M. Suhail/iStock Editorial via Getty Images

In our view, AutoZone (NYSE:AZO) is a high-quality retailer with a strong competitive position in the automotive aftermarket industry.

The company has exhibited solid growth, high returns on capital, and intelligent capital allocation over many years. However, at its current valuation, we believe the stock lacks a sufficient margin of safety to warrant a Buy rating.

Our key points:

- AutoZone's business is supported by favorable industry tailwinds such as increasing miles driven and an aging vehicle fleet. The company is also well-positioned to gain share in the attractive DIFM (Do-It-For-Me) segment.

- AutoZone has built a wide moat through its extensive store footprint, superior customer service, strong brand, and best-in-class parts availability. We think these advantages are difficult for competitors to replicate.

- The company has a long runway for growth in DIFM, but this segment has seen growth decelerate significantly in recent quarters. So far, management's ability to successfully execute on growth initiatives isn't showing up in the numbers yet.

- AutoZone's high-quality business model generates strong cash flows and earns impressive returns on invested capital. However, the stock's valuation is near 10-year highs and appears expensive relative to history.

- Risks to the business include the long-term threat of electric vehicles, a tight labor market, and potential supply chain disruptions. While manageable, these factors add uncertainty.

Given what we view as a full valuation and notable risks, we believe investors can afford to be patient and wait for a better entry point. We rate the stock a Hold.

The Case for Compelling Growth: Secular Tailwinds & Key Initiatives

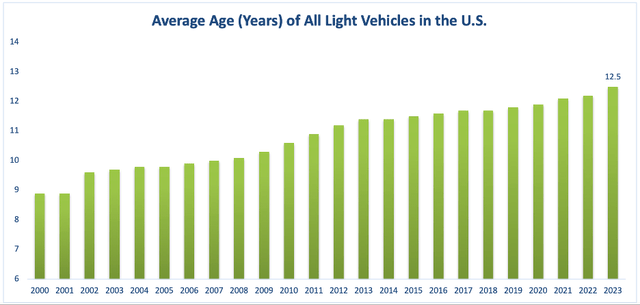

The two key drivers of demand in the auto parts industry are miles driven and average vehicle age - both of which are trending favorably for AutoZone, as outlined in the charts below.

Moving 12-Month Total Vehicle Miles Traveled (FRED) Average Age (Years) of All Light Vehicles in the U.S. (U.S. Department of Transportation (DOT))

Miles driven have recovered to pre-pandemic levels, while the average age of vehicles on the road reached a record 12.5 years in 2023.

In our view, AutoZone's biggest growth opportunity lies in its do-it-for-me (DIFM) business, which caters primarily to domestic commercial customers. AutoZone's domestic commercial business accounted for just over 25% of the company's total revenues in FY 2023. AutoZone currently captures just 4-5% of this market, and as such has a long runway for growth within this segment.

Management is aggressively expanding its commercial program, which are now in 92% of the company's domestic locations, and views this as their top growth priority. Key initiatives include adding "megahub" locations (100K+ SKUs) to improve parts availability, using technology to increase delivery speed, and building out relationships with local, regional and national accounts.

However, despite being management's top priority for growth, sales growth for this segment have decelerated rapidly - down from +44.4% year-over-year growth in 3Q21 to just +2.7% in Q2 2024. Management expects trends to improve in the back half as comparisons ease and strategic initiatives ramp up.

Longer-term, the addressable market in DIFM is massive - estimated at $86bn in 2022 - representing an attractive opportunity for significant growth if management's focus on and initiatives within this area begin to materialize in the form of reaccelerated growth and additional market share capture.

AutoZone is also expanding its store base, especially internationally. The company currently has over 850 stores in Mexico and Brazil and we think they have a long growth runway in both markets as International same-store sales continue to be very strong, up 10%+ in recent quarters.

AZO: A Well-Oiled, Wide Moat Business

AutoZone has built a wide moat around its business, which we believe has been achieved through its extensive store footprint, best-in-class customer service, strong brand, and superior parts availability.

In do-it-yourself (DIY), AutoZone sets itself apart with excellent customer service. Knowledgeable employees provide expert advice and go above and beyond to help customers complete their repairs. To this end, AutoZone offers free services like battery testing, check engine light readings, and tool loans to foster strong customer loyalty. This high-touch support is hard to replicate online. Moreover, many auto parts are heavy or bulky and therefore expensive to ship, and since they're highly specialized, it disincentivizes e-commerce giants like Amazon (NASDAQ:AMZN) to compete in this space.

