Bilanol

SJW Group (SJW) is a water utility with service areas in California, Texas, and New England. It is a long-tenured company with a market cap of about $2B.

The buy thesis

This bull thesis has 2 parts:

- Why water utilities in general are opportunistic

- Why I think SJW is better positioned than peers.

A variety of factors set up for a wave of projects which will facilitate expanding rate base for the water utilities. As such, the entire sector is likely to grow at an above historical pace at a time when valuations are depressed.

SJW is positioned to outperform peers due to exposure to key locations, impending rate cases and cheaper valuation. Utilities tend to be on the more consistent side, so I would not anticipate a home run here, but I think SJW can deliver a moderately above market return at below market risk.

Utility rate base expansion opportunity

It is well known that America’s infrastructure is not as well maintained as it could or perhaps should be. This is particularly true when it comes to water infrastructure.

S&P Global Market Intelligence

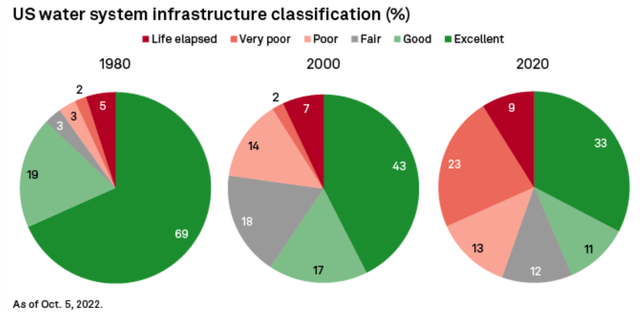

As of 2020, only 33% of water infrastructure was in excellent condition with nearly half in poor or worse condition.

The government seems to be perpetually trying to solve the problem with infrastructure bill proposals. Large spending bills are difficult to pass, particularly when the deficit is already so large.

For bridges, roads and other such infrastructure, some sort of government spending might be the only option, but water has a different choice – the private sector.

Presently, the vast majority of water systems are still funded and controlled by municipalities. The government operated ones are in particularly poor condition due to the aforementioned lack of funding.

Increasingly, municipalities are turning to the water utility companies. These public stock exchange traded companies can take over water systems and modernize the failing infrastructure through capital investment, but here is the kicker: When the company spends the money, it is not funded by the already budget-constrained government, but rather by the consumers of the water.

Regulatory bodies, through general rate cases, dictate how much the utility company can charge the customer and it often results in a win-win. The company gets a profit margin that facilitates growth, while consumers get cleaner water with less PFAS or lead contamination at what has consistently remained a very reasonable price.

Much of the growth of water utilities comes from expanding their rate base via either improving existing jurisdictions or acquiring new jurisdictions through M&A.

I believe M&A in the water utility space is headed for a boom period for the following reasons:

- The fragmentation provides opportunity for larger, better capitalized players to buy accretively.

- The aforementioned failing infrastructure serves as an impetus for municipalities to sell.

At an aggregate level, water demand grows roughly linearly with population. Population growth in the U.S. is not that high, but due to the consolidation of municipal water systems into the publicly traded companies, the rate bases of these companies could expand rapidly, leading to significant earnings per share growth.

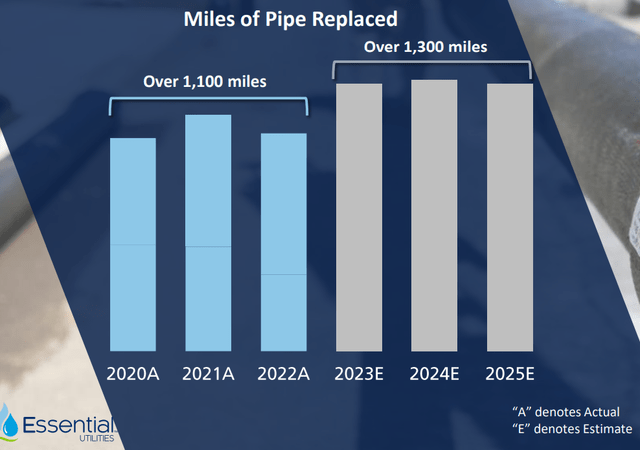

To some extent this is already happening with the largest water utility, Essential Utilities (WTRG), calling for a nearly 20% increase in its pipe replacement schedule.

