zimmytws/iStock via Getty Images

The NCAA’s March Madness tournament is an annual opportunity to learn humility.

I know I’ve written about this in past years, but the odds of filling out a perfect bracket are astronomical. It’s worth addressing again in 2024, starting with a quote from the NCAA itself.

Early in March, while everyone was speculating about who’d be eligible for placement to begin with, it wrote how:

“Every year, millions of people fill out a bracket for the NCAA tournament. If you’re like us, you hear that little voice saying, ‘What if I became the first person ever to fill out a perfect bracket? This could be the year!”

Which means it’s never happened before. People have, of course, correctly guessed the winning team. But “here’s the TL/DR version of the odds of a perfect NCAA bracket” according to its backing organization:

- “1 in 9,223,372,036,854,775,808 (if you just guess or flip a coin)”

- “1 in 120.2 billion (if you know a little something about basketball.”

Which is why “that little voice” saying you can achieve a perfect bracket is gravely mistaken. Just accept that:

“This will not be the year. And neither will next year, or any in the next millennium.”

As such, I hope you’re having fun with March Madness 2024, keeping it light with small bets. But if you want to make real money that won’t leave you on the edge of your seat…

I’d recommend real estate investment trusts (REITs). They have much better odds to talk about.

It Gets Easier When You Can Walk the Walk

Of course, some March Madness years are more predictable than others, as this one seems to be. USA Today wrote just the other day that:

“Since original odds for the men’s NCAA Division I tournament came out following Selection Sunday, not much has changed at the top. All four No. 1 seeds remain in the tournament as well as all four No. 2 seeds, and UConn still reigns supreme as the clear favorite to win the title.”

That team is certainly Gary Parrish’s pick, a college basketball insider writing for CBS News. He had UConn to begin with, and he’s sticking with it. Yet, like everyone else, he’s still completely out of the running for a perfect bracket.

After Sunday’s culling, he explained how:

“I always welcome and enjoy a Sweet 16 with a Cinderella or two sticking around. But we don’t have that this year. What we have in its place is an 11th-seed power-conference program with two national championships to its name as an ersatz Cindy story – and NC State, you’re more than welcome to continue charming us. But I also don’t have the run continuing beyond this Friday. Of my initial Sweet 16 picks, I landed only 10, which is a shame. But it also gives me the chance to regroup and get it right from here on out.”

Again, it’s an opportunity to practice humility. Life in general is, when you really think about it.

You win some. You lose some. And hopefully you learn along the way.

That’s why your odds improve immensely (though still pointlessly) when “you know a little something about basketball” versus just guessing about March Madness wins or flipping a coin. One in 120.2 billion versus 9.22 quintillion.

Studying might not “make perfect,” but it certainly helps.

Past Results + Present Positives = Likely Future Profits

Do you know what else helps?

Intensely limiting the money you put down on foolish bets. It’s much better to concentrate the vast majority of your cash in sturdy, stable investments.

Go ahead and put $20 into your office pool or $100 into your buddy’s bet. I’ve already admitted more than once to taking $500 to the blackjack tables in Vegas when I go. So it would be hypocritical for me to counsel otherwise.

But save your big bucks for games with the highest likelihood of succeeding… like select real estate investment trusts.

I’ve been writing about my “March Madness REIT” selection process off and on for over a month now. And just in time for the real Sweet 16’s emergence, I’ve got my own list of continuing contenders to consider.

These companies hail from nine different sectors:

- 4 net-lease REITs

- 2 tech

- 1 healthcare

- 2 office

- 2 residential

- 2 industrial

- 1 self-storage

- 1 retail

- 1 mortgage.

Some of those categories might surprise you, especially the idea that anything office could be worthwhile. But believe me when I say I’ve crunched the numbers.

You can – and should – do with my analysis as you see fit. But the facts and figures I’m seeing show a lot of promise.

These REITs have already survived at least the Covid-19 shutdowns and the chaos it caused – if not other epic problems of the past like the Great Financial Crisis. Their current situations, balance sheets and all, make them look equally capable going forward.

