DKosig

Right before we entered 2024, I issued a relatively bearish article on Crescent Capital BDC (NASDAQ:CCAP) despite the favorable tailwinds for BDCs across the board (e.g., high SOFR, low corporate default levels, decent outlook on the investment activity).

Theoretically, CCAP embodied all of the necessary characteristics for me to assign a bullish rating. The main positives were (and still are) the following:

- Well-diversified portfolio at single company level.

- Investments in durable and cash generating business (i.e., no focus on the VC-type of companies).

- Almost 90% of the AuM placed in the senior secured first lien and unitranche securities.

Yet, there were a couple of elements, which motivated me to assume a more conservative view on this BDC. The most important ones were relatively aggressive leverage levels, constant ~ 2 - 3% non-accruals, and a heavy bias into unitranche segment, which is impossible to assess given that parts of this category theoretically could be located in deeply subordinated investments.

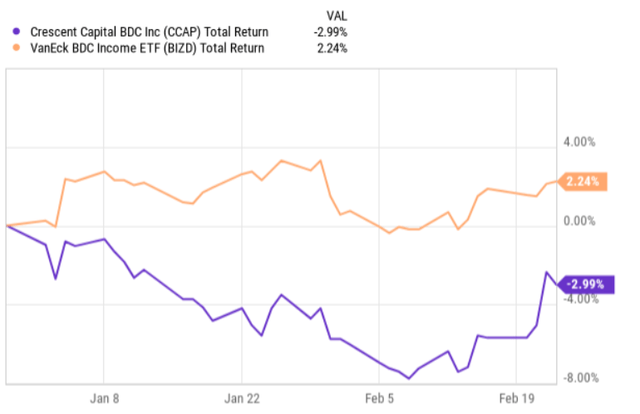

Since the publication of the article, the thesis has played out quite nicely.

YCharts

If we look at the chart above, we can see how CCAP has underperformed the broader BDC market by roughly 530 basis points (measured on a total return basis).

However, during this time, CCAP also circulated its Q4, 2023 earnings, which were quite solid, revealing several patterns that indicate favorable dynamics within the underlying fundamentals.

So, let's now take a look at the recent earnings package to determine whether the return divergence from the index in combination with attractive fundamentals might contribute to the change of rating going from neutral to bullish.

Thesis update

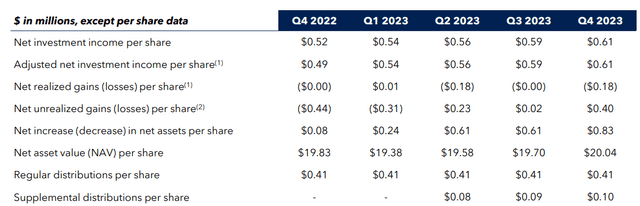

The most critical KPI, which highlights BDC's ability to generate cash in an organic manner, is the NII per share metric.

Here, CCAP has historically delivered solid results, maintaining the same positive momentum even in Q4, 2024, which has generally been a quite challenging quarter for most of its peers (i.e., declining investment volumes, where previous investment repayments exceed the amount of new transactions that in turn lead to smaller NAV base from which to generate NII).

CCAP Quarterly Earnings Presentation

On a quarter to quarter basis, CCAP has registered ~3% growth in the NII despite the prevailing (and temporary) headwinds in the overall BDC space. This is a quite considerable fact to take into account when thinking of CCAP's ability to maintain stability during times when the market is not extremely favorable, as it has been since the Fed started to hike interest rates.

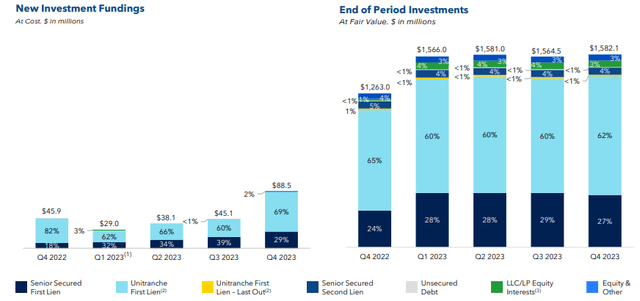

One of the key drivers behind the improving NII has been fairly positive new investment funding activity, which has been consistently ticking upwards since Q1, 2023. In Q4, 2023, the volumes almost doubled, sending a signal that the current momentum is rather strong. As a result of the Q4 funding activity, the total investment base moved higher accordingly, which again allows CCAP to capture spreads from a larger asset pool.

CCAP Quarterly Earnings Presentation

What is critical for long-term investors, is that a BDC does not sacrifice its quality and underwriting standards just to sign incremental transactions, thereby either maintaining the status quo in the investment (asset) base or growing it further to accommodate dividend hikes.

One might think that CCAP has done this given that its investment amounts have remained stable, while for many BDCs out there, the net investment volumes have been negative.

Yet, according to Henry Chung - President, commentary in the recent earnings call, this is clearly not the case:

We continue to back well-capitalized borrowers with significant equity cushions and the weighted average loan to value of our new investments for the quarter was 36%. We remain highly selective from a credit and risk-adjusted return perspective and maintain a long-term strategic view on capital deployment that is insulated by our orientation to first lien credit risk and non-cyclical industries.

The weighted average LTV of 36% is very, very low, providing a notable cushion for CCAP to recover the value in case of any corporate distress. In addition, there is also an implied benefit from this low leverage, which puts no significant pressure on the company's cash flows, leaving ample amounts after debt service that could be deployed in the underlying business.

Finally, it is encouraging to see that CCAP's leverage (i.e., one of my key areas of concern) has improved. In other words, the debt to equity ratio has now trended downwards for the third quarter in a row, reaching 1.15x as of Q4, 2023. This puts CCAP just below the sector average of 1.18x.

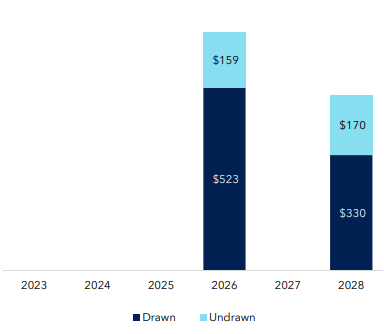

Plus, the current debt maturity profile looks quite enticing as well.

CCAP Quarterly Earnings Presentation

As we can see in the graph above, CCAP has no maturity until 2026, which in the context of several below market fixed interest rate financings (~29% of the total debt portfolio) come in handy.

The bottom line

While it is difficult to fully unpack and assess the reasons behind CCAP's recent price drop, one of the obvious catalysts for this could be the fact that the BDC has almost the entire portfolio structured at floating interest rates terms. Against the backdrop of normalizing interest rates, these assets will automatically generate lower yields, thus rendering the overall investment profile less attractive.

However, there are two factors that should offset this movement:

- Circa 70% of CCAP's debt based on SOFR, which will also adjust accordingly.

- Lower SOFR implies higher deal activity, which will boost the investment base from which to generate incremental NII.

Now if we analyse the underlying fundamentals, we will notice positive dynamics and momentum across the board: improved NII, de-risked balance sheet, tangible new funding volumes based on strict underwriting standards and no material worsening in portfolio quality.

This in conjunction with the recent negative price divergence from the index creates an interesting opportunity to enter CCAP.

So, I am setting a buy now.

Yet, having said, I am still reluctant to go big here or assign a "strong buy" rating given the heavy focus on unitranche category, which still is an enigma with no visibility on the underlying details (e.g., location in the capital structure).