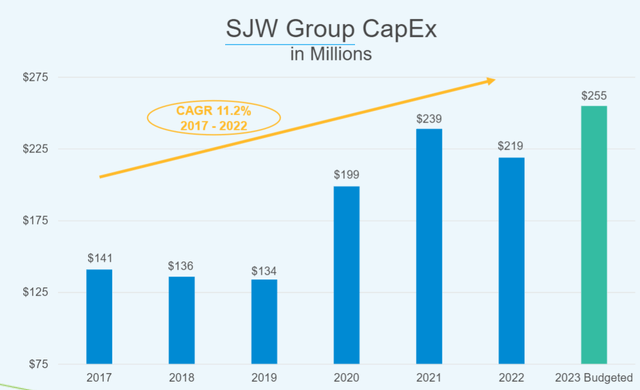

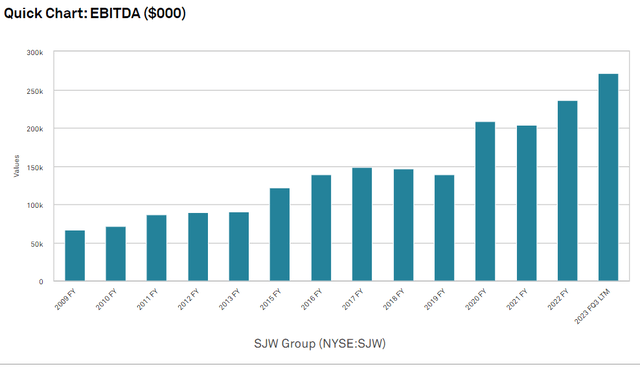

SJW Group has also already experienced significant growth from a combination of organic and M&A.

Unlike in other industries, capex is a great thing for utilities as each dollar of approved spending results in about a 9% ROE (depending on state).

The increases so far have significantly increased SJW’s EBITDA.

S&P Global Market Intelligence

However, the pace is looking to expand, with SJW announcing:

“Five-year plan to invest $1.6B in water/wastewater infrastructure and PFAS remediation, subject to regulatory approval”

Note that SJW has a $2B market cap, so incremental spending of $1.6B would dramatically expand its rate base. This is not some pie in the sky hope of the company, rather much of the planned $1.6B is already in various stages of review.

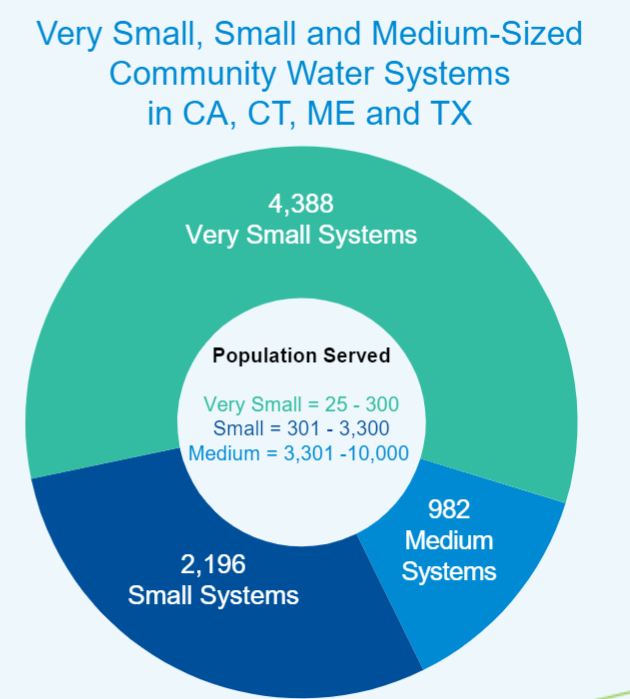

SJW’s rate base expansion seems to be significantly faster than that of the sector, and I suspect it is related to their markets being particularly fragmented.

SJW

These really small systems make for easy M&A targets as the better capitalized and more experienced SJW can simply run them more efficiently. In addition to M&A, it means many potential projects in these areas are going uncapitalized which allows SJW to come in with proposals.

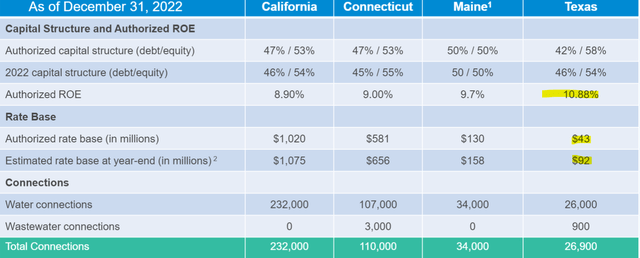

In particular, I find SJW’s Texas exposure to be opportunistic. Its subsidiary, Texas Water, serves the Austin-San Antonio Corridor which has rapid population growth. Apartment development is rampant in these MSAs to meet the growing population and each apartment needs a water connection.

SJW’s Texas rate base grew from $43 million in 2022 to an estimated $92 million by the end of 2023.

That is more than doubling, and I think the growth will continue. It is also worth noting that Texas has an unusually high authorized return on equity (ROE) of 10.88%, which makes rate base growth in this area particularly accretive to earnings per share.

Beyond the rate base growth, SJW also has some organic growth opportunity.