And while I can’t predict the future, they’re all showing signs they can “take it all” in this REIT matchup.

Keep reading on to see what I mean.

The Net Lease Sector

iREIT®

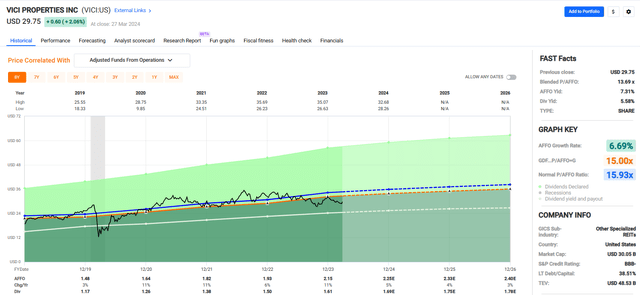

VICI Properties (VICI)

This gaming REIT invests in and has a diverse portfolio of leading gaming properties that include top hospitality and entertainment destinations. Some of its more well-known properties are located in Las Vegas and include Caesars Palace, the Venetian Resort, and MGM Grand.

In total, the company has a 127 million SF portfolio comprised of 93 income producing assets which consist of 54 gaming properties and 39 experiential, non-gaming properties. Its gaming properties have over 4.0 million SF of gaming space and features more than 60,000 hotel rooms, roughly 6.7 million SF of convention space, and over 500 restaurants, nightclubs, sportsbooks, and bars.

The company’s 39 non-gaming properties primarily consist of family entertainment bowling alleys that covers ~1.6 million SF across 17 states. Since 2019 VICI has had an average AFFO growth rate of 6.69% and an average dividend growth rate of 10.11%. The stock pays a 5.58% dividend yield and trades at a P/AFFO of 13.69x, compared to its average AFFO multiple of 15.93x.

We rate VICI a Buy.

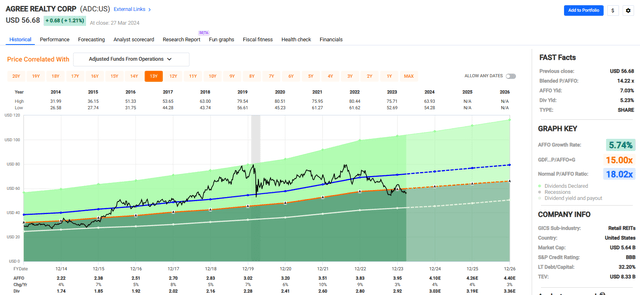

Agree Realty (ADC)

This company is a REIT that is focused on the acquisition, development, and management of free-standing net leased properties which are leased to top-tier retailers in their respective industries.

The company’s portfolio spans 44.2 million SF and is made up of 2,135 properties located in 49 states. ADC prides itself on having a high-quality portfolio leased to high-quality tenants. Some of its top tenants include leading retailers such as Walmart, Home Depot, Tractor Supply, Kroger, Lowe’s, Wawa, 7-Eleven, and Sherwin-Williams.

Notably, about 69.1% of its annualized base rent (“ABR”) comes from tenants (or parent company) with investment-grade credit ratings. This net lease REIT strategically targets basic properties, or “fungible square boxes” that can be released to tenants operating across different retail sectors.

ADC is not interested in single purpose assets such as car washes, golf driving ranges, or casinos. While the company’s portfolio almost entirely consists of retail properties, they target retail industries that are necessity-based and ecommerce resistant such as grocery stores, convenience stores, and home improvement stores.

Additionally, the company has a growing ground lease portfolio leased to top tenants such as Lowe’s, Wawa, Walmart, and Home Depot. As of December 31, 2023, the company’s net-lease portfolio was 99.8% leased and had a WALT of 8.4 years. Currently the stock pays a 5.23% dividend yield and trades at a P/AFFO of 14.22x, compared to its average AFFO multiple of 18.02x.

We rate Agree Realty a Buy.

