alvarez

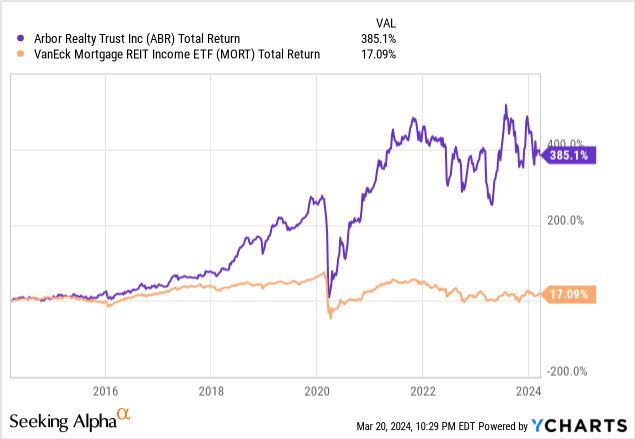

Arbor Realty Trust (NYSE:ABR) is a mortgage REIT company with a highly diversified business with a solid dividend yield of almost 14%. If you've been following my articles you know that I am usually not a big fan of mortgage REIT companies for a variety of reasons such as high leverage and high risk-taking and I see most of them as wealth destroyers but this could be one of those unique MREITs that actually create value for investors. You can clearly see it in the chart below where ABR is up 385% in the last 10 years (in total returns including dividends) whereas mortgage REITs in general represented by VanEck Mortgage REIT ETF (MORT) resulted in mostly flat returns (about 1% annualized) during the same period despite offering double digit dividends.

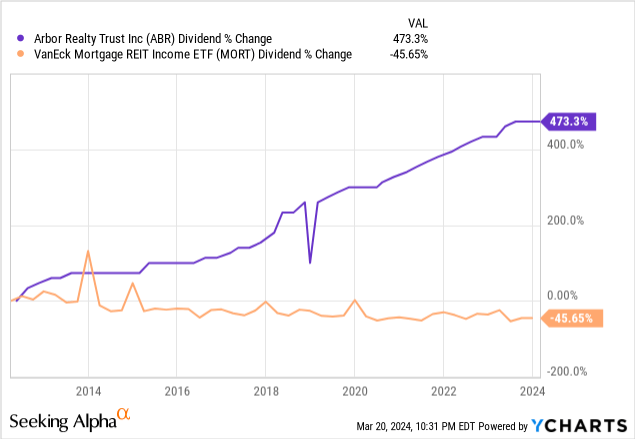

Another thing that sets ABR apart from other mREITs is the fact that it's been actually hiking dividends year after year whereas most mREITs have to keep cutting their dividends because they are not sustainable. In the last 10 years ABR hiked its dividends by 473% whereas the average mREIT actually saw its dividends decline by almost half during this period.

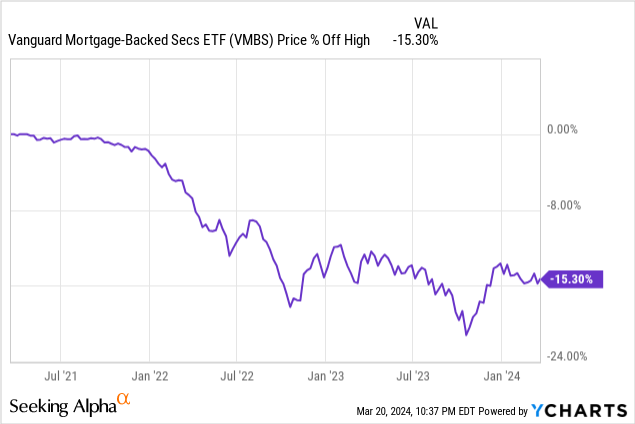

It is no surprise that most people buy mortgage REITs for their high yields which can often range from 10% to 20%. In order to pay these large dividends, these companies will typically use high levels of leverage which will put them in risk even if they are using government-backed mortgages to generate income. There is a common misconception about "government guaranteed mortgages" that you can't lose money in them because they are guaranteed by the government so therefore they must be as safe as government bonds but people forget that even government bonds can lose significant value from time to time. When bond or mortgage product is backed by the government it's backed against the risk of default or total wipe out but not guaranteed to protect its value which is a big difference. It's not uncommon for government backed loans or even treasuries themselves to lose 15-20% of their value from time to time. This may not be a big deal for investors buying those bonds or mortgages but it can be a big problem for mortgage REITs that can use as much leverage as 5x or more. If you are leveraged by a factor of 5x and your holdings lose 20% of their value, you will be totally wiped out even though all your holdings may be government guaranteed.

