fotoVoyager

Elevator Pitch

I still rate SK Telecom Co., Ltd. (NYSE:SKM) [017670:KS] stock as a Buy. In my prior October 10, 2023 update, I wrote about SKM's dividend outlook and its 2028 top line target.

SK Telecom recently reported above-expectations Q4 2023 earnings, but the market still values SKM at a low-single digit EV/EBITDA multiple which is linked in part to what is known as the "Korea discount." The financial regulator and the government in South Korea have the intention of implementing changes to allow Korean companies to command higher valuations. In the case of SKM, the company is actively buying back shares and shifting its business mix towards AI-related offerings, and these actions are potential value re-rating drivers for the stock.

Q4 2023 Earnings Surpassed Expectations

SK Telecom issued a set of presentation slides revealing the company's most recent financial results for the fourth quarter of 2023 on February 5, 2024 morning Korea time (or February 4, 2024 evening US time). SKM's Q4 2023 earnings were better than what the sell side had anticipated earlier.

The company's operating profit expanded by +17% YoY to KRW297 billion for Q4 2023, which was +2% higher than the consensus operating income estimate of KRW292 billion (source: S&P Capital IQ). Also, SK Telecom's actual Q4 2023 net income attributable to shareholders of KRW176 billion turned out to be +16% above the consensus bottom line forecast of KRW152 billion as per S&P Capital IQ data.

In its Q4 2023 earnings presentation, SKM credited its latest quarterly bottom line beat to the good performance of the "B2B (Business-to-Business) business on the back of new orders and growth of Data Center utilization rates", and its "efforts for cost efficiency." In my earlier October 20, 2022 write-up for the company, I had already mentioned that SK Telecom's data center business is "still in the very early innings of growth" with the potential for operating profitability improvement driven by "economies of scale."

Specifically, SK Telecom's B2B business achieved a +6% YoY increase in segment revenue in Q4 2023, which was better than the company's overall top line expansion of +3% YoY for the recent quarter. SKM's EBITDA margin also improved by +20 basis points YoY from 27.1% for Q4 2022 to 27.3% in Q4 2023. This implies that SKM's expense optimization plans are working well.

However, SK Telecom's valuations are undemanding notwithstanding the recent quarterly earnings beat. The issue relating to the valuation discount for SKM's shares is addressed in subsequent sections of this article.

Regulator And The Government Want To Tackle The Korea Discount Issue

Year-to-date up to February 2, 2024, SKM's shares declined by -1.4%, which represents a 540 basis points underperformance as compared to the S&P 500's +4.0% rise in 2024 thus far. However, this benchmarking of SK Telecom's stock price performance against the S&P 500 might not be fair, considering that SKM is a Korean company whose share price trajectory could be more closely linked to the Korean equity market.

In 2024 thus far, SK Telecom's shares are in negative territory, similar to the Korean market index, KOSPI, which is down by a wider -3%. It will be reasonable to attribute a meaningful part of SK Telecom's underperformance to the valuation discount assigned to listed Korean companies in general.

A recent February 1, 2024, Bloomberg article defined the "Korean discount" as Korean stocks trading a significant valuation discount to "overseas peers" driven by factors like "poor corporate governance and meager shareholder returns." There is proper justification for claiming that SK Telecom, a Korean company that is listed in South Korea and also has American Depositary Shares traded in the US, is also a victim of the Korean discount.

SK Telecom is now valued by the market at 3.7 times consensus next twelve months' EV/EBITDA. In comparison, its US peers AT&T (T) and Verizon (VZ) are currently trading at consensus next twelve months' EV/EBITDA multiples of 6.5 times and 7.2 times, respectively.

Earlier on January 23, 2024, The Korea Times reported that South Korea's Financial Services Commission has introduced a "Corporate Value-up Program" that is targeted at "supporting (Korean) companies to enhance their market values." A February 1, 2024 report (not publicly available) issued by Jefferies (JEF) titled "Korea Reforms: Lessons From Japan" noted that the "Corporate Value-up program" will potentially include initiatives like mandatory corporate disclosures for "shareholder return policies and plans for creating value" and "an index/ETF of high-shareholder-value companies." In the February 1, 2024 Bloomberg article which I referred to earlier, South Korea's finance minister was quoted as saying that "the (Korean) government will increase the attractiveness of the local stock market by improving poor shareholder returns."

