BalkansCat/iStock Editorial via Getty Images

My Thesis

On March 28, 2024, shares of Xiaomi Corporation (OTCPK:XIACY) (OTCPK:XIACF) surged more than 12% after the company released an electric car about $4,000 cheaper than Tesla's (TSLA) Model 3, according to CNBC News. They also announced a partnership with auto insurance platform Cheche Group (CCG), which will offer a digital SaaS service platform for auto insurance transactions with operational support, the Seeking Alpha News team reported.

Many people are now asking themselves the question: To what extent is Xiaomi's entry into the EV market worthwhile for shareholders? In my opinion, the company's EVs will face serious competition, but Xiaomi has one huge advantage over Tesla - and it is this advantage that should give Xiaomi shares a reason to keep rising in the medium term.

My Reasoning

Xiaomi unveiled its first EV, the SU7, pricing it aggressively at ~215,900 yuan (or ~$30,408) in China - this pricing significantly undercuts Tesla's Model 3, which starts at ~245,900 yuan in the country to date. Xiaomi's CEO, Lei Jun, acknowledged that the company would sell each car at a loss at this price point, CNBC notes, and it sounds unsurprisingly to me - Xiaomi tries to capture as large a share of the EV market as possible, even if it has to keep its new business segment at a loss. Based on its specifics, Xiaomi's SU7 may be indeed a great competitive car as it surpasses the Model 3 on over 90% of metrics (according to the management commentary), including a minimum driving range of 700 kilometers (~435 miles) compared to the Model 3's 606 kilometers (~377 miles).

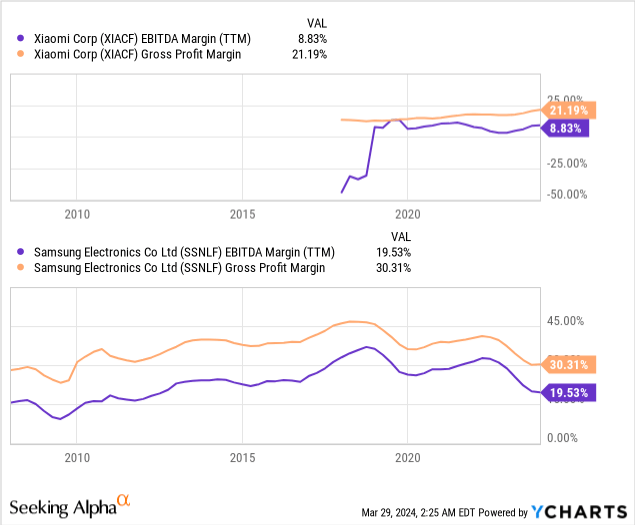

Xiaomi's first major competitive advantage over Tesla and other companies such as NIO Inc. (NIO) or XPeng Inc. (XPEV) is that Xiaomi isn't a pure electric car manufacturer - the company's core business is the production and sale of electronics. Yes, the company's margins lag behind those of Samsung (OTCPK:SSNLF), which is probably because the company targets lower price segments, but in the long run Xiaomi still earns quite well.

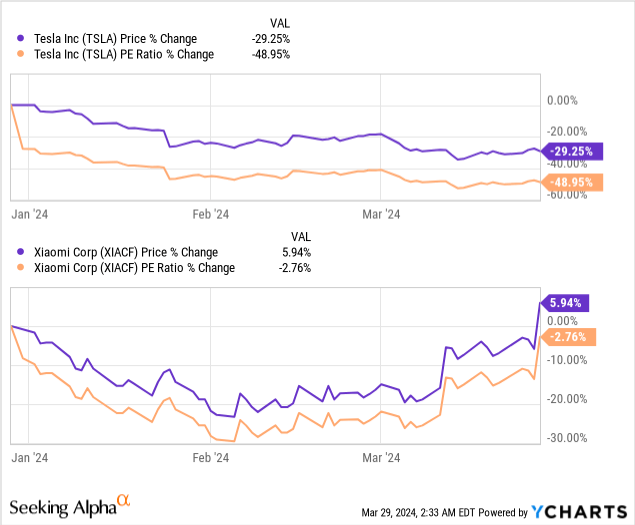

Since Xiaomi earns a lot in its core business, it can afford to operate at a loss for several years in one of its segments that it considers promising. Tesla can't get back there after many years of losses, and as the market is saturated, its margin starts to shrink to the industry average, leading to a lower premium in its valuation. Xiaomi, on the other hand, receives a kind of valuation premium boost because an important, potentially fast-growing segment has been added.

