_ultraforma_

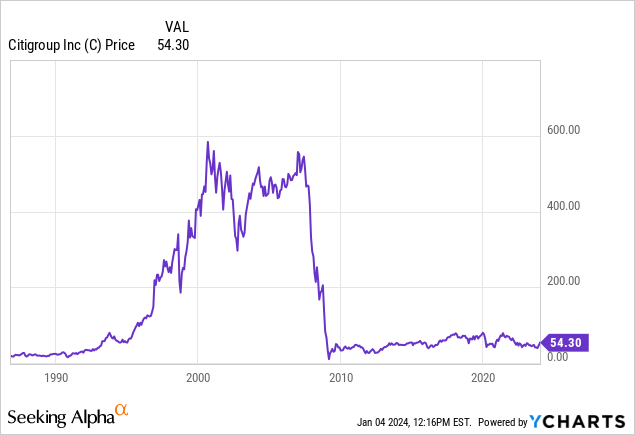

During the golden age of finance in the 1990s and 2000s, Citigroup (NYSE:C) rose to prominence while delivering returns in excess of 30x to shareholders with the foresight to buy early. But by the time of the 2008 financial crisis, the bank's massive exposure to troubled mortgages threatened to put the firm out of business. The U.S. government graciously intervened, and Citi was saved at a heavy price to shareholders. Since then, a succession of CEOs has come and gone from Citi with turnaround plans, but nothing ever stuck. The stock has resumed its dividend over the past few years, but true believers are few and far between. After 15 years of no growth, those who believe Citi can finally get it together are getting a price. Among the converts over the past few years is Mike Mayo, a top banking analyst known for his sharp wit and brutal questions on quarterly conference calls. Mayo put out a note this week arguing that Citi's stock can double in three years.

Why Citi Has Been Dead Money

Citi's struggles over the past 15 years are manifold. The bank pursued a high-growth, high-risk strategy in the 1990s and 2000s, and the strategy worked for a long time. In 1998, Citi acquired Salomon Brothers, the wild trading firm profiled by author Michael Lewis in Liar's Poker, his bestselling book about his work as a Salomon bond salesman in London. This isn't specific to Citi, but in the 1990s and 2000s, it wasn't unheard of for young traders to take down bonuses of $5 million to $10 million after winning huge bets with their firm's money. When they lost, they often ended up at other firms or simply retired in their late 20s and 30s. The crisis in 2008 put an end to the party, but Citi's legacy network of bank branches remained, with all of its associated expenses.

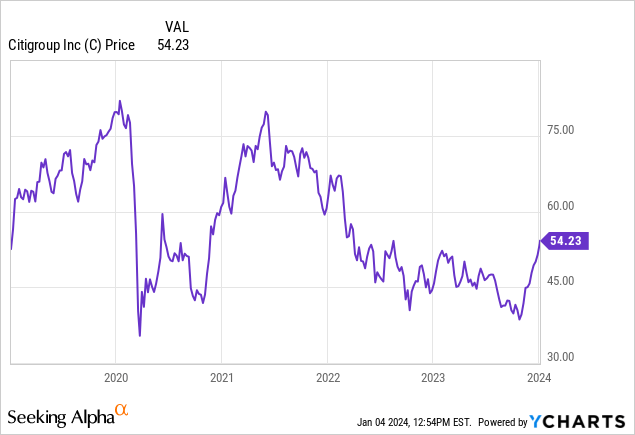

After the crisis, Citi's expensive growth and risk-taking apparatus found itself directly in conflict with the bank's obvious need to reduce headcount and deleverage. Today's Citi's headcount is roughly the same as it was 10 years ago, as is its revenue. So is its share price. There are a lot of other things going on with the company, such as a steady whirr of regulatory drama and the push and pull of different CEOs and their plans for the company, but I think this effectively sums it up. A high global cost structure and a lack of direction prevented Citi from getting in gear as quickly as competitors like Bank of America (BAC), which also found itself at the brink during the crisis, but has recovered more of its peak 2007 market value. This inability to cut costs still shows today, with Citi clocking in at a 6.7% return on equity, compared to a healthy 11.5% at BAC, 10.1% at Morgan Stanley (MS), or 9.8% at Truist (TFC). Citi remains well below its pre-pandemic highs.

