Marat Musabirov

The Western Asset Investment Grade Income Fund (NYSE:PAI) is a closed-end fund that can be employed by those investors who are seeking to earn a high level of income from the assets in their portfolios. Unfortunately, it is not particularly good at this as its 4.92% current yield is worse than that of just about every fixed-income closed-end fund in the market today. In fact, the fund's current yield is actually lower than that of a good money market fund or short-term U.S. Treasuries. It is, therefore, somewhat unlikely to appeal to most income-focused investors as there are safer options available for those who are seeking to earn a high yield. Here is how this fund compares to other investment-grade bond funds in terms of yield:

Fund | Current Yield |

Western Asset Investment Grade Income Fund | 4.92% |

BlackRock Core Bond Trust (BHK) | 8.39% |

MFS Government Markets Income Trust (MGF) | 7.82% |

John Hancock Investors Trust (JHI) | 6.14% |

BlackRock Enhanced Government Fund (EGF) | 5.22% |

As we can clearly see here, even the government bond funds are able to sport higher yields than the Western Asset Investment Grade Income Fund. When we consider that many income-focused investors are somewhat risk-averse, it is unlikely that they would be willing to purchase a risky fund with a lower yield than a typical money market fund. That certainly limits the appeal of this fund when compared to other options.

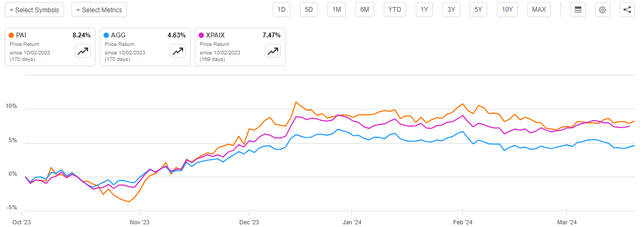

As regular readers can likely remember, we previously discussed the Western Asset Investment Grade Income Fund in early October 2023. The market today is significantly different to the one that existed at the time that the previous article was published. In particular, during the first half of October 2023, U.S. Treasury yields were generally rising and the bond market was selling off long-dated issues as the general expectation was that the Federal Reserve would be keeping interest rates very high for an extended period of time. The bond markets began to shoot up beginning in late October, which continued through the end of the year. However, since that time, investors have realized that bonds were almost certainly priced too high at the start of 2024 and the market has been gradually selling off since that time. As such, we can probably expect the Western Asset Investment Grade Income Fund to have delivered mixed performance in the market. That is, however, not the case as shares of the Western Asset Investment Grade Income Fund have appreciated 8.24% since the date that the previous article was published. This was a markedly better performance than the 4.63% gain of the Bloomberg U.S. Aggregate Bond Index (AGG):

However, one interesting thing that we have been seeing with fixed-income closed-end funds lately is that their shares are outperforming the actual assets in their portfolios. This was the case here, as the underlying portfolio only grew by 7.47% on a per-share basis:

While the fund still managed to beat the Bloomberg U.S. Aggregate Bond Index, it did not manage to do as well as might be assumed from a simple look at the fund's share price movements. This could have an impact on the fund's valuation, which we will need to examine later in this article. After all, it rarely makes sense to buy a fund that is trading at a higher price than is justified by the underlying assets.

As I have pointed out in various previous articles, a simple look at the share price performance of a closed-end fund does not tell someone how well investors in the fund actually did during a specific period. This is because closed-end funds such as the Western Asset Investment Grade Income Fund typically pay out most or all of their investment profits to their shareholders in the form of distributions. The basic goal is to keep the portfolio size relatively stable while giving the investors all of the profits earned by the fund. This is the reason why many closed-end funds boast higher yields than most other things in the market. As the distribution itself represents an investment return, it also means that an investor in the fund will end up with a higher return than the share price performance would indicate. As such, we want to include the distributions paid by the fund during any analysis of its results. When we do that, we see that investors in the fund have actually benefited from a 10.50% total return since my previous article on this fund was published. This is better than the 6.17% total return provided by the Bloomberg U.S. Aggregate Bond Index over the same period:

This is not a bad return from a bond fund for a roughly half-year period, however, it was still beaten by the BlackRock Core Bond Trust's 14.18% total return over the same period. In this case, the BlackRock fund's higher yield almost certainly contributed a lot to the performance difference. As I have pointed out in various previous articles though, it could be questionable whether or not any bond fund is capable of holding onto its recent gains as there could be some reasons to believe that bonds are overpriced right now. This is even more apparent in light of some of the comments that accompanied the Federal Reserve's meeting earlier this week.

As the chart above shows, it has been nearly half a year since we last discussed the Western Asset Investment Grade Income Fund. As such, a great many things have changed that could alter our thesis for it. In particular, the fund released its full-year 2023 annual report that should give us a much better understanding of how well it actually navigated the rather volatile bond market that existed over the course of last year. We will want to pay special attention to this report in our analysis today, particularly when it comes to the fund's ability to sustain its current distribution.