I'll get to Xiaomi’s valuation shortly, but for now, I want to continue the topic of the company’s competitive advantage over Tesla and other EV players.

The financial stability of its core business is far from the main reason for Xiaomi’s competitive advantage. Tesla, for example, has almost twice as much cash on its balance sheet as Xiaomi today. I mean, no one is questioning Tesla's financial position. What's important is the development of the ecosystem, where I think Tesla is slightly inferior to Xiaomi.

If you google "Tesla's ecosystem" you'll find that the company is actively working on expanding its energy storage and solar systems to the home. Products such as solar panels and the Powerwall home battery should enable its future consumers to generate and store their own energy, contributing to a more sustainable lifestyle, Ecosystemizer reports.

This is a very noble, environmentally friendly approach to expanding and diversifying, but as far as I can imagine, building such an ecosystem takes years and is aimed primarily at the highest social strata of the population. I suggest you sit down and calculate how much it would cost you to make your house self-sufficient, which even has a positive electricity balance at the end of the year.

Xiaomi has taken a slightly different path, looking for ways to further monetize the "Human x Car x Home" ecosystem under construction. It's a systemic innovation solution that aims to promote seamless collaboration between devices and ensure the same experience within Xiaomi's integrated smart platform:

By integrating people, cars, and homes, we aim to create an end-to-end interconnectivity beyond anything available today,” stated Daniel Desjarlais, Director of Communications Xiaomi International.

Xiaomi's transition from "Smartphone x AIoT", the “Human x Car x Home" smart ecosystem seamlessly merges personal devices, smart home products, and cars. This facilitates seamless connectivity of hardware devices, real-time coordination, and driving advancements, as well as collaboration with industry partners.

As the foundation of the “Human x Car x Home" smart ecosystem, it integrates over 200 product categories incorporating 600 million global devices, and covering more than 95% of user scenarios. By engaging with global partners, developers, and manufacturers, Xiaomi HyperOS will empower the ecosystem to unlock and leverage an expansive range of possibilities.

Xiaomi EV's first product - the highly anticipated Xiaomi SU7, is positioned as a "full-size high-performance eco-technology sedan" that pushes boundaries in performance, ecosystem integration, and the mobile smart space. Alongside Xiaomi SU7 design, Xiaomi has developed the five core EV technologies: E-Motor, CTB Integrated Battery, Xiaomi Die-Casting, Xiaomi Pilot Autonomous Driving, and Smart Cabin. Backed by a monumental investment of over CNY 10 billion RMB in R&D, and a global team of more than 3,400 engineers and 1,000 technical experts in key areas, Xiaomi has produced an outstanding vehicle.

Source: Xiaomi's official press release

Such an ecosystem seems to me to be much simpler than what Tesla is trying to build today. The companies are taking slightly different paths, but because of this existing "simplicity", Xiomi's development could prove to be much more sustainable than Tesla's (at least in China and Asia). In any case, I expect the company will need fewer resources for faster monetization.

With these features in mind, let's talk about the company's valuation.

Right now, Xiaomi is trading at 0.84 times forwarding EV/sales and a TTM price-to-earnings ratio of 19.41. That's incomparably cheap for any EV player, but since Xiaomi is primarily an electronics company, we have to look at it in the context of the consumer electronics industry.

