gorodenkoff/iStock via Getty Images

Okta, Inc. (NASDAQ:OKTA) has been a surprising winner as of late as Wall Street cheered the company's latest results. The stock has held on to its post-earnings surge, and there are indeed reasons to justify the optimism. The company crushed guidance on both the revenue and remaining performance obligation fronts. While management did not raise full-year guidance by that much, Wall Street appears to hold the view that the updated targets remain far too conservative, and I agree myself. I am however of the view that longer-term consensus estimates are too aggressive and that the stock does not trade at compelling valuations relative to those estimates. While OKTA has been a name which I owned in the past, I struggle to make the math work here. I reiterate my avoid/hold rating for the stock.

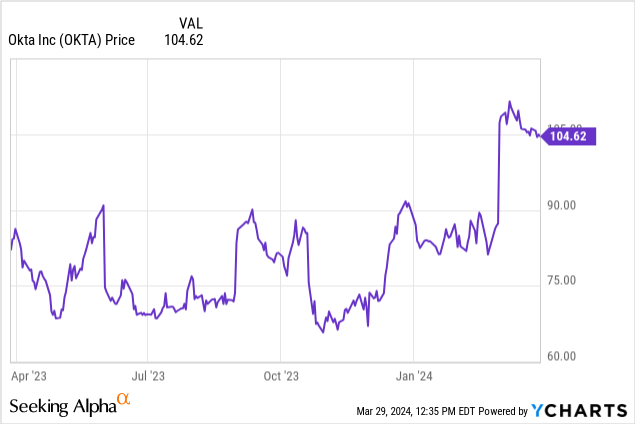

OKTA Stock Price

When I last covered OKTA in January, I explained why I was selling the stock amidst a broader tech rally.

The company then delivered a strong earnings report and the stock has surged since then. Had I accurately predicted such a strong result, perhaps I might not have sold my position so early as there were indeed some positive indicators in the report. However, I'm of the view that OKTA trades at rich valuations largely due to the rich pricing of the tech sector overall.

OKTA Stock Key Metrics

OKTA is an enterprise tech company which enables two-factor verification.

The company is technically in the cybersecurity sector, but has not recently enjoyed the typical cybersecurity valuation premiums, perhaps due to various cybersecurity incidents over the past year. The company also has faced headwinds from the cost-cutting seen during the 2022 year as the company is reliant on headcount growth.