SJW organic growth

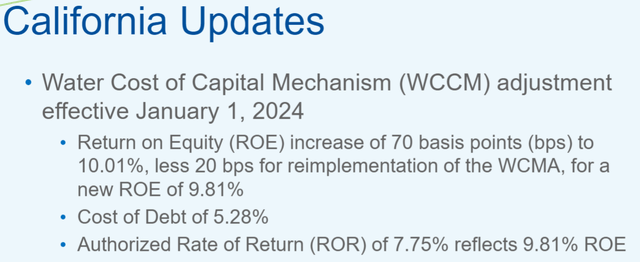

With the rise of interest rates in 2023, there is some pressure on regulatory bodies to authorize higher ROEs for the water utilities. Effective January 1st 2024, SJW has achieved a 70 basis point increase to its ROE in California due to the Water Cost of Capital Mechanism.

Another rate increase is in the pipeline with a requested 18.1% revenue increase filed with Public Utilities Regulatory Authority which is expected to be decided in 2Q24.

A 1.19% Water Infrastructure and Conservation Adjustment was already approved by PURA effective starting October 1, 2023.

PFAS opportunity

PFAS, or polyfluoroalkyl substances are known as the “forever chemical” and have been determined to be quite dangerous to public health.

These are unfortunately present in quite a few water systems, and the utilities are well positioned to deal with the problem and perhaps clip a profit while helping public health.

SJW has applied for a $540 million capex program in 2025-2027 designed to address PFAS.

That would be a sizable increase to rate base.

Valuation – water utilities and SJW specifically

Water utilities, like most utilities, tend to trade inverse to interest rates. While their profitability has continued to increase even as rates rose, there was a constituency effect.

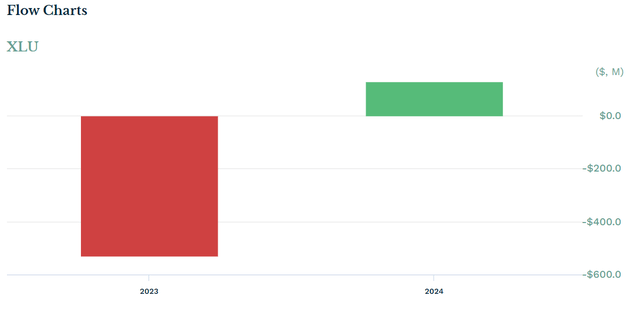

Many investors buy utilities for their consistent dividends causing the sector to be viewed as a bond proxy. With the surge in interest rates in 2023, the dividend yields of utilities became less appealing to investors resulting in broad based selling. This is evident in ETF trading, with over $500 million of outflows from the Utilities Select Sector SPDR® Fund ETF (XLU) in 2023.

Market prices came down considerably as a result of the broad selling.

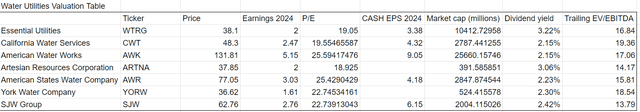

At the same time, water utilities were almost universally growing earnings and EBITDA, resulting in multiples coming down substantially. Below is a table of various valuation metrics.

2MC using data from company filings and S&P Global Market Intelligence

In my opinion, given the rate base growth opportunity and the now cheaper valuations, the water utilities are generally opportunistic.

SJW appears to be slightly cheaper than its peers. While its 22.7X earnings multiple is in-line with the sector average, an outsized chunk of depreciation is depressing its earnings figure. Some of the depreciation is, of course, a real expense, as the assets will eventually have to be replaced, but the accounting depreciation schedules are significantly faster than the real decline in value.

Taking depreciation out, we can look at Cash EPS where SJW comes in at $6.15 per share, which gives it a nearly 10% cashflow yield.

This cash flow yield is significantly greater than that of any of its competitors.

These companies have differing capital structures which can distort earnings metrics. As such, I like to also look at a leverage neutral metric such as EV/EBITDA.

Again, SJW Group appears cheaper than peers with a 13.79X EV/EBITDA multiple and peers closer to 16X.

Not just a dividend play

I get why investors are less intrigued by utilities in this environment. SJW’s 2.4% dividend yield is unimpressive when one can just buy a treasury at 4%-5%.

However, I think the concept of utilities as just dividend plays is antiquated. The demand for better water infrastructure facilitates increased rate base and makes these legitimate growth vehicles.

SJW is positioned to grow at 6% annually for the foreseeable future.

Unlike Treasuries, utilities raise their dividends. SJW has raised its dividend for 55 consecutive years and I see no signs of that streak stopping.

Overall, I think SJW Group is moderately undervalued with a strong fundamental outlook, which I think will cause it to outperform the market.

The REIT market has gotten egregiously underpriced making it a great time to get in to the right REITs. To help people get the most updated REIT data and analysis I am offering 40% off Portfolio Income Solutions, but you can only get it through this link.

https://seekingalpha.com/affiliate_link/40Percent

I hope you enjoy the plethora of data tables, sector analysis and deep dives into opportunistic REITs.