AzmanJaka

Investment thesis

Fortrea (NASDAQ:FTRE) stock has been trading in a range bound manner since IPO (i.e. between $25-33/ Share). The company has poor fundamentals, with very low expected revenue growth (2-3%), and extremely low EBITDA margins (~5%). There is high debt burden on the company, with Debt/ EBITDA of 10.3 and Almat-Z score nearing the lower threshold- indicating imminent risks and potential inability of the company to service its debt. The management has not been able to share any detailed plans to improve EBIT margins and grow the topline- further increasing the risks.

The stock is a strong sell, and investors should be wary of initiating fresh long positions in the company.

Overview and Segmental Revenue

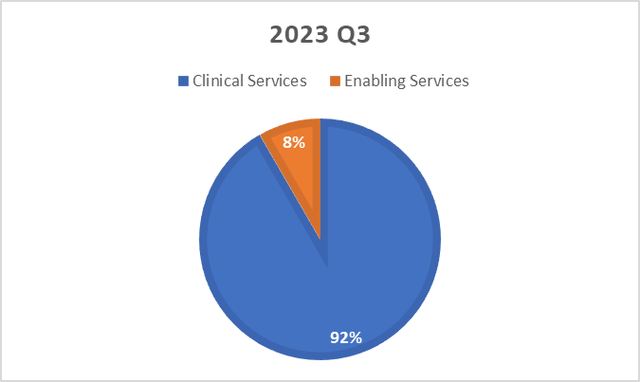

Fortrea is a contract research organization (CRO). The company has ~19K employees, and ~$3Bn in revenue from 2 segments (i) Clinical Services: Where it provides pharmacology and development related services to bigger healthcare clients- especially pharmaceutical companies and biotech companies; and (ii) Enabling Services: Where the company enables its clients to enhance the trial drug supply outcomes. Majority of the revenue today comes from Clinical services segment (>90%) and on a YoY basis this segment grew only by 2.1% (Q3 2023). At the same time, its enabling services segment actually de-grew in Q3 2023 by 0.6% YoY. These details and additional segmental details are there in the Q3 results presentation.

Fortrea revenue split (Image created by author, with data from company filings)

The company has a long history in this space and was actually established in 1990 as Covance. After 2 decades of multiple M&As, Fortrea was formally spun off by Labcorp in July 2023, and listed as a public company on stock exchanges. The company is still dependent on labcorp for certain enabling data (particularly diagnostic and central lab data) and has a strategic partnership with its erstwhile parent for the same.

Since the IPO, revenue growth has lagged, with the company losing market share to peers Iqvia Holdings Inc (IQV) and Thermo Fisher Scientific (TMO).

Topline growth is expected to be muted for the next 2-3 years

The projected pharma R&D spend is expected to increase only at 2.9% per annum till 2028. Additionally, as per the company’s recent presentations at JPM Healthcare conference, 2024 and 2025 is expected to be a softer growth year for Contract Research as an industry.

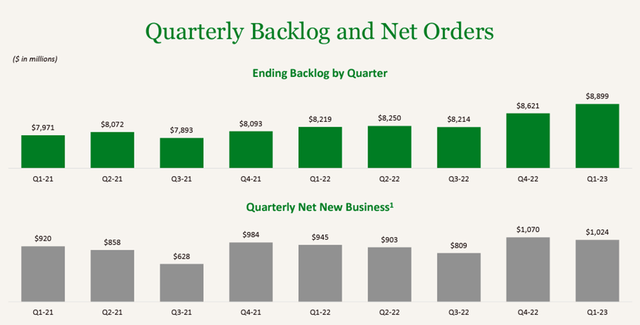

Apart from industry specific concerns, Fortrea faces certain company specific challenges. Firstly, it has been suffering from a slower backlog conversion rate for its booked clients. This is particularly due to staffing challenges at patient recruitment delays in certain geographies/ therapy areas.

Quarterly Backlog in orders (Company presentations)

Additionally, it faces a risk for a slowdown in request for proposals (RFPs) and net new orders. This is due to the post spin-off impact, apart from the slow industry growth (particularly from bio-tech clients)- which have had a challenging last 2 years.

