querbeet

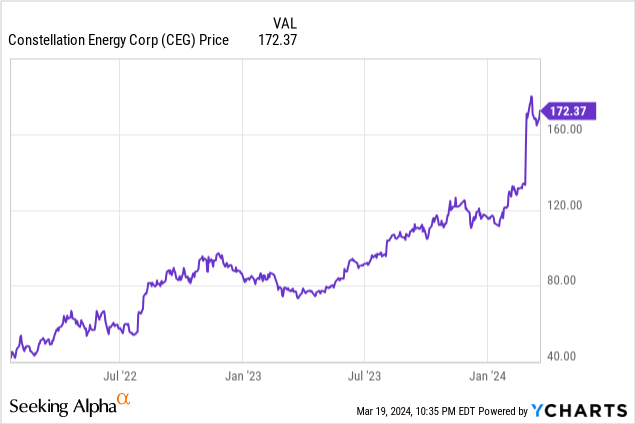

More investors have discovered Constellation Energy (NASDAQ:CEG) since my last review nearly a year ago: its stock price has increased an incredible 120% and its market capitalization has increased an equally incredible 112%.

While enthusiasm for an independent power producer with so much carbon-free electricity production capacity — especially nuclear — is likely to continue the stock’s momentum, Constellation can only be recommended as a momentum or ESG play. It's at 93% of the 52-week high and pays a 0.8% dividend.

Nuclear power is highly valued especially for its baseload operations characteristics as well as for being carbon free.

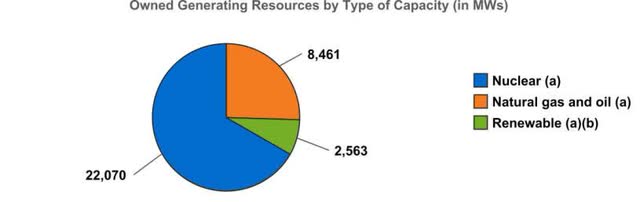

CEG was spun off from Exelon (EXC) in January 2022, containing Exelon Generation’s nuclear plants and other generating assets in a standalone, unregulated company. Constellation’s owned generating capacity is 33,100 megawatts. Within this, Constellation’s nuclear-powered electricity generation capacity is 22,100 megawatts, or 67% of its total capacity.

Constellation is the top US producer of carbon-free electricity with a 10% share of the country’s carbon-free electricity via its nuclear, wind, solar, and hydro units. It's notable for having the overall largest nuclear fleet in the US. The Southern Company (SO) may soon be able to claim the largest individual nuclear plant in the country with Georgia Power's four Vogtle nuclear units at 4600 MW of capacity.

I own shares of Constellation Energy. While it may appeal to momentum or ESG investors, it may not appeal to dividend and capital appreciation investors. I'm downgrading Constellation Energy from buy to hold.

US Electricity Demand and Macro

Markets — including utilities and independent power producers — are sensitive to Federal Reserve Fed funds rate changes. However, at its next meeting, the Fed is not expected to move rates. The Fed is signaling three rate cuts later in the year, but fewer than before in 2025.

According to the EIA’s most recent forecast, US electric power demand is expected to grow 2% in 2024 to 4285 billion kilowatt-hours after falling by 2% between 2022 and 2023.

Ongoing federal and state decarbonization policy goals and legislation play directly to Constellation’s strength: its large fleet of nuclear generation plants, with high capacity factors, have been and will be key in providing non-hydrocarbon (“clean”) electricity.

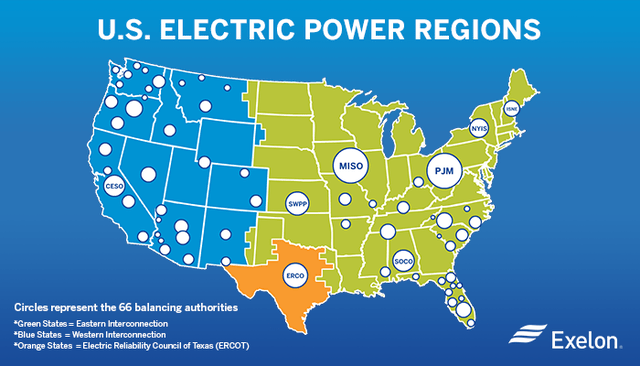

Indeed, in Constellation’s most recent investor presentation, the company notes that “day-to-day, renewable generation can swing as much as turning on or off five nuclear reactors in PJM.” PJM is a regional transmission organization - RTO - that coordinates the movement of wholesale electricity in all or parts of 13 states and the District of Columbia. (Effectively a regional grid.)