On the commercial side, AutoZone has spent decades building relationships with professional mechanics and auto garages. AutoZone's extensive inventory and the ability to quickly source obscure parts from hub locations reinforces the company's value proposition. AutoZone has also been heavily investing in technology to make it easier for shops to do business with them.

Solid Fundamentals; Expensive Valuation

AutoZone recently reported solid Q2 2024 results, with +4.6% total sales growth and +1.5% same-store sales growth on a constant currency basis. Gross margins expanded +160bps to 53.9%, and operating profit grew +10.9%, while EPS increased +17.2%.

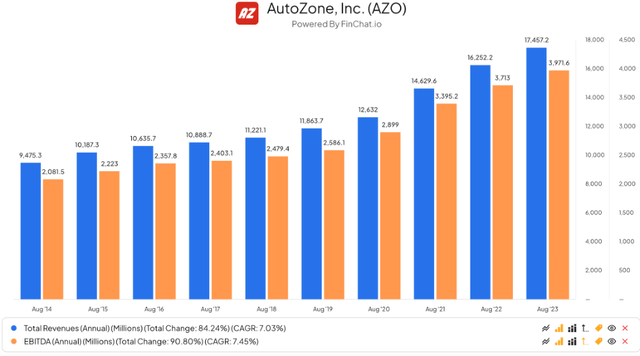

Over the last decade, AutoZone has grown revenue at a 7.0% CAGR, while EBITDA has compounded at just under 7.5% annually, as shown in the chart below.

AZO - Revenue & EBITDA Growth (FinChat.io)

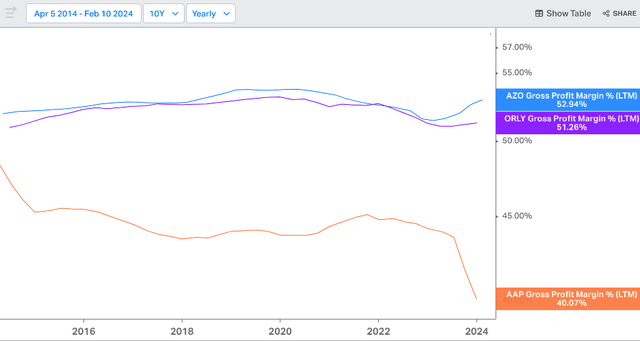

The company boasts sector-leading gross margins in the mid-50% range, slightly better than its closest competitor O'Reilly (NASDAQ:ORLY) and well above the less superior Advance Auto Parts (NYSE:AAP), as shown in the chart below.

AZO - Industry Leading Gross Margins (Koyfin)

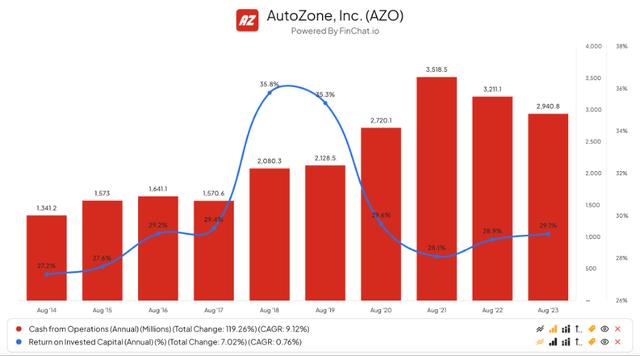

Depicted in the chart below, AutoZone's high-quality business model generates strong cash flow and earns high returns on invested capital (ROIC) - compounding operating cash flow by more than +9% over the last year while consistently maintaining an ROIC north of 25%.

