filadendron

Introduction & Investment Thesis

Atlassian (NASDAQ:TEAM) is a team collaboration and productivity software provider that has severely underperformed the S&P 500 and Nasdaq 100 YTD. The company announced its Q2 FY24 earnings report, where revenue and earnings grew by 21% YoY and 43% YoY, respectively. While the company is heavily investing in product innovation by launching targeted solutions to boost productivity and improve business outcomes, gaining market share by targeting enterprise customers, successfully migrating its customers from Server and Data Centers over to the Cloud, and growing its profitability, it faces some short-term risks that may put pressure on the company’s stock valuation.

As macroeconomic uncertainties remain, we can see further pressure in the company’s SMB customer segment. Plus, the magnitude of the potential churn associated with Atlassian stopping its server deployment and migrating its customers over to the Cloud is still unknown. At the same time, the company also operates in a highly competitive market, and as a result, any slowdown in its Cloud migration project or overall Cloud Revenue will cause volatility in the stock price, which I believe is priced to perfection based on my valuation. As a result, I will choose to remain on the sidelines at the moment and rate the stock a “hold” at the moment.

About Atlassian

Atlassian is a provider of team collaboration and productivity software that helps teams organize and complete shared work. Their products include Jira Software and Jira Work Management, Confluence, Trello, Jira Service Management, Jira Align, and Bitbucket, which teams across organizations use to better organize, collaborate, and complete projects in order to drive superior business outcomes.

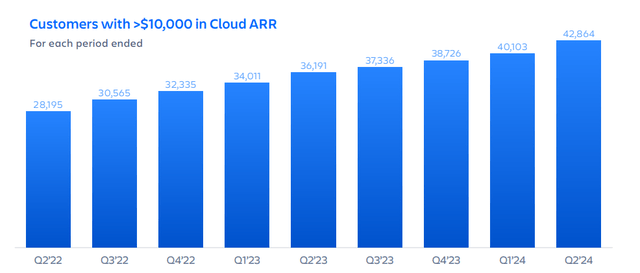

In terms of their target market, they serve organizations of all sizes across industries. In Q2 FY24, Atlassian had a total of 302,000 customers, out of which 42,864 contributed $10,000 in Annual Recurring Revenue [ARR], which grew 18% YoY.

Atlassian primarily distributes and sells their products online and through solution partners. Their go-to-market strategy also benefits from customer word-of-mouth, which significantly reduces their customer acquisition costs (CAC). Once Atlassian has acquired a new customer, it employs a “land and expand” model to drive deeper adoption of its subscription-based pricing model of its solution suite, resulting in new user growth, new use cases, and higher revenue per customer.

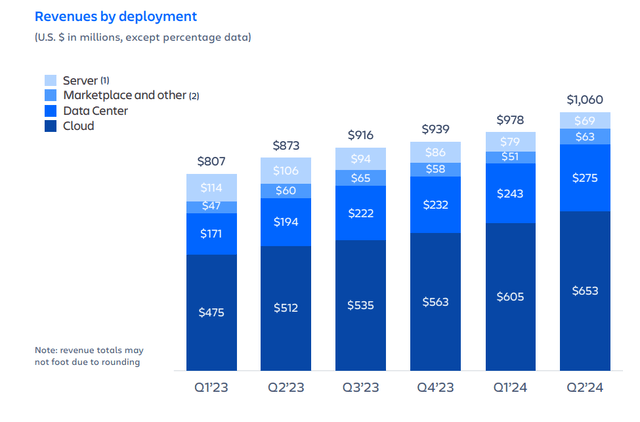

In Q2 FY24, the company generated $1.06B in revenue, growing 21% YoY. Subscription Revenue contributed 88% to Total Revenue, growing 31% YoY to approximately $932M.

The good: Expanding Upmarket, Launching new products, Cloud Migration and Improving Margins

Atlassian reported Q2 FY24 earnings results, where it generated revenue of $1.06B, growing 21% YoY and beating estimates by 4%. There are 3 growth drivers that I am going to dive into that will explain Atlassian’s growth trajectory thus far and whether they will continue to act as a tailwind over the longer term.

The first growth driver is the company’s strategic initiative to focus on expanding upmarket by targeting larger enterprises. During Q2, the customer count touched 302,000, with 42,864 customers contributing $10,000 in Annual Recurring Revenue (ARR), which grew 18% YoY. Out of the 42,864 customers contributing $10,000 in ARR, 326 came from their acquisition of Loom. I believe that by effectively targeting enterprise customers, Atlassian can drive higher revenue per customer with deeper adoption, which in turn will help it unlock higher operating leverage. Plus, I believe that Atlassian can further benefit from Loom’s customer base, as it creates larger cross-sell opportunities moving forward.

Q2 FY24 Earnings Slides: Atlassian's $10K+ customers

The second growth driver is the company’s culture of continued product innovation. In October, they launched Compass, built on top of their cloud platform, in order to help engineers better track their services and systems, improve engineering standards, and create a better developer experience. At the same time, Atlassian’s management is committed to driving investments in AI, and they are now rolling out Atlassian Intelligence into general availability in the premium and enterprise editions of Jira Software, Jira Management, and Confluence, which will allow teams to instantly draft and summarize content as well as automate various tasks with new AI capabilities designed to boost the productivity of teams. I believe that given the vast amount of data, Atlassian can differentiate its competitive positioning as it continues to invest in R&D to build targeted AI solutions. This will build a further compelling case for its Server and Data Center customers to migrate to the cloud, which I am going to talk about in the next section.

