Tim Boyle

Introduction

As a dividend investor it's always great to see well-known, established companies like Kimberly-Clark (NYSE:KMB) trading at what we deem as attractive valuations. Especially when they have a lengthy track record of paying growing dividends. But sometimes when Mr. Market prices in headwinds for a company, it can be more than just typical market volatility. In this article we discuss the company's financials, their projected growth outlook, and dividend safety to see if Kimberly-Clark is worth investing into at the current price.

Why Kimberly-Clark?

Kimberly-Clark is a well-known company with brands most consumers are probably very familiar with. From their family care segment with names like Scott, Kleenex, and Cottonelle to their baby & childcare products like Huggies and Pull-ups, a lot of people likely use their products on a regular basis.

They operate in three segments: Personal Care, Consumer Tissue, and K-C Professional. Many are also familiar with their feminine care products like household name Kotex, or maybe you visited a public bathroom and saw a paper towel dispenser with Kimberly-Clark written across it without realizing it. Either way, KMB has a large presence and has been around for a very long time having been founded in 1872.

So, because of their long history and cheap valuation, investors may see a familiar name like KMB and think the stock can continue its past performance into the future. But since COVID, where the company did well, KMB has struggled somewhat due to what I think is changing consumer habits, which we'll discuss later in the article.

Headwinds & Risks

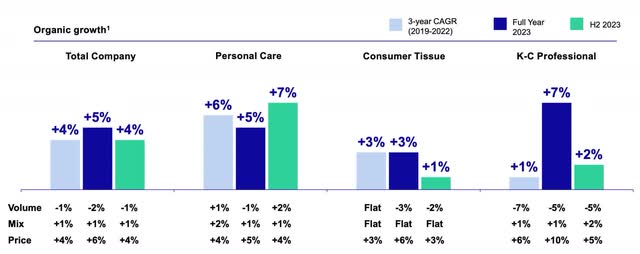

For fiscal year '23, Kimberly-Clark managed total organic growth of 5% to close out the year. Now, some may say that's not bad despite headwinds many companies have faced because of the challenging economic backdrop due to the rapid rise in interest rates.

However, volumes were down across all segments and down 1% over the last 3 years. But due to their well-known brands, KMB managed to increase prices of their products to offset lower volumes. But the question investors need to ask themselves is: How long can the company keep this up?

Because of inflationary pressures, the consumer staple passed on rising costs to consumers. But as consumer spending becomes tighter and tighter due to inflation and higher interest rates, consumers will likely look for cheaper alternatives i.e., store brands.

Gross margins also declined quarter-over-quarter to 34.9%, down from 35.8%. However, this did rise from 32.8% year-over-year, reflecting revenue realization, mix, and cost savings that offset currency headwinds. Net sales were $5.0 billion for the full-year growing 3%.

However, this was down from Q4 '22. Besides gross margins, operating profit margins and EPS also declined year-over-year by 80 basis points and 2% respectively. EPS for the full-year was $5.21 vs $5.72 in fiscal-year '22. Management attributed this to currency headwinds and monetary losses in hyperinflationary economies.

2024 Doesn't Look Much Better

For this year, KMB expects low-to-mid single digit growth in net sales. Additionally, they expect to continue with price increases. Adjusted operating profit growth and EPS are expected to grow at higher rates however, but still face negative impact from FX translation.

Again, you have to ask yourself, how long can they sustain by creating profit growth from price increases? Although they have a long history of operating during economic downturns, I'd like to see how management expects to sustain growth going forward without relying on their ability to increase prices.

Their Chief Financial Officer addressed operating profits and earnings for the full-year during Q4 earnings:

At the same time, we expect operating profit and earnings this year to be more 48% vs 52%, first half vs second half weighted, compared to what turned out to be more of a 51:49 split in 2023. This reflects a combination of the balance of sales, greater currency headwinds in the first half and our expectation for greater productivity gains as the year progresses.

2023 Wasn't All Bad

To be fair Kimberly-Clark did manage to do some good things in 2023 like increase the dividend, buyback shares, and pay down debt, all great measures to strengthen their dividend safety for now and in the future. The ability to repurchase shares also shows their cash flows remained strong despite headwinds.