Current Profit Margin is much less than the industry standard, with pressure likely to continue

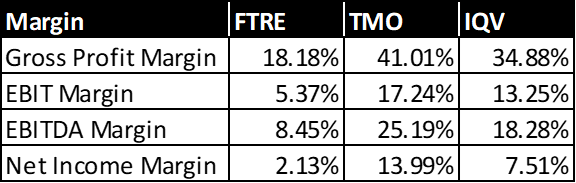

Compared to its CRO industry peers like TMO and IQV, Fortrea has poor profitability margins.

Margin profile vs Peers (Image created by author, using data from Seeking Alpha)

In 2022, the reported EBITDA margins were ~ 14%. However, as per latest filings, recently reported EBITDA margins are lower due to variations in cost recognition methodology. As per the latest 10Q report:

The Company’s financial statements for periods through the Spin reflect the historical financial position, results of operations and cash flows of the Company, for the periods presented, prepared on a “carve-out” basis and have been derived from the condensed consolidated financial statements and accounting records of Labcorp using the historical results of operations and historical basis of assets and liabilities of the Company and reflect Labcorp’s net investment in the Company.

In my view- this is the most serious concern for the company. (CRO) industry is heavily levered, and having low operating margins may in fact impair Fortrea’s ability to service its debt obligations- adding to a never ending loop of issues.

Fortrea’s Balance sheet is starting to show warning signs

Fortrea’s current Altman-Z score is 1.53. This is alarmingly close to the usual lower threshold of 1.23, which indicates a very high probability of failure. To make matters worse, it has a cash to debt ratio of 0.6, Debt to EBITDA ratio of 10.03 and interest coverage of 0.54. These ratios are very poor compared to the industry and indicate high stress.

The company has an ROIC of ~2.1% and the cost to service its debt is much higher (estimated WACC should be > 10%). This indicates that the company may spin into a debt spiral if it is unable to increase its ROIC very soon.

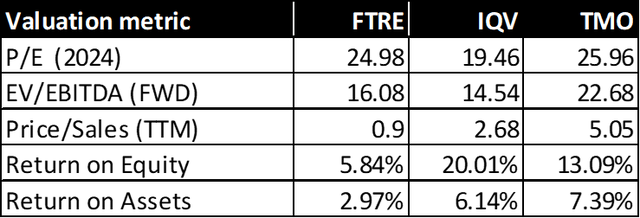

Stock is trading at rich valuations

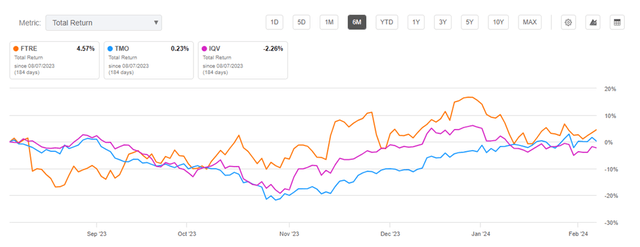

Over the last 6 Months, Fortrea shares have been largely flat (but performing slightly better than its peers). The company shares have been trading in the range of $26-$33, as its peers have been negatively impacted with overall pessimistic outlook for the (CRO) industry as a whole.

Stock returns vs Peers (Seekingalpha)

From a multiple perspective, Fortrea is trading at a Fwd P/E multiple of 24.98. In my view, this multiple is astronomical for a company with such poor margin profile and high debt. The multiple is also much higher vs IQV. While its P/S ratio is lower vs peers (0.9 for Fortrea vs 5 for TMO and 2.68 for IQV)- this essentially reflects the poor margin profile for Fortrea and should not be looked as a potential undervaluation. The RoE for Fortrea is less than half of TMO and ~ 25% of IQV- making the risk profile very different.

