Kwanchanok Taen-on

Interest rates and inflation have been the overarching themes in financial markets for the last couple of years and that situation won't change any time soon. Our clever, initial remedy was to identify fixed-to-floating rate preferreds that would soon convert from fixed to floating and insulate us from the pain of rising interest rates. The AGNC Investment Preferred Series ((NASDAQ:AGNCL), (AGNCM), (AGNCN), (AGNCO), and (AGNCP)) are each fixed-to-floating. Our objective today is to consider if a change of strategy is warranted in the ever changing economic environment.

The Latest

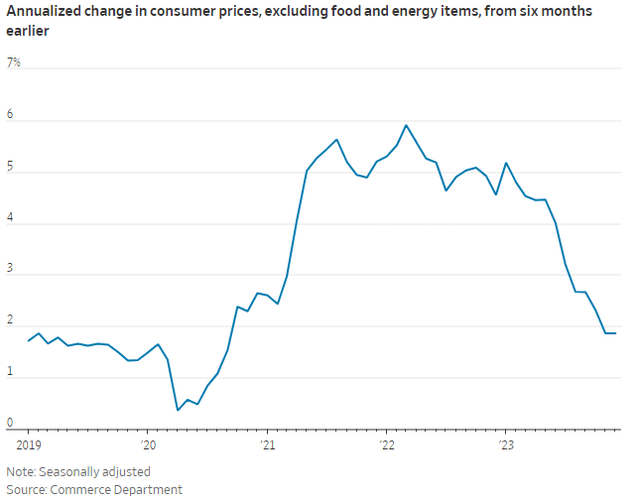

The Bureau of Economic Analysis' January 26th personal consumption expenditures (CPE) report got tongues wagging with renewed calls and expectations for Fed interest rate cuts in the first half of 2024. CPE, the Fed's favored inflation gauge, rose 0.2% in December from November, putting it 2.6% above December 2022. The pressure for the Fed comes from the pace at which inflation has cooled; in the last six months, prices rose at just under 2% annualized.

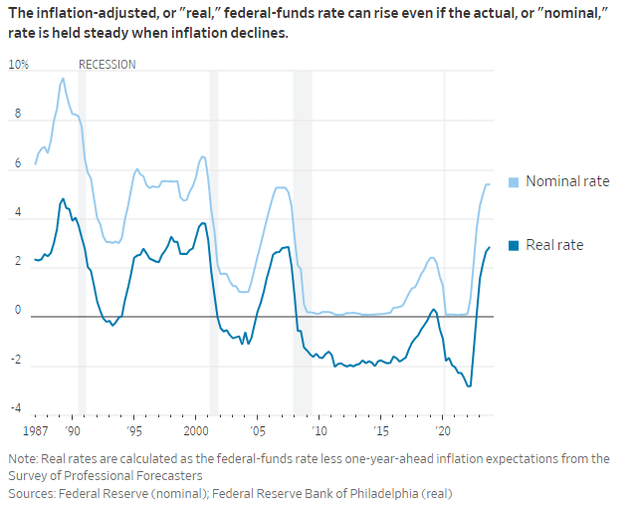

The reason the Fed will feel pressure to cut rates is that as the rate of inflation declines, economic policy becomes more restrictive if the Fed does nothing to lower the Nominal Fed Funds rate.

Federal Reserve Bank of Philadelphia

In our fixed-to-floating preferred allocations we want to understand not only which way interest rates are going, but also how they are moving on the duration of the yield curve.

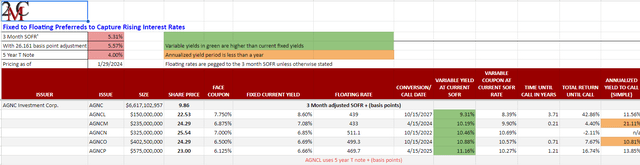

AGNC Preferred Series

The table above details the entire equity capital stack for AGNC Investment (AGNC), both common and preferred shares. The preferred shares are all fixed-to-floating and each carries a $25.00 liquidation preference, but they vary in the terms and timing of their callability and conversion.