About The Fund

According to the fund's website, the Western Asset Investment Grade Income Fund has the primary objective of providing its investors with a very high level of current income. This makes a lot of sense considering the strategy that the fund is employing in order to achieve this objective. The fund's website does not go into a great amount of detail with its strategy description, as it only states the following:

Provides a portfolio of primarily investment grade debt, including government securities, bank debt, commercial paper, and cash/cash equivalents.

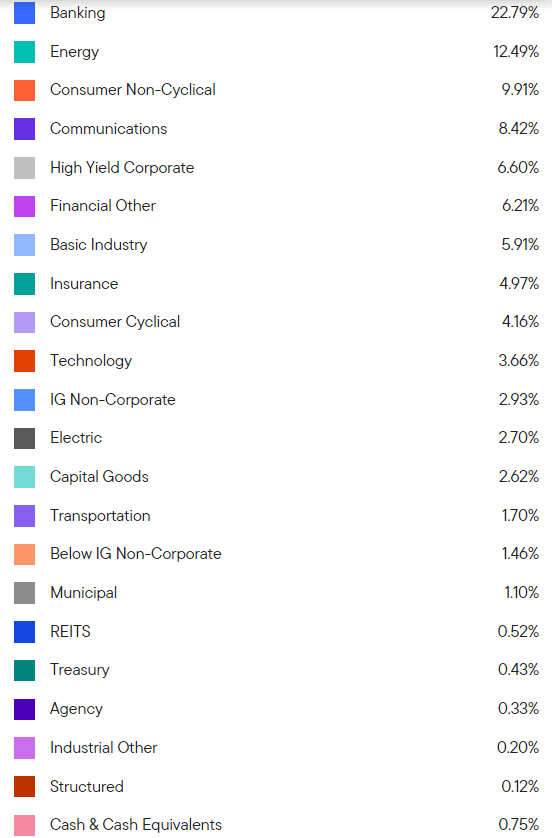

That description is much more akin to a prime money market fund than an investment-grade bond fund. Commercial paper is a short-term security issued by highly creditworthy companies that has a maximum maturity of 270 days from its initial issuance so it is frequently included in money market funds that are seeking a higher return than can be obtained via investment in short-term U.S. Treasury bills and repurchase agreements. However, a very quick look at the fund's fact sheet reveals that it is invested in substantially different assets than would be found in a money market fund:

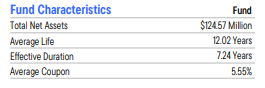

Fund Fact Sheet

We immediately note that the average life of the assets in the fund's portfolio is 12.02 years and the effective duration is 7.24 years. A money market fund cannot invest in such long-dated assets. It is therefore uncertain why exactly the fund's website description lists commercial paper and cash equivalents as an asset class that may be included in the fund. Here is the asset allocation table from the website:

Franklin Templeton

Commercial paper is not listed here at all, and cash/cash equivalents are only listed at 0.75% of the fund's assets.

Overall, despite the impression that the website's strategy description might impart, the Western Asset Investment Grade Income Fund appears to be exactly what its name suggests. This is a fund that is investing primarily in investment-grade bonds with maturity dates well into the future. It is not investing in short-term assets except as a place to park cash temporarily before distributing it to investors.

The fact that the fund is investing in primarily long-dated bonds means that it is fairly heavily exposed to interest rate risk. We can see this quite clearly in the fact that the fund's portfolio has an average effective duration of 7.24 years. Investopedia defines duration:

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. In general, the higher the duration, the more a bond's price will drop as interest rates rise (and the greater the interest rate risk). For example, if rates were to rise 1%, a bond or bond fund with a five-year average duration would likely lose approximately 5% of its value.

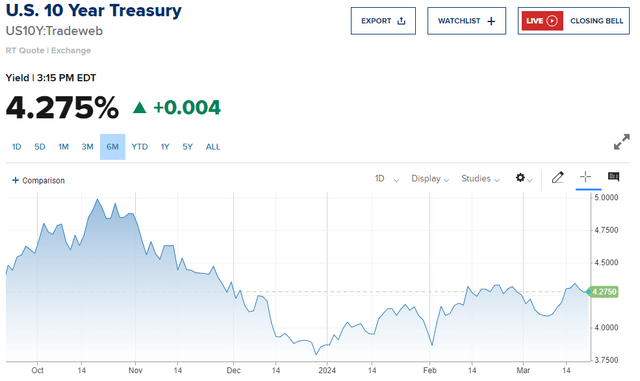

The Bloomberg U.S. Aggregate Bond Index has an average duration of 6.02 years right now. Thus, the Western Asset Investment Grade Income Fund is actually more exposed to interest rate risk than even the bond index. This is one thing that explains the fund's recent outperformance relative to the index, as long-term interest rates fell substantially since early October. We can see this clearly by looking at the yield of the ten-year U.S. Treasury note over the past six months:

Clearly, the current 4.275% yield possessed by this note is lower than the level at which it sat in early October when we previously discussed this fund. The higher a bond's duration, the more its price will rise when interest rates fall so the higher duration of the Western Asset Investment Grade Income Fund should cause it to outperform the index when interest rates fall. That is exactly what we saw over the past six months.