2023 Results for Constellation Energy

In 2023, Constellation Energy reported net income of $1.6 billion compared to a net loss of -$160 million in 2022.

In 2023, adjusted EBITDA (non-GAAP) was +$4.0 billion compared to +$2.7 billion in 2022. The 2023 result was $900 million more than the originally projected midpoint estimate.

As used by CEG, “adjusted EBITDA” excludes:

*Income taxes

*Depreciation and amortization

*Net interest expense

*Unrealized fair value adjustments (mark-to-market for derivatives)

*Decommissioning-related activities

*Pension and other postretirement employment benefit non-service credits

*Separation costs

*Other items not directly related to ongoing business operations

*Noncontrolling interest related to exclusion items.

The company added to its nuclear capacity by purchasing an interest in the South Texas Project. After completing its first $1 billion share repurchase program, in December 2023 Constellation authorized a new $1 billion share repurchase program.

Constellation Energy Operations

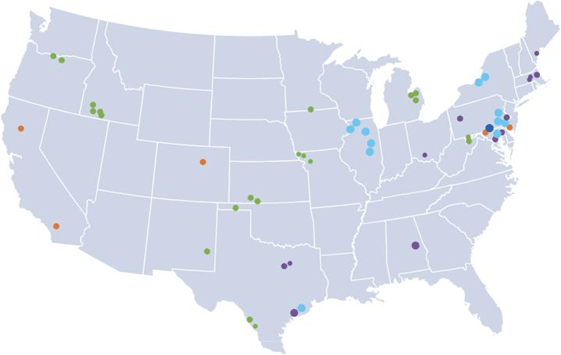

The map below from the company’s most recent 10-K shows the locations of Constellation owned electricity generating units as of Dec. 31, 2023.

Light blue is nuclear,

Dark blue is hydro,

Purple is natural gas/other,

Light green is wind,

Orange is solar.

Constellation Energy

As the chart below shows, 67% of Constellation’s 33,100 megawatts of owned generating capacity is nuclear, 8% is renewable, and the remaining 25% is natural gas and oil.

Constellation Energy

Geographically, the company’s owned 33,100 MW of generating capacity divides as:

Mid-Atlantic 32%

Midwest 35%

New York 9%

ERCOT (Texas) 14%

Other regions 10%

Per the next map, the PJM (Mid-Atlantic) and MISO (Midwest) power regions are particularly key for Constellation.

Exelon

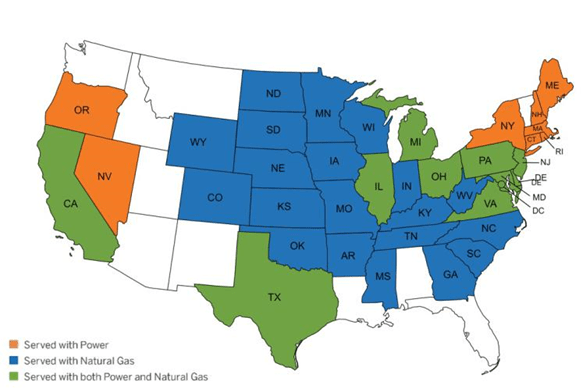

In 2023 the company supplied 205 terawatt-hours of electricity to retail customers and whole load auctions (143 terawatt-hours retail) and 800 billion cubic feet (about 2.2 BCF/D) of natural gas to retail customers. The map below illustrates the states Constellation serves.

Constellation Energy 10-K

Competitors

Constellation Energy is headquartered in Baltimore.

CEG competes with utilities that have nuclear power production such as Duke (DUK), Tennessee Valley Authority, Dominion Energy (D), Public Service Enterprise (PEG), NextEra (NEE), Southern Company (SO), and Entergy (ETR).

It also competes with other independent power producers like Vistra (VST), which bought Energy Harbor Corp. — and its 4,000 MW of nuclear power capacity — for $3.4 billion.

In 2023, Southern Company’s Georgia Power started up the first new US nuclear unit in 30 years, 1100-megawatt Vogtle 3. Equally sized Vogtle nuclear unit 4 has reached criticality and is expected to be in service in the second quarter of 2024.

In all, by August 2023 (so, including Vogtle 3) the US had 93 operating nuclear reactors at 54 plants. These have typically generated about 20% of US electricity.

Governance

On March 1, 2024, Institutional Shareholder Services ranked Constellation Energy’s overall governance as a rather poor 8, with sub-scores of audit (4), board (4), shareholder rights (9), and compensation (8). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

On Feb. 29, 2024, shorts were 2.0% of float. Insiders owned a small 0.21% of the company’s equity.

