FABRICE COFFRINI/AFP via Getty Images

Thesis

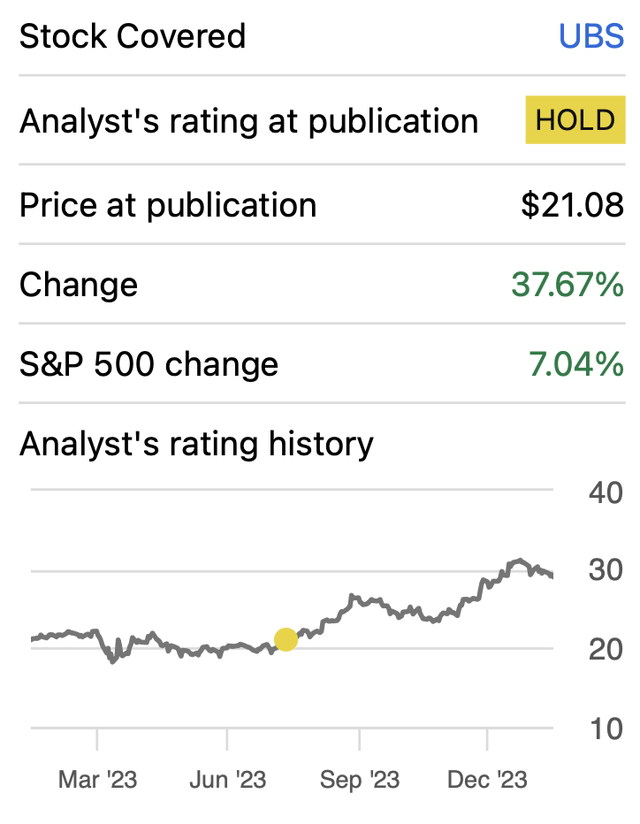

In the aftermath of my previous article on UBS Group AG (NYSE:UBS), the stock has surged by an impressive 37.67%. In this piece, I aim to elucidate why, despite lingering concerns about underperformance, UBS represents a compelling opportunity.

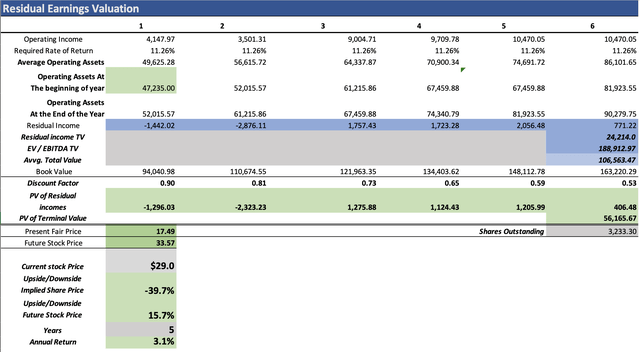

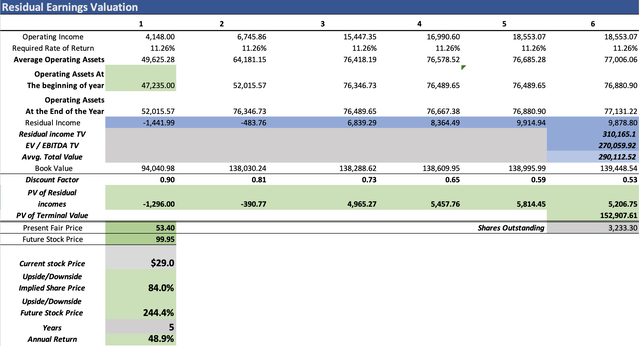

Furthermore, I have crafted two Residual Earning Models, with the most optimistic one pointing to a fair price of $53.40. Essentially, this suggests that UBS is catching with the market valuation of the American retail banking giant Wells Fargo and Company (WFC), by suggesting a fair $152.8 billion market cap.

Looking ahead, the same model forecasts a future stock price of approximately $99.95, indicating that UBS is poised to evolve into a $290 billion entity. This projection places it squarely between the market caps of Bank of America Corporation (BAC) and JPMorgan Chase & Co. (JPM). With these compelling prospects in mind, I am upgrading my rating from "hold" to "buy."