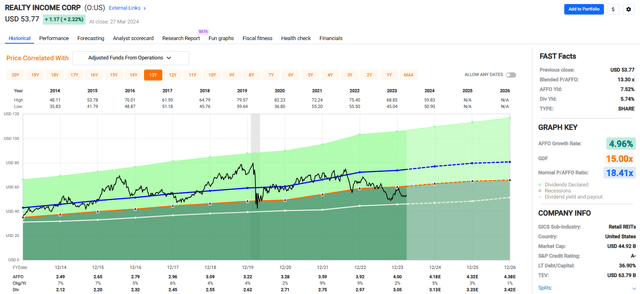

Realty Income (O)

This company is a net lease REIT that was formed in 1969 and publicly listed in 1994. It specializes in the acquisition and management of a portfolio of single-tenant, freestanding commercial properties that are leased to tenants on a long-term, triple-net basis.

Realty Income’s portfolio is diversified by property type and primarily includes retail, industrial, and to a lesser extent, gaming properties. At the end of 2023 retail properties represented 81.8% of the company’s portfolio, industrial made up 12.7%, and gaming properties represented 3.9% of its portfolio.

In total, the company has a 272.1 million SF portfolio made up of 13,458 properties that are leased to approximately 1,300 tenants operating across 86 industries. The company has properties in all 50 states, the United Kingdom, Spain, Italy, Ireland, France, Germany, and Portugal and at the end of 2023 it reported a portfolio occupancy of 98.6%.

On March 13, the company announced its Board of Directors authorized a dividend increase, with the monthly dividend increasing from $0.2565 to $0.2570 per share. Since 2014 Realty Income has had an average AFFO growth rate of 4.96% and an average dividend growth rate of 3.92%.

The stock pays a 5.74% dividend yield and trades at a P/AFFO of 13.30x, compared to its average AFFO multiple of 18.41x.

We rate Realty Income a Buy.

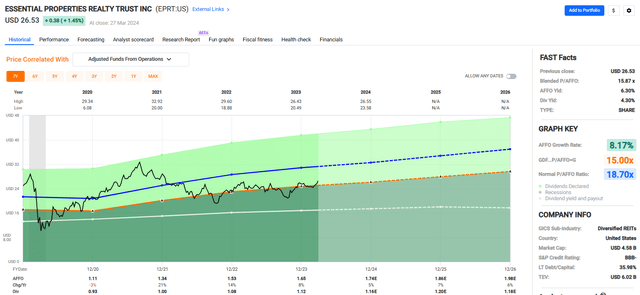

Essential Properties Realty Trust (EPRT)

This net lease REIT has a market cap of approximately $4.8 billion and a 18.7 million SF portfolio made up of 1,873 commercial properties leased to 374 tenants operating across 48 states.

As of the company’s latest update its portfolio was 99.8% leased and had a WALT of 14.0 years. EPRT targets single-tenant properties that are fungible and smaller scale. Its average investment per property totaled $2.7 million at the end of 2023.

Additionally, it looks for tenants operating in service-oriented and / or experienced-based industries to mitigate the threat of e-commerce. The company has wide tenant industry diversification and owns properties used multiple industries such as car washes, early childhood education, medical / dental, quick service restaurants, grocery stores, auto repair, and health and fitness.

The company’s largest industry is car washes which represents 15.1% of its portfolio, followed by early childhood education and quick service restaurants which represents 11.6% and 10.7% respectively.

The stock pays a 4.30% dividend yield and trades at a P/AFFO of 15.87x, compared to its average AFFO multiple of 18.70x.

We rate Essential Properties Realty Trust a Buy.

Technology Sector

iREIT®

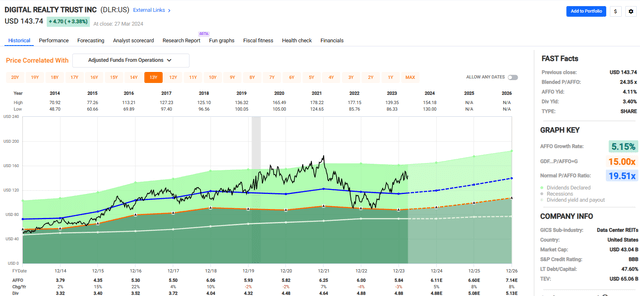

Digital Realty Trust (DLR)

This company is a data center REIT that specializes in data center, interconnection, and colocation solutions for customers operating across multiple industries.

