andreswd

Investment action

I recommended a buy rating for Health Catalyst (NASDAQ:HCAT) when I wrote about it the last time (14 Nov 2023), as I expected, HCAT to come out as a stronger business with a better profitability profile as management executes on their growth strategies. Based on my current outlook and analysis of HCAT, I recommend a buy rating. I am confident that HCAT can meet management's FY28 guidance, generating >$100 million in EBITDA. As HCAT shows evidence of achieving that over the years (e.g., expanding margins), valuation should start to rerate upwards to peers' levels.

Review

HCAT reported 4Q23 revenue growth (on 23 Feb 2024) of 9% to $75.1 million, coming in at the top end of the guided range of $70.1 to $75.1 million. By segment, technology revenue grew 5% to $47.1 million, and professional services revenue grew 14% to $27.9 million. Adj gross profit came in at $34.7 million, translating to margins of 46.2%, which was down 450 bps due to gross margin contraction at Technology (down 215 bps to 66.6%) and Professional Services (down 584 bps to 11.8%). As for adj. EBITDA, it came in at $1.4 million, in line with guidance of $0.3 to $2.3 million.

I believe the results were great, and the outlook for HCAT remains positive. The drop in share price represents another chance for investors to buy the stock at a cheap valuation again. The macro backdrop has certainly improved compared to 2023, especially with the Fed reiterating its view to cut rates this year. This should lead to a better spending environment for the healthcare industry, which translates to better bookings for HCAT. At the micro level, I continue to be positive about HCAT's growth initiatives, in particular its TEMS offering and next-generation data platform.

Regarding TEMS, I am very positive about this driving growth and margin expansion. At its core, TEMS addresses a number of critical issues that clients face, such as outsourcing, financial constraints and expenses, and recruitment and retention. During the investor day, chart abstraction was emphasized as one of the key features. Reduced time to extract data per use case, as well as costs and burdens associated with data collection, are all benefits of HCAT's solution. By doing so, clients are free to focus on their patients and other stakeholders rather than manual extraction. The addition of AI makes this product even better because it has the potential to evolve into an even more efficient version. Management claims that they anticipate a 24% reduction in abstracting time as a result of Chart Abstraction AI, which could lead to savings in labor costs. Translating these back to financial terms, it means higher growth and margins. Regarding growth, since HCAT can help customers reduce the total cost of ownership and improve efficiency, I expect the adoption rate to accelerate. On margins, because a bunch of manual work is done through AI, which means lower labor costs per use case and human error, HCAT has become more cost-efficient, and this makes the 25% margin run rate target a lot more plausible. Finally, with the end market's financial situation expected to improve (as the cost of capital comes down from rate cuts), the adoption rate of TEMS offerings should also improve.

The next-gen data platform is anticipated to bridge the gap between DOS and non-DOS customer spending with its more adaptable design. At present, HCAT counts over 500 non-DOS clients in addition to 100 DOS clients. Management noted a significant disparity in the amount of money spent by the two groups, with DOS clients typically spending multimillions of dollars and HCAT and non-DOS clients spending only a few hundred thousand dollars. With this new platform's increased modularity and flexibility, HCAT can better meet client needs; in other words, HCAT is able to offer solutions that meet the needs of clients in the middle of the spending capacity spectrum. The next-gen platform also makes it easier for HCAT to incorporate new capabilities as key performance indicators and applications are developed. This means that HCAT can release more products that can be used for cross-selling to its current customer base, which increases DBR.

Looking ahead, I am confident that HCAT can meet management's long-term guidance of >$500 million in revenue by 2028 and $100 million in EBITDA, which equates to a 11% revenue growth CAGR over 5 years with 20% EBITDA margins. This effectively implies EBITDA growth of ~34% over the next 5 years.

Valuation

Author's work

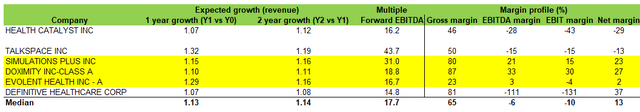

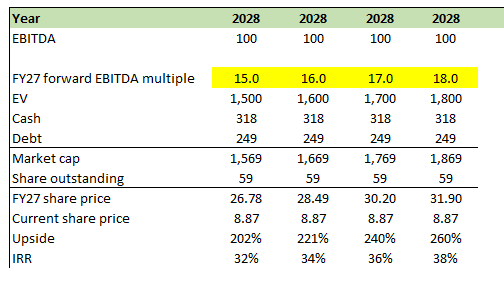

As I believe HCAT is able to achieve management long-term (FY28) guidance, the question is: what multiple should HCAT trade at? To figure this out, I looked at other application software companies in the healthcare industry to get a sense of the possible range of multiples. There are two key factors to pay attention to here: (1) expected revenue growth rates; and (2) margin profile. Based on management's long-term guidance, HCAT is going to grow to low teens for the next 5 years and achieve an EBITDA margin of 20%. Using these factors, I zoomed down to 3 peers for HCAT because of their similar targeted audience (healthcare companies) and growth profile in the medium term (2nd year growth): Simulations Plus (SLP), Doximity (DOCS), and Evolent Health (EVH). You would notice that EVH trades at a lower multiple despite higher growth, and that is because of a lower margin profile. I believe this is a key reason for the current HCAT multiple as well. As it shows that EBITDA margin can expand, valuation should improve to SLP and DOCS levels. I have laid out in my model four multiples scenarios, and all of them provide attractive IRR over the next four years.

Note that this is a different valuation methodology vs. my previous model that focuses on revenue growth. Now that we have a EBITDA target, I think it makes more sense to value it base on profits than revenue.

Risk and final thoughts

A recovery in macro conditions is quite important for HCAT FY24 performance. If the macro situation worsens, spending in the healthcare industry is going to get further pushed out to FY25/26. This is definitely possible, as the housing situation in the US remains in an undersupply situation. If the Fed cuts rates and inflation starts to surge again, we could see another round of rate hikes.

I'm reiterating a buy rating for HCAT despite the recent drop in share price. I believe HCAT's TEMS offering and next-generation data platform position them well for future growth and margin expansion. As such, management's long-term guidance of exceeding $100 million in EBITDA by FY28 is achievable. A near-term catalyst is a potential rate cut by the Fed, which should drive an improving healthcare spending environment. As HCAT demonstrates its ability to execute on its growth strategies and expand margins, its valuation should improve to reflect its peers' multiples.