The final growth driver is the company’s ongoing initiative to migrate its customers from on-premise to the Cloud, as part of its long-term vision. In Q2 FY24, Cloud Revenue grew 27.5% YoY, in line with expectations. According to management’s commentary in the Shareholder Letter, this was driven by seat expansion, migration from Server and Data Center to the Cloud, cross-selling of additional products, upselling of premium-priced solutions, and higher customer retention. In Q2, migration to the Cloud increased by more than 2x YoY across both Enterprise and SMB, with migration from the Data Center to the Cloud driving more than 60% of all the migrations. With fewer than expected churns among their Server customers, this indicates that customers are deepening their commitment to Atlassian. I believe that as Atlassian continues to drive superior product innovation, the rate at which customers make the switch to the Cloud will continue to pick up.

Q2 FY24 Earnings Slides: Atlassian's revenue mix by deployment types

Shifting gears to profitability, Atlassian generated non-GAAP operating income of $250M, growing 43% YoY while expanding its margins by 360 basis points from Q2 FY23 to 23.6% in Q2 FY24. This was achieved by streamlining operating expenses that grew 13% YoY, compared to revenue that grew 21% YoY, allowing margins to expand. At the same time, as Atlassian sees success migrating its customers to the Cloud, while continuing to expand upmarket to drive higher average revenue per customer with greater possibilities of upsell and cross-sell opportunities among new and existing customers, I believe it will unlock additional operating leverage while expanding its profit margins.

The bad: Weaker growth in paid seat expansion among SMBs, possible churn from Cloud Migration, Tough competitive landscape

Atlassian management had highlighted that it had experienced weaker than expected paid seat expansion in Atlassian Cloud among their SMB customer segment in their Q2 FY24 Shareholder letter, although strong results from their enterprise customer segment helped offset it. Given that Atlassian’s business model involves converting freemium users to paid users, who then further expand usage and seats over time, a slowdown in the US and the global economy, as interest rates remain higher for longer, can curb spending, especially among the SMB segment, which is often more disproportionately exposed to macroeconomic risks and a higher cost of borrowing. As a result, should we see continued headwinds in the SMB customer segment, coupled with a broader macroeconomic slowdown, it may dampen Atlassian’s growth prospects.

Simultaneously, the cloud migration project may face some headwinds, as the management highlighted in its forward-looking guidance for FY24, where Cloud Revenue is expected to grow between 28.5% and 30.5% YoY, of which migration to the Cloud will contribute 10 points and Loom will contribute 1.5 points of growth. As the company stops supporting its Server Deployments in February 2024, their Cloud revenue forecast is predicted based on the management’s belief that while some of their Server customers will migrate to the Cloud, the majority will migrate to the Data Center, and a portion of them will not migrate at all, increasing the probability of customer churn, which will act as a short-term headwind to Atlassian’s top-line.

Plus, the competitive landscape is fierce with deep-pocketed large technology players such as Microsoft (NASDAQ:MSFT) and ServiceNow (NYSE:NOW), as well as emerging businesses that include GitLab (NASDAQ:GTLB) and Asana (NYSE:ASAN). While Atlassian continues to differentiate its competitive positioning by investing in its product innovation and offering a breadth of products that are easily integrated and delivered through multiple deployment options while employing a low-cost distribution model to keep its CAC low, the company’s stock can face headwinds with its valuations compressing, if it sees growth rates materially slow down by increasing customer churn and economic uncertainty.

Tying it together: Atlassian is a Hold

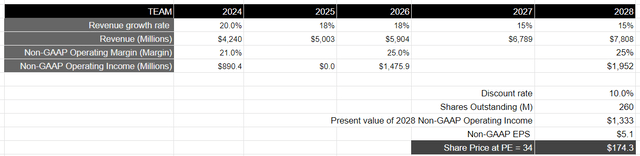

Looking forward, the company expects to generate Cloud Revenue in the range of 28.5% to 30.5% YoY in FY24, which would translate to a total Cloud Revenue of $2.7B in FY24. Meanwhile, it expects that Data Center Revenue will grow 36% YoY to $1.11B, with growth decelerating in H2 as migration to the Cloud accelerates. Furthermore, Atlassian will no longer recognize Server revenue beyond February 2024 and therefore expect Server revenue to be zero in Q4 FY24. Finally, the management expects its Marketplace revenue to grow in the mid- to high single digits. Given the set of expectations from Atlassian, I believe therefore that the company will generate approximately $4.2B, which represents a growth rate of 20% YoY. In terms of profitability, Atlassian expects to generate a non-GAAP operating margin of approximately 21% in FY24, which would translate to a projected non-GAAP operating income in FY24 of $882M.

Assuming that Atlassian maintains its revenue growth rate in the high teens range over the next two years, followed by a slowdown in the growth rate to the mid-teens afterwards, it should generate revenue of approximately $7.8B in FY28. Assuming that the company will continue to gain operating leverage as it streamlines its operating expenses and continues to drive deeper adoption of its solution in the enterprise segment, I believe non-GAAP operating margin should improve incrementally YoY to 25% by FY28, which will translate to a non-GAAP operating income of $1.95B, or a present value of $1.3B when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% annually over a 10-year period with a price-to-earnings multiple in the range of 15–18, I believe that Atlassian should trade at twice the multiple given its pace of earnings growth rate, which would equate to a price-to-earnings multiple of approximately 34, or a price target of $174, or a downside of 10%.

Author's Valuation Model

Conclusion

I am impressed thus far by the management’s product innovation and focus to drive growth upmarket while improving its overall profitability. But there are growing risks in the SMB customer segment, as macroeconomic risks may put seat expansion at risk. Furthermore, the magnitude of the estimated churn as Atlassian stops its server deployments in February is still unknown. Should the migration to the Cloud occur at a slower than expected rate, I am expecting short-term volatility in the stock, especially when the stock is perfectly priced in the current valuation. As a result, I will choose to be on the sidelines and rate the stock a “hold” at the moment.