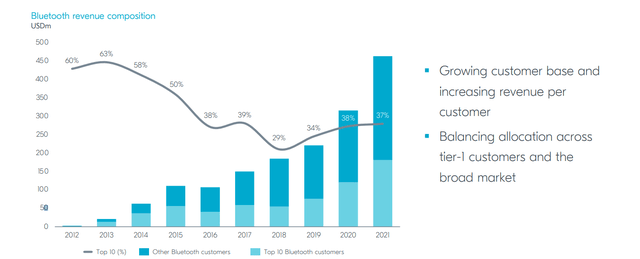

The end-user markets for these products are significantly diverse. We're talking wearables, mobile/PC, Smart home, VR/AR, Consumer Asset tracking, Audio, Toys, CE Remotes, Drug Delivery, Hearing aids, Monitoring, every industrial sector and sub-sector, and traditional sectors like Catalog sales. The company's sales are increasing in appeal in terms of the mix, with a growing customer base on a per-customer revenue, and balancing allocations overall.

Nordic Semiconductor IR (Nordic Semiconductor IR)

The company is expanding into cloud-based services, viewing this as the next long-term revenue addition for the company. This includes things like location services, predictive GPS, Over-the-air updates for firmware, and other value-add services for the company.

The company, based on its coverage here in SA, might look like a very small one. It also doesn't have a dividend - but it's still a very solid business with a very well-working business model.

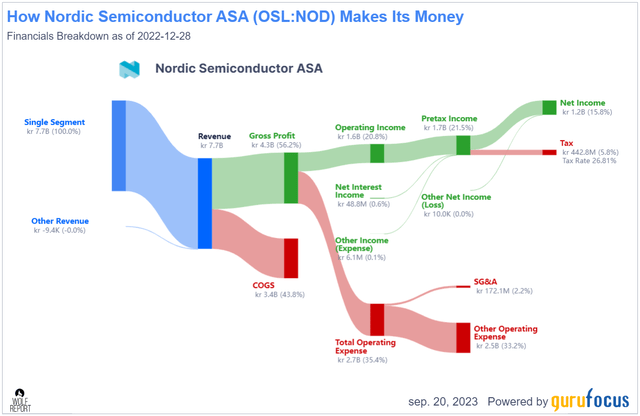

Nordic Semiconductor (GuruFocus)

In addition, the company has a very strong balance sheet, and looking at the latest results, the trends are certainly moving in the right or positive overall direction. The company is seeing declining revenues - but this is part of the same trend that's been true for the market segment for over a year at this point.

2Q23 is the latest report we have, reporting a revenue decline of around 23% on a YoY basis, but slightly recovering on a sequential basis. The company's 50%+ gross margins and solid EBITDA margins of over 15%+ are intact, with current numbers, with forward guidance that continues to be above 50% for the future as well, and a 3Q23 revenue level of around $165 on the high-end. However, the company confirms very low visibility here. There are clear growth opportunities, but it's a very volatile overall market.

Still, despite volatility, company products are being included more and more across the board in a variety of products and technologies.

Nordic Semiconductor ASA IR (Nordic Semiconductor ASA IR)

The company also launched its new nPM1300, which is an ultra-high-efficiency PMIC, that has seen multiple wins for its design and product introductions towards the end of 2023. For a semi-company, Nordic Semiconductor actually has a very low CapEx intensity. At less than 3.5% of revenue as of this quarter, the company is below several competitors, without seeming to sacrifice much in the area of innovation. The company also has a strong cash position - the low debt is something we touched on.

Nordic Semi is very optimized in terms of NWC, managing an LTM NWC/Revenue of 29% With estimates in line for a similar 3Q23 to the 2Q23 period, I don't see many negatives here. Not fundamentally speaking, at least. You can certainly call Nordic semi "volatile", you can call it overvalued if you're so inclined given the massive growth that the company has been doing since early 2003 when it traded for below its current normalized P/E premium for more than 15 years. But that's no longer where we are.

We're instead in a situation where Nordic Semi is on the decline due to a negative outlook for 2023, following a ridiculously strong 2022 and 2021, which saw EPS growth of 79% and 91% respectively. Going into 2023, that EPS growth is expected to go back down almost to 2020 levels, below 2 NOK per share.

However, beyond that is where we see real upside. And because Nordic Semiconductor is actually what I would consider a market leader with a 20-year history of managing a 19% EPS growth on an annualized basis, I can at the very least bring a thesis to bear when it comes to this company.

