LaylaBird

The Company

Park-Ohio Holdings Corp. (NASDAQ:PKOH) is a $313-million market cap company that provides supply chain management outsourcing services, capital equipment, and manufactured components globally. It operates through 3 segments, according to the latest 10-Q filing:

- Supply Technologies [46% of Q3 FY2023 sales] - offers a Total Supply Management solution, including various support services and spare parts;

- Assembly Components [25.9%] - provides fuel-related components and flexible assemblies, along with value-added services;

- Engineered Products [28.1%] - offers induction heating and melting systems, pipe threading systems, and forged products for various industries.

In Q3 Park-Ohio's Supply Technologies segment demonstrated robust performance, with net sales reaching $192.8 million, marking a 4% YoY increase. This growth was primarily fueled by heightened customer demand across key end markets, notably in heavy-duty trucks and buses, military and civilian aerospace, power sports, and industrial and agricultural equipment sectors. The segment's fastener manufacturing business also thrived due to elevated customer interest in proprietary products. Notably, the Supply Technologies segment reported a substantial boost in EBIT, reaching $15.6 million, signifying a remarkable 45% increase compared to Q3 FY2022. This surge was attributed to higher sales levels, customer price increases, and strategic profit-enhancement actions implemented within the segment.

The Assembly Components segment showed ~$108.4 million in net sales, showcasing a notable 7% YoY increase. EBIT also experienced a remarkable upswing, reaching $11.2 million this year compared to $2.6 million in the same quarter the previous year. The segment's operating margins surged to 10.3%, marking an impressive 770 basis points increase year-over-year, driven by profit flow-through from heightened sales levels and the successful implementation of profit-improvement initiatives over the preceding 2 years.

The Engineered Products segment's net sales were $117.6 million in Q3, representing a robust 21% YoY increase, propelled by substantial demand in both the capital equipment business and the forged and machined products business. The capital equipment business witnessed a 21% year-over-year sales increase, with a backlog reaching $172 million at the end of September 2023. In the forged and machined products business, sales surged by 22%, driven by heightened customer demand in key end markets such as rail, aerospace, and defense. Despite a marginal increase in segment operating income to $7.1 million (vs. $5.8 million Q3 FY2022), the capital equipment business demonstrated significant profitability improvement, offsetting lower profitability in the forged and machined products business.

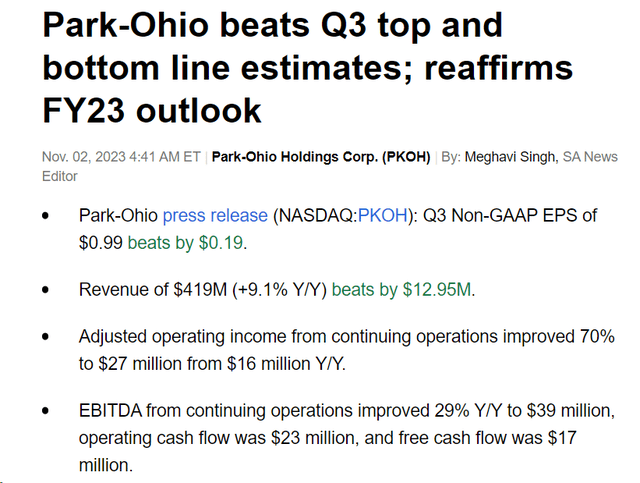

So on a consolidated basis, Park-Ohio's net sales reached $419 million, reflecting a substantial 9% year-over-year increase driven by strong organic growth across all business segments. The company's gross margin from continuing operations improved by 300 basis points to 16.7%, underscoring enhanced profitability. Operating income and EBITDA from continuing operations experienced significant growth, reaching $27 million and $39 million, respectively. Notably, GAAP EPS from continuing operations surged by 71% to $0.99 per diluted share, and adjusted EPS showed a solid 16% increase. The firm beat Mr. Market's expectations in terms of both EPS and sales by a wide margin:

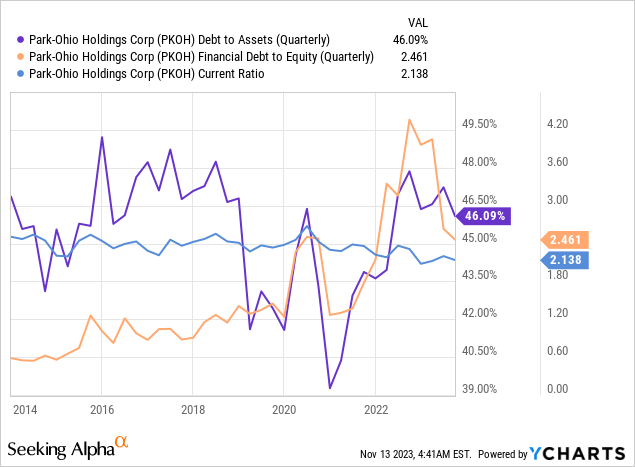

With strong operating cash flow at $23 million and FCF at $17 million, Park-Ohio reported an enhanced liquidity position in Q3 with total liquidity of $174.9 million, comprising $51.2 million in cash on hand and $123.7 million in unused borrowing availability under credit arrangements. The ratio of total debt to total assets is now around 46%, while the still high leverage ratio of ~2.5 continues to fall. The current ratio is ~2.14, indicating that there is no serious liquidity risk in the company.

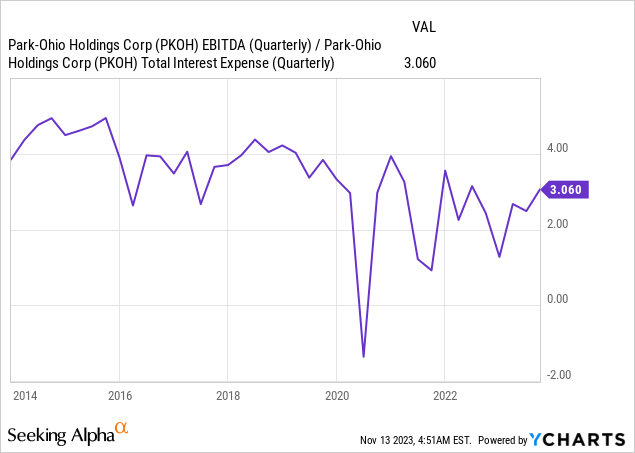

Although I am somewhat concerned about the company's high level of debt, I am reassured by the growing EBITDA coverage of interest expenses.

In my opinion, the company is showing obvious signs of a turnaround in its operating business and the high level of debt does not appear to be too much of a problem.

The Valuation

Park-Ohio's management anticipates a positive outlook for FY2023, expecting a 10-15% year-over-year increase in revenues from continuing operations. The company also foresees higher year-over-year adjusted operating income, EBITDA, FCF, and adjusted EPS. However, it acknowledges a potential negative impact on Q4 revenues due to the UAW strike affecting several OEM customer plants. While tentative agreements have been reached, the full impact on fourth-quarter revenues remains uncertain as production ramps back up to normal levels. The monthly revenue levels from the impacted OEM plants are estimated to total ~$25-30 million across the Assembly Components and Supply Technologies segments. Despite these challenges, Park-Ohio aims for positive operating cash flows driven by improved profitability and reduced net working capital days, with an expectation of a positive FCF of ~$20-25 million for FY2023.

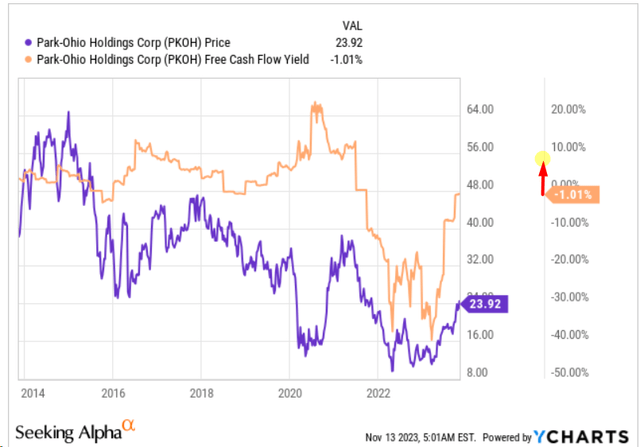

According to YCharts data, PKOH's market cap amounts to ~$313 million as of November 10, 2023. So the mid-range of PKOH's FCF guidance for FY2023 [$22.5 million] places FCF yield at ~7.2%, which is above the middle of the usual PKOH's pre-COVID range, indicating an undervaluation:

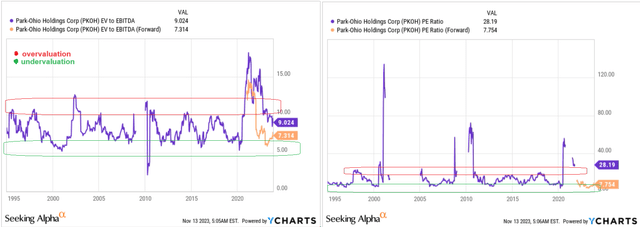

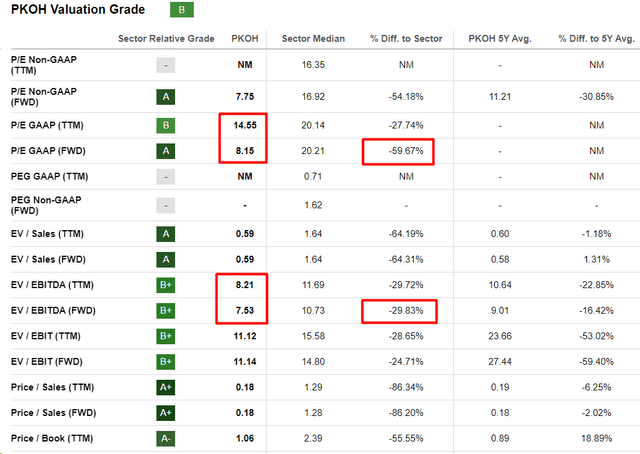

If we focus on the usual P/E and EV/EBITDA ratios, then even after the YTD growth of 86%, the stock is still in the "undervaluation zone" in terms of forward ratios [which are quite low, by the way, in absolute terms]:

The sharp decline in multiples that we see for the next-year ratios makes PKOH shares undervalued by around 30-60% if we compare the key metrics with the median values of the entire Industrials sector.

Seeking Alpha, PKOH's Valuation, author's notes

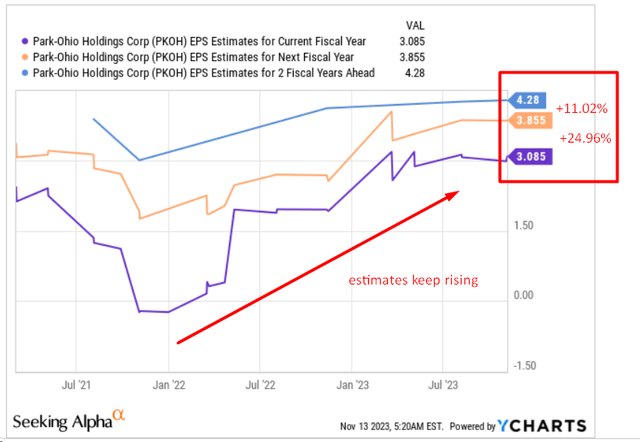

At the same time, it cannot be said that the growth of the PKOH business will end next year (which would logically explain the low multiples). As we can see from the YCharts data, Mr. Market sees a continuation of PKOH's EPS growth in 2 years:

If we assume that Park Ohio actually generates earnings per share of $3.86 in FY2024 [the company has beaten forecasts 50% of the time over the last 8 years, so let's assume the analysts are right this time], then the stock should theoretically adjust its multiples upward if growth continues in FY2025. I think a P/E of 10x would be fair based on history and industry norms. Then PKOH should trade at $38.6 per share by the end of FY2024 - that's 61.4% more than what I'm seeing on my screen right now.

The Bottom Line

Of course, investing in Park-Ohio Holdings Corp. carries multiple risks potential investors should be aware of. First off, the company's fortunes are closely tied to the cyclical nature of the industrial sector, making it susceptible to economic downturns and fluctuations in manufacturing activities. PKOH faces the risk of supply chain disruptions stemming from geopolitical events, natural disasters, or ongoing challenges related to the COVID-19 pandemic. Labor relations, customer concentration, and the potential impact of a high debt load further underscore the risk profile. Additionally, competition, acquisition integration challenges, foreign exchange fluctuations, regulatory changes, and the need for technological adaptation contribute to the overall risk landscape.

But despite these risks, I think small-cap investors should keep a close eye on PKOH. After all, the company is showing excellent recovery momentum, plans to reach solid FCF generation and the firm's EPS is set to keep on rising. All of this makes PKOH cheap today against the backdrop of sharply declining implied EV/EBITDA and P/E forward ratios. My calculations led me to the conclusion that there is an undervaluation of 61.4% in the medium term. I therefore rate the PKOH share as a 'Buy' this time.

Thank you for reading!

Hold On! Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!