Fortrea: Key valuation metrics (Image created by author, using data from Seeking Alpha)

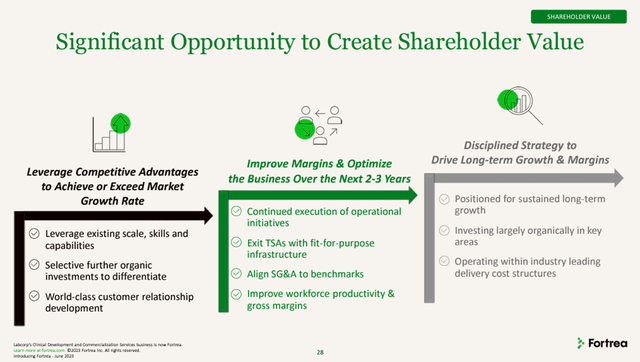

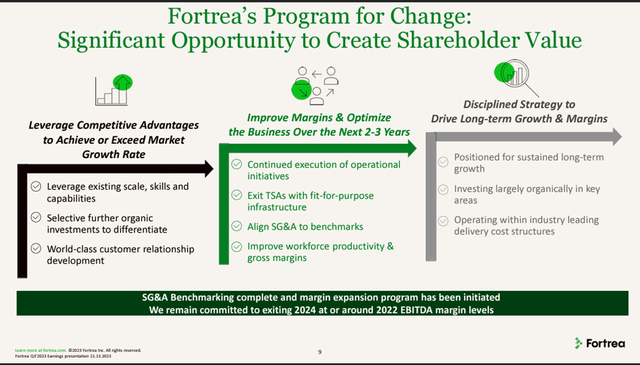

There is no clear roadmap laid out by the management to increase its margins

While the management realizes that low margin is one of the biggest challenges for Fortrea, it is a secondary priority over growth and is planned to be executed over “next 2-3 years”. In both, June 2023 and November 2023 the company literally used the same roadmap vision in investor presentations, and did not add any specifics on the progress. It took the company 1 quarter to complete an SG&A benchmarking and initiate the margin expansion program, when its balance sheet is in an alarming situation. Moreover, in my opinion, some of these levers have a very low probability of success without directly impacting Topline (e.g. Rationalizing operating workforce or SG&A costs for a very heavy labor-intensive company is likely to impact topline growth).

Fortrea June 2023 Investor presentations (Fortrea Investor presentations) Fortrea November 2023 investor presentations (Fortrea Investor presentations)

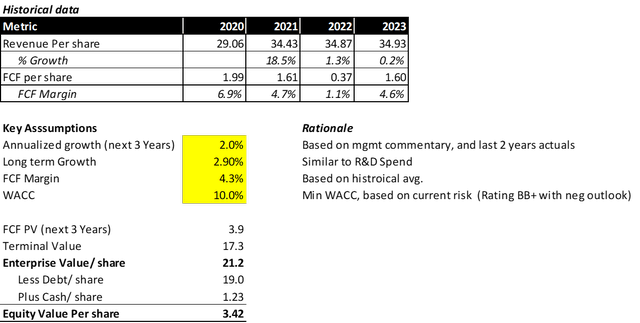

Majority of the EV of Fortrea will be required to repay the current debt

Currently, the company has a Free Cash Flow margin of just ~4%. I have assumed that the revenue grows between 2-2.9%, with the near-term outlook closer to 2% (as per management commentary) and long-term growth in line with industry R&D spend (2.9%). Given the current risk profile of the company (BB+ with negative outlook) rating, it is very conservative to have a 10% WACC assumption.

Given these assumptions, the Enterprise value of Fortrea comes out ~ $21.2 per share. With $19/share in debt, we get around $3.42/ share as the fair value of firm’s equity.

In my opinion, the company will have to significantly improve its margin profile AND improve topline growth in order to be able to return some value to shareholders. This looks far from reality in the current scenario.

Fortrea DCF Valuation (Image created by author, using data from Tradingview.com & Seeking Alpha)

Conclusion and Recommendation

The shares of Fortrea are significantly overvalued, and I would like to rate the company as a Sell. The sentiment is also echoed by some fund managers, with Vanguard Health Care Fund, Ken fisher and Jefferies group completely selling out their positions in Q3 and Q4 2023. New investors should be vary of initiating any new long positions in the stock.

While we may see some stock upside before the Q1 earnings release, the management will have to significantly deliver on its promises to warrant a change in the fundamentals for the company.