Daniel Grizelj

Small-caps have been terrible performers relative to large-caps. Value has been a terrible style performer relative to growth. But the one fact pertaining to all conditions is that they will change. At some point, both small and valuable I believe should lead again. And if you agree, then the Vanguard Russell 2000 Value Index Fund ETF Shares (NASDAQ:VTWV) is worth a look. VTWV is an exchange-traded fund designed to track the Russell 2000 Value Index, representing U.S. small-cap value stocks. The idea of combining the value and size factors forms the core of VTWV's investment strategy, and this approach is rooted in the Fama-French three-factor model.

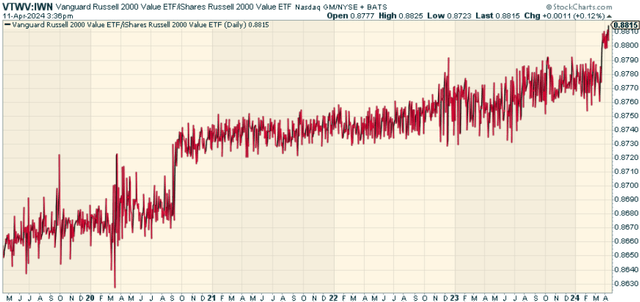

The VTWV fund has been in operation since September 2010, offering investors exposure to the small-cap value segment of the U.S. stock market. It maintains a portfolio of over 1400 holdings, with a 12-month distribution yield of 1.93% and a total expense ratio of 0.15%. VTWV is a direct competitor of the iShares Russell 2000 Value ETF (IWN), which follows the same index but with a slightly higher total expense ratio of 0.24%.

A Look At The Holdings

The top 10 holdings account for a mere 4.67% of the portfolio, demonstrating the fund's diversified nature. Let's take a closer look at the top 5 positions:

- Chord Energy Corporation (CHRD): Accounting for 0.53% of the fund, Chord Energy Corp. is one of the leading players in the energy sector.

- SouthState Corporation (SSB): With a weightage of 0.50%, South State Corp. is a prominent name in the financial sector.

- Commercial Metals Company (CMC): Commercial Metals Co. holds 0.49% of the fund's portfolio. The company operates in the basic materials sector.

- Murphy Oil Corporation (MUR): This energy company contributes 0.46% to the fund's portfolio.

- Matador Resources Company (MTDR): Matador Resources, another player in the energy sector, holds a 0.46% weighting in the fund.

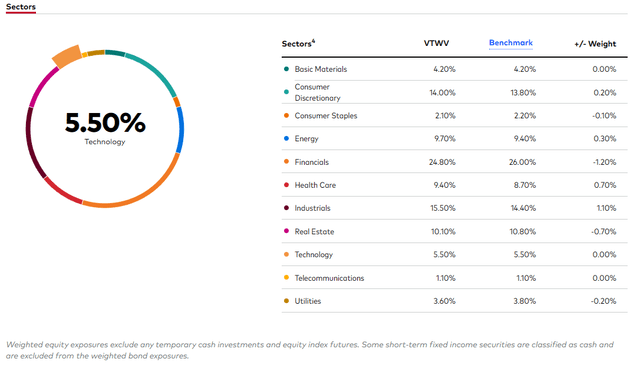

Sector Composition and Weightings

A closer look at the sector composition reveals that the heaviest sector in the portfolio is financials, accounting for 24.8% of the asset value. Industrials are the second-largest sector, followed by Consumer Discretionary.

Peer Comparison

When compared to its peers tracking the same index, VTWV has slightly outperformed IWN in terms of returns since inception. Much of this has to do with the fee differential between the two funds, making VTWV a winner.

Pros and Cons of Investing in VTWV

Like any investment, investing in VTWV comes with its fair share of pros and cons. On the positive side, the fund offers exposure to small-cap value stocks, which have historically provided higher returns compared to large-cap stocks. It also boasts a low expense ratio of 0.15%, making it a cost-effective option for investors.

However, the fund has been more a victim of the cycle we've been in, with small-caps and value both being out of favor. At some point that changes, but your guess is as good as mine as to exactly when.

Conclusion

The Vanguard Russell 2000 Value Index Fund ETF Shares presents an opportunity for investors to gain exposure to U.S. small-cap value stocks. While the fund has demonstrated a slight edge over its direct competitor, IWN, the decision to invest in this is more a function of your view around a market rotation out of large into small, and style rotation out of growth and into value.

The challenge on this is the timing. Because the value style is heavily focused on the financial sector, anyone better here is betting on a re-acceleration of lending and the domestic consumer. That's not necessarily a bad bet at this point in the cycle. Just be mindful that the large-cap growth dominant world we've been in can persist a bit longer.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals--it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).