da-kuk

Fortinet, Inc. (NASDAQ:FTNT) continues to deal with the fallout of a pandemic induced hardware boom. On a positive note, the company's SASE and SecOps businesses are looking strong but are currently too small to move the needle.

Fortinet believes that the hardware cycle could be close to bottoming and therefore expects an acceleration of growth later in 2024. Given the size of the pandemic boom, I believe there is a risk of a protracted downturn.

While Fortinet isn't overly expensive given its long-term prospects, it will be difficult for the company to maintain its current revenue multiple through an extended period of low double digit / high single digit growth. This creates significant downside risk, as witnessed by the reaction to the company's Q4 2024 earnings.

Market

Fortinet's performance is likely to remain weak in the short term, as the largest part of its business is also expected to provide the least growth. Prior firewall product life cycles have lasted approximately four years, with eight quarters of higher growth followed by eight quarters of slower growth. Based on this, Fortinet has suggested that it could now be halfway through the down cycle. Given the size of the pandemic boom, I believe there is a high probability that the current downturn will be extended. While conditions are still soft, Fortinet has stated that its conversations with CIOs and CISOs are more positive than they were 12 months ago though.

Longer term, Fortinet is expecting the network security market to grow in the 10-20% range and eventually be larger than the network market. At the moment, it is only around one third the size. Much of this growth will be driven by the fact that network security is around 10x more expensive than an equivalent networking device. The additional compute demands of network security also play to Fortinet's ASIC capabilities.

Fortinet is also well positioned to capitalize on the SASE opportunity. The higher interest rate environment is supporting this part of the business by increasing the appeal of OpEx relative to CapEx. While competition in this area is increasing, most vendors continue to report strong results and expect solid growth going forward.

Figure 1: Fortinet TAM by Segment (source: Fortinet)

Fortinet

Fortinet operates at the convergence of networking and security. While the company is currently facing headwinds, its expansion beyond traditional network security into areas like SASE and SecOps should provide a bright future.

Figure 2: Fortinet's Business Segments (source: Fortinet)

Secure Networking

Secure networking accounts for 60% of Fortinet's billings and is currently its largest market. Fortinet is the number one network security vendor, with over half the global firewall deployment.

Fortinet’s ASICs are the key to the company’s competitive advantage in network security. The company continues to integrate more functionality into its OS and drive lower costs and improved performance with its hardware. Fortinet offers a range of firewall form factors, all based on its FortiOS operating system. The secure networking business provides Fortinet with a large customer base (~700,000 customers) in which to sell additional solutions.

SASE

Fortinet now offers a unified SASE solution, consisting of SD-WAN, ZTNA, secure web gateway, CASB, and firewall as a service. Fortinet's solution can be deployed on-premises or in the cloud. Fortinet continues to add features to its SASE solution and expand its PoP network.

Fortinet has around 35 of its own PoPs and a partnership with Google provides an additional 180 PoPs. Fortinet also deploys its hardware in carrier PoPs internationally. Managing its own infrastructure and equipment provides a cost advantage. Hyperscaler PoPs run FortiOS on normal hardware though, undermining Fortinet’s advantage.

Fortinet's SASE billings increased 19% YoY in the fourth quarter and accounted for 21% of total billings, with growth being driven by small and medium-sized businesses, or SMBs. The company's SASE pipeline is also up over 150%.

Fortinet’s SASE solution is priced significantly below competitors, which makes sense given the focus on SMBs. Fortinet appears willing to sacrifice margins in the short term in order to build the business and also potentially has a cost advantage relative to some competitors.

SecOps

SecOps billings increased 44% YoY in the fourth quarter, accounting for 11% of total billings. Growth was attributed to EDR, SIEM, email security, and NDR.

94% of Fortinet’s SecOps business currently comes from existing customers. Fortinet believes that this is due to consolidation, but it could also suggest an inability to attract new customers. This is difficult to discern given the size of Fortinet’s existing customer base.

Given the growing importance of data to SecOps, consolidation could be a tailwind going forward. Fortinet also continues to embed AI in its products in support of this. FortiAI is already available on FortiSIEM and FortiSOAR and more products will be adding this function in the coming months.

Large enterprises constitute around 55% of Fortinet’s SecOps business. The mid-enterprise segment is the fastest growing though.

