Mr-Tigga/iStock Editorial via Getty Images

March 5th, 2024 may have been many traditional investors' official welcome to the wonderful world of cryptocurrency volatility. With respect to January 12th, 2024 - which resulted in a 7% intraday decline shortly following Bitcoin's (BTC-USD) spot ETF approval - March 5th, saw a 14.4% intraday swing in BTC from a new all time high of $69.3k down to $59.2k all over the course of a five hour period. If you're new here, this is classic crypto behavior.

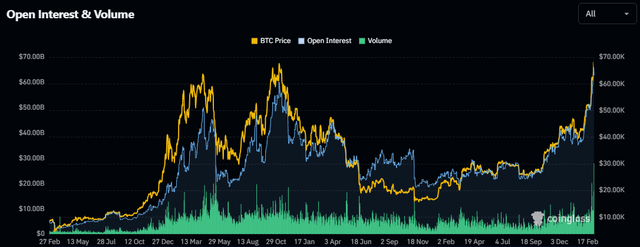

The market's top cryptocurrency ultimately traded back up to $64k following what was the largest flash crash for BTC since spot ETF approvals in January. Just as it was "sell the news" in January when approvals were announced, Bitcoin making a new intraday all time high in dollars was yet another piece of news that traders decided to sell. On March 4th, there was $66 billion in total crypto market open interest. That figure fell to $62.75 billion on March 5th. While this is still a very elevated level of OI historically speaking, it ends a streak of ten consecutive days of open interest increases:

Crypto Open Interest (Coinglass)

Now that we've flushed out about $3 billion in open interest from the crypto market following Bitcoin's new ATH, market speculators have been reminded these assets can indeed go down. In my view, this is a good time to reset allocations and think about where BTC might wind up later this year, after it establishes something resembling a test of support levels in the weeks to come.

In this article, we'll explore some of Bitcoin's network metrics and valuation multiples that can be referenced for possible indications of cycle tops. How close may we be to a new cycle peak based on historical norms? We'll explore. But first, we'll have a look at the iShares Bitcoin Trust ETF (NASDAQ:IBIT) and compare it to some of the other spot Bitcoin ETFs in the US market.

Spot Bitcoin ETF Landscape

| Fund | Ticker | BTC Balance | AUM |

|---|---|---|---|

| Grayscale Bitcoin Trust | (GBTC) | 415,232 | $26,460,659,200 |

| iShares Bitcoin Trust | IBIT | 170,721 | $10,879,195,725 |

| Fidelity Wise Origin Bitcoin ETF | (FBTC) | 110,905 | $7,067,421,125 |

| Ark 21 Shares Bitcoin ETF | (ARKB) | 35,369 | $2,253,889,525 |

| Bitwise Bitcoin ETF | (BITB) | 26,656 | $1,698,653,600 |

| Invesco Galaxy Bitcoin ETF | (BTCO) | 6,248 | $398,153,800 |

| VanEck Bitcoin Trust | (HODL) | 4,299 | $273,953,775 |

| Valkyrie Bitcoin Fund | (BRRR) | 3,161 | $201,434,725 |

| Franklin Bitcoin ETF | (EZBC) | 2,697 | $171,866,325 |

| WisdomTree Bitcoin Fund | (BTCW) | 759 | $48,367,275 |

Source: BitcoinTreasuries.net, Author's Calculations as of 3/5/24

In just under two months since spot ETFs were approved, the combined net flow of all US-based products is approximately 157k BTC. Importantly, this figure adjusts for the Grayscale fee migration outflow and provides a more complete picture of the new investment demand for the underlying asset. The current value of the 157k BTC that has come under management through these products is about $10 billion.

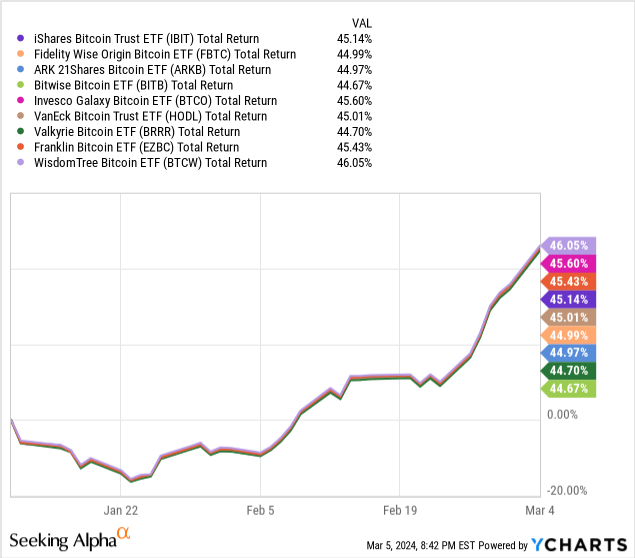

Comparing the new funds from a total return standpoint shows very little variance between the funds after these first few weeks. Many of these ETFs have offered or still offer fee waivers up to a certain date or AUM figure. For IBIT, the AUM level to trigger the end of the fee waiver was $5 billion. This was reached in mid-February. Going forward, IBIT will have a 0.25% expense ratio, which is very much in line with most peers. Where IBIT is likely going to be most attractive to buyers is in the fund's liquidity:

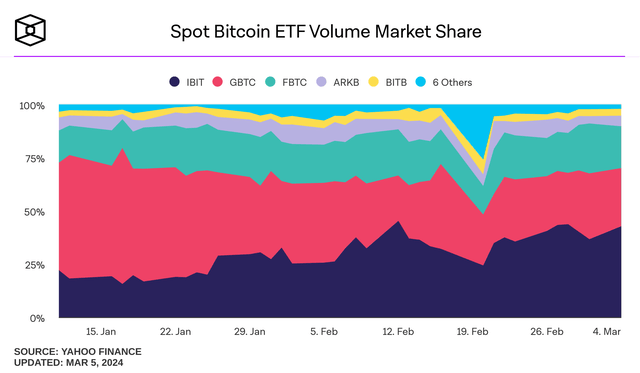

Spot ETF Volume Share by Fund (TheBlock)

IBIT share of ETF volume was between 18-20% for much of January. Since then, the fund has quickly eaten away at Grayscale's volume share lead. Ever since February 20th, IBIT has been the dominant asset in the market by share volume. I think this is telling, considering GBTC is still a larger fund by AUM.

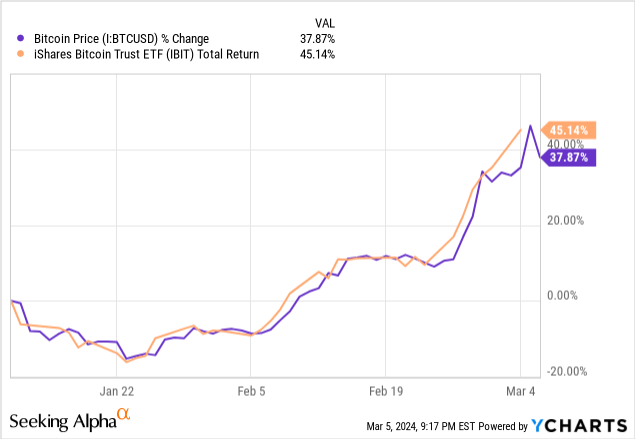

Perhaps more than share volume liquidity or even expense ratios, long term investors may just want the confidence that IBIT is going to perform with the underlying asset and not deviate wildly from net asset value, as has been the case with Bitcoin's closed end funds over the last several years. In this regard, IBIT will likely get the job done without much need for shareholder worry, given the redeemability of shares.

For the benefit of Bitcoin buyers using spot funds like IBIT who are riding this bull for the first time this year, there are a few things to consider when building your potential exit strategy.

Key Network Metrics

It's important to remember that Bitcoin was designed to be a decentralized and distributed permissionless ledger. Given that, we want to look at usage metrics like active addresses and transfer volumes. However, growth in Bitcoin network activity doesn't necessarily mean the native currency of the network is undervalued. Thus, it's also important to look at ways of measuring BTC's valuation relative to historical precedent as a guide for when the coin price may be too extended. In this section, we'll look at both kinds of metrics.

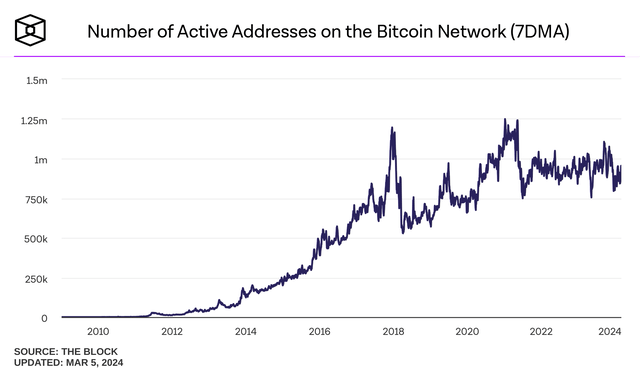

Active Addresses (7 DMA) (TheBlock)

Daily active addresses on-chain typically oscillate between 750k and 1 million during a given day. While this doesn't necessarily make Bitcoin the most used blockchain network strictly based on daily active users, the long term trend has continued to increase with DAU spikes during moments of coin price FOMO. No such DAU spike can be seen yet.

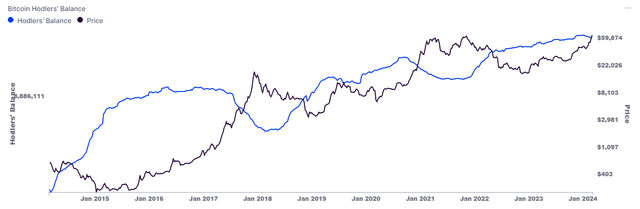

Hodler Balance (weekly) (IntoTheBlock)

Often viewed as the "smart money" in the Bitcoin arena, BTC wallet addresses that have held funds for a year or longer have been dubbed "hodlers." The total hodler balance is currently 13.5 million BTC, or 69% of the circulating coin supply. These wallets generally distribute BTC to new buyers on the way up. Hodler distribution does appear to have started in mid-January when that cohort of wallet addresses held 13.8 million BTC. During the last bull run in BTC, it took a year between when hodler balance peaked and when coin price peaked.

