jan van der Wolf/iStock Editorial via Getty Images

Investment thesis

Our current investment thesis is:

- Farfetch is a mess, with only further issues ahead. The company needs cash imminently, particularly as we have limited visibility of Q3. If this is worse than expected, which could certainly be the case, the business may already be within 18 months of running out of money. Debt markets are no longer an option and with a depressed market cap, neither is public markets. Farfetch’s CEO is potentially brokering a deal as I type this but we struggle to see any value for shareholders from this. Even at its current valuation, further downside is possible due to bankruptcy risk.

- Beyond this, upon the assumption investors can still own this stock publicly in the years to come, we do not think there is anything attractive about Farfetch. Its route to profitability is marred with significant stumbling blocks, while its efforts to cut costs will only contribute to benefiting its competitors.

- At a time when luxury stocks are persistently declining, we implore any investors interested in this stock to consider brands instead (many of which we have covered).

Company description

Farfetch (FTCH) is a global technology platform that connects consumers with a curated selection of luxury fashion items from boutiques and brands around the world. Through its e-commerce platform, Farfetch offers a unique shopping experience, allowing users to access a vast array of high-end fashion products.

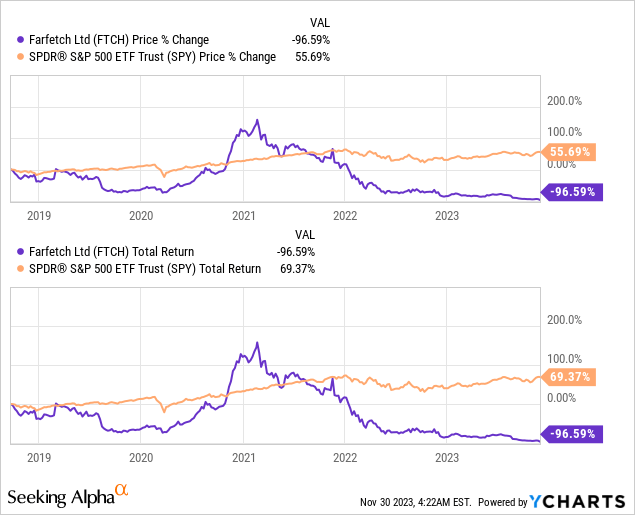

Share price

Farfetch’s share price performance has been dismal, it has lost over 90% of its value and appears to be in dire straits. The company has struggled with improving its financial performance and is now facing material risks to its existence.

Financial analysis

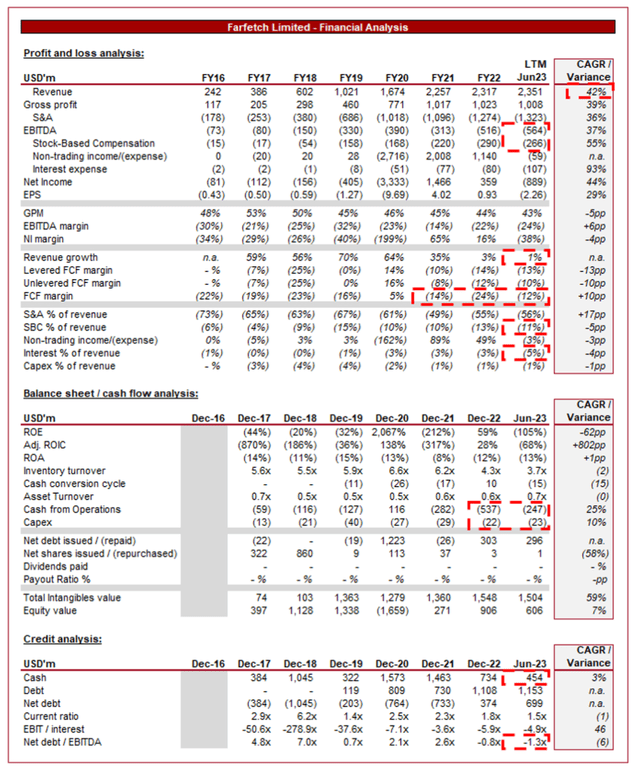

Farfetch financials (Capital IQ)

Presented above are Farfetch's financial results.