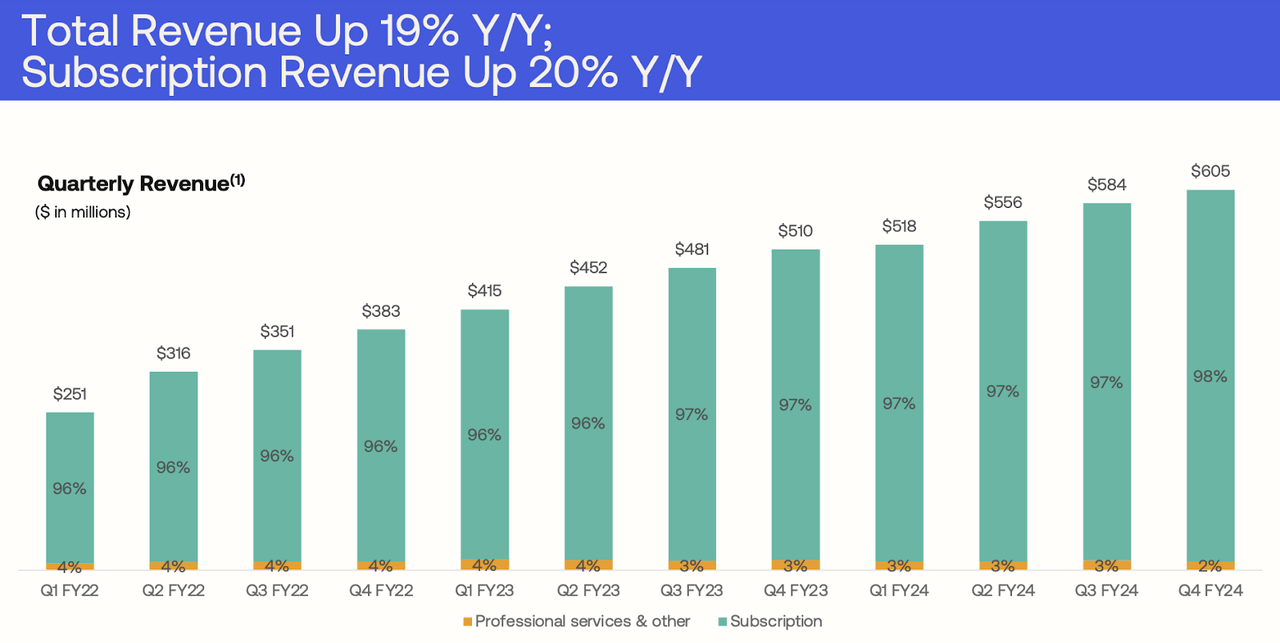

In its most recent quarter, OKTA delivered 19% YoY revenue growth, crushing guidance for 15% YoY growth.

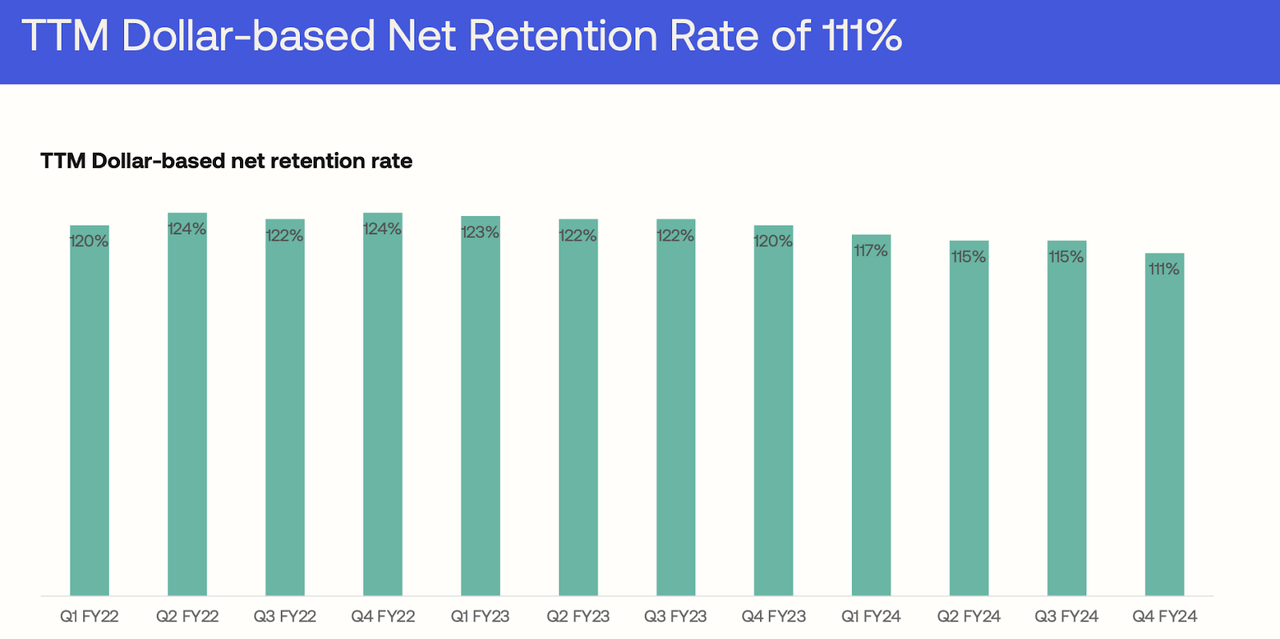

The company saw its dollar-based net retention rate compress sequentially to 111%.