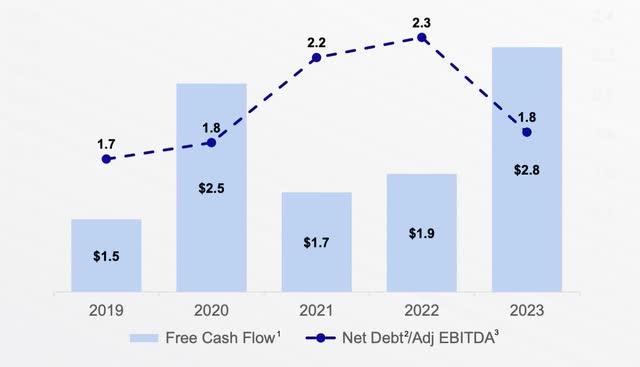

Besides the drop-off from COVID, free cash flow has grown nicely by 61% from roughly $1.7 billion to nearly $2.8 billion at the end of fiscal year '23. Furthermore, the company managed to reduce CAPEX spending over the same period by roughly 24% to $766 million. For the year, management repurchased 1.8 million shares and paid $1.6 billion in dividends. Additionally, they raised the dividend by 3.4% to $1.22 a share for the 52nd consecutive year.

Furthermore, their balance sheet remains strong while the company also managed to de-leverage to 1.8x, down from 2.3x in 2022. This is in comparison to their A-rated peer, Church & Dwight's (CHD) 1.8x. Their debt maturities are also well-staggered and their liquidity profile strong with $2 billion on the revolving credit facility and $566 million in debt maturing this year & $559 million in 2025.

Catalysts

At their recent investor day the consumer staple unveiled a new plan to optimize its margin structure to sustain long-term growth going forward. And this is expected to generate more than $3 billion in gross productivity and $500 million in savings.

The transition includes investing in science and technology to meet consumers' needs. The transition to the new organizational structure is expected to be complete by the end of this year. If this comes to fruition, this will not only give the company better dividend coverage, but free up capital for sustainable share repurchases, likely driving earnings growth in the future while boosting shareholder sentiment.

I think this is a great step in the right direction as consumer habits have changed quite dramatically since COVID, which has hampered KMB's growth. Furthermore, with financial tightening, more consumers seem to be in search of value instead of loyalty to well-known brands.

Whether KMB has make this transition remains to be seen. And if we experience an unexpected downturn or miss a soft landing, this could slow progress going forward. I will be watching the company closely in the coming quarters to monitor transition progress.

Valuation

At the current price of $126 at the time of writing, KMB is trading closer to their 52-week low of roughly $116, which may be very attractive for some investors. Wall Street currently rates the stock a hold which I suspect is due to their disappointing 2024 outlook and headwinds currently. The dividend yield of nearly 4% is also attractive and above the sector median's 2.65% and KMB's 5-year average.

With current headwinds, I don't see the share price moving much as they are likely to trade near the current price until headwinds improve. However, due to the valuation now may be a good time for investors to dollar-cost average into the stock if you believe inflationary pressures will moderate in the foreseeable future.

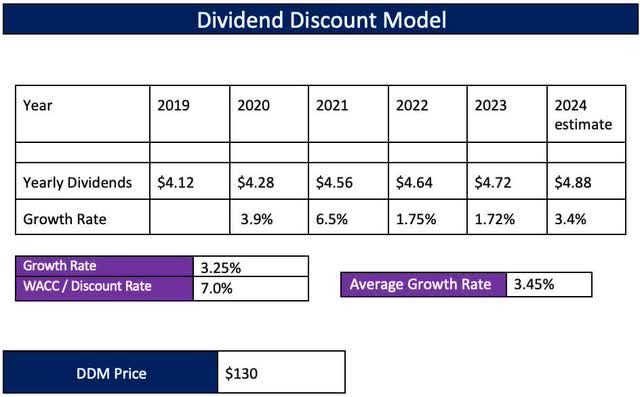

Using the Dividend Discount Model I have a price target of $130, about 3% upside from the current price. If you're looking for a greater margin of safety then I suggest waiting for a potential pullback. But Kimberly-Clark is a Dividend King with a long history so that may never come. As previously mentioned, the stock is near its 52-week low so now may be a good time to DCA.

As you can see above KMB's dividend growth has grown at a rate of nearly 3.5% over the last 5 years, nothing great. With headwinds still expected and a recession still on the books, I decided to use a lower rate of 3.25% to manage expectations.

However, Kimberly-Clark does have a long operating history so 3.25% is reasonable but since COVID, their dividend growth has slowed considerably. And I think it's likely we will see slower growth, at least for the foreseeable future. For this I also decided to use a WACC of 7%, on the lower end of the S&P's historical 7% to 10% average.

Bottom Line

Kimberly-Clark, as a result of headwinds and a weak 2024 outlook, is trading at an attractive valuation currently. Because of headwinds, I think the market has already factored this into the current share price.

I like that the company managed to de-leverage its balance sheet, giving themselves financial flexibility if the company experiences unsuspected headwinds or if the economy falls into a recession which would likely impact their financials.

If and when rates do decline, I think KMB's share price could see some appreciation if consumer sentiment shifts positively. Although their valuation is attractive here closer to its 52-week low, due to their poor outlook currently, I rate the consumer staple a hold.