The fact that this fund has a higher duration than the aggregate bond index also works in reverse. In theory, it should mean that the fund declines more than the index when interest rates rise. This could pose a risk right now when we consider some of the comments that were made by the Federal Reserve following the meeting of the Federal Open Market Committee earlier this week. In particular, the Federal Reserve seems less likely to cut interest rates in 2024 than previously. The Federal Reserve's dot plot revealed the following:

- Only one member of the Federal Open Market Committee thought that more than three 25-basis point cuts would be appropriate for the full-year 2024 period. That one member said four cuts, and nobody said more than 100 basis points of cuts. At the start of this year, five members of the committee said that more than three cuts would be appropriate for 2024.

- For 2025 and beyond, the expectations for the federal funds rate moved higher than they were at the start of the year.

This suggests that interest rates may permanently be higher than the market expects right now. However, that is arguably a bit of a stretch. It does, however, suggest that a growing number of members of the committee believe that current economic data is far too strong to support rate cuts right now. If data continues to come in strong, as seems quite possible considering that the Federal Government will almost certainly continue fiscal stimulation in an election year and the Federal Reserve will probably want to avoid a resurgence of inflation leading up to the presidential election, we may see more pushback from the Federal Reserve to cut rates even three times. Thus, bonds may still be overpriced, especially when we consider the central bank's prediction of rates remaining high for an extended period. That could be an issue for a high-duration fund like the Western Asset Investment Grade Income Fund.

Distribution Analysis

As mentioned earlier in this article, the Western Asset Investment Grade Income Fund has the primary objective of providing its investors with a very high level of current income. In pursuance of this objective, the fund invests its assets in a portfolio that primarily consists of bonds or other income-producing assets. Bonds generally deliver the majority of their total return in the form of direct payments to their owners, which in this case is the fund. It collects these coupon payments and combines them with any money that the fund manages to realize through the sale of bonds that have gone up in price, which is a common occurrence in periods of falling interest rates. The fund then pays out all of this money to its investors, net of its own expenses. As the bonds in this fund have an average coupon of 5.60%, we can expect that this business model will result in the shares having a reasonable but not an exceptional yield.

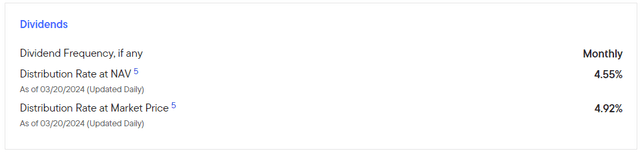

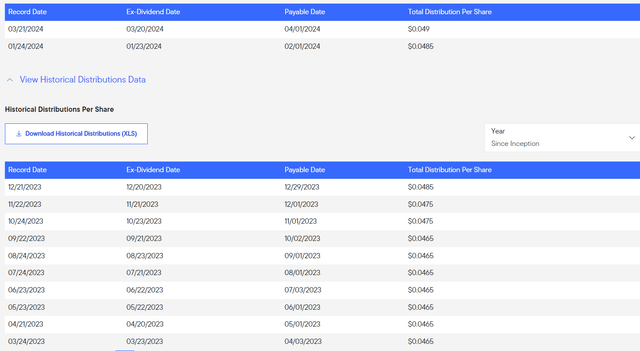

This is indeed the case, as the fund pays a monthly distribution of $0.0490 per share ($0.5880 per share annually), which gives it a 4.92% yield at the current market price. The website confirms this:

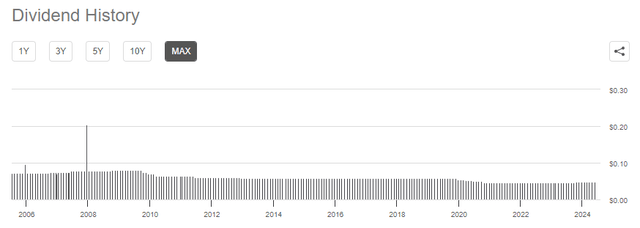

Unfortunately, the fund has not been especially consistent with respect to its distributions, as it has both raised and lowered it numerous times over its history:

This is something that may prove to be a bit of a turn-off for those investors who are seeking to earn a safe and consistent level of income from the assets in their portfolio. However, it is not particularly surprising that a bond fund would have to change its distribution over time as the returns provided by a bond portfolio tend to change with interest rates and interest rate movements are not something that the fund can control. The fund will naturally have to change its distribution to correspond to the returns that it is actually receiving from its assets because otherwise, it risks destroying its net asset value. Destruction of net asset value caused by overdistribution ultimately reduces the ability of a fund to sustain itself over an extended period of time. Thus, we generally would prefer that a fund reduce its distribution when its investment performance weakens, despite the adverse impact that this has on our incomes.

