courtneyk

Note:

I have covered Performant Financial Corporation or "Performant Financial" (NASDAQ:PFMT) previously, so investors should view this as an update to my earlier articles on the company.

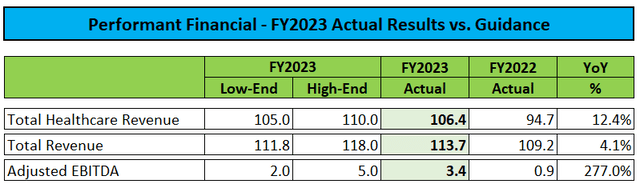

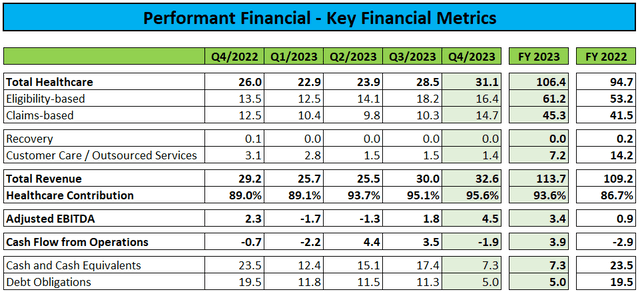

Last week, Performant Financial reported fourth quarter and full-year 2023 results largely in line with updated projections provided on the Q3 conference call in November.

Company Press Releases / Regulatory Filings

After a weak first half, an improved H2 performance resulted in both FY2023 revenues and Adjusted EBITDA coming in within the ranges communicated by management at the beginning of the year:

Healthcare revenues of $106.4 million increased by 12.4% year-over-year and represented 93.6% of total revenues while Adjusted EBITDA of $3.3 million more than tripled.

However, $4.1 million in capital expenditures resulted in slightly negative free cash flow for the year.

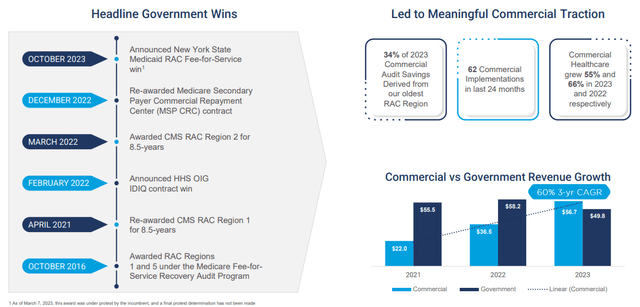

While the company's commercial segment has shown consistent growth in recent years, Performant Financial's government business experienced some challenges in 2023 as outlined by management on the conference call:

Staying with our government clients, revenue declined 14% for the full year. As discussed on previous calls, challenges emerged in 2023, including the timing of addressable claims under the public health emergency and reduced demand inventory within our mature CMS Medicare payer business.

However, government revenues started to rebound in the fourth quarter and management expects the recovery to continue into 2024 (emphasis added by author):

Our diverse portfolio of products and clientele provides a strong foundation for performance to achieve steady organic revenue growth. Looking at 2024, we expect government to lead the way, while commercial continues to build upon its strong historical growth.

The scaling of CMS RAC Region 2 and the HHS OIG contracts underscore this trajectory, as does our New York State RAC win pending resolution of the protest. While the government portfolio experienced some challenges in 2023, we are largely past those trials and expect to build off the 2023 trough.

On the flip side, management warned of potential impact from the recent cyberattack suffered by a division of UnitedHealth (UNH):

In considering our outlook, it is important to address the recent change healthcare outage. While as of now, performance has not been directly impacted by this outage, we are mindful of the challenges faced by payers and providers navigating through claims and payment processing difficulties. The strain on our system, coupled with potential processing delays, could affect payers behavior and the timing of available claims for our review. Although the situation is fluid with information updating daily, we deem it necessary to bring attention to this issue.

Despite the challenges posed by the outage, we perceive any resulting disruptions as temporary.