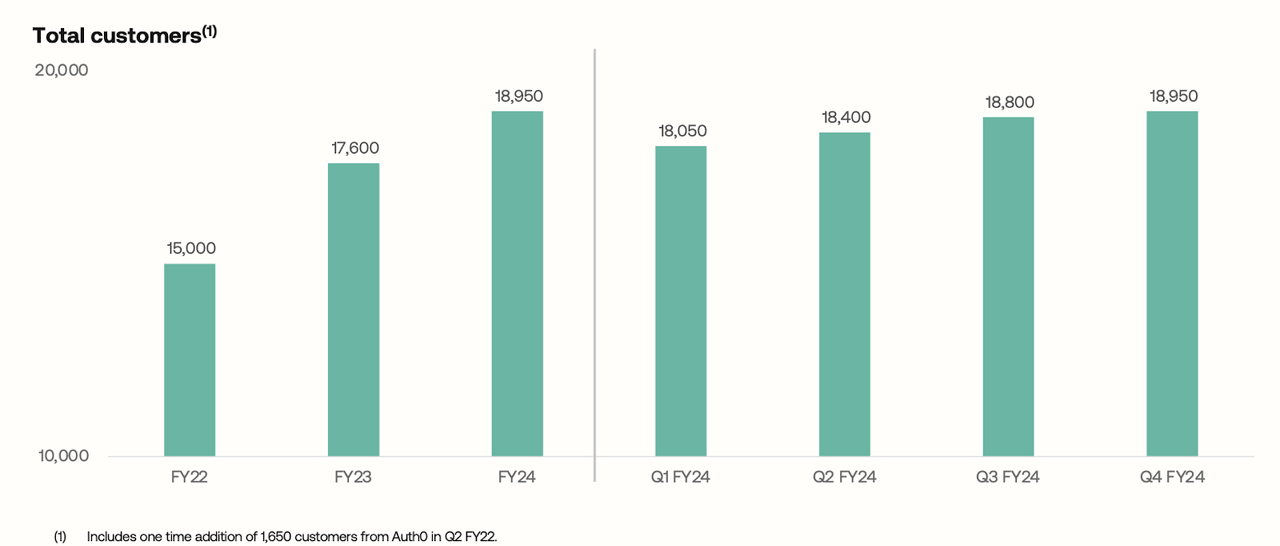

OKTA also saw customer count growth decelerate sequentially as well - clearly, these two metrics may not necessarily move directly in line with revenues. This also may raise questions about whether the 19% year-over-year revenue growth rate can be sustained moving forward, though that concern appears to already be validated by management's guidance.