Fortunately for investors, the Western Asset Investment Grade Income Fund has been increasing its distribution over the past few months:

These distribution increases have been slight, but we can see that the fund has increased its monthly distribution from $0.0465 per share to $0.049 per share over the past year. This is a 5.38% increase, which has supposedly been enough to outpace inflation (depending on how exactly inflation is measured and what dataset is used). That is nice to see because it means that investors in this fund who are dependent on the fund's distribution to cover their expenses should have been able to maintain their purchasing power over the past year. As is always the case though, we want to ensure that the fund is actually able to afford the distributions that it is paying out in order to avoid net asset value destruction. Let us analyze that.

Fortunately, we have a very recent document that we can consult for the purpose of our analysis. As of the time of writing, the most recent financial report for the Western Asset Investment Grade Income Fund corresponds to the full-year period that ended on December 31, 2023. This is a much more recent report than the one that we had available to us the last time that we discussed this fund, which is very nice to see. After all, the second half of 2023 bore witness to two widely disparate bond markets. Over the summer, bond prices declined dramatically as interest rates rose due to investors becoming used to the idea that interest rates would not be reduced in the second half of 2023. The Federal Reserve actually increased the federal funds rate in July of that year, which likely contributed to this perception. The exact opposite occurred in November and December 2023, as various market participants began to believe that the Federal Reserve would cut interest rates five or six times in 2024 and started aggressively buying up bonds in order to lock in high yields before interest rates dropped. That drove bonds and bond funds up to very high levels. The first environment probably caused this fund to suffer some losses, but it may have been able to earn fairly substantial gains during the final two months of the year. The most recent financial report will give us a good idea of how well the fund navigated these two market environments.

For the full-year 2023 period, the Western Asset Investment Grade Income Fund received $6,744,386 in interest and $48,337 in dividends from the assets in its portfolio. We have to subtract out the money that the fund paid in foreign withholding taxes, which gives it a total investment income of $6,782,901 for the full-year period. The fund paid its expenses out of this amount, which left it with $5,828,093 available to shareholders. That was, fortunately, sufficient to cover the $5,345,161 that the fund paid out in distributions over the period.

The Western Asset Investment Grade Income Fund appears to simply be paying out its net investment income:

FY 2023 | FY 2022 | |

Net Investment Income | $5,828,093 | $5,600,962 |

Distributions | $5,345,161 | $5,307,116 |

This is a good sign, and it is generally what we want to see from a fixed-income closed-end fund. The fund did still suffer $2,729,569 net realized losses in 2023 and substantial unrealized losses in 2022, but these are not as important as it is pretty easy to avoid losing money on bonds in the long run by never paying higher than face value for them and simply holding them until maturity. Unfortunately, many bonds were selling at a price above par value during 2020 and 2021 and they may never recover to the price that they had in those years. The fund may therefore be forced to eat some losses on any bonds that it purchased in those years. Overall, though, it should be fine as long as it continues to pay out less than its net investment income. That does not, however, mean that the fund will not need to cut its distribution again as net investment income typically declines when interest rates go down and the fund is forced to replace maturing bonds with new ones that have lower coupon yields.

Valuation

As of March 20, 2024 (the most recent date for which data is currently available), the Western Asset Investment Grade Income Fund has a net asset value of $12.91 per share but the shares currently trade for $11.95 each. This gives the fund's shares a 7.44% discount on net asset value at the current price. That is roughly in line with the 8.00% discount that the shares have averaged over the past month. As such, the current price is acceptable for those who want to purchase the fund today.

Conclusion

In conclusion, the Western Asset Investment Grade Income Fund is a straightforward closed-end bond fund that simply pays out its net investment income to its shareholders. This is a very reasonable proposition as it should mean that the fund is not overdistributing and destroying its net asset value. However, this fund's yield is also not particularly competitive with other options in the market and yield-hungry investors may find other options more to their liking.

The only real problem with buying this fund today is that bonds in general may still be overpriced. While it is true that the market is now trading in line with the Federal Reserve's own expectations following the steady decline in bond prices year-to-date, there could be reason to believe that the central bank itself is too optimistic and will not be able to reduce interest rates without causing a resurgence in inflation. If that proves to be the case, then shares of this fund may experience some weakness going forward. With that said, I see no reason to rush out and sell the shares.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!