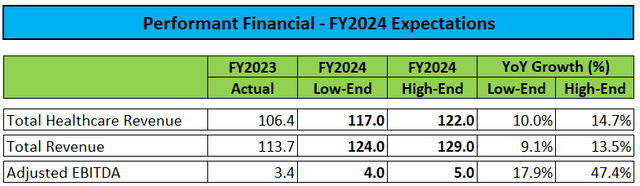

As a result, the company expects another year of moderate healthcare revenue growth while Adjusted EBITDA is forecasted in a range of $4 million to $5 million:

But with capital expenditures projected to increase by almost 50% to $6 million this year, free cash is likely to be negative again.

Similar to 2023, the company expects a weak start to the year (emphasis added by author):

In thinking about the start of the year, we find it prudent to acknowledge that the combination of the more subdued revenue growth in the first quarter, the higher run rate of spend, and the investment initiatives we are undergoing will likely result in a negative year-over-year adjusted EBITDA trend for the first quarter.

After that, we do anticipate stronger adjusted EBITDA in the remaining quarters of 2024, though may look more muted year-over-year by the fourth quarter as the technology and sales investments would become part of our run rate and we would anticipate being well underway in standing up the New York Medicaid RAC contract.

However, the issue is already well reflected in consensus estimates, so I wouldn't expect a negative surprise when the company reports first quarter results in May.

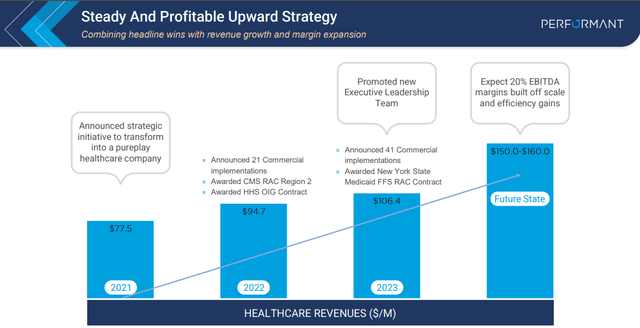

Longer-term, the company is targeting annual healthcare revenue to increase to a range of $150 million to $160 million with 20% EBITDA margins.

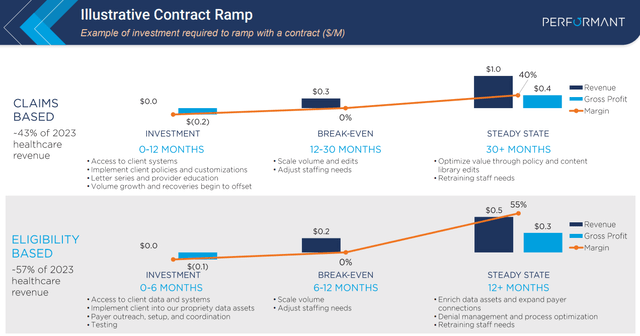

At the current growth rate, Performant Financial should be able to achieve the targeted revenue range in 2027, but I am struggling with the company's apparent expectation of almost the entire revenue growth falling to the bottom-line given the persistent requirement to invest in new contract implementations:

That said, profitability should indeed increase quite meaningfully once the majority of recent contract wins moves into the steady state phase.

But with potential earnings inflection still a couple of years in the future, I don't see any compelling reason to initiate new or add to existing positions at this point.

Consequently, I am reiterating my "Hold" rating on the shares.

Bottom Line

A good finish to an otherwise mediocre year helped Performant Financial to achieve management's stated 2023 top- and bottom-line targets. However, results mostly came in at the lower end of initial expectations.

For this year, the company expects moderate growth in the core healthcare segment to continue, as well as a slight increase in Adjusted EBITDA.

However, ongoing investment requirements are likely to result in another year of negative free cash flow, but following the refinancing of the company's credit facility in Q4/2023, liquidity should not be an issue for the time being.

With potential earnings inflection still a couple of years in the future, I don't see any compelling reason to initiate new or add to existing positions at this point.

Consequently, I am reiterating my "Hold" rating on the shares.

Massively Outperform in Any Market

Value Investor's Edge provides the world's best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.