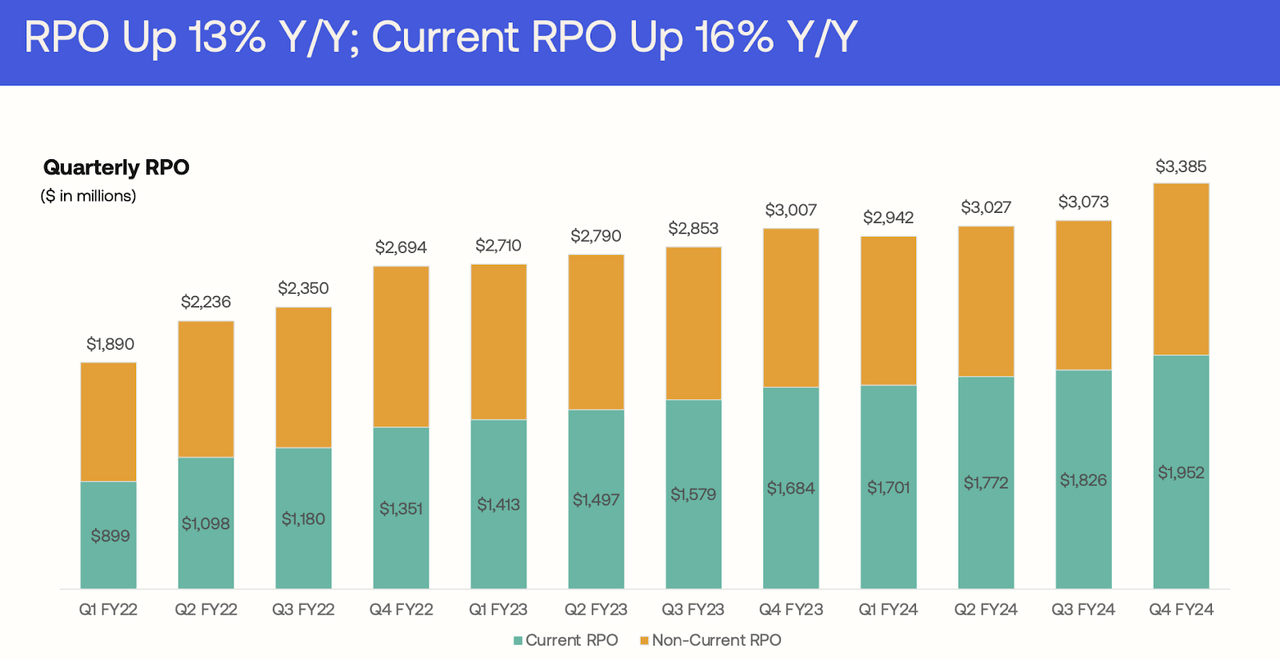

The biggest surprise came in the strong showing for remaining performance obligations ('RPOs'), with cRPOs growing 16% YoY, far surpassing guidance for 11% to 12% growth. This is significant due to cRPOs being often viewed as a leading indicator of forward revenue growth. On the conference call, management stated that the outperformance was not due to any "one-off big deals" but was just indicative of "broad-based strength" in their customer base. While this cRPO showing might imply decelerating growth rates from the recent 19% top-line showing of this past quarter, the implied deceleration is far less than Wall Street had feared (which is clearly indicated in the stock's strong recent price action).