Revenue & Commercial Factors

Farfetch’s revenue has grown impressive, primarily due to its significant investment in customer acquisition. The company exploited the e-commerce boom to gain market share through its unrivaled breadth of brands. The company has a unique approach relative to local retailers, as it sources products globally from 1000s of businesses, allowing consumers globally to get the best deals while offering hassle-free returns.

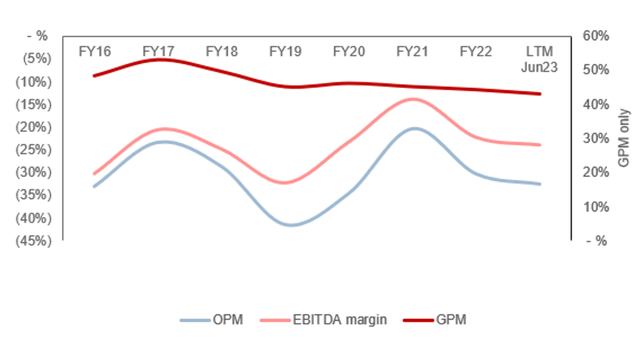

Margins

The issue with Farfetch’s model is that it is incredibly expensive to deliver. The company has been loss-making throughout its history and has made little progress toward profitability.

Consumers have no reason to be loyal to a retailer like they are to a brand, forcing Farfetch to maintain its lucrative service to customers and limiting a reduction in marketing spend. As the above illustrates, the business has seen limited gains from scale. This begs the question of where margin appreciation can come from.

For this reason, we consider its model broken. The company has an unrivaled position in the market, but it is for the very reason it has achieved this that it cannot now transition to profitability. As Farfetch cuts its marketing spend and reduces discounts, consumers will turn to other retailers who are now more price competitive, contributing to a downward spiral.

Balance sheet & Cash Flows

Farfetch’s balance sheet has quietly worsened throughout the last decade, as cash from debt and equity has been periodically raised in order to fund its losses. With interest comprising 5% of revenue, Farfetch is likely maxed out on debt.

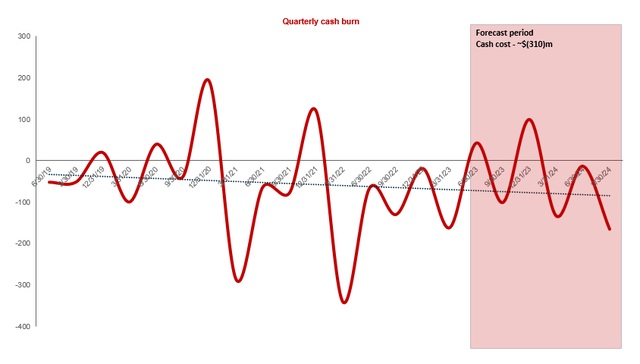

At its run-rate FCF level, we estimate Farfetch is burning ~$300m annually, which implies it will be through its $454m of cash by the end of 2024. We have conducted an analysis of its quarterly cash burn, overlaying our forecast growth assumptions (HSD growth to early 2024, followed by LDD growth). This illustrates the importance of delivering imminent cost savings.

Quarterly cash burn (Capital IQ / Author calcs)

This is the reason for the dire financial situation. Farfetch needs to raise cash imminently to shore up its balance sheet, which we estimate to be ~$500m, as this would provide a near-term buffer and sufficient cash to get through a 24-month period (at which point rates will likely have declined and the business can reassess). At a market cap of ~$800m and EBITDA negative, however, it will be extremely difficult to find a willing financier.

Quarterly results (Q2)

Farfetch’s recent performance has been disappointing, with top-line revenue growth of +1.9%, (5.5)%, +8.1%, and (1.3)% in its last four quarters. In conjunction with this, margins have continued to slide.

As discussed, this is primarily due to the wider macroeconomic environment, although potentially a reflection of its softening retail presence as marketing efforts are cut.

Key takeaways from its most recent quarter (caveating that almost every forward-looking item may no longer be applicable following Management’s announcement):

- GMV continued to grow despite the slowdown in revenue, up +7%. A significant portion of this is likely pricing-driven in conjunction with a lower comparable base.

