If Getty Images must get royalties, at least let it go to whoever took this stunning photo. Charlie Parker

Last time, I wrote about the move in interest rates, hedging, and the bear attack on Blackstone Mortgage Trust, Inc. (BXMT).

The page view data is in, and the crowd displayed their interest level:

I won't make that mistake again. At least not for a few days. Thank you for the clear feedback.

Today, we're going to talk about shares with big dividend yields and upside to call value.

Why big dividends? Because one thing I've learned about Seeking Alpha is that most readers just love collecting a big yield.

The REIT Forum

Alright, here are some ideas.

Ready Capital

Ready Capital Corporation (RC) has a big yield at 13.6%. We estimate book value today is about $14.35, so the price-to-book (at $10.58 while writing) would be about .74. That's low enough to be a good deal.

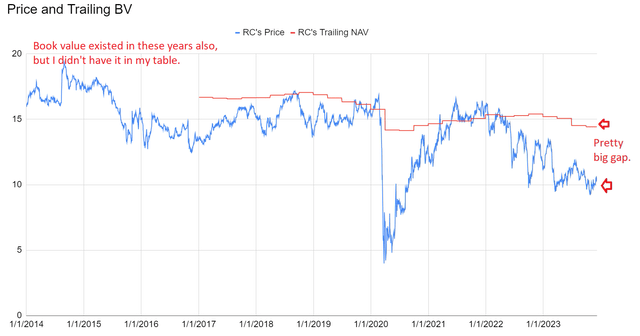

Not convinced? Allow me to share an image contrasting the historical NAV (same as book value in this case) with the share price:

Do you see how the gap between the price and the book is pretty big? Congratulations! You used a more useful metric than the dividend yield.

Like most mortgage REITs, RC saw its book value decline some. However, they were able to protect the substantial majority of it. Good enough, given the rough environment.

This makes RC one of the most attractive mortgage REITs today. I think RC is a good deal at $10.58.

Annaly Capital Management

Annaly Capital Management, Inc. (NLY) sports a 14.2% dividend yield. However, the discount to book value is only 5% (based on our estimates). I'm not going to get into the bull camp yet. However, we're getting much closer to it. Spreads are pretty big and Treasury yields are moving in the right direction. Perhaps a bit too fast, but it isn't as bad as rates ripping higher.

So that's a big yield, but only a modest upside to book value. The spread between MBS rates and Treasury rates creates some extra upside though.

We were briefly bullish on NLY, but shares ripped higher. If they dip, we could be again.

Let prices drop 10% for no reason, and I'd be thinking about ringing the bell.

AGNC Investment Corp.

Not a chance. That 16.1% dividend yield is not enough to bring me in for AGNC Investment Corp. (AGNC). I could get a better deal with NLY or Dynex Capital, Inc. (DX).

When it comes to AGNC, I am:

The REIT Forum

But you came here for ideas about what to buy.