Overview

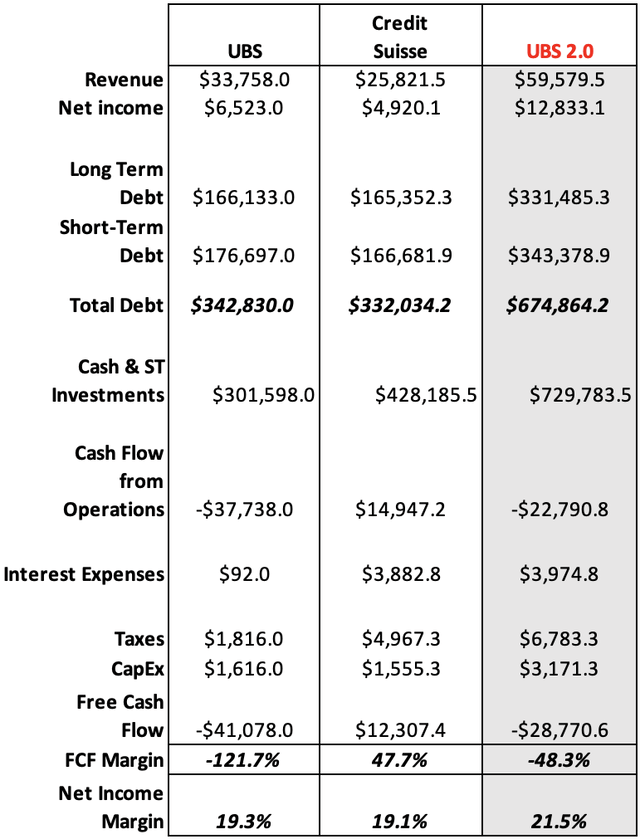

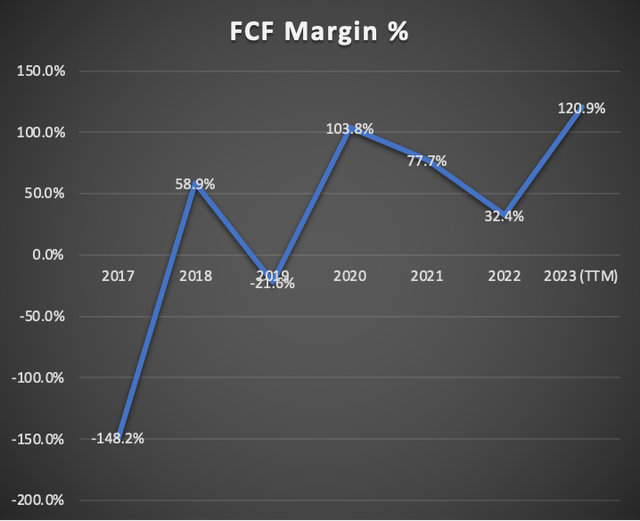

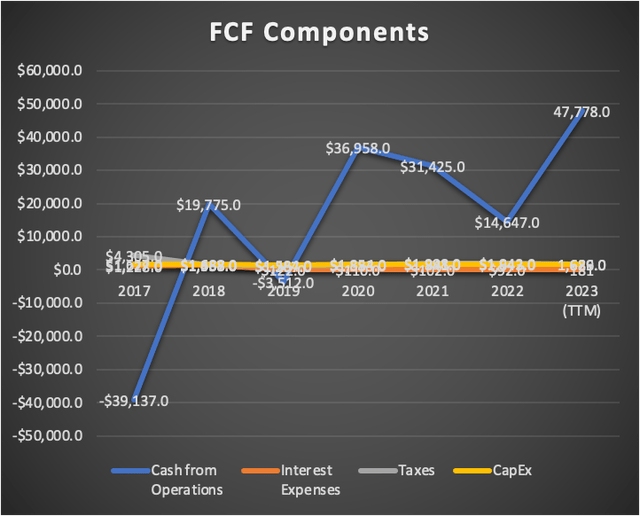

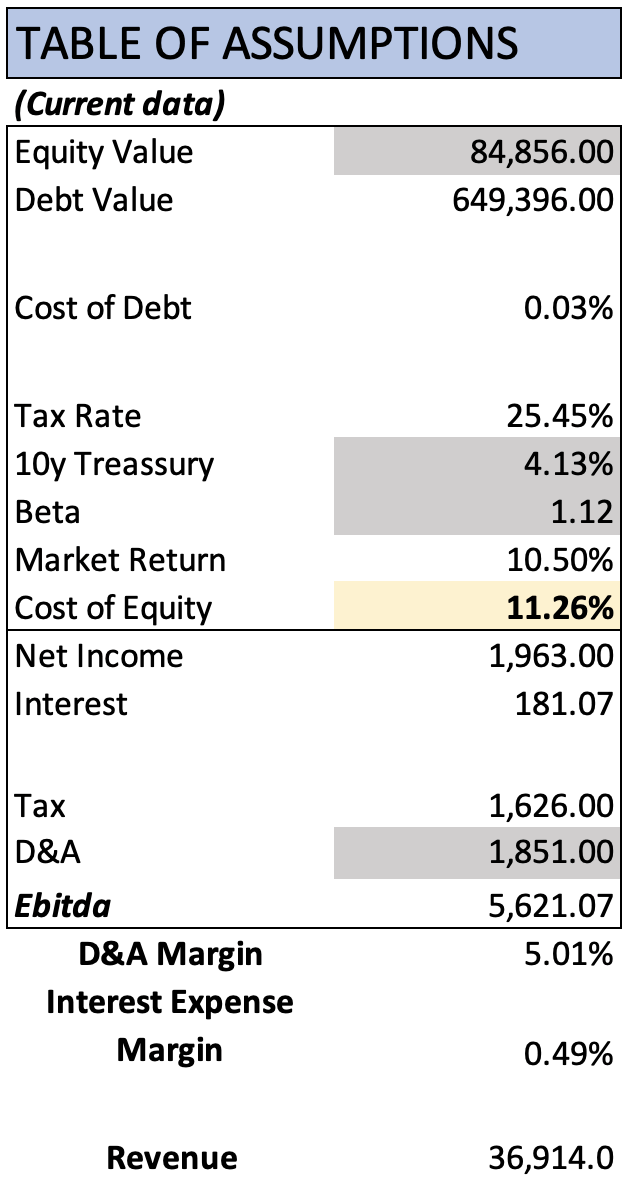

In the table provided below, I outline my expectations for the company following the merger. Upon comparing this projection to the company's current data, it becomes evident that the amalgamated entity closely aligns with my forecasted debt levels, surpassing my Free Cash Flow estimate by a significant margin. However, it falls short in terms of revenue, net income, and cash, shedding light on the financial challenges UBS is currently grappling with. Particularly concerning is the FCF, which is likely trending downwards in the short-term, as the cash from operations appears to be inflated due to the impact of the "change in other net operating assets." This adjustment is attributed to the acquisition of Credit Suisse's "Other operating assets,".