At the end of 2023 the company’s portfolio consisted of 309 data centers located in over 25 countries and more than 50 metropolitan areas. DLR has 124 data centers located in the U.S., 112 located in Europe, 36 located in Latin America, 14 located in Asia, 14 located in Africa, 6 located in Australia, and 3 located in Canada.

The data center REIT provides connectivity and data storage for many well-respected companies including Oracle, Meta, Verizon, AT&T, and IBM. By annualized recurring revenue (“ARR”), the company’s top segment is cloud providers which makes up approximately 37% of its ARR. Since 2014 Digital Realty has had an average AFFO growth rate of 5.15% and an average dividend growth rate of 4.60%.

The stock pays a 3.40% dividend yield and trades at a P/AFFO of 24.35x, compared to its average AFFO multiple of 19.51x.

We rate Digital Realty a Hold.

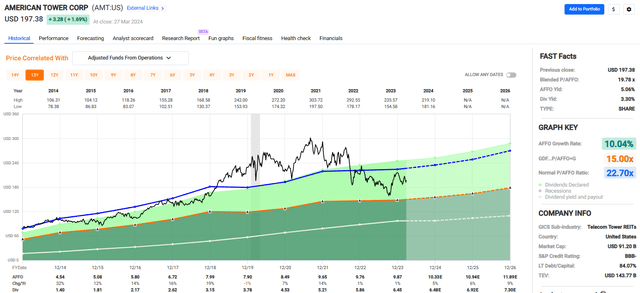

American Tower (AMT)

This company is the largest publicly traded cell-tower REIT with a market cap of approximately $92.0 billion and a portfolio of multitenant communications infrastructure which includes more than 224,000 communications sites located across 25 countries.

AMT’s global portfolio consists of 42,000 cell towers in the U.S. and Canada, more than 180,000 towers located internationally, roughly 1,700 distributed Antenna Systems, and an interconnected network of 28 data centers across the U.S.

The company leases its shared communications infrastructure to industries that provide wireless technologies such as media broadcast, wireless carrier networks, and broadband providers. AMT’s assets appear to have a long-runway for growth with the increasing use of mobile data services and new technologies such as 5G and edge computing.

Since 2014 the company has had an average AFFO growth rate of 10.04% and an average dividend growth rate of 19.48%.

The stock pays a 3.30% dividend yield that is well covered with a 2023 AFFO payout ratio of 65.35% and trades at a P/AFFO of 19.78x, compared to its average AFFO multiple of 22.70x.

We rate American Tower a Buy.

Healthcare Sector

iREIT®

Healthpeak Properties (DOC)

This company is a REIT that specializes in the acquisition, development, and management of healthcare properties across the United States. It focuses on real estate that facilitates healthcare discovery and delivery and has 3 main asset classes including laboratory’s, outpatient medical, and continuing care retirement community (“CCRC”).

At the end of 2023, Healthpeak’s lab properties made up 51.3% of its portfolio NOI, outpatient medical made up 37.6%, while CCRC made up 9.3% of its portfolio NOI. The remaining 1.8% is categorized as “other non-reportable”. On March 1, 2024, the company announced that it had closed on its merger with Physicians Realty Trust.

The combined company will keep the name Healthpeak Properties, but the ticker symbol was changed from PEAK to DOC. Management expects the merger will result in $40 million of synergies in the first year and increase 2024 AFFO by 3.4%.

Since 2019 the company has had an average AFFO growth rate of 0.77%. Analysts expect AFFO to remain flat in 2024 but then increase by 7% and 3% in the years 2025 and 2026 respectively.

The stock pays a 6.55% dividend yield and trades at a P/AFFO of 11.97x, compared to its average AFFO multiple of 19.59x.