So how is ABR different from other mREITs? First, it focuses on multi-family residentials and commercial loans which tend to be more stable even though some sub-sectors of commercial real estate sector has been going through some rough times right now especially in the office space. Second, ABR diversifies itself in its usage of different financial products such as bridge loans, mezzanine loans, preferred equity investments, and agency loan products so it's not limited to one type of loans. This allows the company to have some flexibility and perhaps better manage its risks. I would almost say that ABR is a hybrid between an mREIT and a business development company focusing on real estate but keep in mind that this is not how the company defines itself so it's just my opinion which you may or may not agree with.

The company also engages in active asset management, active risk management and active relationship management where the company can closely watch how its investments are doing and take corrective action quickly if and when needed before things get out of control. Furthermore the company also has other income streams that don't come with as much risk such as in house loan origination. Loan origination is thought to be less risky because companies don't have to hold the loan they created and they can package them together to sell to servicing companies. In fact, ABR can keep high quality loans it generated while selling off more questionable ones since it is the one generating them and it knows which ones are more likely to succeed or fail even at the time of origination. This allows the company to have better risk management.

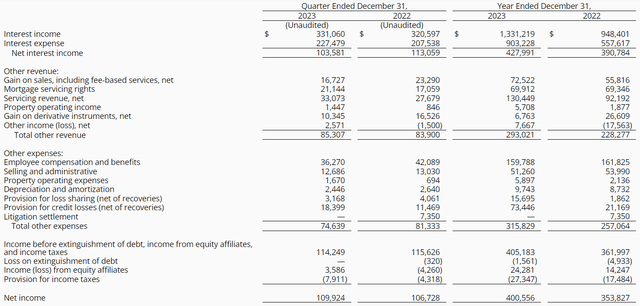

Last year was an interesting year for the company that had both risks and opportunities as interest rates were pretty high for the most of the year driven by the Fed's actions in order to curtail inflation. The company saw both its interest income and its interest expense rise substantially but there are no surprises there since that's what happens in a rising interest rate environment. For the full year, net interest income came at $427 million, up from $390 million from the year before while the net income for the full year came at $400 million, significantly up from $353 million in 2022. I was surprised to see that the company's commercial loan business didn't cause much damage last year while many other commercial loan providers were suffering including several regional banks that went out of business and had to be bailed out.

Financial Results (Arbor Realty Trust)

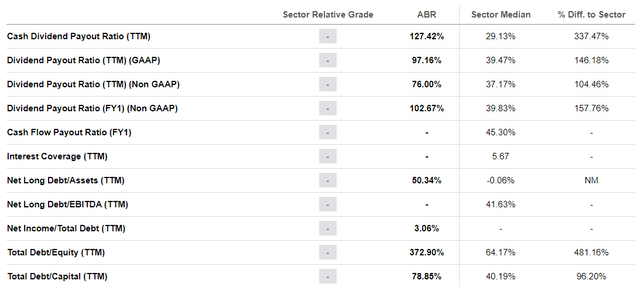

Since this is designated as a REIT the company virtually pays all of its income as dividend so when you look at the company's payout ratios, you might see percentage figures very close to 100% and you might be inclined to believe that the company's dividend is not sustainable. It's hard to judge a REITs or mREITs dividend's sustainability since they tend to distribute all their earnings but one thing we can say about this company is that it hasn't missed a dividend payment in recent history (at least going back a decade) and it has a very solid history of hiking dividends year after year as I mentioned above so I am less worried about them not being able to cover their dividends for the time being.

Dividend Sustainability (Seeking Alpha)

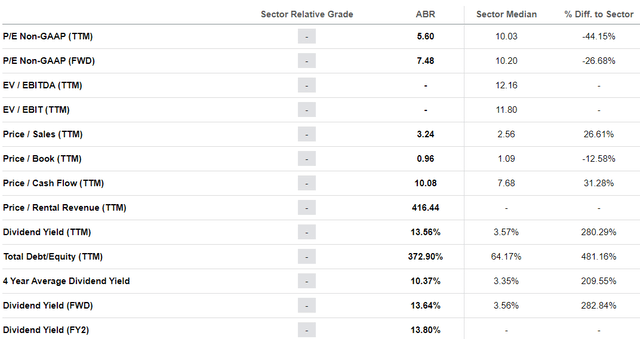

The company's valuation looks attractive with a trailing P/E of 5.50 and forward P/E of 7.50 against sector median of 10 for both metrics. Meanwhile the company's price to cash flow ratio of 10 is a bit above sector median of 7. One metric that looks absurd for the company is the price to rental revenue ratio of 416%. This might look excessive but keep in mind that this is an mREIT company and rentals are a very small part of their business so the high number is highly misleading.