This predicament stems from UBS divesting operations from Credit Suisse, a strategic move that reduces revenue and, consequently, net income, while UBS has assumed nearly all the debt of the acquired Credit Suisse. Additionally, UBS has incurred fines resulting from the wrongdoing of the acquired bank.

Financials

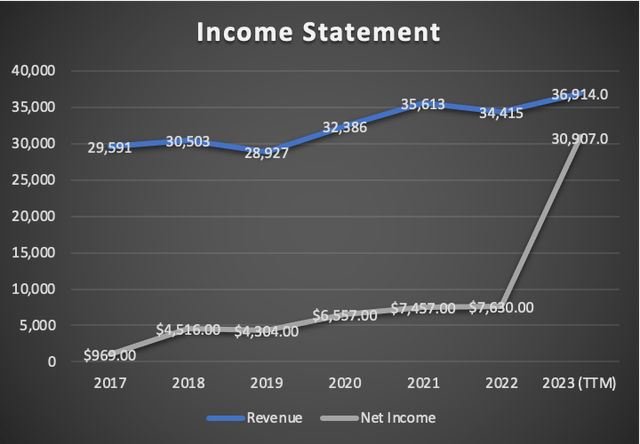

UBS has exhibited a commendable revenue growth rate of 4.1%. Since my previous article, where the trailing twelve-month [TTM] revenue stood at $33.8 billion, there has been a notable 8.4% increase, bringing the current revenue to $36.9 billion. Net Income has experienced a remarkable surge, presently standing at $30.9 billion, a substantial increase compared to the previous net income of $6.5 billion. However, it is essential to note that this surge is primarily attributed to a $28.9 billion gain in a goodwill adjustment. Excluding this extraordinary gain, net income would have amounted to approximately $2 billion, marking a 69% decrease from the previous net income of $6.5 billion.