AZO - Historical Cash Flow Generation & ROIC (FinChat.io)

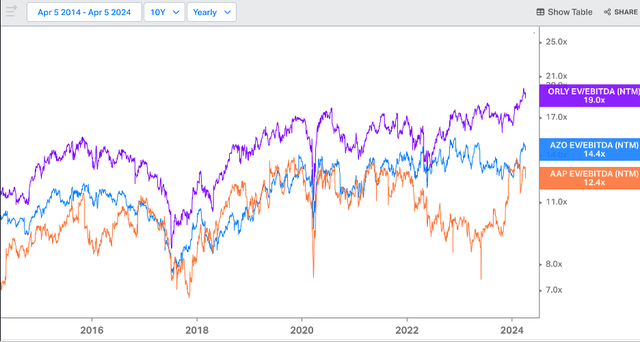

While AutoZone currently trades at a discount to O'Reilly, as shown below, the stock looks expensive to us relative to history - trading near 10-year highs.

AZO - Historical EBITDA Multiple Relative to Peers (Koyfin)

Without being overly aggressive in our future growth estimates, we don't see significant upside in AutoZone given where the stock is trading today.

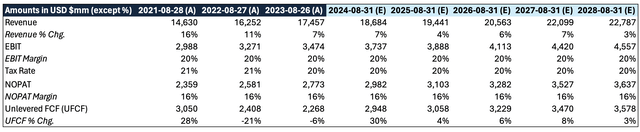

In our analysis, summarized in the tables below, we used Wall Street consensus estimates for future revenue growth in each period through FY 2028. To keep things simple, we assumed EBIT margins, the company's tax rate, CapEx/Revenue, and annual change in net working capital/revenue remained consistent with FY 2023 levels through the end of the forecast period.

AZO - Cash Flow Build (FinChat.io; TEI Analysis)

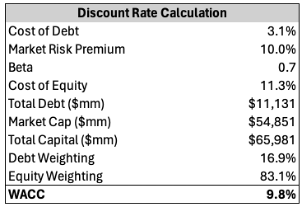

Assuming a ~3% cost of debt, 4.34% risk free rate (current 10-year Tbill yield), and a 10% market risk premium, we get a WACC of 9.8%. In absence of calculating a true WACC we would typically use a 10% discount rate, so using AutoZone's actual WACC seemed reasonable to us.

AZO - Discount Rate Calculation (FinChat.io; TEI Analysis)

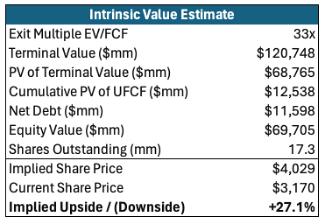

Given our favorable view of AutoZone's business quality and competitive positioning, we assumed the company continued to trade at its current EV/FCF (~33x) through the end of the forecast period. While assuming some level of multiple compression would be more conservative, particularly from what we view as a historically high multiple for the stock, we think it would be reasonable to expect further multiple expansion from current levels if the management successfully executes on their growth initiatives. While we haven't the slightest clue where interest rates will be 5 years from now, a "Fed pivot" to a more dovish stance on rates would also support future multiple expansion. All things considered, we are comfortable assuming no change in multiple for our analysis.

AZO - Estimate of Implied Upside (FinChat.io; TEI Analysis)

In order for us to get excited enough to buy a full position in a business, we need to see a clear path to doubling our money in 3-5 years. Since our conservative estimates suggest a much less attractive outcome, we're fine continuing to sit on the sidelines.

Might Be a Bumpy Ride From Here

In addition to lacking a sufficient margin of safety at its current valuation, we see several notable risks which could negatively impact AutoZone's ability to generate attractive returns for shareholders going forward.

The rise of electric vehicles poses a long-term threat to AutoZone, as EVs have fewer moving parts and different maintenance needs than ICE vehicles. However, the transition to EVs will happen gradually and AutoZone has time to adapt its assortment. With over 280mm vehicles in the current car parc, there will still be plenty of ICE vehicles on the road needing service for decades to come.

AutoZone also faces risks from a tight labor market and potential supply chain disruptions. Attracting and retaining skilled employees is critical to preserving AutoZone's customer service advantage. The company is investing in wages/benefits, training, and technology to boost retention and efficiency. Management has navigated the supply chain challenges of the pandemic well thus far, but future disruptions are always possible.

AZO: We Like the Business, But Not The Price

In our view, AutoZone is a best-in-class retailer with a long track record of steady growth, high returns on capital, and intelligent capital allocation.

The company's strong competitive positioning and massive growth opportunity in DIFM are enticing, but with the stock trading where it is today, we can't justify adding to a position in AutoZone at current levels.

As such, we currently maintain a Hold rating on AutoZone.