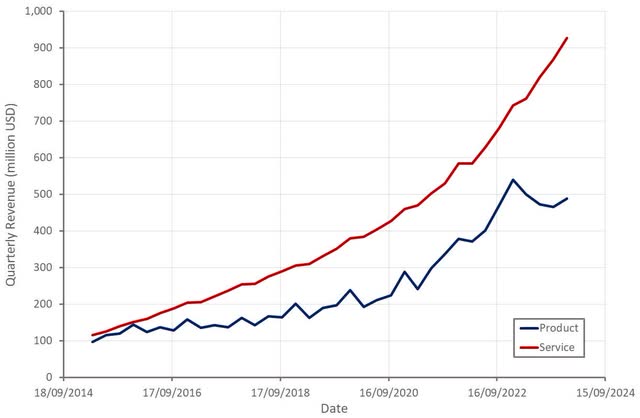

Financial Analysis

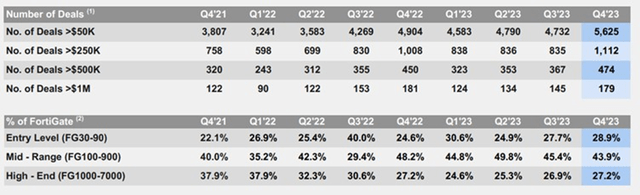

Q4 revenue was $1.42 billion USD, an increase of 10% YoY, driven by services revenue, which was up 25% YoY. Service revenue strength was attributed to SecOps, SASE, and other security subscriptions. Product bookings declined 10% YoY to $488 million USD. In Q4 2023, 68% of billings came from secure networking, 21% from unified SASE and 11% from security operations. Government and financial services were both areas of strength, growing around 25% YoY, while service providers and retail were relatively weak.

A muted seasonal budget flush likely weighed on Q4 growth, but Fortinet benefited from deals that had pushed out of previous quarters. Fortinet had six transactions worth in excess of $10 million USD in the fourth quarter, with secure networking contributing the majority of value in these deals. Fortinet added 6,400 new logos in Q4.

Figure 3: Number of Deals and FortiGate Sales (source: Fortinet)

Fortinet anticipates the firewall cycle to remain a headwind in 2024, although demand is expected to improve through the year. There is a risk that that the current down cycle is particularly severe though given the size of the upcycle.

Fortinet also faces difficult comparable periods due to the drawdown of its post-pandemic backlog boosting revenue in 2023. The company has suggested that the drawdown of its backlog was a low double-digit product revenue tailwind in 2023. Backlog is expected to be a $150-200 million USD YoY comparison headwind in 2024.

First quarter revenue is expected to be $1.3-1.36 billion USD, representing 5.4% growth at the midpoint. While this soft growth should prove temporary, Fortinet's valuation is a high for a company currently generating little growth.

Figure 4: Fortinet Revenue (source: Created by author using data from Fortinet)

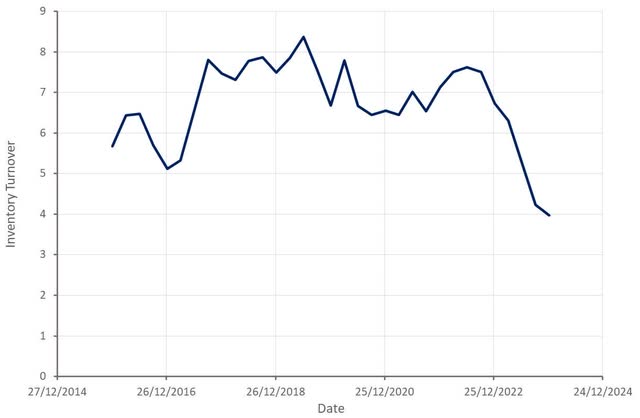

Fortinet's inventory turnover continues to fall, highlighting current product demand weakness. This will weigh on product margins in the short term.

Figure 5: Fortinet Inventory Turnover (source: Created by author using data from Fortinet)

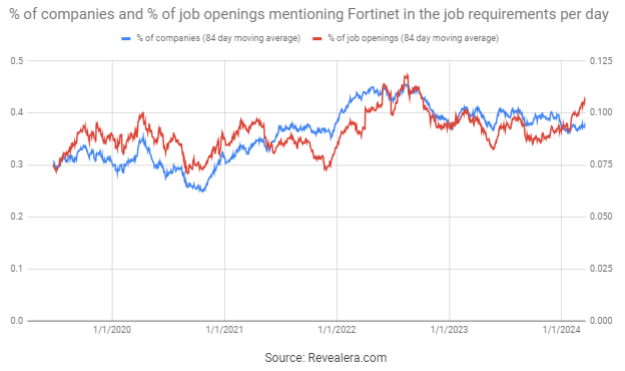

The number of job openings mentioning Fortinet in the job requirements appears to have picked up modestly in recent weeks, which could be supportive of growth later in the year. There appears to be some seasonality to this data though.