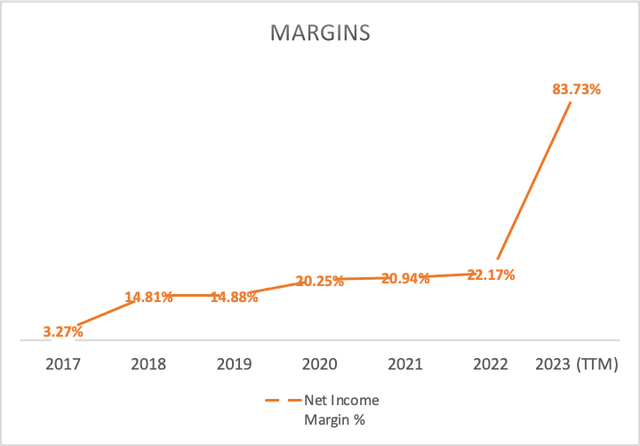

The current net income margin of 83.73% is indeed impressive, but when excluding the goodwill impairment, the net income margin would have been around 5%, significantly lower than the previous net income margin of 19.3%.

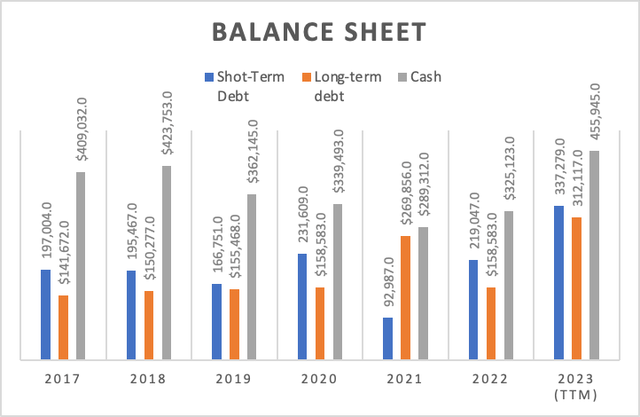

As for the balance sheet, it appears robust, with UBS theoretically capable of covering around 70% of its total debt load. This is far behind the three major American banks, JPMorgan, Bank of America, and Wells Fargo, as discussed in my article "JPMorgan vs. Banks of America vs. Wells Fargo." Where the three banks had enough cash to cover all of their debt, including short-term and long-term.

Turning back to UBS, the growth rate of its total debt has been substantial at 15.3%, mainly driven by the acquisition of Credit Suisse. Meanwhile, cash has grown at a more modest pace of 1.9%. Prior to the acquisition, Credit Suisse's cash stood at $428 billion, implying that UBS's cash should have been approximately $729 billion. However, the current cash position is $455.9 billion, indicating a substantial expenditure of $273 billion. This trend is concerning.

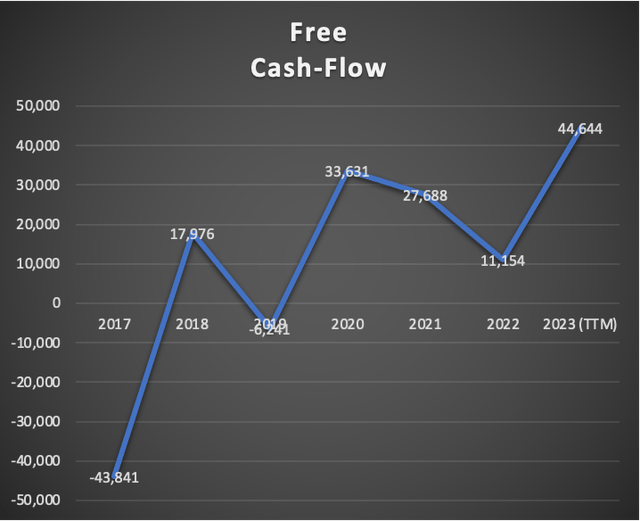

In the realm of free cash flow, a noteworthy positive shift has been observed. In my previous article, FCF was negative at -$41 billion. However, this turnaround is attributed to changes in net operating assets, a rare occurrence, as UBS recently acquired Credit Suisse's operating assets. More details on this can be found in the financials section of the UBS ticker on Seeking Alpha.

In conclusion, it is evident that UBS is currently performing worse than it appears when excluding extraordinary incomes earned in the fiscal year 2023. This trend is likely unsustainable, posing a concern for the future. Moreover, UBS's plan to wind down Credit Suisse raises questions, especially as they intend to use the proceeds from a nearly bankrupted company to pay down debt, introducing an element of risk given UBS's desperation in this endeavor.

Valuation

In this valuation, I will employ two residual earnings models for UBS, the first derived from Analysts' estimates, and the second based on my estimates, which have been refined from those presented in my previous article.

