Bet_Noire

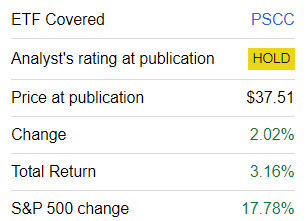

It has been a while since I shared with my dear readers an in-depth assessment of the Invesco S&P SmallCap Consumer Staples ETF (NASDAQ:PSCC). In the previous note presented in April 2023, I acknowledged that there were a few bullish arguments, including PSCC's remarkable value tilt and compelling past performance. However, its exposure to the quality factor was too small, which, together with liquidity concerns, resulted in this vehicle earning only a Hold rating from me. Today, I would like to offer a fresh look at its factor exposures to illustrate why a rating upgrade remains unjustified.

Recapping the strategy

According to the Invesco website, the cornerstone of PSCC's strategy is the S&P SmallCap 600 Capped Consumer Staples Index, which it has been tracking since its inception in April 2010. The index has a comparatively simple methodology: the idea is to track a group of GICS consumer staples stocks, "including tobacco, textiles, food and beverage, and nondiscretionary retail," selected from the S&P 600, a well-known U.S. small-cap echelon benchmark (a nuance here is that its components might be valued at much more than $2 billion). The index is reconstituted and rebalanced four times a year: in March, June, September, and December.

Remarks on performance attribution

Comparing the datasets as of April 17, 2023, and the one from January 22, which I used in the factor analysis, I found out that PSCC's portfolio has not changed much. Just two names were removed: Hostess Brands and Seneca Foods (SENEA), which accounted for 6.59% and 0.54% of the net assets, respectively. Hostess traded on NASDAQ with the ticker TWNK until its acquisition by The J. M. Smucker Company (SJM) was completed in November. Seneca was removed from the S&P 600 in June, thus becoming ineligible for the small-cap consumer staples index as well. At the same time, just two companies were added, namely WK Kellogg Co (KLG) and Energizer Holdings (ENR), now accounting for 5% and 2%, respectively.

The screenshot taken on January 23 (Seeking Alpha)

Since the portfolio has remained almost unchanged, it is much easier for us to investigate what exactly has detracted from the fund's performance since the previous note, thus resulting in it meaningfully underperforming the S&P 500. So the primary reason is that 19 of its holdings out of those that retained their place in the portfolio have seen their share prices going down, with the following five names delivering the worst results:

| Ticker | Company | Weight as of April 17, % | % decline |

| (NUS) | Nu Skin Enterprises | 4.05 | -55.72% |

| (MED) | Medifast | 2.14 | -44.58% |

| (UNFI) | United Natural Foods | 3.19 | -42.44% |

| (HAIN) | The Hain Celestial Group | 3.17 | -39.45% |

| (BGS) | B&G Foods | 2.19 | -33.80% |

Based on the comparison of prices as of April 18 and January 23

Nine holdings that have seen capital gains over that period were unable to offset this, even despite them delivering rather impressive returns, especially ELF.

| Ticker | Company | Weight as of April 17, % | % gain |

| (SMPL) | The Simply Good Foods Company | 6.13 | 13.7% |

| (CENT) | Central Garden & Pet Company | 0.79 | 19.7% |

| (ANDE) | The Andersons | 2.64 | 20.6% |

| (WDFC) | WD-40 Company | 5.1 | 41.3% |

| (ELF) | e.l.f. Beauty | 9.25 | 66.2% |

An important remark here is that, thanks to its meteoric share price rise, ELF has recently joined the S&P 400 index, which is supposed to track the U.S. mid-cap equity echelon. As of January 22, PSCC held 20 shares in it (implying an almost zero weight); in the dataset as of January 23, there were no ELF shares.

What is the factor story?

Compared to April of last year, PSCC still maintains a value tilt, with a few minor improvements on the quality front. On the negative side, its exposure to the growth factor remains rather small, which I believe can be a drag on its performance going forward.

Value

| Metric | Holdings as of January 22 |

| Market Cap | $2.42 billion |

| Enterprise Value | $3.06 billion |

| EY | 4.16% |

| P/S | 1.81 |

| EBITDA/EV | 7.18% |

| FCFY | 10.88% |

Calculated by the author using data from Seeking Alpha and the fund

PSCC's portfolio is still dominated by mid-caps, as illustrated by its weighted-average market cap, which is well above the $2 billion limit (close to 59% of its holdings have a market cap above that level). In April, it was slightly higher at $2.65 billion. As usual, I should remind investors that this is a typical issue for 'small-cap' funds, so they should be prepared for overweening exposure to mid-caps in the cases of most passively managed vehicles targeting smaller companies.