How Citi Can Turn It Around

Citi tapped Jane Fraser as CEO in 2021 to improve the bank's profitability and erase the discount to peers. Under Fraser's tenure, headcount initially started growing again, and the stock fell as skeptical investors bailed. But Fraser has begun to cut costs in earnest. Citi recently closed its municipal bond business, a business the bank was once dominant in. Then, the bank also exited distressed debt. Earlier, Fraser reduced its layers of management from 13 to 8. Talk is cheap, but we're seeing some real action from Citi to get costs under control and close the profitability gap with peers.

Analysts expect Citi to lay off as many as 25,000 employees as part of this process. This gets us back to Mike Mayo's call. Mayo ironically gained industry fame for trading barbs with Citigroup over questionable accounting in the 2010s, but he sees the light now–and is making a big bullish call.

Mayo's thesis (paraphrased):

- Citi is a simpler business after exiting marginal lines of business and geographies.

- Citi can cut costs by reducing headcount and keeping expenses flat over the next three years, while revenue grows at a reasonable pace.

- Citi can buy back stock on the cheap due to market distrust.

- Book value has increased in recent years ($99.28 per share as of the last quarterly report).

Mayo has a $70 price target for Citi this year, but a $119 3-year price target as the expected turnaround takes hold. He presents a bear case as well based on the fact that Citi has a history of underperforming, but I'm intrigued by the call. Mayo has a history of butting heads with bank management, and he's sticking his head out here on the call. Notably, Citi is expected to be among the banks more heavily affected by the Fed’s new capital plans, but his analysis accounts for potential negative effects from the plan.

My Analysis

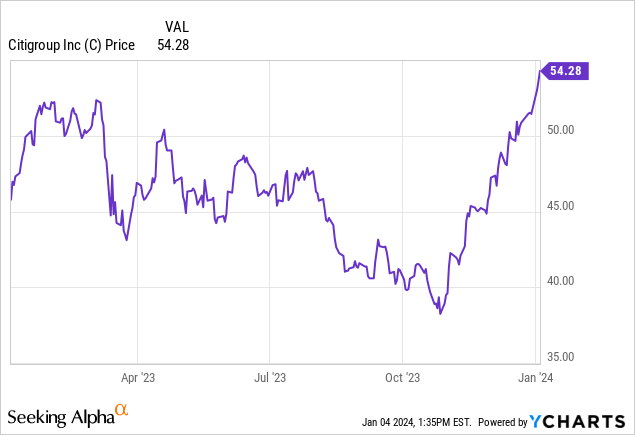

If you look at a 1-year chart here, you see that Citi has soared from under $40 per share to nearly $55. The stock isn't expensive by any stretch, but there seem to be investors who are piling into the stock after a long stretch of underperformance.

When you see a huge move in a stock in a short period of time, it can either be an underreaction, an overreaction, or about right. In my experience, overreaction is more common than underreaction, especially over short time frames.

Citi does have some positive things going for it, the ~4% dividend yield chief among them. I'd be a little wary about buying C over $50 but would be inclined to put some money in around $45. It's possible I simply miss out here, but C's P/E ratios are presently not much different from healthier peers like Truist and Bank of America. Many analysts prefer to use price to book, which shows Citi as cheaper, but I think you may want a little more compensation than you're getting after a 30% run-up in a few weeks.

You can set text or email alerts with your brokerage or through free apps, and in this case, I'd consider setting up a notification if Citi drops below $45. That's where you can buy Citi with a strong margin of safety in my mind, and the dividend yield is closer to 5%. The exact price you need for a 5% dividend yield is actually $42.40, which is a more conservative margin of safety. Citi is far from a recession-proof stock so having a lower purchase price is helpful.

Bottom Line

Citi as a top 2024 pick is an interesting call, and I think it's a reasonable buy at today's prices after taking concrete action toward cutting costs. However, given the rapid run-up in the stock, investors have a better margin of safety by buying C stock in the $42-$45 range. If Citi flawlessly executes its game plan over the next three years, analyst Mike Mayo could easily be correct in his $119 price target for Citi. However, given the history of setbacks at the company, I feel that a greater margin of safety is beneficial for investors. I rate C stock a hold with an eye toward getting money in if the stock pulls back.