Granite Point Mortgage Trust

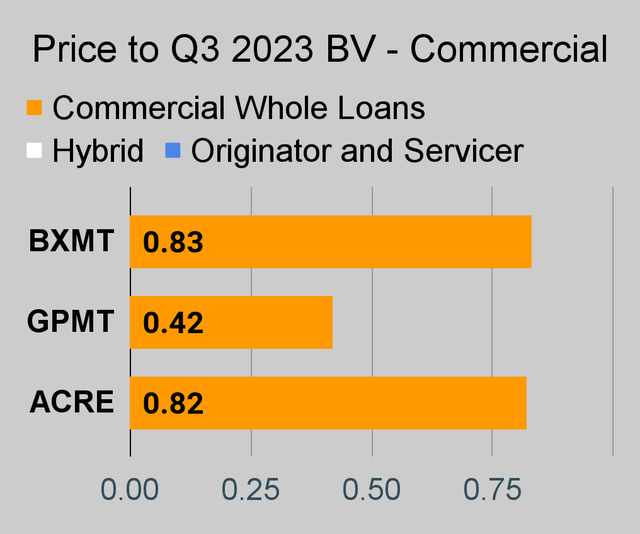

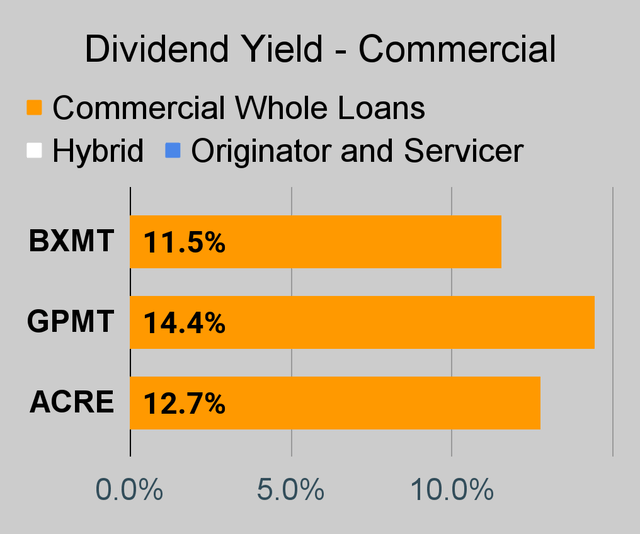

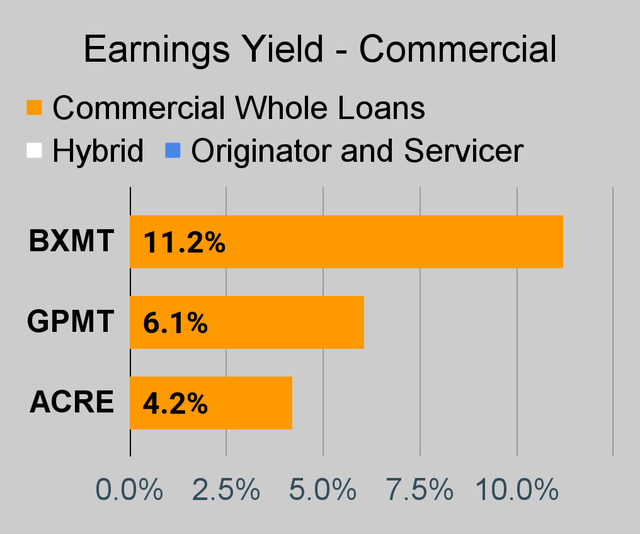

If investors are willing to take on a heavy amount of risk, they could speculate with Granite Point Mortgage Trust Inc. (GPMT). Shares carry the lowest price-to-book ratio at .43. However, we aren't suggesting that the fair value of their assets is actually that high. Commercial mortgage REITs can hold loans at historical amortized cost, net of any expected losses. To write those loans today, I think they would require a higher yield. I would not buy their assets at book value. However, that's a pretty big discount. To be clear, this is not comparable to the other mortgage REITs we discussed. The 14.4% dividend yield is big, but the portfolio is much riskier because they own commercial loans.

It's a high-risk choice, but it has the potential for a big rally. I own some shares, but my position is less than 1% of my portfolio. It's presently about 0.74%.

Prospect Capital Corp.

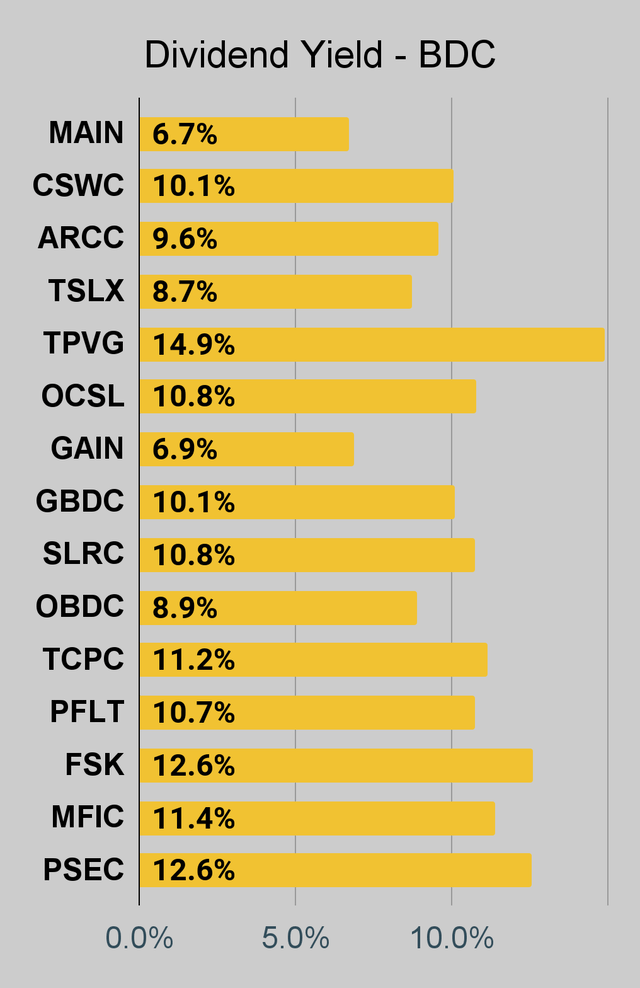

Seeing as we're talking high-risk shares already, let's talk about one of the worst BDCs. Prospect Capital has a dividend yield of around 12.65% and shares trade at about 62% of our estimated book value.

Do I think they are a great company? Clearly not. Do I wake up at night wishing I built my portfolio around the company? Never. However, the price got smacked around so hard that we're actually turning a bit bullish.

The REIT Forum

I wouldn't plan to buy these shares and sit on them for the next decade, but I think they could get quite a bit closer to book value. Consequently, I think they have enough upside to get the bullish rating.