We rate Healthpeak Properties a Strong Buy.

Office Sector

iREIT®

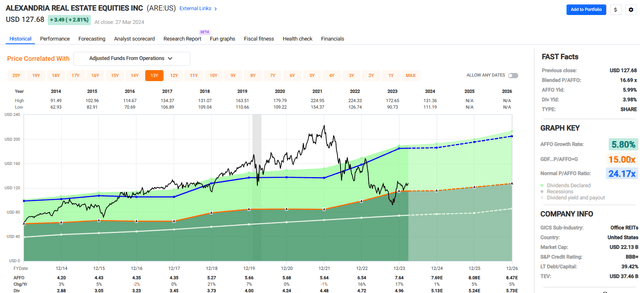

Alexandria Real Estate (ARE)

This company is the only publicly traded, pure-play life science REIT and has a 73.5 million SF asset base in the U.S. consisting of operating properties (42.0 million SF), properties in development or under construction (7.6 million SF), and future development projects (23.9 million SF).

The company specializes in developing life science properties in innovation cluster locations in major gateway markets such as Boston, New York City, San Diego, Maryland, the Research Triangle, Seattle, and San Francisco.

Some of the industries that utilize ARE’s lab space include multinational pharmaceutical, medical products & devices, biotechnology, and academic and medical research. Some of the company’s top tenants include Bristol-Myers, Alphabet, Harvard University, Eli Lily, and Boston Children’s Hospital.

At the end of 2023 the company reported its operating properties had an occupancy rate of 94.6% with a WALT of 7.4 years. Since 2014 the life science REIT has had an average AFFO growth rate of 5.80% and an average dividend growth rate of 6.64%.

The stock pays a 3.98% dividend yield and trades at a P/AFFO of 16.69x, compared to its average AFFO multiple of 24.17x.

We rate Alexandria Real Estate a Buy.

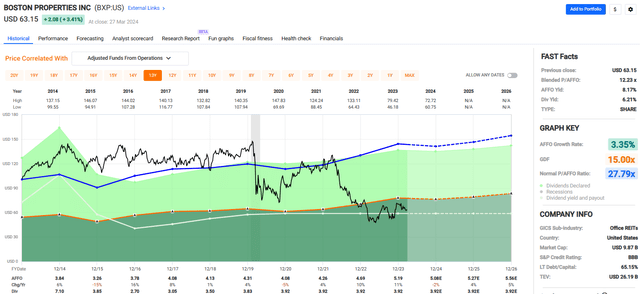

Boston Properties (BXP)

This company is a leading publicly traded office REIT that develops, owns, and manages top-tier workplaces in the United States. The REIT’s properties are located in 6 major gateway markets that include Boston, Los Angeles, New York, San Francisco, Washington, D.C. and Seattle.

At the end of 2023, BXP’s portfolio, including properties owned by unconsolidated joint ventures, totaled 53.3 million square feet and consisted of 188 properties.

The office REIT’s in-service properties were 89.9% leased and had a WALT of 7.6 years. The company leases its office space to leading companies such as Microsoft, Google, and Bank of America. Its largest tenant is Salesforce which made up 3.31% of the company’s share of annual rent.

In March, the company announced its Board of Directors had declared a quarterly dividend of $0.98 per share, payable on April 30th. The dividend rate of $0.98 is unchanged from the dividend paid in the first quarter of 2023.

BXP pays a 6.21% dividend yield and trades at a P/AFFO of 12.23x, compared to its average AFFO multiple of 27.79x.

We rate Boston Properties a Strong Buy.

Residential Sector

iREIT®

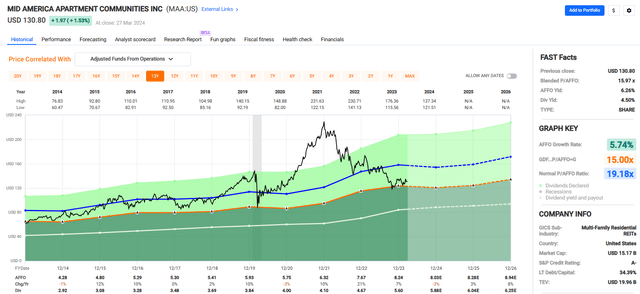

Mid-America Apartment Communities (MAA)

This company is a real estate investment trust (“REIT”) that specializes in the acquisition and operation of apartment communities with a portfolio of properties that are heavily concentrated in the Sunbelt.