Author's Calculations

As mentioned earlier, this initial model is constructed using analysts' estimates, focusing on UBS's projected EPS, Revenue, revenue growth, and EPS growth.

| CAPM | |

| Risk Free Rate | 4.13% |

| Beta | 1.12 |

| Market Risk Premium | 6.370% |

| Required Rate of Return | 11.264% |

The determination of UBS's operating assets presents a nuanced challenge, given its significant Swiss domestic bank and extensive investment & wealth management operations across various countries. While domestic banking is confined to Switzerland, the investment and wealth management arms span multiple regions.

To ascertain net operating assets, I will deduct cash reserves from total assets, followed by subtracting current liabilities, encompassing deposits, current debt, and "other current liabilities." The latter serves as the operating liabilities in the formula, while all cash reserves are categorized as non-operating assets in this calculation. Consequently, the resulting difference from subtracting cash and marketable securities from total assets will yield the figure for operating assets.

Wall Street Prep Wall Street Prep

Analysts' Estimates

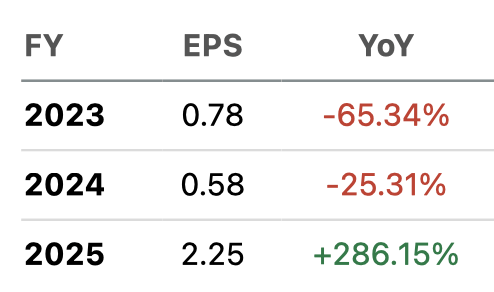

As mentioned earlier, this initial model is constructed using analysts' estimates, focusing on UBS's projected EPS, Revenue, revenue growth, and EPS growth.

Commencing with EPS, the estimates indicate $0.78 for FY2023, $0.58 for FY 2024, and $2.25 for FY2025. For revenue, the estimates stand at $40.6 billion for FY2023 and $47.8 billion for FY2024. Forward revenue growth is projected at 10.20%, while the 3-5-year long-term EPS growth rate is set at 7.83%. Both metrics will serve as key inputs for projecting revenue and net income beyond FY2024.

Seeking Alpha

In the table below, "operating income" is presented, calculated by multiplying the EPS by the number of shares outstanding and then incorporating the tax expenses. D&A and Interest, although not utilized in the Residual Earnings Valuation, are included, allowing for an appreciation of the expected EBITDAs.

| Revenue | Operating Income | Plus D&A | Plus Interest | |

| 2023 | $40,650.0 | $4,148.0 | $6,186.31 | $6,385.71 |

| 2024 | $47,840.0 | $3,501.3 | $5,900.18 | $6,134.85 |

| 2025 | $52,719.7 | $9,004.7 | $11,648.26 | $11,906.86 |

| 2026 | $58,097.1 | $9,709.8 | $12,622.97 | $12,907.95 |

| 2027 | $64,023.0 | $10,470.1 | $13,680.39 | $13,994.44 |

| 2028 | $70,553.3 | $11,289.9 | $14,827.65 | $15,173.73 |

| ^Final EBITA^ |

The resulting model yields a fair price of $17.49, indicating a downside of -39.7% from the current stock price of $29. Furthermore, for FY2028, the model projects a stock price of $33.57, translating into an annual return of 3.1% through 2028.

These estimates paint a bleak picture, suggesting potential catastrophe for investors. This pessimism could be attributed to the previously mentioned strategic logic: UBS's downsizing of Credit Suisse is impacting its revenue potential, while simultaneously shouldering the majority of Credit Suisse's debt and fines.

My Estimates

To initiate the formulation of my estimates, the first crucial step involves constructing revenue projections. Additionally, I have factored in the anticipated cost savings stemming from significant layoffs. According to my calculations, UBS would need to implement the dismissal of approximately 7,000 employees annually over a five-year period (something that I mentioned in my previous article) to achieve the targeted 35,000 job cuts. Moreover, I estimated a 20% reduction in Credit Suisse's revenue, equivalent to approximately $860 million per year for the next five years.