- Farfetch signed over 30 new e-concession brand partners in H1, further boosting its competitive position.

- Significant reduction in headcount (~800) across cost centers, with Management targeting further reductions of ~150m vs. plan.

- Cartier.com and Net-a-porter.com launches are expected 2024, with Cartier in particular having significant potential given the interest surrounding the brand.

- Restructure of the NGG segment (owned brands) with a focus on scale and profitability. There have been talks of LVMH potentially acquiring the Off-White license.

- Management has stated that it expects to deliver Adj. EBITDA profitability and positive free cash flow in 2023.

Recent developments

Pandemic

Farfetch has experienced a rollercoaster ride in the last few years. Following the onset of the pandemic, the company experienced impressive growth, with consumers locked indoors with stimulus checks in hand. Management’s strategy during this period was aggressive customer acquisition, with very generous discounts and marketing spending in order to win customers.

Growth slowdown

We covered Farfetch initially at the back end of this period (2022), rating the stock a sell. Although the company was performing well in generate sales, we did not see sufficient overarching financial progression and also felt macroeconomic headwinds would snowball and negatively impact sales.

Since then, Farfetch has experienced a material slowdown in revenue growth. Despite boasting a +42% CAGR into LTM Jun23, it only grew by +3% in FY22 and is currently up +1% in the LTM period. With inflationary pressures and elevated interest rates, consumers are increasingly financially focused on living expenses, reducing discretionary spending.

Compounding this is a slower recovery in China. Many, including ourselves, are hesitant about the demand for luxury from the Chinese in the coming years, as a number of issues within the country are negatively impacting the wealthy cohort.

Looking ahead, these negative headwinds do not appear to be subsiding. Although inflation has fallen, debt markets remain difficult to access and consumers are increasingly struggling. We suspect expansionary policy returns in mid-to-late 2024, but likely as a means of stopping an economic decline. With Farfetch needing to cut costs, the company is positioned to be overly exposed to this, with a decline in revenue appearing inevitable.

Richemont x YOOX Net-A-Porter

Farfetch’s relationship with Richemont (OTCPK:CFRHF) has been sold as incredibly important to its success. Richemont’s attempt at developing an online presence has been dismal, partially because it lacks the expertise necessary to understand the customer base that frequents e-commerce. Farfetch is better at selling Richemont’s brands online, likely even Kering’s (OTCPK:PPRUF) brands, than Richemont/Kering are. YOOX Net-A-Porter failure is evidence of this.

Following years of failure, Richemont struck a deal to sell a significant share of YOOX to Farfetch, including providing the business with significant financing. This deal was cleared by the European Commission in Oct23.

Given the consideration is Class A shares, and comes with much-needed financing, we believe Farfetch got the better end of the deal (particularly as it ties Richemont to Farfetch).

The disastrous last few days

On 28th November, Farfetch’s share price jumped on the news the stock may be taken private. Following the issues we highlighted above, and will discuss in detail below, the business has fallen out-of-favor with the markets. Neves, the CEO and Founder, controls Farfetch through a dual-class structure (15% ownership and 77% control), allowing him the necessary control to push through such a deal. In order to do so, he will require significant backing due to the loss-making nature of the company, which is why the rumors included Richemont as a marquee investor.

We believe this was a deal that was dead on arrival. The reason is simple, no brand owned by a rival of Richemont will want Richemont benefiting from it, or allowing Richemont control over how it is retailed. This is likely a major factor as to why Kering has not acquired the business. For this to be on the table, Richemont has to be a minority.

Aside from this, Richemont experienced a fairly underwhelming decade, see our paper for further details, primarily due to declining margins. To take a material stake in Farfetch would be counterintuitive to the improvements it has made in recent years.

Unsurprisingly, Richemont came out on the 29th of November to deny this by stating “Richemont would like to remind its shareholders that it has no financial obligations towards Farfetch and notes that it does not envisage lending or investing into Farfetch”. This appears to make clear that Richemont is done with Farfetch, likely due to the recent change in market conditions, acknowledging that pain is ahead and conservatism must return.

Further compounding this is the following: “Richemont added that it's "carefully" monitoring the situation, including reviewing its options in respect to arrangements with Farfetch in respect to YOOX Net-A-Porter.”. Richemont is likely considering the financial cost of reneging on the deal compared to deepening its relationships with Farfetch.

