claffra

On August 17, 2023, nearby NYMEX gasoline futures were at the $2.8375 per gallon wholesale level when I wrote on Seeking Alpha:

On April 25, I recommended the UGA ETF, believing seasonality and the geopolitical landscape made the ETF a compelling value at below $60 per share. While I remain bullish on fossil fuel prices for the stated reasons, the seasonality could cause a decline over the coming weeks and months.

For those holding long positions, a trailing stop could be the optimal approach for protecting profits and capital. The most significant factor to remember when trading or investing is that we are not long or short any risk position at the execution price, but at the current market level. Therefore, since risk is always a function of potential rewards, adjusting risk levels and reward horizons is appropriate based on the current market price.

Gasoline is an oil product, and petroleum is the energy commodity in the eye of an ongoing geopolitical storm. As the market approaches a seasonally weak period, extra caution is advisable for the coming weeks and months.

The United States Gasoline Fund (NYSEARCA:UGA) product moves higher and lower with nearby NYMEX gasoline futures prices. On August 17, UGA was at $71.40 per share.

Gasoline is a seasonal commodity- Futures move before the seasonal forces occur

Gasoline prices tend to peak during spring and summer, which are the peak driving seasons. Good weather and vacations cause drivers to put more clicks on odometers, leading to peak gasoline demand.

Therefore, gasoline prices tend to rally during spring and summer and decline during fall and winter. Meanwhile, since the futures market reflects prices for deferred delivery, they often move ahead of seasonal forces. Therefore, preparing for an upcoming seasonal opportunity is often the optimal approach to trading or investing.

Gasoline prices have declined- Gasoline is the most ubiquitous oil product

In the mid-August article on Seeking Alpha, I warned that seasonality could cause gasoline prices to fall over the coming months. On August 17, the NYMEX gasoline futures were at the $2.8375 level.

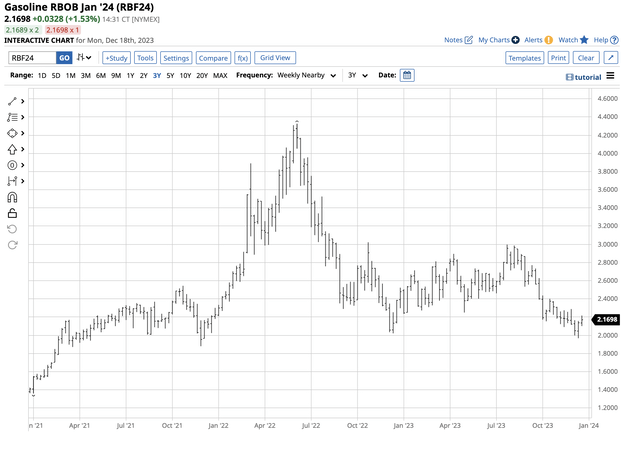

Weekly Chart of NYMEX RBOB Gasoline Futures (Barchart)

As the weekly chart highlights, NYMEX gasoline futures have made lower highs and lower lows since August 2023, falling below the $2 per gallon wholesale level in mid-December and trading at the $2.1698 per gallon level on December 18.

Gasoline is the most ubiquitous oil product and during the heart of winter, the demand reaches a seasonal low. The recent decline and probe under $2 per gallon reflect the seasonal nature of the leading oil product powering vehicles that are not operating at the same level as during the peak driving season.

COP28, two wars, the bifurcation of the world’s nuclear powers, the U.S. SPR, and U.S. energy policy support higher gasoline prices in 2024

There are compelling reasons to put gasoline on your investment and trading radar for 2024 during the current seasonal lull:

- COP28: In a recent Seeking Alpha article on the COP28 draft, I concluded, “The COP28 draft is another factor supporting higher crude oil prices. While climate change is a threat, economic vested interests, and non-cooperation from the world’s two most populous countries mean oil and other hydrocarbons will continue to power the world.” Higher oil prices translate to rising gasoline prices over the coming months.

- War: The war in Ukraine is approaching its second anniversary, with no end in sight. Russia is a leading oil producer and the most influential non-member of OPEC, the international oil group, cooperating with production quotas and policies. Russia needs the highest possible oil price to keep its economy afloat and fund its ongoing war efforts. Meanwhile, the war in Israel is another factor supporting oil prices. Iran funds Hamas, Hezbollah in Lebanon, and the Houthis in Yemen. Iran is an OPEC member with significant logistical control in the Persian Gulf and Straits of Hormoz, a critical chokepoint for the worldwide oil supply chain. Escalating regional conflicts would threaten supplies, pushing petroleum and oil product prices higher.

- Bifurcation of the world’s nuclear powers: Tensions between Washington and U.S. allies with Beijing, Moscow, Teheran, and Pyongyang could disrupt global shipping and supply chains. Moreover, the potential for a BRICS currency that ends the U.S. dollar’s dominance as the petrodollar could push oil prices higher as China, India, and other countries purchase petroleum in non-dollar currencies. A decline in the dollar’s role in worldwide trade could lift oil prices as the dollar’s value declines.