Preferred Shares

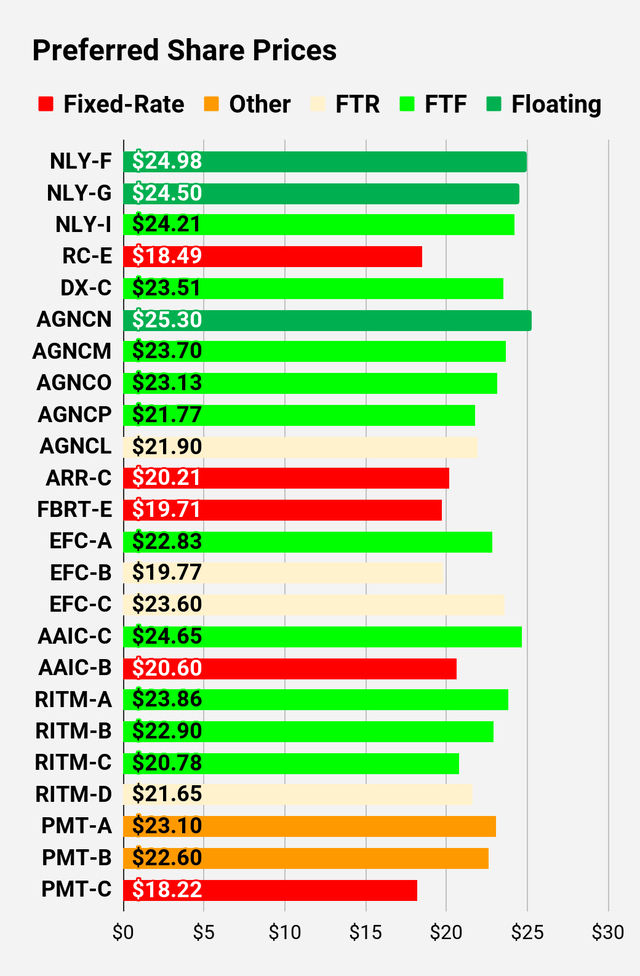

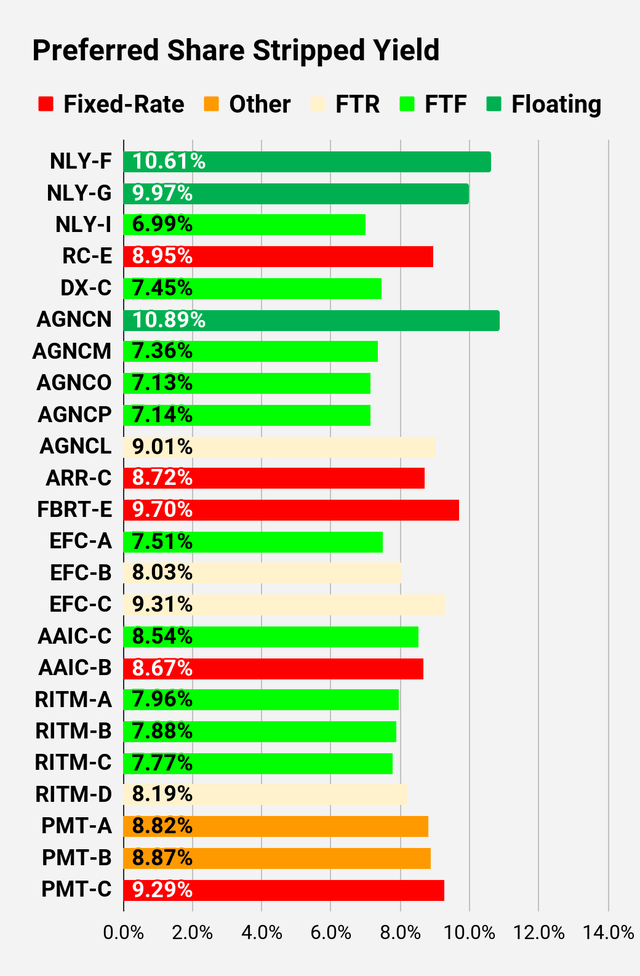

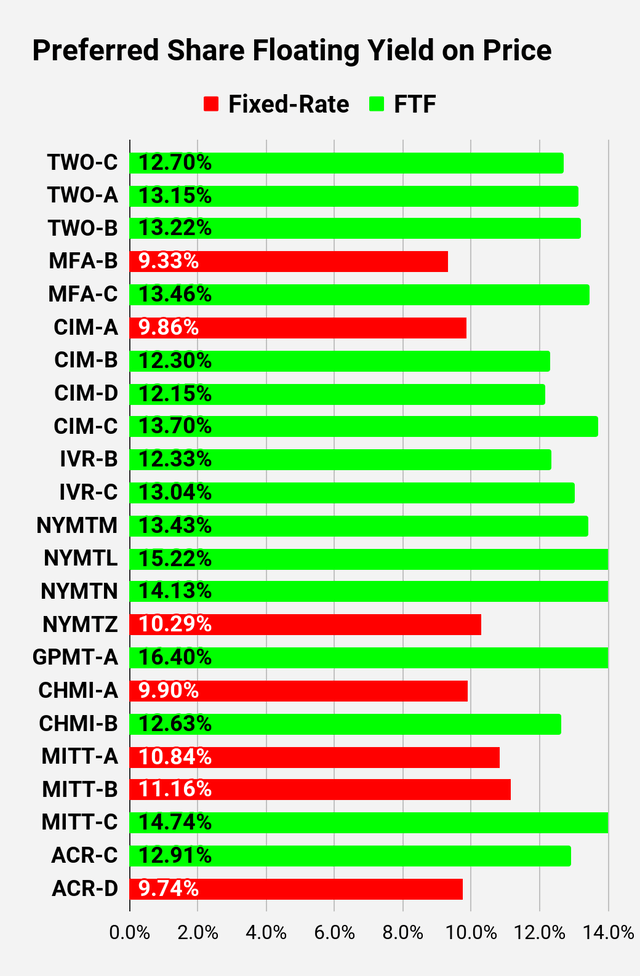

How about a call out for RITM-D (RITM.PD)? Sure, the dividend yield is only 8.19%, but if the rate was resetting today (actual reset date is 11/15/2026) the yield would jump to 12.45%.