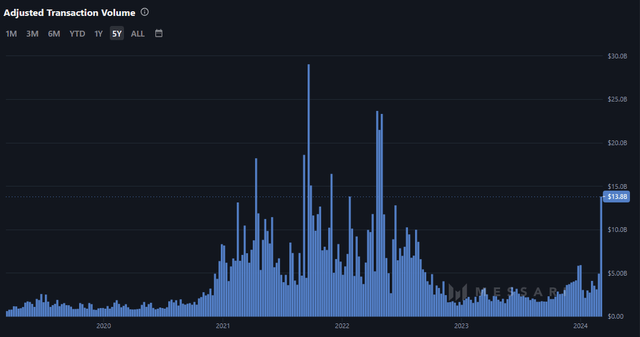

Bitcoin Transfer Volume (Messari)

Another important measure is transaction volume. In the last week, nearly $14 billion in adjusted transaction volume has flowed through the network. Making it the largest week of volume since May 2022. The data in the chart above is an attempt at volume adjustment that eliminates noise like wash trades or spam transactions. It's way too early to call this the start of a trend based on just one week of data, but it is a good sign. Shifting gears now to cycle indicators:

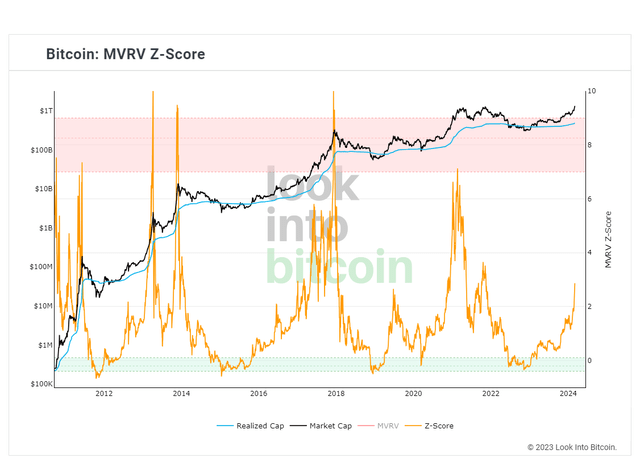

MVRV Z-score (LookIntoBitcoin)

The chart above shows Bitcoin's MVRV Z-score. I tend to like this metric far more than something like Bitcoin's Stock-To-Flow Model because I think it has done a better job of predicting BTC price floors. The blue line above shows the realized value of BTC based on the average price at which each coin last moved. The black line is the market cap of BTC. The orange is the Z-score, or standard deviation test, of the two combined metrics. Following each of the last halving cycles, the market needed a MVRV Z-score above 7 before we had a cycle top. The current read is 2.87.

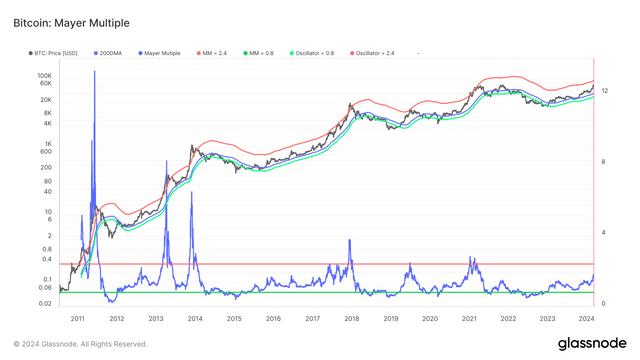

Bitcoin Mayer Multiple (Glassnode)

Another interesting model to consider is the Mayer Multiple. The way this is calculated is by utilizing the price of Bitcoin and its extension from the coin's 200 day moving average. Using this tool, BTC has historically been extended when the multiple hits 2.4. It is currently 1.7. In the chart above, Glassnode has also built in oscillators that can help analysts or readers determine what the BTC price would be at a 2.4 Mayer Multiple. As of March 5th, that reading is $90.8k.

Risks

None of this means Bitcoin's price has to continue higher. We can only look to the past for indications, not expectations. Just because valuation tools and multiples may have worked at predicting price tops and bottoms in the past, it doesn't mean they'll work again. Frankly, we've already entered the era of unprecedented behavior for Bitcoin. The approval of the spot ETFs have directly led to Bitcoin achieving a new all time high price before a halving - this is the first time this has happened.

Closing Thoughts

While each camp has certainly had their disagreements through the years, I like Bitcoin as a speculative instrument for many of the same reasons that I like Gold. Chief among those reasons would be that central planners can't print supply. Investors who have the means and the technical knowhow would likely do well to buy BTC and hold directly on-chain in a self-custodial wallet. Short of that, funds like IBIT should definitely do the trick for investors who just want easy exposure to the idea. I certainly wouldn't rule out Bitcoin retracing lower to some support levels in the very near future. However, assuming we do get lower prices, I would think bulls would welcome the opportunity to buy lower.