MAA’s portfolio is comprised of approximately 102,662 apartment units that are located in 16 states and the District of Columbia. On March 19, the company announced its board of directors approved a quarterly dividend of $1.47 per share which is payable on April 30th.

The quarterly dividend is unchanged from the previous quarter but represents a 5% increase compared to the dividend paid a year ago. This apartment REIT has paid consecutive quarterly dividends since 1994 with no suspensions or cuts. Since 2014 the company has had an average AFFO growth rate of 5.74% and an average dividend growth rate of 7.37%.

The stock pays a 4.50% dividend yield and trades at a P/AFFO of 15.97x, compared to its average AFFO multiple of 19.18x.

We rate Mid-America Apartment a Buy.

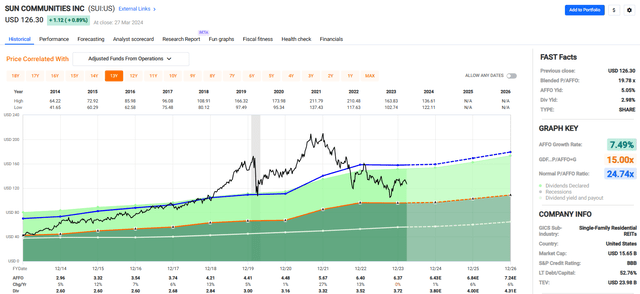

Sun Communities (SUI)

This company is a REIT with a focus on purchasing and managing manufactured housing communities (MH), recreational vehicle parks (RV), and marina properties in the U.S., the U.K., and Canada.

By the close of 2023, the REIT’s portfolio consisted of 667 properties. This includes 353 MH communities, 179 RV parks, and 135 marinas. In aggregate, these properties encompass roughly 227,340 developed sites, which include both MH and RV sites, as well as wet slips and dry storage in its marina properties.

The company’s rental revenues are diversified between its MH, RV, and Marina property types. The company receives 50% of its rental revenue from its MH communities, 29% from its RV parks, and 21% from its marinas. Since 2014 the company has had an average AFFO growth rate of 7.49% and an average dividend growth rate of 4.00%.

The stock pays a 2.98% dividend yield that is very secure with a 2023 AFFO payout ratio of 58.40 and trades at a P/AFFO of 19.78x, compared to its average AFFO multiple of 24.74x.

We rate Sun Communities a Buy.

Industrial Sector

iREIT®

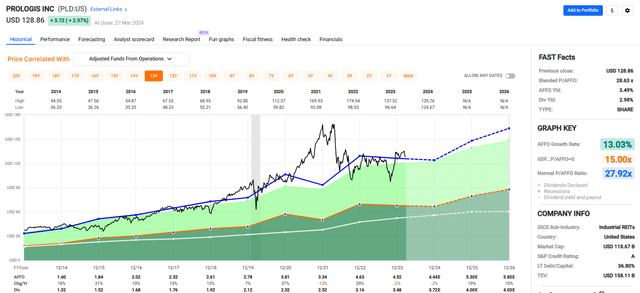

Prologis (PLD)

This industrial REIT has a market cap of approximately $118.4 billion and portfolio made up of 5,613 properties totaling 1.2 billion SF that are leased to more than 6,000 tenants operating in 19 countries.

The company is a leader in logistics real estate and has a significant impact on global trade as its distribution centers process 2.8% of annual global GDP.

The industrial REIT is a global company with properties spanning across 4 continents but approximately 86% of its NOI is generated in the U.S. Canada, Latin and South America make up 4% of its NOI, Europe makes up 8%, and Asia makes up roughly 2% of the company’s NOI.