Figure 6: Job Openings Mentioning Fortinet in the Job Requirements (source: Revealera.com)

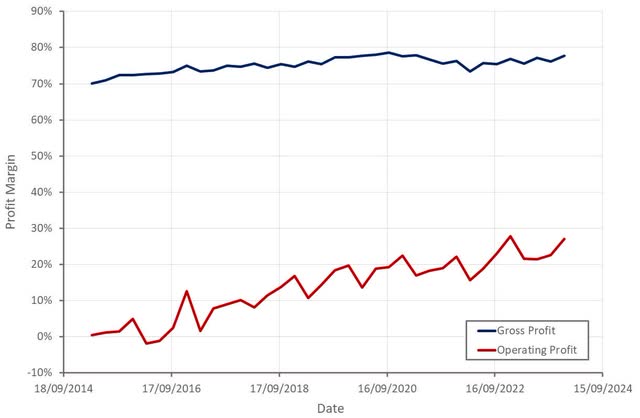

While Fortinet’s product gross profit margins are under pressure, the company is benefitting from a shift in revenue mix towards services. Product gross margins declined 5.1% YoY in Q4, which was attributed to inventory issues and product transitions.

Fortinet's operating profit margin was approximately 23%, with the roughly 2% YoY increase reflecting modest operating leverage and cost management.

Figure 7: Fortinet Profit Margins (source: Created by author using data from Fortinet)

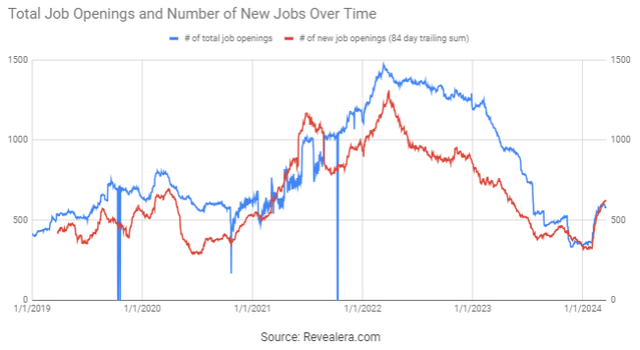

Fortinet's job openings also suggest increased optimism regarding the company's near-term prospects. If anticipated growth fails to materialize, this could be a drag on margins though.

Figure 8: Fortinet Job Openings (source: Revealera.com)

Conclusion

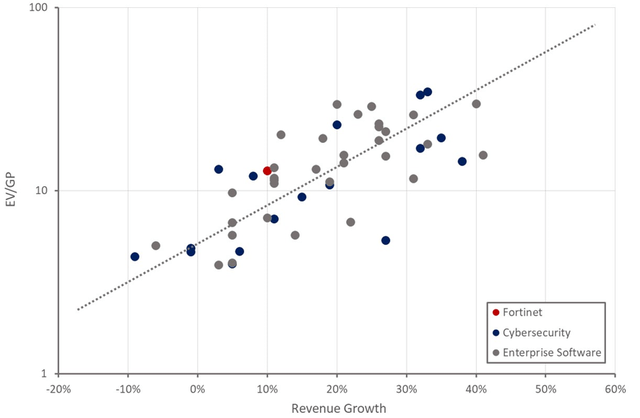

Fortinet, Inc.'s valuation is high given its current growth rate, with investors showing a willingness to look through current weakness due to the company's margins, competitive advantage and long-term prospects.

While I think the stock will do well in the long run, caution is warranted at the moment. Recurring revenue only constitutes 66% of Fortinet's total revenue making a decline in revenue a possibility if there is an extended period of demand weakness. If growth fails to accelerate in the second half of 2024, or investor optimism for cybersecurity stocks fades, Fortinet's share price could fall significantly from current levels.

Figure 9: Fortinet Relative Valuation (source: Created by author using data from Seeking Alpha)