Anyway, the ETF offers an interesting value story, which is not visible upon cursory inspection. Truly, its earnings yield looks a bit depressed (the S&P 500 has an about 4% EY now), but it is skewed by loss-making companies like HAIN, so it is worth paying more attention to alternatives that offer a different perspective. For example, the debt-adjusted EY (EBITDA/EV) looks more than healthy at above 7%, bolstered mostly by such holdings as MED, Cal-Maine Foods (CALM), and USANA Health Sciences (USNA). The levered FCF yield is even more appealing, at almost 11%. Besides, companies with a B- Quant Valuation rating or higher account for 33.5%, which is a relatively strong result.

Quality

Though PSCC has small exposure to companies with a B- Quant Profitability rating or better (only around 47%), one notable improvement can still be spotted on the quality front. More specifically, the fund has a much lower allocation to cash flow-negative companies at this juncture, just 6.1% vs. 12.4% as of the previous assessment. Still, an around 40 bps decrease in the weighted-average Return on Total Capital is a disappointment.

| Metric | Holdings as of January 22 |

| ROTC | 10.96% |

| ROA | 7.66% |

| Total Debt/EBITDA | 2.82 |

| EBITDA Margin | 14.1% |

Calculated by the author using data from Seeking Alpha and the fund

Growth

Investors should not expect robust growth characteristics from the PSCC portfolio. Even though there are a few notable growth stories under the hood, like The Chefs' Warehouse (CHEF), which is forecast to deliver almost 52% EBITDA and over 28% revenue growth going forward, portfolio-wise metrics look mostly subdued, as shown below.

| Metric | Holdings as of January 22 |

| EPS Fwd | 5.99% |

| Revenue Fwd | 3.94% |

| EBITDA Fwd | 5.29% |

Calculated by the author using data from Seeking Alpha and the fund

The primary reasons for these figures being so bleak are summarized below:

- 21.5% are expected to face pressure on the top line, or margins, or both, resulting in EBITDA contraction; this is close to the April level (~20%);

- companies that are forecast to deliver lower sales also account for about a fifth of the net assets (16% in April);

- lower earnings per share are anticipated for 17.4%, which looks like an improvement vs. April, when close to 24% of the holdings were forecast to deliver an EPS decline.

A fresh look at performance

Over the May 2010–December 2023 period, PSCC underperformed the iShares Core S&P 500 ETF (IVV) by around 15 bps, primarily because it has a much weaker 2023 than this bellwether fund (14.8% vs. 26.3% total return). At the same time, it beat the First Trust Consumer Staples AlphaDEX Fund (FXG), the Consumer Staples Select Sector SPDR ETF (XLP), and the iShares Core S&P Small-Cap ETF (IJR).

| Portfolio | IVV | FXG | PSCC | XLP | IJR |

| Initial Balance | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Final Balance | $52,175 | $40,597 | $51,238 | $37,787 | $41,633 |

| CAGR | 12.85% | 10.80% | 12.70% | 10.22% | 11.00% |

| Stdev | 14.87% | 13.49% | 15.83% | 12.21% | 19.46% |

| Best Year | 32.30% | 42.25% | 45.34% | 27.43% | 41.32% |

| Worst Year | -18.16% | -11.49% | -6.71% | -8.07% | -16.19% |

| Max. Drawdown | -23.93% | -19.73% | -24.10% | -13.63% | -36.12% |

| Sharpe Ratio | 0.83 | 0.76 | 0.78 | 0.78 | 0.59 |

| Sortino Ratio | 1.31 | 1.27 | 1.27 | 1.28 | 0.9 |

| Market Correlation | 1 | 0.76 | 0.7 | 0.7 | 0.91 |

Data from Portfolio Visualizer

Do investors need small- and mid-cap consumer staples stocks in 2024?

I believe while investors might consider minor allocations to SMID consumer staples, they do not necessarily need them to bolster the performance of their portfolios in 2024, as they do not offer significant growth characteristics. Besides, liquidity concerns remain. All in all, the rating on PSCC remains unchanged.