The current yield is not amazing. It's only 8.19%. Sure, you could object to including this share. However, the yield to call is 13.37%. If RITM-D calls, that's a really nice return. If they don't call, the investor can start collecting a substantially higher yield. It is possible that 5-year Treasury rates (the reference rate for RITM-D's new rate in late 2026) will be much lower in the future. Or they might not be. This is one of the shares that should appeal to some buy-and-hold investors. It's not an exciting pick, but it has a solid long-term return profile.

Stock Table

We will close out the rest of the article with the tables and charts we provide for readers to help them track the sector for both common shares and preferred shares.

We're including a quick table for the common shares that will be shown in our tables:

Type of REIT or BDC | ||||

Residential Agency | Residential Hybrid | Residential Originator and Servicer | Commercial | BDC |

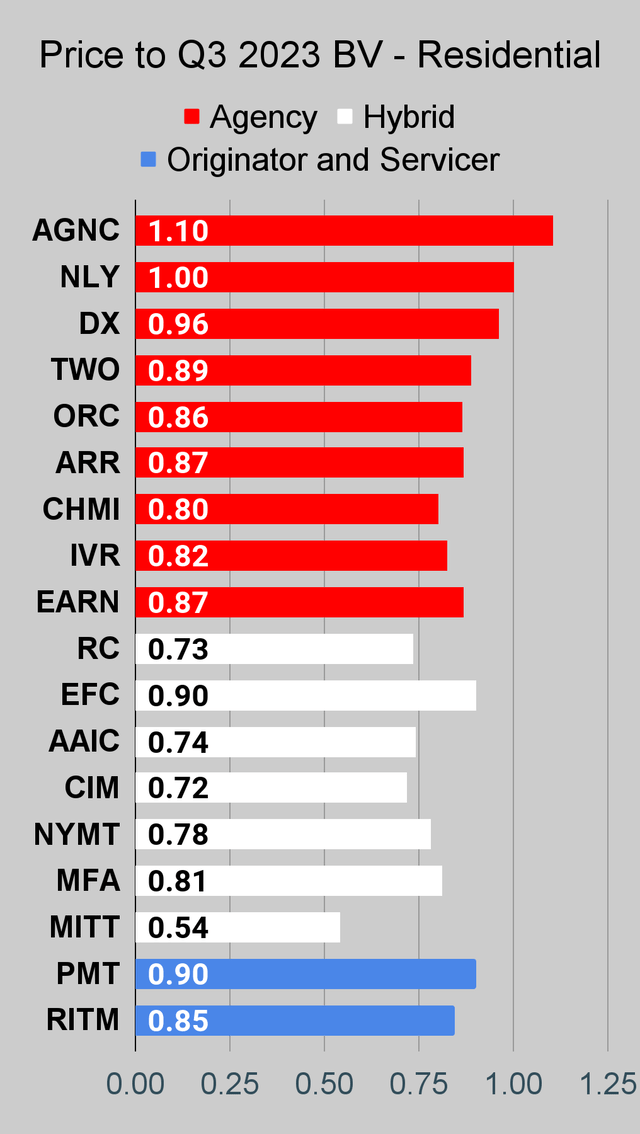

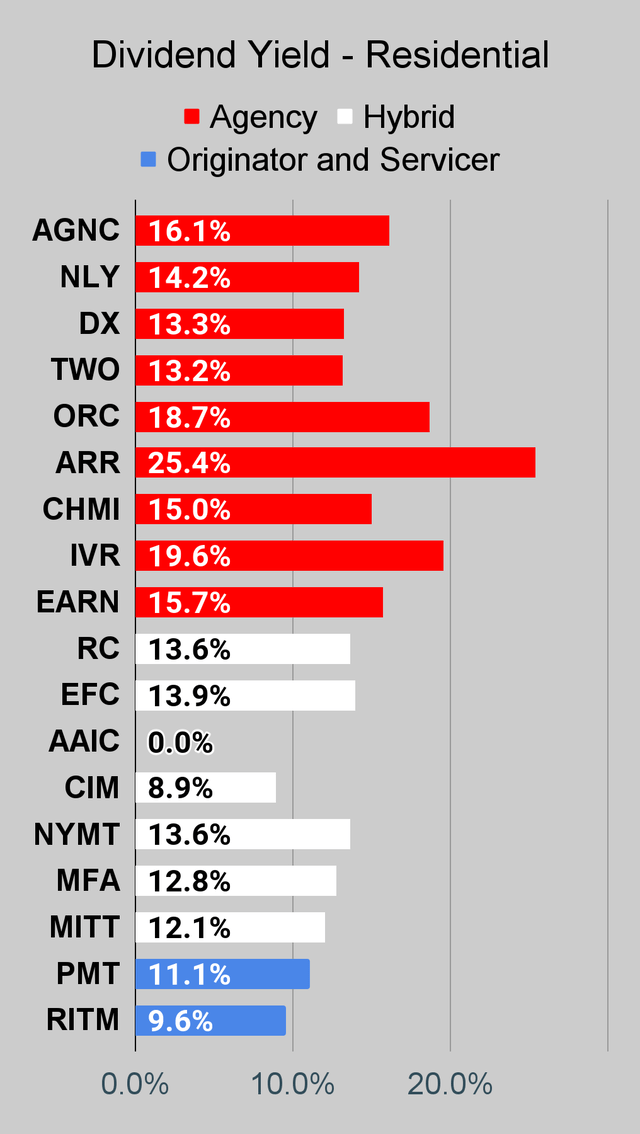

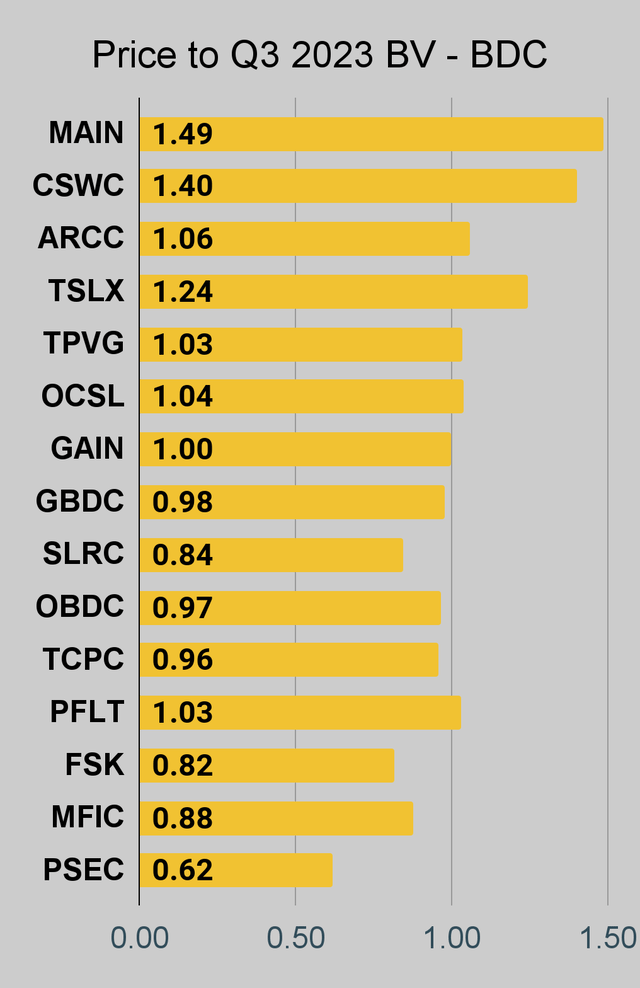

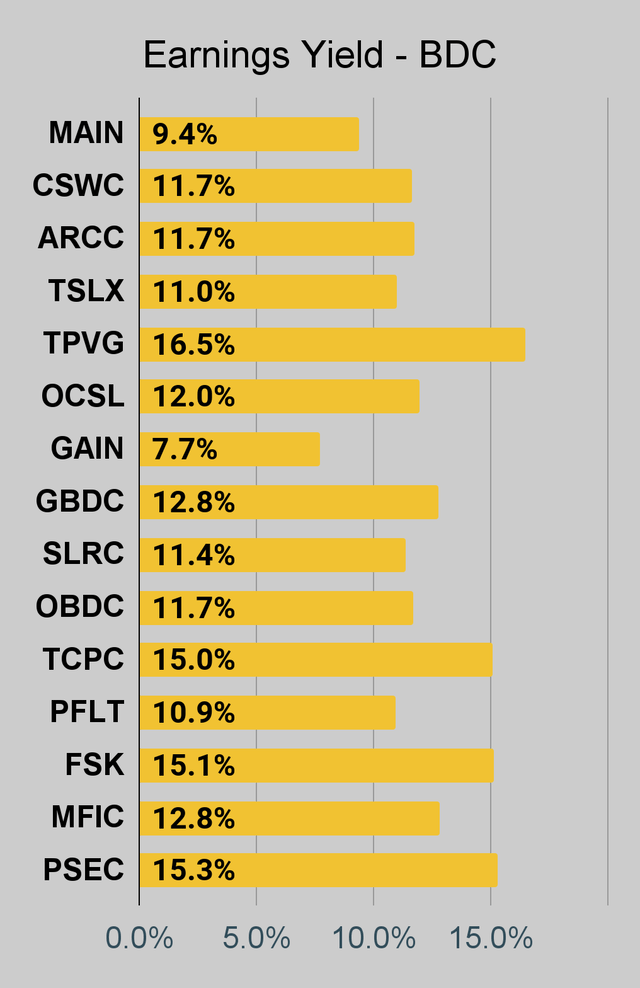

If you're looking for a stock that I haven't mentioned yet, you'll still find it in the charts below. The charts contain comparisons based on price-to-book value, dividend yields, and earnings yield. You won't find these tables anywhere else.