AGNCN converted to floating rate on October 15, 2022 and has since enjoyed market pricing at slightly above par as a result of it paying a double digit yield under current adjusted SOFR rates. AGNCM and AGNCO are next to convert to floating rate (04/15/24 and 10/15/24, respectively) and, as such, have seen their share prices drifting toward the $25.00 par as the calendar advances. AGNCP converts on 04/15/25 and, if interest rates don't change dramatically, might see its share price appreciate as that date approaches.

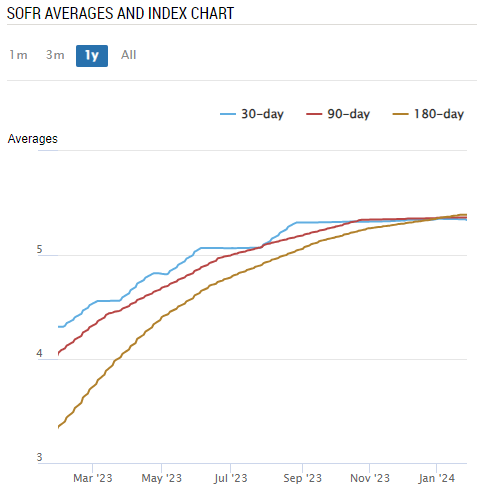

Though on different schedules and terms, these four preferreds conversions are linked to the 3 month SOFR rate (previously linked to the demised 3 month LIBOR rate). SOFR is on the short-term end of the yield curve and, consequently, tacks close to the movements in the Fed Funds rate.

Federal Reserve Bank of New York

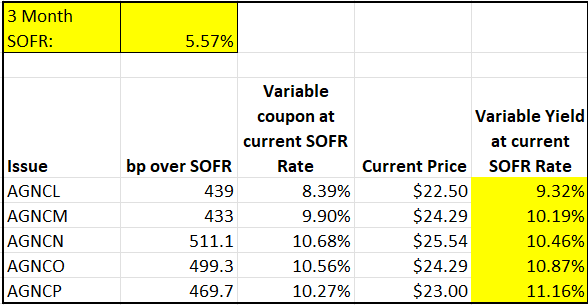

As the above graph describes, SOFR rates plateaued late in the 3rd quarter, shortly after the Fed's last rate hike. If SOFR stays at current levels, this is what the AGNC preferreds' yields look like on conversion.

Flat Fed Funds Rate

2MCAC

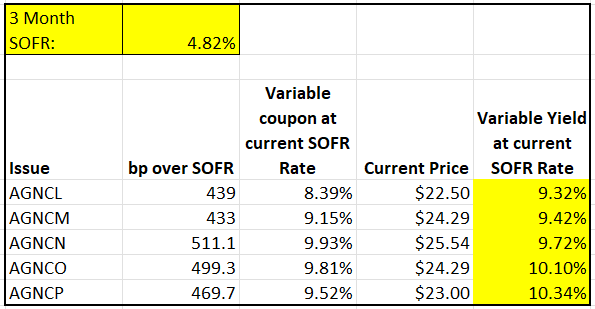

At the last FOMC meeting, it was revealed that Fed governors contemplate as many as three rate cuts in 2024. If SOFR hews close to the course of a 75 basis points rate cut, this is what the AGNC preferreds' yields might look like.

75 Basis Points Fed Funds Rate Cut

2MCAC

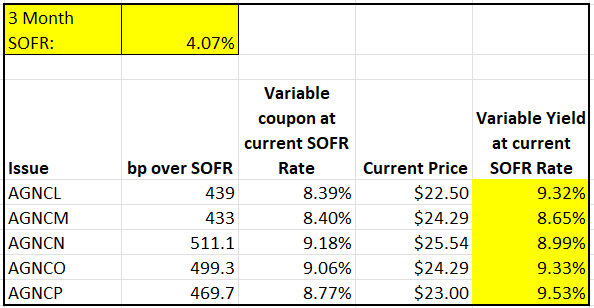

If inflation continues to trend lower, the Fed may feel they need to cut rates further to keep monetary policy unrestrictive to economic growth. If we see 150 basis points of rate cuts, this is what the AGNC preferreds' yields might look like.