| UBS | Credit Suisse | Total | Net Income | Taxes | Operating Income | |

| 2023 | 33,758.00 | 25,821.50 | 59,579.50 | 3,693.93 | 1,626.00 | 5,319.93 |

| 2024 | 34,703.22 | 24,961.50 | 59,664.72 | 5,119.86 | 1,626.00 | 6,745.86 |

| 2025 | 35,674.91 | 24,101.50 | 59,776.41 | 12,313.55 | 3,133.80 | 15,447.35 |

| 2026 | 36,673.81 | 23,241.50 | 59,915.31 | 13,543.72 | 3,446.88 | 16,990.60 |

| 2027 | 37,700.68 | 22,381.50 | 60,082.18 | 14,789.22 | 3,763.86 | 18,553.07 |

| 2028 | 38,756.30 | 21,521.50 | 60,277.80 | 14,645.95 | 3,727.39 | 18,373.34 |

Now, how did the net income materialize? It was derived through the net income margins obtained from the previous model. Are these margins feasible? Absolutely, they fall within the range of the average net income margin recorded by UBS from 2017 to 2023. Could they potentially be lower due to the integration of Credit Suisse? I am inclined to believe otherwise because UBS's strategy revolves around retaining only those operations that align with UBS's established business style, therefore maintaining UBS-like margins.

| Net Income Margin |

| 6.20% |

| 3.92% |

| 13.62% |

| 13.32% |

| 13.04% |

| 12.76% |

Nevertheless, it's crucial to note that these are expense cuts, and consequently, they will be directly factored into net income.

| Revenue | Operating Income | Plus D&A | Plus Interest | |

| 2023 | $40,650.0 | $4,148.0 | $6,186.34 | $6,385.73 |

| 2024 | $59,664.7 | $6,745.9 | $9,737.66 | $10,030.33 |

| 2025 | $59,776.4 | $15,447.3 | $18,444.75 | $18,737.96 |

| 2026 | $59,915.3 | $16,990.6 | $19,994.96 | $20,288.86 |

| 2027 | $60,082.2 | $18,553.1 | $21,565.81 | $21,860.52 |

| 2028 | $60,277.8 | $18,373.3 | $21,395.88 | $21,691.56 |

| ^Final EBITA^ |

As illustrated by the model, it produces a fair price of $53.40, representing an upside of 84% from the current stock price of $29. Looking forward to FY2028, the model indicates a stock price of $99.95, translating into annual returns of 48.95% throughout the year.

Admittedly, this valuation appears notably optimistic when compared to consensus estimates. However, I maintain the belief that these projections are achievable. Banking operations, being highly liquid, coupled with UBS effectively eliminating its second rival from the competition and evolving into a $5 trillion wealth manager, contribute to this optimism.

Moreover, the Schweizerische Nationalbank (OTCPK:SWZNF) has pledged support for UBS. Even though UBS has expressed confidence in not requiring assistance, the question remains: If the need arises, would Switzerland truly deny it?

Additionally, to dissipate fear, I decided to also halve the possible savings due to the cost-cutting measures, and the fair price comes out at $34.67, and the future price at $65.36.

Risks to Thesis

The primary risk that stands out is associated with Credit Suisse's domestic banking division. There is a concern that the Swiss Government might be hesitant to let go of all the jobs from Credit Suisse. However, it's essential to note that the domestic bank represented one of Credit Suisse's most profitable segments. Consequently, UBS requires its continued operation to ensure it can meet all of Credit Suisse's financial obligations.

Another noteworthy risk is the simultaneous reduction in Credit Suisse's size by UBS, despite assuming a substantial amount of debt. The combination of falling revenue and escalating debt poses significant challenges. As previously mentioned, UBS aims to trim Credit Suisse's balance sheet by approximately 20-40%, with plans to eliminate around 35,000 jobs. This strategic move introduces complexities that warrant careful consideration and management.

Conclusion

In conclusion, the intricate landscape of UBS's strategic maneuvers and impending merger with Credit Suisse unfolds a narrative of both promise and peril. While ambitious cost-cutting initiatives and the potential for synergies present an optimistic outlook, there looms the shadow of substantial risks. The uncertainties surrounding the fate of Credit Suisse's domestic banking operations, and the inherent challenges of downsizing while grappling with increased debt, underscore the intricate balancing act UBS faces. The first valuation model, based on analysts' estimates, suggests a fair price of $17.49, indicating a downside of -39.7% from the current stock price of $29. On the contrary, the second model, incorporating expense cuts projections, yields a more bullish fair price of $53.40, signifying an upside of 84%. As stakeholders navigate through the complexities of this transformative period, the interplay of economic conditions, regulatory dynamics, and the execution of UBS's strategic vision will ultimately determine whether the envisioned success materializes or if the path forward proves to be more challenging than anticipated.