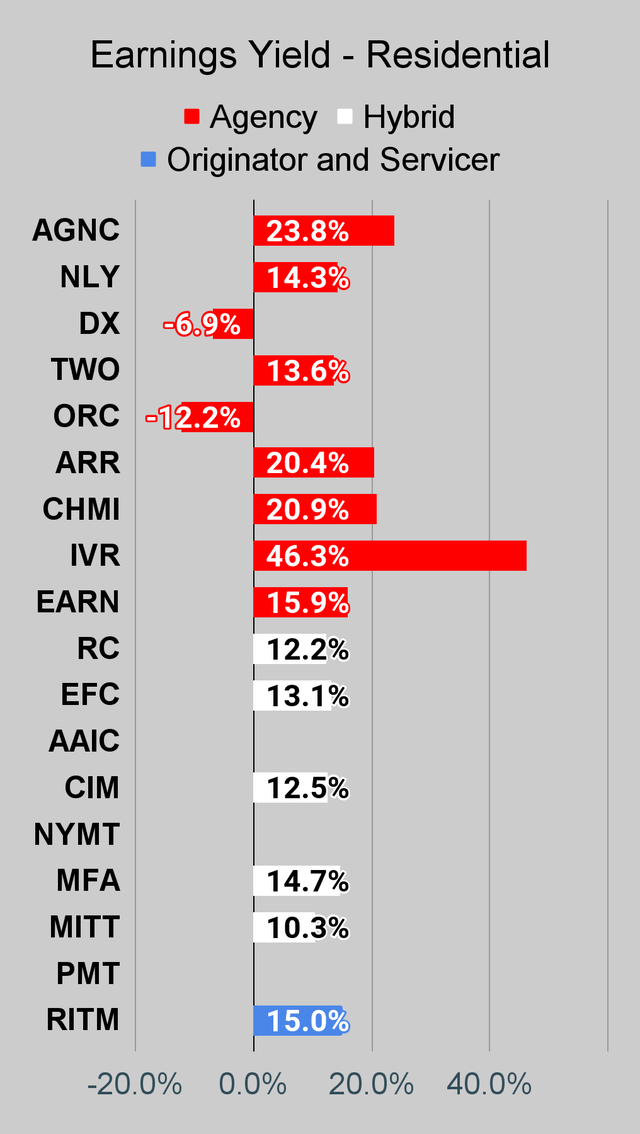

For mortgage REITs, please look at the charts for AGNC, NLY, DX, ORC, ARR, CHMI, TWO, IVR, EARN, CIM, EFC, NYMT, MFA, MITT, AAIC, PMT, RITM, BXMT, GPMT, WMC, and RC.

For BDCs, please look at the charts for MAIN, CSWC, ARCC, TSLX, TPVG, OCSL, GAIN, GBDC, SLRC, OBDC, PFLT, TCPC, FSK, PSEC, and MFIC.

This series is the easiest place to find charts providing up-to-date comparisons across the sector.

Notes on Chart Sorting

Within each type of security, the sorting is usually based on risk ratings. However, it's quite common to have a few shares that are tied. When the shares are tied for risk rating, the sorting becomes arbitrary. There may occasionally be errors where a share's position is not updated quickly following a change in the risk rating. That can happen because the charts come from a separate system. When I update the system we use for members, it doesn't change the order in the charts.

When I say "within each type of security," I'm referencing categories such as "agency mortgage REITs". The "hybrid mortgage REITs" are all listed after the "agency mortgage REITs." However, that does not mean RC (lowest hybrid) has a higher risk rating than the highest agency mortgage REIT. Each batch is presented by themselves.

PMT and RITM are tied for risk rating.

Finally, there's an outlier. We don't cover EARN. However, it was frequently requested for this series. Consequently, I added it to the charts. The important part here is that EARN was never assigned a risk rating. Since it has no assigned risk rating, it got lumped in at the top. However, I do not believe EARN would actually get a higher risk rating than IVR.

This could probably be written better. If someone feels inclined to take it upon themselves to write a section that is objectively better at communicating these points, I would be interested in using it. I'm grateful to have the best readers on SA. I attribute this to self-selection bias. I include enough things to offend the dumb people that I'm left with the best readers.

Residential Mortgage REIT Charts

Note: The chart for our public articles uses the book value per share from the quarter indicated in the chart. We use the current estimated (proprietary estimates) book value per share to determine our targets and trading decisions. PMT and NYMT are not showing an earnings yield metric as neither REIT provides a quarterly "Core EPS" metric. Presently, a few other REITs also have no consensus estimate.

Second Note: Due to the way historical amortized cost and hedging are factored into the earnings metrics, it's possible for two mortgage REITs with similar portfolios to post materially different metrics for earnings. I would be very cautious about putting much emphasis on the consensus analyst estimate (which is used to determine the earnings yield). In particular, throughout late 2022 the earnings metric became less comparable for many REITs.

