StarZImages/iStock via Getty Images

The market appears to have gone all in on Advanced Micro Devices, Inc. (NASDAQ:AMD), rising sharply after it reports results next week. If earnings and guidance beat expectations, a rally to $200 doesn't seem far-fetched, if earnings and guidance miss, an outcome similar to Intel and Tesla may await.

AMD will report fourth-quarter results on January 30 after the close of trading. Analysts see earnings growing by 11.9% this quarter to $0.77 per share, while revenue is expected to grow by 9.5% to $6.1 billion. Historically, adjusted gross margins are a big number for AMD and are expected to expand to 51.5% from 51% last year.

AMD's stock has rocketed higher in recent months as investors see a fortune in the stock driven by the growth of data centers and the increased usage of AMD's artificial intelligence GPUs. It sets expectations high for the data center business, with revenue expected to grow by 39% to $2.3 billion in the fourth quarter, while the client-side segment is expected to grow by 68% to $1.5 billion. The growth will need to be present in those two units because gaming is expected to decline by 24.2% to $1.2 billion, and the embedded unit will drop by 24% to $1 billion.

Guidance will be the key, especially if the stock should continue to gain. Analysts' consensus estimates forecast earnings to grow by 14.8% in the first quarter to $0.69 per share, on revenue growth of 8.1% to $5.785 billion, as adjusted gross margins expand to 51.8% from 50% last year.

Valuation Is Priced For Perfection

Expectations are high for AMD based on the P/E ratio over the last twelve months of earnings, which has risen to more than 70 and only rose higher when the company emerged from years of lackluster results in 2018 and 2019. Also, the price-to-sales ratio has climbed to 13.2, levels not seen in a few years and, more importantly, at the upper end of the historical range. Given the stock's monstrous rise, there is no room for error when this company reports results.

Options Market Is Extremely Bullish

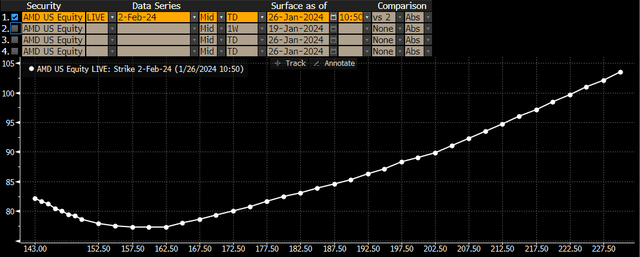

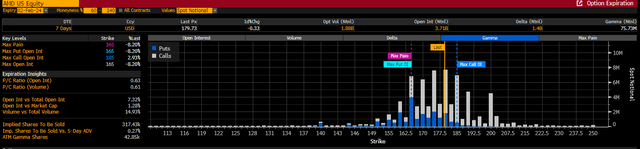

The options market seems to be even more bullish than the stock market regarding AMD. With the stock trading around $180, the skew in implied volatility is clearly to own a move higher in the shares post results, as noted by the rising implied volatility the higher the stock price increases for the expiration date on February 2.

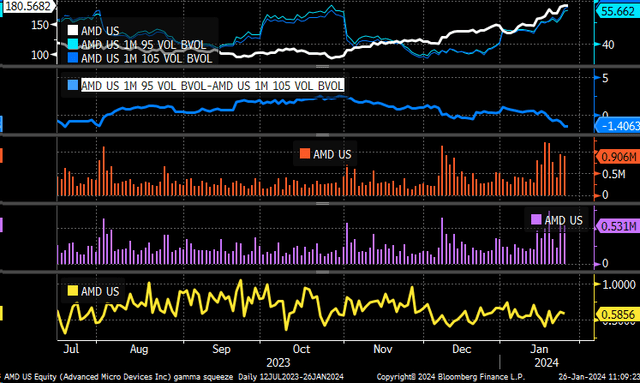

Call volume in AMD has been heavy, and the 105% moneyness 1-month options are trading with a higher implied volatility level than the 95% moneyness 1-month options. The heavy call volume and the skew in the implied volatility level in AMD and the rising stock suggest that the stock is driven higher by the heavy demand to own upside calls in AMD.

Too Much Optimism Could Be A Bad Thing

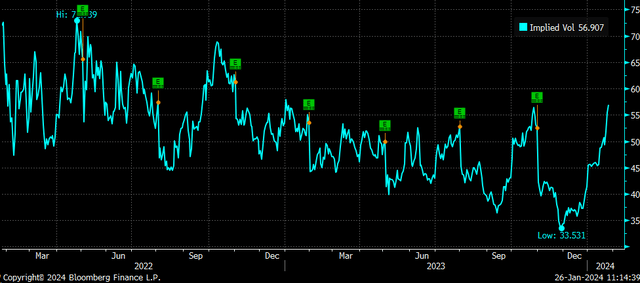

But all of this bullish enthusiasm could hurt the stock after the report. Because heading into results, implied volatility tends to rise, and implied volatility tends to fall sharply after results. It means that options traders are paying a lot to own calls in AMD, and once the earnings pass, the IV in AMD will fall sharply.

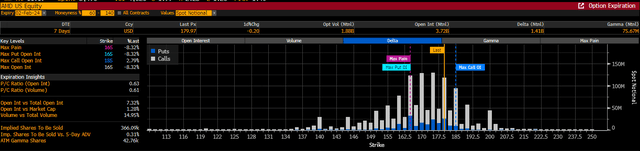

So, while the demand to own calls going into the results is bullish, it could be bearish post-results because the value for all the calls will diminish once the IV falls. Right now, there is a massive build of call delta in AMD, and based on the profile of implied volatility, it would seem that most calls have likely been bought to open, which means the sellers of the calls are likely market makers who are hedged. If options traders were selling calls, the IV for AMD would decline the higher the stock price rises, which is not the case currently. Once the results hit, the IV will drop, and it will cause a repricing in the value of the calls, which means that hedges will need to be unwound, causing selling in the stock.

What this means is that AMD will need to report not only results that are good enough to compensate for large bullish expectations already built in, as noted by the stretched valuation of the shares on a historical basis, but will need to be good enough to overcome the very high level of optimism in the options market. In this case, a large amount of call gamma built up around the $185 strike price for February 2. The stock will need to clear the $185 level following results, or it will likely see a drift lower as implied volatility levels drop and hedging flows unwind.

Going into results, the expectations for AMD are incredibly high, and the options market is betting on a decisive outcome. If the outcome is strong, it could lead to a push higher in the shares, leading to a test of $200. If the results do not meet the expectations or worse, the guidance is weak, which could result in a massive decline in the shares.

The market has placed a big bet on AMD reporting stellar results.

Don't Be Reactive; Gain a Deeper Understanding and Anticipate Future Market Trends

TRY READING THE MARKETS AND GET THE FIRST 2-WEEK FREE *

- Reading the Markets identifies macro trends likely to influence the stock market.

- I utilize economic data and macroeconomic forces to forecast the potential directions of interest rates, the value of the dollar, and commodity markets, along with their possible impacts on stocks.

- These relationships are more crucial than ever when making short- and long-term trading or investment decisions.

- I offer daily videos or podcasts complemented by a written commentary.

*2-week trial not available on Mobile App