Kirpal Kooner

Arbor Realty Trust (NYSE:ABR) is set to face a more challenging environment, but the company looks well prepared and the dividend seems safe.

Company Profile

ABR is a real estate investment trust (“REIT”) that operates in two business segments. In its Structured Business, the firm invests in structured finance assets within the multifamily, single-family rental (“SFR”) and commercial real estate markets. It primarily invests in bridge loans, but also will invest in mezzanine debt as well as junior participating interests and preferred and direct equity. It also will invest in real property either through joint ventures or directly. At the end of Q3, about 87% of its Structured portfolio was in multifamily bridge loans.

In its Agency Business, the company originates, sells, and services multifamily loans through Fannie Mae, Freddie Mac, Ginnie Mae, the FHA, and HUD. The company retains the servicing rights and manages most of the loans it originates from but will pool and securitize the loans and sell tranches in them to third-party investors. It also generally holds the highest risk tranche of its securitizations.

Dealing With A Challenging Environment

ABR is very much tied to the multifamily housing market, with much of its business providing non-recourse bridge loans with interest only payments. Its bridge loans typically are for 3 years, with the possibility of extensions. Now with this type of lending comes credit risk, and ABR management has been warning of a challenging environment over the next few quarters.

One of the issues multifamily property owners have been dealing with is higher interest rates and subsequently higher cap rates. Cap rates are a property’s net operating income divided by its asset value and are similar to the yield on a bond. It is one of the main metrics real estate investors look at when valuing rent-producing properties.

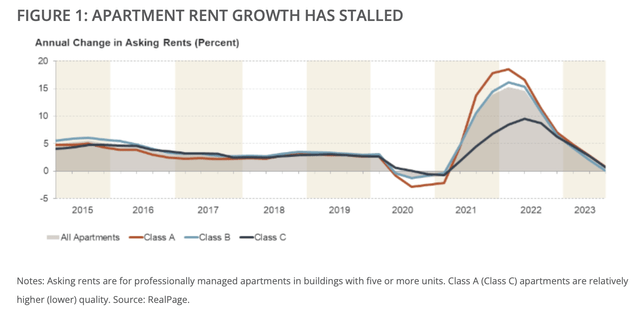

Similar to yields on bonds, when rates rise, cap rates generally should follow, which they have, being steadily on the rise since Q2 2022. Now this can come from net operating income, or lower property values. Rents soared in 2021 and 2022, but increases stalled in Q3, up only 0.4%. Meanwhile, costs are still elevated. At the same time, there are a lot of new multifamily units under construction, with 440,000 unit deliveries expected in 20-24 and 900,000 total units under construction. More supplies coming online should further help mute rent increases. As such, with cap rates going up and rent increases flattening out, that means multifamily valuations could go down.

RealPage/JCHS

Now ABR has been warning of a challenging environment since last February, and last quarter its commentary was no different. On its Q3 earnings call, CEO Ivan Kaufman said:

“We feel we are right in the thick of this dislocation. Operating our business with the expectation that the next 2 or 3 quarters will be the most challenging part of this cycle. We have been laser focused over the last 2 years preparing for this environment. One of our primary focuses has been and continues to be preserving and building up a strong liquidity position. We're very pleased to report that we currently have approximately $1 billion in cash what gives us tremendous amount of flexibility to manage through this downturn and provides us with the unique ability to take advantage of the opportunities that will exist to generate superior returns on our capital. Clearly, given the current interest rate environment, we expect to experience additional stress. We need a tremendous amount of discipline and expertise to successfully navigate this market. And we're very pleased to have a tenured senior management team with a track record of managing through multiple cycles as well as what I consider to the best asset management team in the industry. This is an extremely challenging environment.”

Now the company has seen some credit quality issues start to pop up. It had 6 loans worth $98 million become non-performing in Q3. The company restructured a $70 defaulted loan, making it perform again, which helped offset this, so it only had a $28 million net increase in delinquencies in the quarter.

The company also added $15 million to its Current Expected Credit Loss ("CECL") reserves, as it expects its portfolio to come under more stress. In total, it has about $73 million in CECL reserves on its balance sheet. With nearly $900 million in non-restricted cash, it has also built up its cash reserves to deal with any stress. To do this it has been converting multifamily bridge loans into agency products to get back capital and turn into cash. As a result, the company has reduced its bridge loan exposure since the start of the year, and also sees its remaining months to maturity drop from 19.8 months at end of 2022 to 13.8 months at the end of September for bridge loans.

Outside of its bridge loans, ABR does have a nice fee-based servicing portfolio that has been steadily growing. It is notable that ABR does also have some loss-sharing obligations tied to it as well, however.

As for other opportunities, the firm also announced it was launching a new construction lending business. It is looking to generate 10-12% unlevered returns and then to eventually leverage it to get up to mid- to high-teens returns. This looks like a nice natural extension of ABR’s business.

Valuation

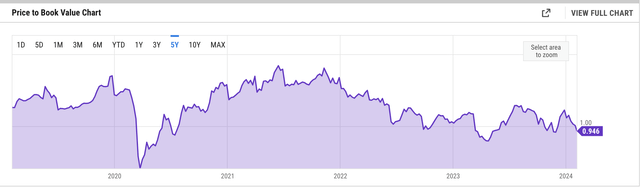

Investment portfolio companies typically are valued based on a price to book or NAV basis. Based on its end of Q3 book value of $12.73, it trades at a around 1.0x book value. In the past 5 years, it has trades as high as 1.84x book value and as low as 0.43x, while averaging 1.29x.

ABR Price to Book Value (YCharts)

A fair value range would be between 0.8x-1.5x, equal to $10.18-19.10. However, given the likely difficult environment ahead and the potential pressure on book value, I’d value the stock closer to between $11.50-12.75 in this environment. The stock currently yields about 13.7%.

Conclusion

While ABR is facing a difficult multifamily environment that could lead to more credit quality issues, the company has been doing a nice job to prepare itself for this environment by reducing its bridge loan exposure and building up cash. This should help mitigate some of the pressure it sees.

At the same time, it has not pushed up its dividend as much as its distributable earnings growth, leaving a nice cushion there as well. While the current environment could pressure book value if it leads to more defaults, the dividend looks pretty safe for now.

With Q4 earnings coming up on February 16th, I'd expect its distributable earnings to tick down from the 55 cents it reported in Q3 to around 50 cents due to some continued weakness in credit quality. I'm not expecting a major blow-up, but I do anticipate the company keeping a cautious tone. I'd continue to monitor credit quality to see if starts deteriorating or if management changes its current tone. Also make sure that its book value is holding up as well and remains pretty steady. If credit quality or book value start worsening, it could be time bail.

Given the current environment, I’m going to start ABR with a “Hold” rating and $12 target. However, I could likely flip to a "Buy" if it were to trade down to $11.50 and credit quality holds up.