Where are we now?

This brings us to now. Farfetch has stated it “will not announce its third quarter 2023 financial results and will not hold its related conference call previously scheduled for Wednesday, November 29, 2023. The company expects to provide a market update in due course. The Company will not be providing any forecasts or guidance at this time, and any prior forecasts or guidance should no longer be relied upon.”

This is a strongly worded announcement and has naturally contributed to a sharp share price reaction, likely in part to the second half of the statement.

Farfetch is in a materially difficult financial situation and Management has likely realized external financing is not an option without crippling the business (and that's assuming someone will actually finance the company with debt). We estimate the company needs ~$500m, which may no longer be coming from Richemont. The only option is an equity exit or bankruptcy (the market cap is far too low for a market raise). With its share price continuing to decline, the former is looking increasingly possible, although will mean material losses for the majority of shareholders. Any equity financiers will likely have to accept funding the business for at least 1-3 years and realistically more if FCF cannot be sufficiently lifted. For this reason, they are unlikely to give existing shareholders much of a premium.

We struggle to see any upside with Farfetch. This is an example of a low-interest rate environment company. It has lost money for years while access has been cheap. Now that cash is expensive, the fun is over. We suggest non-speculators to give Farfetch a wide berth.

We will now briefly summarize the financial and commercial performance of Farfetch, highlighting how it has found itself in the position it is in. We suggest our prior paper for a more detailed view of the company.

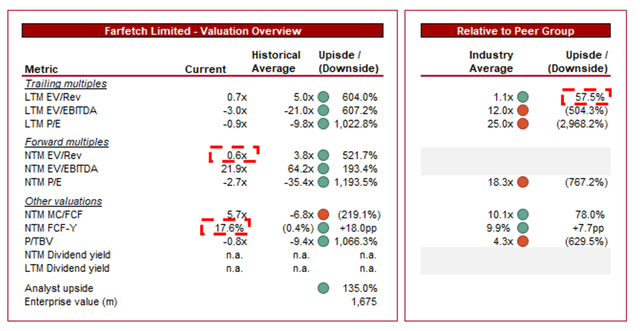

Valuation

Farfetch is currently trading at 0.7x LTM Revenue and 0.6x NTM Revenue. This is a discount to its historical average.

Farfetch’s valuation does reflect its dire position, to a degree, with investors valuing the business at less than 1x its revenue generation. The issue is that we are not looking at a standard valuation here. With material bankruptcy risk and limited downside protection, the business has significant room to fall further before it is rescued.

Further, we continue to reiterate that private funders would be crazy to pay any form of premium for this business given the situation it is in and the long-term cost and risk associated with ownership.

Finally, as Management has stated, its forecast guidance should now be considered unreliable and so we suggest caution to any tempted by the NTM FCF yield.

Risks

The current risks to our bearish thesis are:

- Takeover: A Brand consolidator with aspiration of entering the retail segment could see Farfetch as a brand worth investing in, particularly at the current share price (not pricing in anything beyond its brand). Such targets could include Kering.

- Private deal at a premium: Mr. Neves may sufficient backing to take the business private at a premium to the current share price, even if his super majority is sufficient to close a deal at the existing level.

- Financing secured: Should the Richemont financing remaining in place, Farfetch is not too far from at least enough capital to survive the coming 2 years. This may be enough time to turn EBITDA positive, contributing to an upswing in investor sentiment.

Final thoughts

Farfetch is a mess and we identified this over a year ago. Business models that lack a clear route to profitability, only relying on unsubstantiated scale benefits and customer loyalty are bound to fail.

The business has a lot to show for the cash it has spent in the last decade but equally has not developed a dominant position (with a wide moat). As Farfetch unwinds spending and reduces its size, consumers will go elsewhere, building up its global competition.

So long as the business maintains its relationship with Richemont and Kering’s brands, the company does value in the market. This said, we struggle to reconcile what this can be so long as it is persistently loss-making.

With the business in desperate need of cash, and its CEO rumored to be making movements in the background, we suggest non-speculators steer clear of this company.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.