It is positive that there is a call from the top to address the valuation discount for Korean businesses. More importantly, it is easy to imagine that Korean stocks as a whole can trade at better valuations if a growing number of South Korean businesses place a greater emphasis on shareholder value enhancement.

In the subsequent section, I touch on the things that SK Telecom is doing on its own to drive a positive re-rating of its valuations.

SKM Is Doing Its Part To Warrant A Narrower Korea Discount

SKM has been taking actions to justify a higher valuation for its stock.

SK Telecom disclosed in July last year that it signed a contract with a securities broker to execute the planned KRW300 billion repurchase of its own shares between late-July 2023 to late-January 2024. In its latest Q4 2023 earnings presentation, SKM indicated that this KRW300 billion buyback plan has already been completed.

Share repurchases amounting to KRW300 billion translate into a buyback yield (share buybacks divided by market capitalization) of 2.8%. The consensus next twelve months' dividend yield projection for SK Telecom is 6.8% now as per S&P Capital IQ data. As such, SK Telecom is potentially offering a shareholder yield (buybacks and dividends divided by market capitalization) of close to 10%, or 9.6% to be exact.

Considering SKM's enticing shareholder yield, it is safe to think that SK Telecom should be valued by the market at a narrower discount as compared to other Korean stocks that offer relatively less attractive shareholder returns.

Separately, AI is both a key structural growth trend and a "hot" investment theme, which means that increasing business exposure to AI is probably a good way to reduce the Korea discount.

SKM's goal is to increase the percentage of sales contributed by the company's AI-related services and products from below 10% now to 36% by FY 2028. This target is achievable in my opinion, taking into account SK Telecom's venture into various AI-related business areas and its collaboration with other leading technology companies.

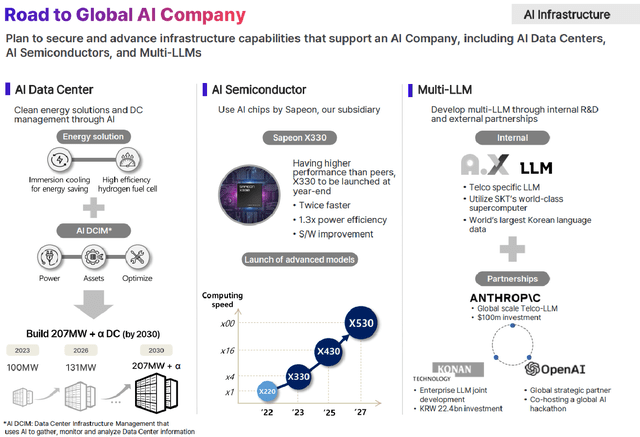

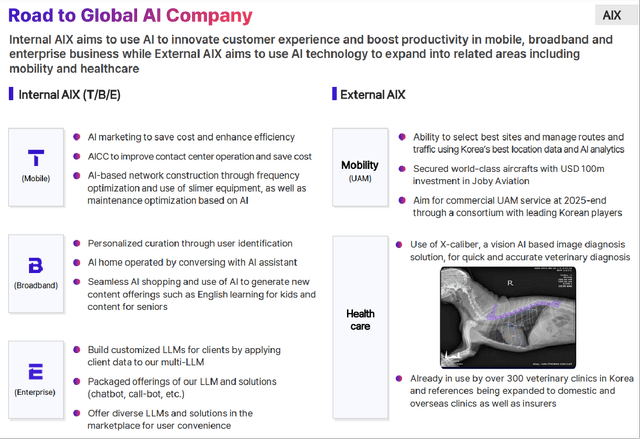

Specifically, SK Telecom has plans to grow in areas such as AI infrastructure and AI digital transformation (AIX), as detailed in the charts presented below.

SK Telecom's AI Infrastructure Plans

SKM's Investor Presentation Slides

SK Telecom's AI Digital Transformation Offerings

SKM's Investor Presentation Slides

In a recent January 2024 interview with local media publication The Korea Herald, the "head of the company's AI assistant service" for SK Telecom revealed that SKM has "cooperated with big tech firms" to "accelerate our global business expansion" in the area of AI. One of the prominent companies that SK Telecom has as its partner is OpenAI, best known for its ChatGPT service.

Closing Thoughts

The valuation discount for Korean stocks in general and SK Telecom specifically might potentially narrow going forward, considering recent market and corporate developments. This explains why I am sticking with a Buy rating for SKM.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like "Magic Formula" stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!