So, let's look at what the valuation for that thesis would look like, based on financial performance with a history of margin growth and revenue expansion such as this, which should go some way to explain the company's current valuation.

Nordic Semiconductor IR (Nordic Semiconductor IR)

The company can also shine when it comes to its CapEx intensity. While the amount of CapEx has actually increased, the percentage of revenue has declined due to sheer revenue expansion for the company. From a 7% CapEx in 2019, we're now down to below 4% in less than 4 years due to the company's fabless business, and we expect these targets to remain in line for 2023 as well. The company continues to invest in test capacity above all, to be able to finalize end products much more quickly when the business receives wafers.

Let's look at valuation.

Nordic Semiconductor - An Earnings upside

Valuation for the company is positive - meaning here that we've seen a significant valuation decline in a very short period of time. The company is down from levels of 150 NOK to less than 110 in less than 6 months. I would argue that there aren't many reasons for this, beyond the lack of clarity the company is able to offer investors for the near term. It's not strange to me that the company expects a 70% EPS drop in 2023E - I would gauge this as likely.

But beyond that, when demand normalizes, we're likely to see substantial upside.

The company has no credit rating and no yield. It's volatility and absolute lack of forecast accuracy means that we have to be conservative here. Don't invest in this company and expect stable development. But the upside is, that when this company goes up, it goes up.

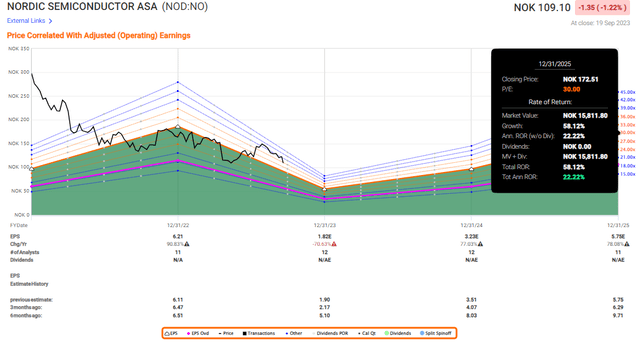

This is the normalized potential RoR to a conservative 30x P/E, which is justified based on this growth rate if it materializes.

Nordic Semiconductor Upside (F.A.S.T Graphs)

S&P Global gives the company an interesting target range, based on 12 analysts, of 100 on the low side to 180 NOK on the high side. This means a high average PT of 140 NOK, but only 4 analysts out of those 12 are actually at "BUY" here. Nordic suffers from the same conviction problems in its analysts as other companies do.

The biggest risk to this investment is near-term volatility. And that volatility, without a doubt, is potentially serious.

But let's say that you have a potential long-term timeframe. If that's the case, then I would say the risk of near-term volatility is less relevant for you. And I do invest in turnarounds like these on a frequent basis - just look at my work in Rolls-Royce (OTCPK:RYCEF) and what that turned out to be.

The important finger of caution I want to lift here is that this company may, and in fact, even be likely to underperform for the next 12 months. But once these earnings growth estimates start materializing, the share price should theoretically react in kind and start going up again.

If this company ever goes to a double-digit native share price, I will take a very serious look at what it offers, because the upside at that point moves closer to triple digits.

For now, it's a "BUY" - a riskier one, but a "BUY" nonetheless.

Here is my thesis for the company as it stands today.

Thesis

- To say that Nordic Semiconductor is a potentially undervalued business would, as I see it, be a very accurate statement. While the company may be in an earnings slump for 2023, the earnings reverse during the periods of 2024 and 2025E are likely to bring about significant growth, compared to the years of 2021 and 2022.

- What's more, I don't believe that these developments are likely to stop or go back down, but back on increased digitization and development on the digital side of things, are likely to expand and grow.

- Based on this, I consider this company as having a potential upside even to a very conservative growth estimate. While 60-70x P/E where the company has been before is sort of a "dream scenario", the company as upside starting as low as 20x P/E. This upside expands - and if we consider the EPS growth of 31.7% annually likely, this would imply a 30x P/E normalized based non 70%+ EPS growth in both 2024 and 2025, which then is at an upside of 22% per year, and a PT of 172 NOK.

- To be conservative, I give the company a 130 NOK PT, and a "BUY" rating though with a speculative note.

Remember, I'm all about:

1. Buying undervalued - even if that undervaluation is slight, and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn't go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every single one of my criteria, making it relatively clear why I view it as a "BUY" here.

Thank you for reading.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.