150 Basis Points Fed Funds Rate Cut

2MCAC

The gist of the examples is to illustrate that securities structured to hedge and protect against higher interest rates become less compelling if the higher interest rates cease to exist.

The Yield Curve

We are the first to admit that we did not see COVID coming. We also didn't anticipate the Fed raising rates 500 basis points, even after they started raising. That said, we also don't know what rates will be two years from now. That is why we are today trying to examine various scenarios within interest rate environments.

AGNC reported 4Q23 results on January 22nd and on the earnings call they expressed optimism about the current investment environment. Dynex Capital (DX) reported on January 29th and were similarly enthused. Of particular interest on Dynex's call was CIO Smriti Laxman Popenoe's comments on where she thought interest rates are headed. From the Dynex Capital earnings call…

Trevor John Cranston JMP Securities LLC

"Looking at the rate positioning slide as of 12/31, it looks like you guys were set up to generally do better if rates move higher, particularly at the longer end of the yield curve. And that's obviously come to pass so far as we sit in January today. So I was wondering if you could maybe sort of update us as we sit today, kind of on your rate positioning and your view on the upgrade risk versus downgrade risk where we sit today."

Smriti Laxman Popenoe President, Chief Investment Officer & Director

"Trevor, thank you for the question. So yes, you're right. The hedges are contemplated in the back end of the yield curve, and we are positioned to benefit from a steepening yield curve, where front end rates go down, and back end rates either remain the same or go higher. So a lot of this is driven by the macroeconomic view that we described during the prepared remarks. And really recognizing that while we may have some level of market pricing in the front end, as I mentioned, there's 150 basis points of cuts already priced in to the front end, the yield curve, which will really benefit our financing costs. In the long-term, we feel like it makes more sense, given a number of other factors that have hedges concentrated in the back end of the curve. So in general, we're positioned actually to benefit from a steeper yield curve, and that's what's reflected in the hedge positioning. And then just in terms of just an update from year-end, I believe the book value is up about 1% or so to [ $13.50 ] area."

So, DX is betting that the yield curve will, finally, un-invert and that long term treasury rates will either remain flat or rise. That scenario describes the difference between the four fixed-to-floating, SOFR indexed preferreds, described above, and AGNCL, which has a floating rate, beginning in 2027, that is indexed to the 5 year treasury yield.

If, as DX CIO Popenoe forecasts, long rates stay flat or rise in the un-inverting of the yield curve, AGNCL will pay its current 8.60% yield against market price until conversion in 2027 and then pay a rate indexed to the going 5 year treasury yield. As I said, we don't know what rates will be in 2027.

The difference, and the potential opportunity, is that AGNCL now trades at $22.50 against a $25 liquidation preference. Fixed income investing is boring until you add a positive total return component; total return calculations relate to yield +/- capital appreciation potential. The AGNC preferreds that have converted or are approaching conversion are priced near or above par; they have no capital appreciation potential. AGNCL at $22.50 has a 10% upside to par.

Fingers crossed, we hold AGNCL to collect an 8.60% yield and the opportunity to sell at par in the event that the yield curve un-inverts.

Make your money work for you

The REIT

market has become significantly underpriced making it a great time to get in to

the right REITs. To help people get the most updated REIT data and

analysis I am offering 40% off Portfolio Income Solutions, but you can only get

it through this link.https://seekingalpha.com/affiliate_link/40Percent I hope you enjoy the plethora of data tables, sector analysis and deep dives into opportunistic REITs.