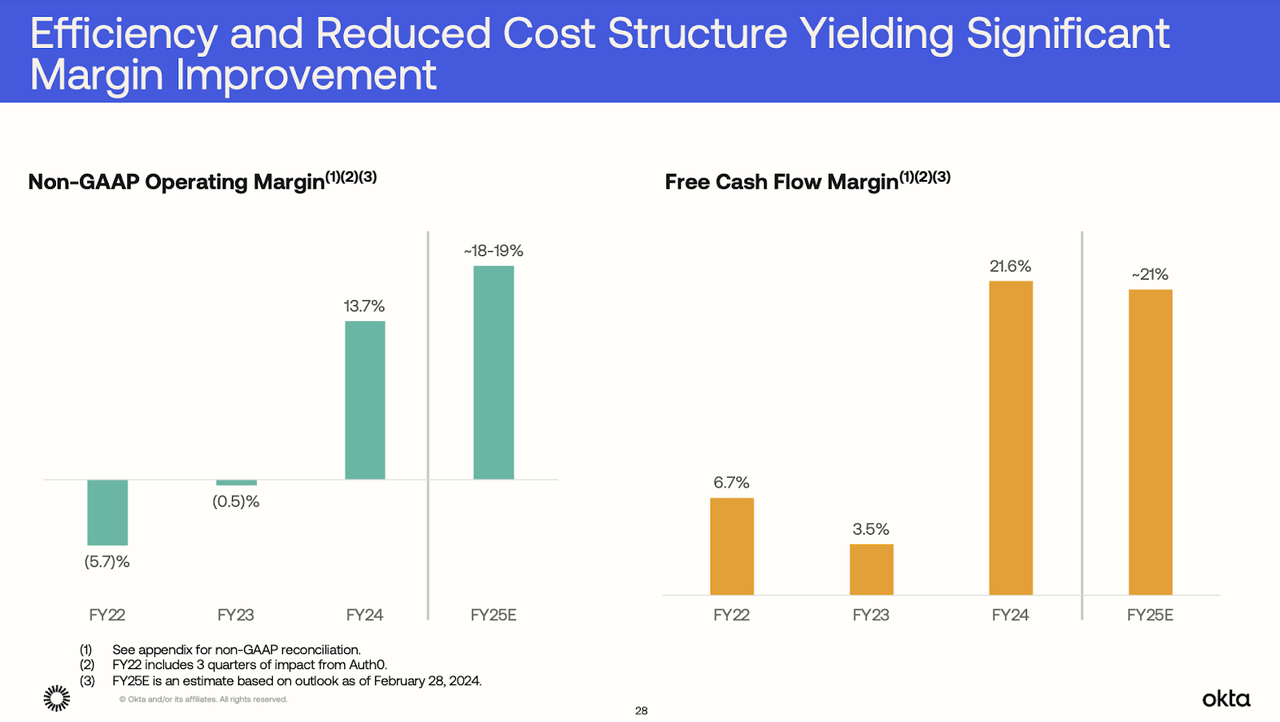

OKTA coupled the strong top-line growth with solid margin expansion as free cash flow margins rose 1,800 bps in the year. Management is guiding for non-GAAP operating margins to expand around 500 bps in the upcoming year. I note that, due to both the company's cost discipline and also in part due to the higher interest rate environment, the company is now within striking distance of achieving positive GAAP net income generation. The company lost only $44 million in GAAP net income in the latest quarter, suggesting that operating leverage may push the company above this important milestone quite soon.

OKTA ended the quarter with $2 billion of cash vs. $1.2 billion of convertible notes, representing a strong balance sheet. Compared with tech peers, I wouldn't be surprised to see OKTA move quickly to lever up its balance sheet to offset the decelerating top-line growth rates.

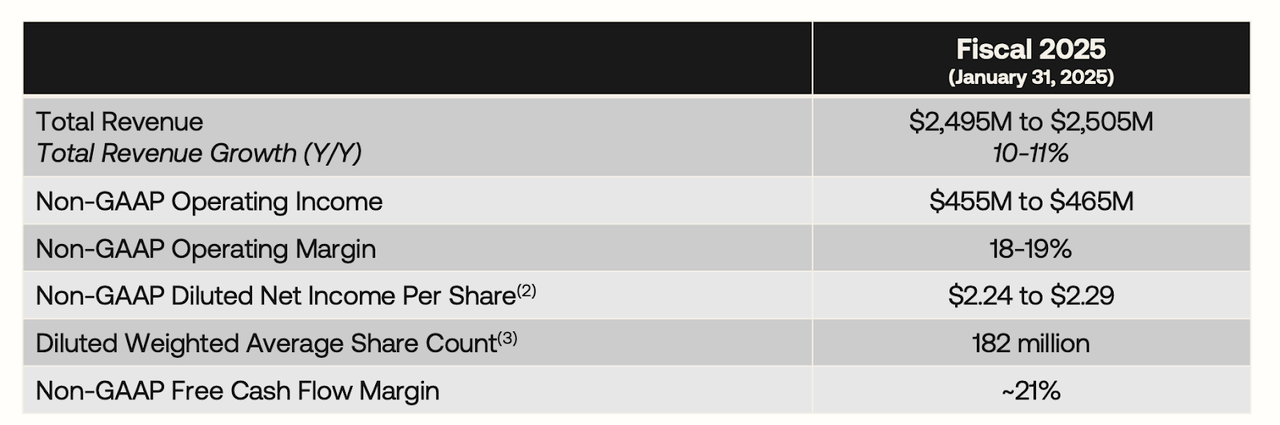

Looking ahead, management has guided for the first quarter to see up to 17% YoY revenue growth and 13% cRPO growth. For the full year, management expects up to 11% YoY revenue growth, representing only a slight increase from the previously issued preliminary guidance for 10% growth. I view this guidance as being unusually conservative given both the strong cRPO growth demonstrated in this past quarter as well as the aggressive implied deceleration from the projected 17% growth rate in the first quarter.

On the call, management also noted that guidance incorporates a large amount of conservatism, as they are monitoring "potential impacts related to the October security incident." That said, management also acknowledged that the pipeline heading into this upcoming fiscal year is "quite a bit stronger" than it was heading into the prior year, giving them "a level of comfort" in the guidance. Some investors may view Wall Street as being a game of beating and raising guidance, and it's possible that this reason has driven the relative strength in OKTA stock.

Is OKTA Stock A Buy, Sell, or Hold?