The REIT Forum |  The REIT Forum |  The REIT Forum |

Commercial Mortgage REIT Charts

The REIT Forum |  The REIT Forum |  The REIT Forum |

BDC Charts

The REIT Forum |  The REIT Forum |  The REIT Forum |

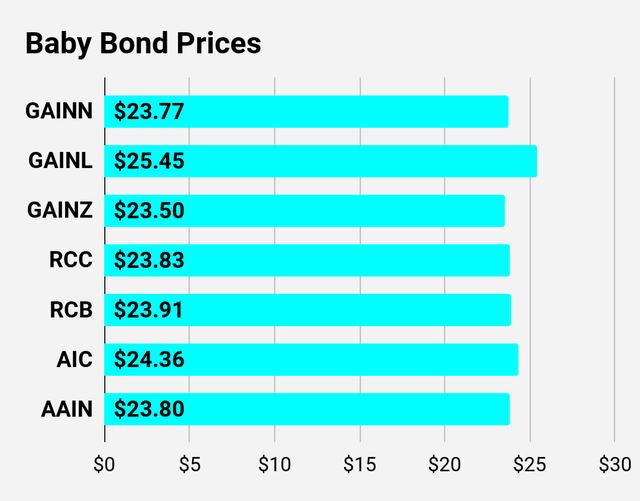

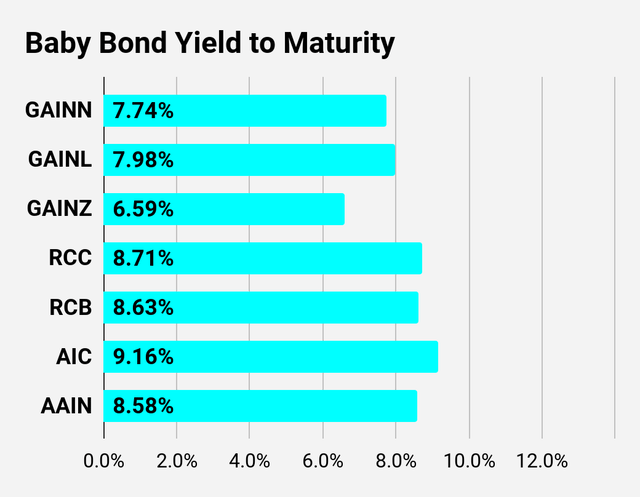

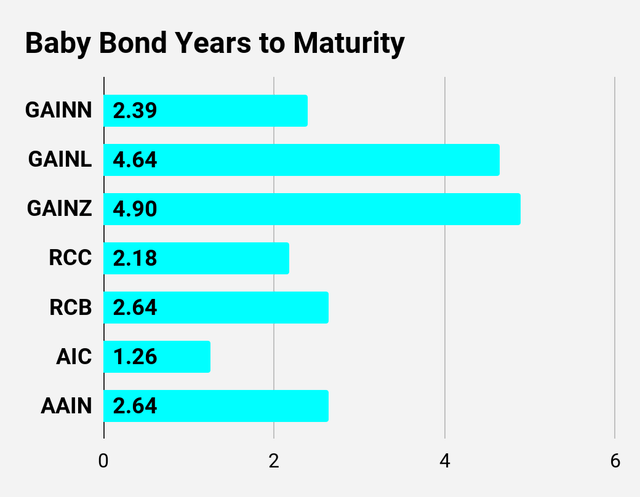

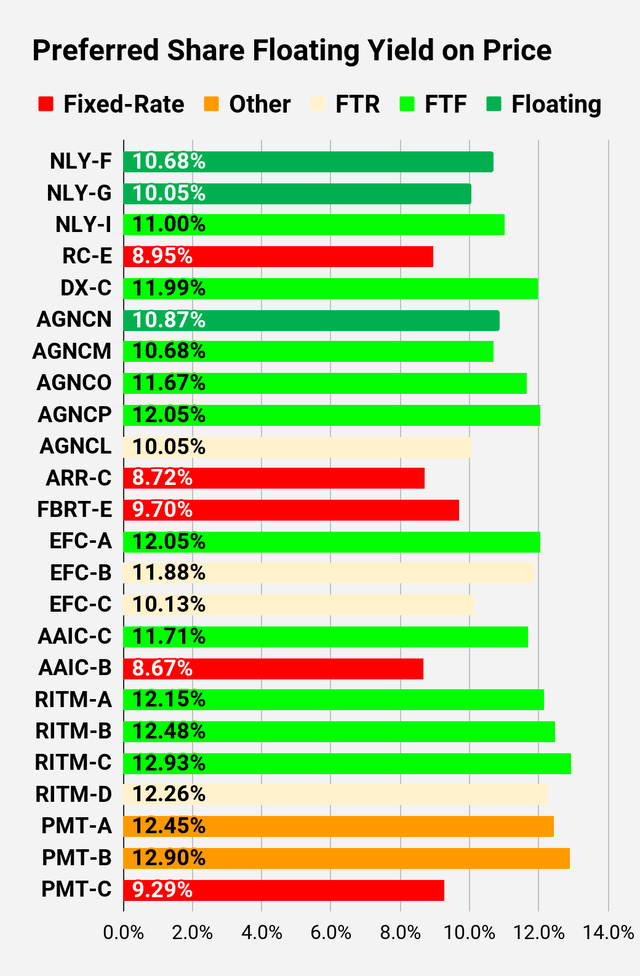

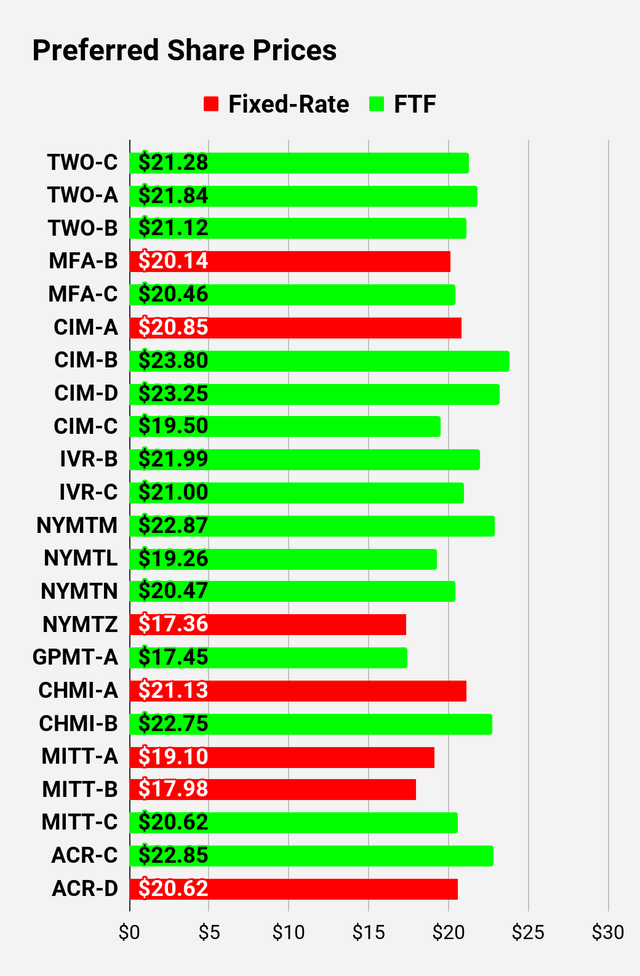

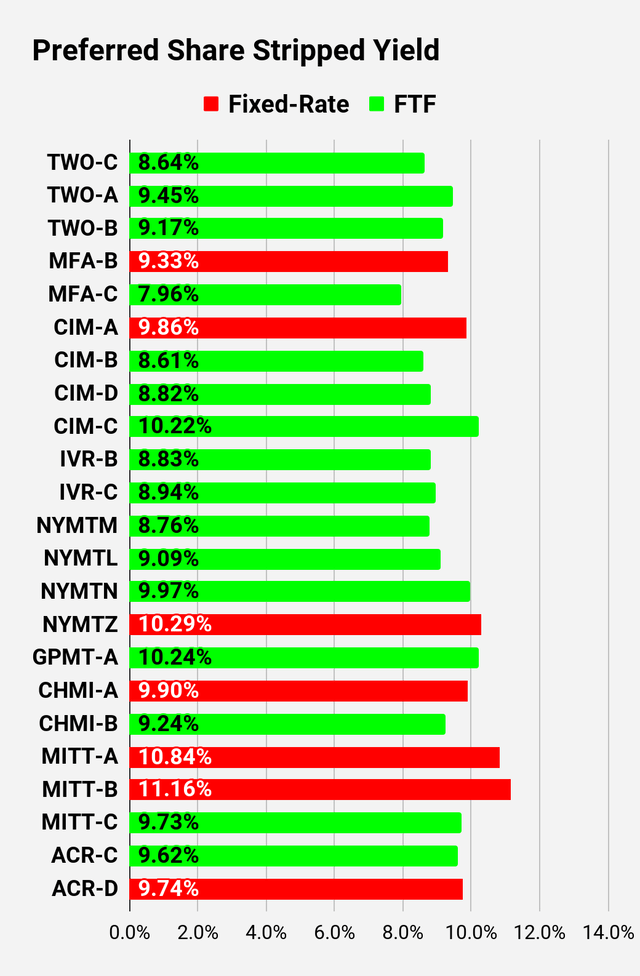

Preferred Share and Baby Bond Charts

I changed the coloring a bit. We needed to adjust to include that the first fixed-to-floating shares have transitioned over to floating rates. When a share already is floating, the stripped yield may be different from the "Floating Yield on Price" due to changes in interest rates. For instance, NLY-F already has a floating rate. However, the rate is only reset once per three months. The stripped yield is calculated using the upcoming projected dividend payment and the "Floating Yield on Price" is based on where the dividend would be if the rate reset today. In my opinion, for these shares, the "Floating Yield on Price" is clearly the more important metric.

The REIT Forum |  The REIT Forum |  The REIT Forum |

The REIT Forum |  The REIT Forum |  The REIT Forum |

The REIT Forum |  The REIT Forum |  The REIT Forum |

Note: Shares that are classified as "Other" are not necessarily the same. For the purpose of these charts, I lumped all of them together as ":Other." Now there are only two left, PMT-A and PMT-B. Those both have the same issue. Management claims the shares will be fixed-rate, even though the prospectus says they should be fixed-to-floating.