The company recently announced it would hold a conference call on April 17, 2024, to discuss its operating results for the first quarter. Since 2014 PLD has had an average AFFO growth rate of 13.03% and an average dividend growth rate of 12.14%.

The stock pays a 2.98% dividend yield and trades at a P/AFFO of 28.63x, compared to its average AFFO multiple of 27.92x.

We rate Prologis a Buy.

Rexford Industrial Realty (REXR)

This company is an industrial REIT that invests in industrial properties located in Southern California (“SoCal”) infill markets. Rexford’s investment strategy is centered around the SoCal infill market.

The company exclusively invests in this region rather than targeting properties across multiple states or countries. SoCal is one of the top industrial markets in the world with a constant supply and demand imbalance.

Supply is limited because developable land is scarce in the area due to the natural barriers, but at the same time there is enormous demand within the state as it is home to roughly 24 million people and over 600,000 businesses. Rather than be somewhat specialized across multiple markets, REXR looks to be an expert in the SoCal market as it is the 4th largest industrial market in the world.

The industrial REIT owns or has an ownership interest in 374 industrial properties totaling 45.9 million SF throughout the SoCal region. As of its most recent update, the company has a same property portfolio occupancy rate of 97.5%. Since 2016 REXR has delivered an average AFFO growth rate of 13.92% and an average dividend growth rate of 14.87%.

The stock pays 3.35% dividend yield and trades at a P/AFFO of 28.37x, compared to its average AFFO multiple of 38.05x.

We rate Rexford Industrial Realty a Strong Buy.

Self-Storage Sector

iREIT®

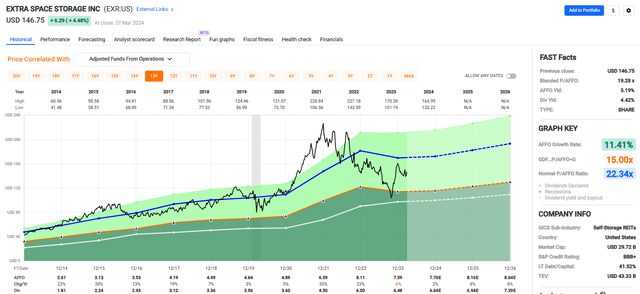

Extra Space Storage (EXR)

This company is a self-storage REIT that is internally managed. It owns and/or manages over 3,700 self-storage facilities spread across 42 states and Washington D.C..

The company’s self-storage properties provide approximately 283.0 million square feet of leasable space and house around 2.6 million storage units. 1,950 of the self-storage facilities in EXR’s portfolio are wholly owned, 472 are held through a joint venture, and 1,337 stores are managed for third party owners.

The company offers a variety of self-storage units from personal and business use to climate-controlled and vehicle storage. Since 2014 EXR has had an average AFFO growth rate of 11.41% and an average dividend growth rate of 16.70%.

The stock pays a 4.42% dividend yield that is covered with a 2023 AFFO payout ratio of 85.43% and trades at a P/AFFO of 19.28x, compared to its average AFFO multiple of 22.34x.

We rate Extra Space Storage a Buy.

Retail Sector

iREIT®

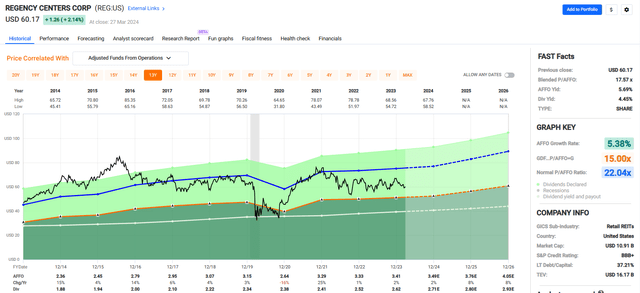

Regency Centers (REG)

This company is a REIT that was established in 1963, went public in 1993, and was added as a S&P 500 Index member in 2017. REG specializes in the development and operation of open-air shopping centers that have optimal surrounding demographics in suburban trade areas.