- The U.S. SPR: The U.S. Strategic Petroleum Reserve fell from over 600 million to below 352 million barrels since late 2021. The U.S. administration released petroleum when crude oil prices spiked over the $130 per barrel level after Russia invaded Ukraine. While crude oil did not eclipse the 2008 all-time high, gasoline and distillate product prices rose to record peaks, with wholesale NYMEX gasoline futures reaching $4.3260 per gallon in June 2022, during the height of the 2022 driving season. In October 2022, the U.S. Administration Fact Sheet told markets the Department of Energy plans to purchase crude oil when prices reached $67 to $72 per barrel. Therefore, the U.S. could support crude oil during its seasonal lows over the coming weeks, adding to the SPR at its lowest level in four decades.

- U.S. energy policy for 2024: The U.S. administration remains committed to addressing climate change by supporting alternative and renewable fuel sources and inhibiting fossil fuel production and consumption. Meanwhile, the world, including the U.S. continues to rely on hydrocarbons for power. Most U.S. cars use gasoline for fuel, which will not change during the 2024 peak driving season.

These factors are compelling reasons for gasoline prices to increase in 2024, and the forward curve already anticipates price appreciation.

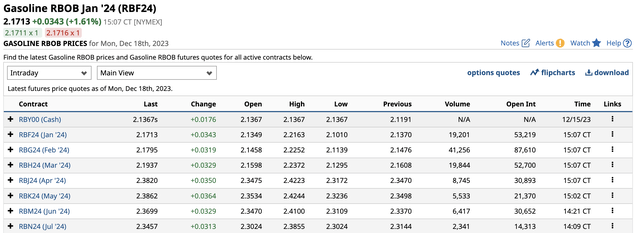

NYMEX RBOB Gasoline Forward Curve Through the 2024 Driving Season (Barchart)

The forward curve of deferred gasoline futures prices shows the price peaks in May 2024 at $2.3862 per gallon wholesale. The peak price for 2024 may be low, considering gasoline prices reached over $4.30 per gallon at the 2022 high. Many factors could push prices considerably higher over the coming months.

Meanwhile, the Fed’s recent pivot to a more accommodative monetary policy stance is bullish for commodity prices, and crude oil and oil products are no exceptions.

A hot debate topic for the November 2024 U.S. election

The future of oil and oil products will be a significant debate topic during the 2024 race for the White House. The current administration and Democrats view climate change as an existential threat and are committed to limiting or eradicating fossil fuels. Meanwhile, Republicans favor a drill-baby-drill and frack-baby-frack energy policy approach to achieve independence from OPEC+. Whether the 2024 contest is a repeat of 2020 with President Biden facing former President Trump or other candidates receiving their parties’ nominations, the debate will not change.

However, the current administration’s energy policies will prevail during the 2024 driving season, which could be highly bullish for gasoline demand and prices.

UGA is the gasoline ETF product- Buy on a scale-down basis over the coming weeks and months- Leave lots of room

On August 17, the United States Gasoline Fund traded at $71.40 per share.

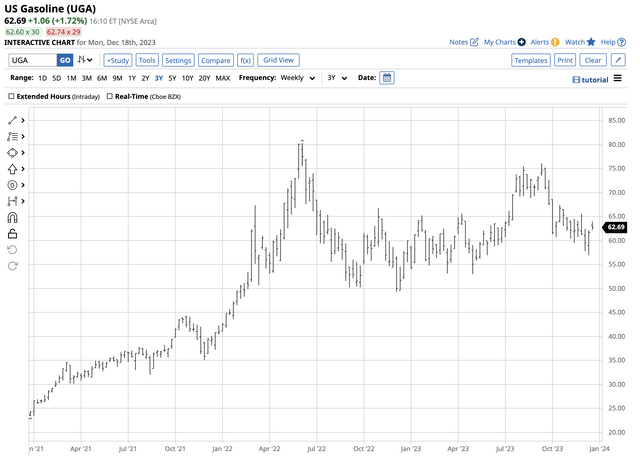

Weekly Chart of the UGA ETF Products Tracking Gasoline Futures Prices (Barchart)

The weekly chart shows the pattern of lower highs and lower lows since the 2023 peak driving season. At $62.69 per share on December 18, UGA was 12.2% lower and in a primarily bearish trend. Meanwhile, UGA has outperformed nearby NYMEX gasoline prices, which declined 23.5% from $2.8375 to $2.1698 per gallon wholesale. UGA tends to outperform on the downside and underperform when gasoline prices rally. When nearby gasoline futures exploded over eleven and one-half times higher from 37.6 cents in March 2020 to $4.3260 in June 2022, UGA rose from $8.19 to $80.29, 9.8 times higher.

As we move towards 2024, and the 2024 driving season begins around May, buying UGA on significant dips could be the optimal approach to gasoline investing for the coming year. Crude oil and oil product markets are highly volatile. As we learned over the past years, prices can move to illogical, unreasonable, and irrational levels on the up and downsides. Therefore, leave plenty of room to add on further declines as surprises over the coming weeks and months could cause significant price variance. However, the odds favor higher gasoline prices during the 2024 driving season above the current prices on the forward curve at the end of 2023.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls, directional trading recommendations, and actionable ideas for traders and investors. I am offering a free trial and discount to new subscribers for a limited time.