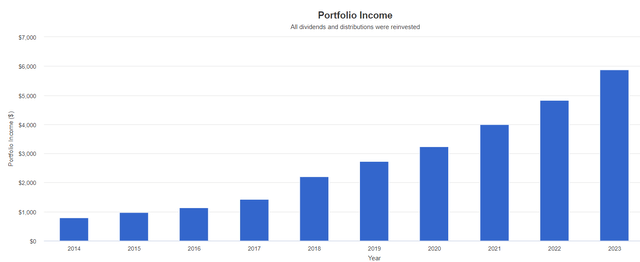

Below is an interesting chart. If you had bought $10k worth of ABR a decade ago and held until now while reinvesting dividends (assuming held in a tax-deferred account), your annual income on this investment would have climbed from $800 in the first year to $5,880 last year driven by both reinvestments of dividends as well as dividend hikes themselves. Your yield to original investment would be as high as 58.8% based on this which is quite impressive not to mention your total returns during this time would be an average annualized rate of 17% between dividends and share price appreciation.

ABR Income Growth (Portfolio Visualizer)

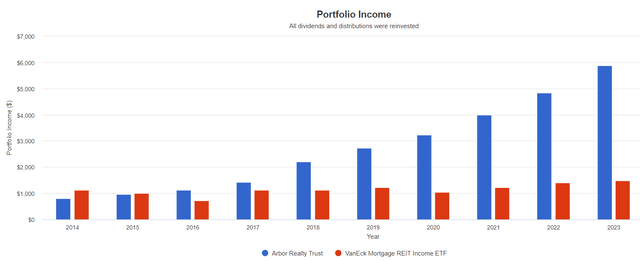

How does this compare against a basket of mREITs or an mREIT ETF such as MORT which I mentioned above. Well, ABR still wins by a large margin. It turns out that since MORT (a basket of 30 mREITs) saw so many distribution cuts, reinvesting your dividends would barely keep it from eroding but not really grow your income in any meaningful way.

Income Growth vs MORT (Portfolio Visualizer)

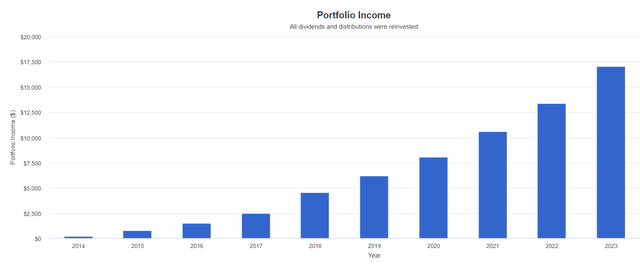

What if you took a different approach. Instead of investing a lump sum of $10k 10 years ago, what if you invested about $500 a month for the last 10 years while reinvesting your dividends. Your annual income would have grown to $17k between monthly installments, reinvesting dividends and actual dividend hikes. Since $500 a month in a period of 10 years totals up to $60k, your yield to cost would be 28% and some change.

Income Growth Over Time (Portfolio Visualizer)

Risks

Well no investment is risk free so there are some risks associated with this one as well. The biggest risk for this company is the overall economy. Since this is a loan company, it basically makes a bet that the economy will be good enough for people and companies to be able to service their loans. If the economy were to take a negative turn and we were to enter a deep recession, many people and companies would be unable to service their debts and default rates would jump substantially. This would result in a drop in earnings or even a possibility of a loss. This could further result in declines of share price as well as a reduction or total elimination of the dividend but hopefully the effects would be temporary.

Another risk for the company is the interest rate risk. Since the company generates most of its income from interest payments, it could see its profits drop significantly if interest rates were to drop in a quick fashion. I am not too worried about this particular risk though because we've seen the company successfully navigate several interest environments in the past already and the last time interest rates dropped sharply, its profits did not drop, if anything it's business volume grew more which made up for the lower interest income. Also keep in mind that the company's interest expenses are also likely to fall in a similar fashion.

Conclusion

All in all this is a good mREIT stock and the only mREIT I personally own at the moment in my portfolio. The stock seems to have a good history of delivering good total returns, hiking dividends and protecting investors from excessive risk (which is rare in mREITs) and it has been outperforming other mREITs by such a large margin that many people (including myself) don't even consider it a typical mREIT but more of a hybrid. Of course past performance of a company is no guarantee of its future performance but at least it can give us a good idea about what to expect within reasonable limits and there are reasons to be optimistic about this company as long as the overall economy continues to perform strongly.