The company looks for properties in high-density and affluent markets. As of its latest update, the markets surrounding the company’s properties (3-mile radius) average over 124,000 people and have an average income per household of roughly $150,000.

The shopping center REIT has a 56.8 million SF portfolio consisting of 482 shopping centers and 80% of its properties are grocery anchored. As of December 31, 2023, the REIT disclosed its same property portfolio was approximately 96.0% leased.

Since 2014 the company has had an average AFFO growth rate of 5.38% and an average dividend growth rate of 3.55%.

The stock pays a 4.45% dividend yield and trades at a P/AFFO of 17.57x, compared to its average AFFO multiple of 22.04x.

We rate Regency Centers a Buy.

Commercial Mortgage Sector

iREIT®

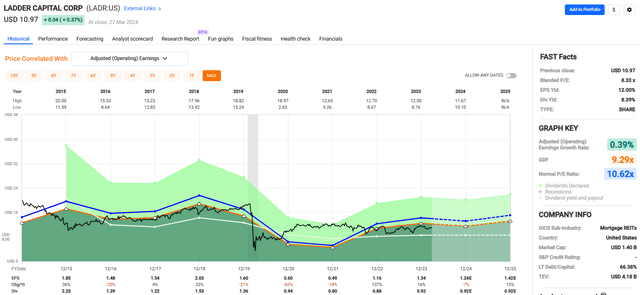

Ladder Capital (LADR)

This finance company is an internally managed mortgage REIT that specializes in underwriting and originating fixed and floating-rate senior first mortgage loans that are secured by commercial real estate.

Additionally, the company owns and operates a portfolio of net lease properties and invests in secured debt instruments. LADR has a $3.1 billion loan portfolio with a weighted average loan-to-value (“LTV”) of 66% that is almost entirely made up of senior secured first mortgage loans (99%+).

The company does not issue construction loans and has a mid-market focus with its average loan size totaling roughly $25.0 million. Multifamily, office, and mixed-use are the largest property types securing the mortgage REITs loans. Multifamily represents 37% of its portfolio, while office and mixed use represent 28% and 18% respectively.

Since 2015 the company has had an average adjusted operating earnings growth rate of 0.39%. Analyst expect earnings to fall by -7% in 2024 but then increase by 15% the following year.

The stock pays a 8.39% dividend yield and trades at a P/E of 8.33x, compared to its average P/E ratio of 10.62x.

We rate Ladder Capital a Buy.

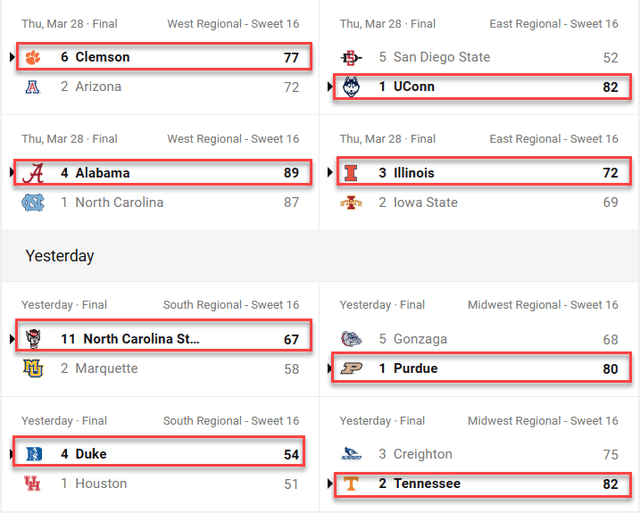

Who's in Your Bracket?

There are eight teams left in March Madness:

I'm sad to see my Tar Heels lose to Alabama...

But happy to see three ACC team advance to the Elite 8 (NC State, Duke, and Clemson).

Most definitely there will be at least one ACC in the Final Four.

UConn looks good too!

It's going to be an interesting week...

Who's in your bracket?

Happy Easter!

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Introducing iREIT®

Join iREIT® on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. Our iREIT® Tracker provides data on over 250 tickers with our quality scores, buy targets, and trim targets.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.