The company's beta is 0.74.

At Dec. 31, 2023, the six largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (11.6%), Capital International (8.8%), BlackRock (7.1%), Fidelity/FMR (6.3%), T. Rowe Price (6.1%), and State Street (5.6%).

Capital International, BlackRock, and T. Rowe Price are signatories to the Net Zero Asset Managers initiative, a group that manages assets worldwide and which limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner. Of note, Vanguard left the group over a year ago and State Street left quite recently. Fidelity was never a member.

Several firms have also left the Climate Action 100+ activist group as US state attorneys general held legislative hearings and/or pulled back on doing state business with member firms. Indeed, the state of Texas just pulled $8.5 billion from BlackRock due to BlackRock's ESG activism.

Financial and Stock Highlights For Constellation Energy

At Constellation’s March 19, 2024, closing stock price of $172.41/share, its market capitalization is $54.6 billion. As noted, the stock price is up 120% from 11 months ago and the market capitalization is up 112% since then.

With a 52-week price range of $71.16-$185.58/share, the closing price is 93% of the high and already above the average one-year target estimate of $159.55/share.

Trailing twelve months’ (TTM) return on assets is 2.1%.

TTM earnings per share was $5.01 for a price-earnings ratio of 34.4. The averages of analysts’ 2024 and 2025 EPS estimates are $7.30 and $7.87, respectively, for a forward price-earnings ratio range of 21.9-23.6.

As Seeking Alpha analyst Gary Gambino reported, the recent price spike was due to a big increase in forward earnings guidance and stable prices supported by nuclear production tax credits.

TTM operating cash flow is -$5.3 billion. TTM levered free cash flow is -$1.61 billion.

On Dec. 31, 2023, the company had $39.8 billion in liabilities, including $7.5 billion of long-term debt and $50.8 billion in assets, giving Constellation a steep liability-to-asset ratio of 78%.

The company has offered the first US corporate green bond ($900 million, 30-year term) for nuclear energy.

Constellation’s dividend is $1.41/year for a yield of 0.8%.

In the 4Q23 presentation, the company reiterated plans to increase dividends 10%/year through the decade, “backstopped by the nuclear production tax credit in the Inflation Reduction Act.” It also authorized another $1 billion share repurchase program.

The average analyst rating for is 2.3, or “buy,” leaning toward “hold” from 13 analysts. At least one analyst considers the stock to be overvalued.

Notes on Valuation

With an enterprise value of $62.3 billion, Constellation’s EV/EBITDA ratio is 15.1, well above the preferred maximum of 10 or less and so far out of bargain territory.

Positive and Negative Risks

Investors should consider their expectations for baseload clean electricity demand growth, as well as total electricity demand growth, as the factor most likely to affect Constellation.

Political and regulatory risk is a positive for Constellation as state and federal governments urge utilities to use non-hydrocarbon (nuclear plus renewables) fuel to make electricity. Moreover, nuclear has grid planning characteristics and advantages over renewables because it is baseload and so requires neither expensive battery storage nor quick-on extra natural gas capacity equal to 110% of renewable capacity.

The higher-than-historical cost of capital is a negative risk. Both debt directly and equity indirectly are now more expensive than in prior years. Equity is more expensive because dividend rates compete for investors with alternatives like bank CD and US Treasury rates.

Recommendations for Constellation Energy

I don’t recommend Constellation Energy to dividend-hunting investors. I'm downgrading it from buy to hold for investors seeking capital appreciation as the strongest capital appreciation may already have occurred. ESG-focused and momentum investors may find Constellation stock of interest, although some may find the poor governance score a concern.

The company has the competitive advantage of being the dominant nuclear electricity supplier in the US. And despite being a relatively new standalone company, the predecessor group of CEG has decades of experience operating nuclear plants as a prior division of Exelon.

Nuclear power’s much appreciated operating characteristics are that it's a) non-hydrocarbon and especially that it is b) baseload as grid operators become increasingly focused on grid stability and 24/7 generation reliability.

Constellation Energy

I hope you enjoyed this piece. I run a Marketplace service, Econ-Based Energy Investing, featuring my best ideas from the energy space, a group of over 400 public companies. Each month I offer:

*3 different portfolios for your consideration, summarized in 3 articles, with portfolio tables available 24/7 to subscribers

*3 additional in-depth articles = 6 EBEI-only articles;

*3 public SA articles, for a total of 9 energy-related articles monthly;

*EBEI-only chat room;

*my experience from decades in the industry.

Econ-Based Energy Investing is designed to help investors deal with energy sector volatility. Interested? Start here with an initial discount.