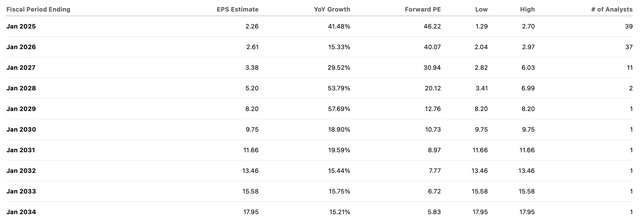

The cybersecurity sector has in general been the market leaders for the tech sectors overall, but OKTA has seen some relative weakness due to suffering from several high-profile cybersecurity breaches. Moreover, the company's products are sometimes viewed as being more commoditized than many tech peers as well as being in the crosshairs of Microsoft Corporation (MSFT). Yet after the recent rally, OKTA was trading at 46x this year's earnings estimates.

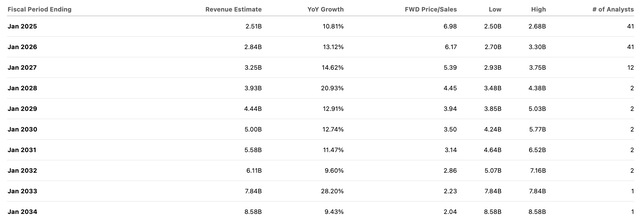

Those earnings estimates look rather aggressive given that they imply 34% net margins by 2034 against expectations of solid double-digit revenue growth over a decade.

Yet for the sake of argument, we can use these consensus estimates at face value (in spite of viewing them to be aggressive). If we assume that OKTA will trade at 30x earnings in 2034, similar to where names like MSFT or Adobe Inc. (ADBE) trade at today, then the stock may be priced at around 18% annual return potential over the next decade. That would be likely more than enough to beat the market, but both the consensus estimates and valuation assumption look too aggressive (I explain my reasoning below later), so that should be considered the "ultra bullish" scenario. On the valuation front, I question whether OKTA should earn such an aggressive multiple given both the highly competitive nature of the company's markets as well as the ever-present risk of customer churn due to cybersecurity breaches. I'd argue that the stock needs to price in these risks through lower valuation multiples. If we instead assume that the stock ends up trading at around 15x to 20x 20234e earnings, then the return potential declines to around 9.8% to 13%. That may still be enough to beat the market (assuming the typical 7% to 9% market returns), but remember that consensus estimates look extremely optimistic. Consensus estimates are implying a dramatic acceleration in top-line growth (with 28% and 21% being top particularly aggressive targets) followed by a very gradual deceleration to 9.4% growth at the end of the decade. In my experience, there aren't many companies that can escape the "law of large numbers" which implies that growth rates must decelerate over time. Some tech companies, including names like Salesforce, Inc. (CRM) and cybersecurity peer CrowdStrike Holdings, Inc. (CRWD), have been able to delay decelerating growth rates but their results appear to benefit from their platform business model which allows for a large degree of upselling to existing customers. Moreover, OKTA is heavily dependent on headcount growth, and it isn't clear if customers are eager to return to aggressively growing headcount moving forward as higher interest rates and potential cost synergies from generative AI might get in the way of that.

Furthermore, competition is an important risk given that the product is (in my opinion) difficult to differentiate among peers as the experience from the customer perspective (two-factor authentication) is arguably easily replicable. This may pressure growth rates as well as pricing over the long term, though OKTA definitely benefits from being a household name. In my view, I find it more likely that annual revenue growth rates average closer to 11% over the next decade, which would imply some acceleration to around 14% to 15% top-line growth by next year, with gradual deceleration to end up at around 7% to 8% growth at the end of the decade. That would lower the implied upside to around 6.8% to 10%. This updated valuation model does not include any potential risk for fallout from the cybersecurity incidents, which may further pressure potential returns.

I note that one future catalyst may be debt-fueled share buybacks as well as the aforementioned prospect for GAAP profitability. Given my pessimistic view of the long-term return potential from the current stock price, I must reiterate my avoid/hold rating for the stock.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!