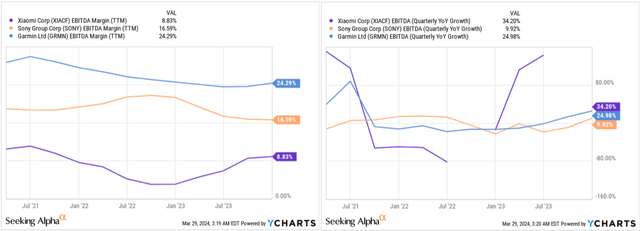

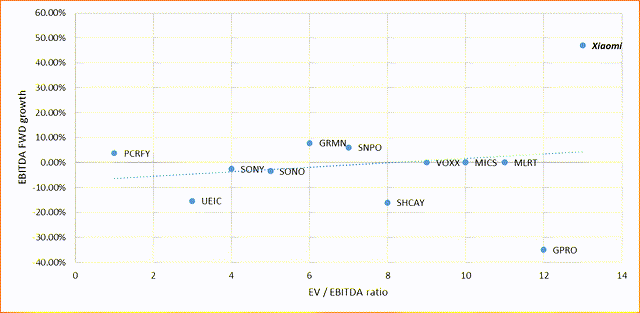

In terms of P/E TTM ratio, Xiaomi at 19.41x is between Garmin (GRMN) at 22.05x and Sony Group (SONY) at 17.81x. At the same time, Xiaomi's EBITDA growth rates are higher than those of its peers, although the EBITDA margin is still significantly lower.

According to Seeking Alpha, Xiaomi's rapid EBITDA growth should continue next year - which is likely why the current EV/EBITDA multiple is twice as high as those of its industry peers:

Seeking Alpha data, Oakoff's work

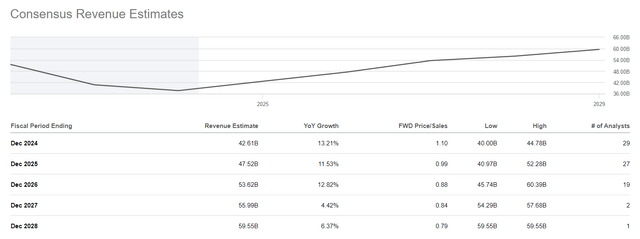

Unfortunately, we don't know what the consensus estimates are for Xiaomi's EPS numbers in the coming years, but Seeking Alpha Premium's data shows the revenue projections:

As you can see, the long-term CAGR of revenue is about 7%, which is very good in my opinion. On this basis, I have doubts that the FWD EV/Sales multiple of 0.84x is fair. In my opinion, Xiaomi's EV/sales should be in the region of 1.1-1.2x, especially considering that the company now has a new revenue stream.

If we take the forecast revenue for the 2024 financial year as a basis, multiply it by 1.15 times, and adjust the resulting value to the current level of the company's net debt, Xiaomi's market cap will arrive at $60.25 billion. This output gives me a growth potential of 12.85% by the end of 2024.

So if I continue the comparison with Tesla, for which I have a long-term "buy" rating, Xiaomi even seems somewhat more stable to me in terms of the margin of safety and the multiple growth potential.

Risks For Your Consideration

Everyone buying Xiaomi stock today should keep in mind that investing in Xiaomi involves navigating several significant risks that demand careful consideration.

Firstly, there are the regulatory uncertainties. The ever-changing Chinese market poses particular challenges for Xiaomi in terms of business operations and market access. These uncertainties could arise from regulatory changes or geopolitical tensions and disrupt the company's course. Many believe that China is currently in a financial crisis and that Chinese politics are preventing the economy from continuing to grow as it has in the past. I believe that although the Chinese economy is run in an authoritarian way, it is not just the actions of the Communist Party that have led to the current stagnation, it is simply the law of the market that the cycle has to change at some point. It is still possible to operate and grow there, especially for companies as efficient as Xiaomi.

Secondly, Xiaomi is facing fierce competition and the need to constantly innovate in the tech industry, which could jeopardize its market position and profitability. Not only has Xiaomi already faced incredible competition in the smartphone and consumer electronics market before, but now the company will have to operate at a loss in car production for several years. So if Xiaomi fails to navigate this competitive environment, it may lead to a decline in market share and financial performance.

Furthermore, Xiaomi's vulnerability to market volatility (not a rare thing for Chinese equities today), supply chain disruptions and brand perception issues increase the risk profile for potential investors.

Your Takeaway

Despite all the risks, I think Xiaomi is making the right move by trying to break into the electric vehicle market with its new and affordable SU7 sedan. The car looks interesting, outperforms Tesla's Model 3 in most respects according to Xiaomi representatives, and will also cost much less. I think Xiaomi Corp. has every chance to establish itself in the market despite today's fierce competition. Moreover, the company's unique advantage, its emerging ecosystem (which makes Xiaomi better than Tesla in some ways), should give the company new incentives for incremental growth as it keeps developing it.

Today, Xiaomi shares are trading quite cheaply, and if we assume even a small premium to valuation due to the firm's participation in the "EV competitive race", I think we can call it undervalued.

For these reasons, I consider Xiaomi a "buy" today.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You'll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.